The paper aims to investigate whether experienced institutional portfolio managers (PMs) exhibit behavioral biases in their decision-making processes, specifically focusing on selling decisions.

Selling Fast and Buying Slow: Heuristics and Trading Performance of Institutional Investors

- Klakow Akepanidtaworn, Rick Di Mascio, Alex Imas, Lawrence Schmidt

- Journal of Finance, 2023

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

This paper examines the decisions of sophisticated market participants – experienced institutional portfolio managers (PMs) – and the authors ask the following questions:

- Is there a significant difference in performance between buying and selling decisions made by institutional PMs?

- Is there an asymmetric allocation of limited cognitive resources towards buying decisions and away from selling decisions?

What are the Academic Insights?

By studying a rich data set containing the entirety of daily holdings and trades from 783 portfolios, with an average portfolio valued at approximately $573 million, the authors find:

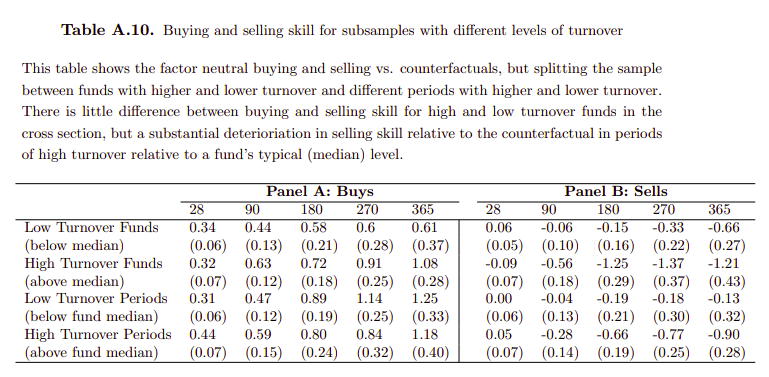

- YES- Despite demonstrating a clear proficiency in making buying decisions, investors exhibit a significant lag in their selling choices. The positions integrated into the portfolio outperform both the benchmark and a randomly acquiring strategy by over 100 basis points annually per dollar of purchase volume and surpass a factor-neutral, random-selling strategy. On the flip side, selling decisions not only fall short of outperforming a random selling strategy lacking any discernible skill but consistently underperform it by substantial margins. According to the authors’ preferred specification, portfolio managers (PMs) forego 80 basis points per year compared to a factor-neutral, random-selling strategy. Further analysis of heterogeneity reveals that the underperformance in selling is most pronounced among managers prioritizing fundamentals and maintaining active, concentrated portfolios with higher tracking error. In contrast, portfolio managers relying on momentum strategies exhibit the least underperformance in selling.

- YES – There is a basis for suspecting that the processes behind selling and buying decisions involve distinct psychological mechanisms. The authors posit that the marked performance disparity between buying and selling can be attributed to an uneven distribution of limited cognitive resources, with a bias favoring buying decisions over selling ones. Essentially, the paper suggests that experienced institutional portfolio managers exhibit an asymmetry in the allocation of cognitive resources, with a greater emphasis on finding new investment opportunities (buying decisions) and a comparatively reduced allocation to selling decisions, often seen as a means to generate cash for purchases. This hints at a cognitive bias or preference in mental effort allocation, potentially influencing the observed performance gap between buying and selling decisions. Examining trades on earnings announcements and non-announcement days suggests that portfolio managers (PMs) possess fundamental skills in selling. However, the results indicate an asymmetry in the allocation of cognitive resources, with PMs dedicating more cognitive resources to buying than selling decisions. The noteworthy enhancement in selling performance on announcement days, characterized by decision-relevant information, supports the idea that PMs bolster their selling abilities when cognitive resources are more actively engaged.

Why does this study matter?

The paper provides valuable insights into the decision-making processes of institutional investors, specifically experienced portfolio managers. The research makes a notable contribution to the literature on behavioral biases within expert circles, disrupting the notion that institutional investors operate purely with rationality and impartiality. Through underscoring the uneven distribution of cognitive resources and its consequential effects on performance, the paper introduces subtleties that enrich our comprehension of how even seasoned professionals can display biases.

The findings indicate significant benefits in creating environments that support enhanced learning, possibly through the implementation of revised reporting standards that emphasize counterfactual sales performance. Moreover, the observed link between heuristic utilization and the underperformance of selling strategies suggests that portfolio managers could achieve notable performance improvements by adopting decision aids or implementing simpler alternative selling strategies.

The Most Important Chart from the Paper:

Abstract

Are market experts prone to heuristics, and if so, do they transfer across closely related domains—buying and selling? We investigate this question using a unique dataset of institutional investors with portfolios averaging $573 million. A striking finding emerges: while there is clear evidence of skill in buying, selling decisions underperform substantially—even relative to random selling strategies. This holds despite the similarity between the two decisions in frequency, substance and consequences for performance. Evidence suggests that an asymmetric allocation of cognitive resources such as attention can explain the discrepancy: we document a systematic, costly heuristic process when selling but not when buying.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.