This study investigates the influence of personality traits on financial decision-making and investment behavior, addressing the gap in explaining persistent heterogeneity in investment choices and returns through conventional demographic and individual characteristics.

Personality Differences and Investment Decision-Making

- Zhengyang Jiang, Cameron Peng and Hongjun Yan

- Journal of Financial Economics, 2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- Are certain personality traits associated with specific investment beliefs, such as expectations about stock market returns and economic indicators?

- How do personality traits impact portfolio holdings, and what are the underlying mechanisms?

- Are the associations between personality traits and investment decisions robust to the inclusion of demographic variables and other control variables?

- How do personality traits important for financial decisions differ from those relevant in other economic domains, and what implications does this have for understanding investment behavior?

- How can economists incorporate personality traits into financial decision frameworks, considering their varying importance, operating channels, and potential interactions with social factors?

What are the Academic Insights?

By analyzing data from a nationwide survey (administered in November 2019) through the American Association of Individual Investors (AAII), a nonprofit organization of about 150,000 members, the authors find:

- YES- The paper highlights that Neuroticism and Openness as the most relevant traits in the domain of financial decisions:

- Neuroticism: Investors high in Neuroticism tend to be more pessimistic about average future stock returns and assign a greater probability to a crash. They also exhibit pessimism about future economic growth and expect higher inflation.

- Openness: Investors high in Openness are more willing to take risks, suggesting a positive association between Openness and optimism regarding investment outcomes.

- YES- The paper highlights the following associations:

- Neuroticism: Investors high in Neuroticism tend to invest less in equities. This could be attributed to their pessimistic beliefs about future stock returns and tail risks. Neurotic individuals may be more prone to worry and anxiety about potential losses in the stock market, leading them to allocate less of their portfolio to equities to mitigate perceived risks.

- Openness: Similarly, investors low in Openness also tend to invest less in equities. This could be due to their higher levels of risk aversion, as suggested by their tendency to be less willing to take risks. Individuals low in Openness may prefer safer investment options with lower risk profiles, leading them to allocate less of their portfolio to equities.

- YES- According to the paper, the associations between personality traits and investment decisions remain robust even after controlling for demographic variables and other control variables. The paper addresses this concern in two ways:

- Investor-level regressions: The paper includes a large set of demographic variables, such as income, wealth, preference, and belief characteristics, as controls in investor-level regressions. Despite controlling for these variables, the explanatory power of personality traits remains significant in explaining investment decisions.

- Stability of personality traits over time: Personality traits display remarkable stability within individuals over time. This high persistence in personality traits mitigates concerns that the documented correlations between personality traits and investment decisions are due to concurrent omitted variables. Since personality traits are mostly determined before the realizations of concurrent variables, they capture persistent differences across individuals that manifest themselves in financial decisions.

- The paper suggests that personality traits important for financial decisions may differ from those relevant in other economic domains, and it discusses the implications of this difference for understanding investment behavior. Here are some key points:

- Domain specificity of personality traits: The paper notes that certain personality traits may be more relevant in specific economic domains. For example, while Agreeableness is found to be important in negotiation and labor market outcomes, it doesn’t play a direct role in financial decisions.

- Relevance of Neuroticism and Openness: The paper highlights Neuroticism and Openness as the most relevant traits in the domain of financial decisions. Neuroticism is associated with pessimistic beliefs about future stock returns and tail risks, while Openness is linked to risk preferences. These traits may have unique implications for investment behavior compared to their role in other economic domains.

- Incorporating personality traits into financial decision frameworks requires a nuanced understanding of their importance, operating channels, and interactions with other factors. By carefully accounting for these factors, economists can develop more comprehensive models of investment behavior that better reflect the psychological factors influencing decision-making.

The personality traits are five:

- Openness, that is the tendency to be open to new aesthetic, cultural, or intellectual experiences

- Conscientiousness, that is the tendency to be organized, responsible and hardworking

- Extraversion, that is the orientation of one’s interests and energies toward the outer world of people and things rather than the inner world of subjective experiences

- Agreeableness, the tendency to act in a cooperative unselfish manner

- Neuroticism, that is a chronic level of emotional instability and proneness to psychological distress

Why does this study matter?

This study offers valuable information to provide insights into the underlying mechanisms driving investment behavior. For example, recognizing the impact of Neuroticism on belief formation and risk perception can help explain why some investors exhibit greater aversion to stock market volatility. Similarly, understanding how Openness influences risk preferences can shed light on why certain individuals are more willing to take investment risks than others.

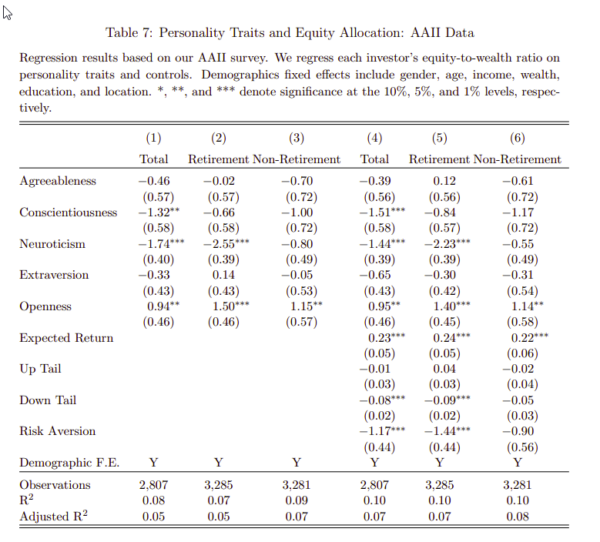

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We survey thousands of affluent American investors to examine the relationship between personalities and investment decisions. The Big Five personality traits correlate with investors’ beliefs about the stock market and economy, risk preferences, and social interaction tendencies. Two personality traits, Neuroticism and Openness, stand out in their explanatory power for equity investments. Investors with high Neuroticism and those with low Openness tend to allocate less investment to equities. We examine the underlying mechanisms and find evidence for both standard channels of preferences and beliefs and other nonstandard channels. We show consistent out-of-sample evidence in representative panels of Australian and German households.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.