This paper explores the applicability of the Bernanke-Blanchard (BB) model across diverse economies, revealing commonalities and differences in inflation dynamics post-pandemic. It analyzes the impact of price shocks, labor market conditions, and supply disruptions on inflation, providing insights crucial for informed policy-making and economic stability.

An Analysis of Postpandemic Inflation in 11 Economies

- Ben Bernanke and Olivier Blanchard

- PIIE,2024

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

The authors ask the following questions:

- What were the primary sources of the post-pandemic surge in global inflation?

- What were the key transmission mechanisms through which inflation spread across economies?

- What were the different viewpoints on the persistence of inflation during the post-pandemic period?

- What are the challenges and considerations in achieving central bank inflation targets in the current economic context?

- How applicable is the BB model across different economies?

What are the Academic Insights?

The authors find:

- The primary sources of the post-pandemic surge in global inflation were:

- Supply-Side Factors like 1) Sharp Increases in Key Commodity Prices (notably in energy and food, which had significant direct and indirect effects on overall inflation), 2) Global Supply Chain Disruptions (these disruptions created shortages and increased costs in various sectors), 3) Reductions in Labor Supply (factors such as early retirements and declines in participation rates contributed to tight labor markets and wage inflation)

- Demand-Side Factors like 4) Strong Aggregate Demand (fueled by pent-up savings accumulated during lockdowns and expansionary fiscal policies, especially in the United States), 5) Accommodative Monetary Policies (central banks’ policies to support the economy during the pandemic contributed to increased demand) and 6) Early and Strong Global Economic Recovery (as the pandemic waned, the rapid recovery in many economies outpaced supply adjustments, further driving inflation)

- The key transmission mechanisms through which inflation spread across economies included:

- Direct Price Effects like Energy Prices (such as gasoline, which had a direct impact on consumer price inflation) and Food Prices

- Indirect Cost Effects like Production Costs (for example, higher energy prices increased the costs of production for non-energy goods and services, leading to broader price increases) and Wage Pressures (for example, rising energy and food prices motivated workers to demand higher wages to compensate for the loss in purchasing power, which in turn increased production costs and prices)

- Inflation Expectations, both Short-Run Expectations (for example, increases in key prices like gas led to higher short-run inflation expectations among consumers and firms, which contributed to wage and price pressures) and Long-Run Expectations (for example, poorly anchored long-run inflation expectations could lead to wage-price or price-wage spirals, where wages and prices continuously push each other up)

- Labor Market Tightness such as Vacancy-Unemployment Ratio (for example, an increase in labor market tightness, measured by the vacancy-unemployment ratio, put upward pressure on wages.) As labor markets became tighter, wage inflation became more persistent, contributing to sustained price inflation.

- There have been two main teams: “Team Transitory” Viewpoint and “Team Permanent” Viewpoint

- Team Transitory: Proponents of this view, including early Federal Reserve officials, argued that the post-pandemic inflation surge was mostly due to temporary supply-side factors such as supply chain disruptions and sharp increases in commodity prices. They believed that these factors would reverse relatively quickly as supply chains adjusted and commodity prices stabilized, leading to a decrease in inflation without the need for significant policy intervention.This view suggested that central banks should “look through” the short-term inflation spike and avoid overreacting with aggressive monetary tightening, as inflation expectations remained well-anchored.

- Team Permanent: Advocates of this perspective, including economists like Olivier Blanchard and Lawrence Summers, argued that exceptionally strong demand, driven by large fiscal stimulus programs and accumulated savings, would put sustained upward pressure on inflation. They believed that inflation would not subside quickly and that continued strong demand, coupled with tight labor markets, would lead to ongoing wage and price increases. This view suggested that central banks needed to take more proactive measures to cool down the economy, such as increasing interest rates, to prevent inflation from becoming entrenched.

- As inflation persisted beyond its initial surge, the debate shifted towards the “last mile” of inflation reduction, focusing on what further actions might be needed to bring inflation back to target levels. One viewpoint was that the reduction in inflation was mostly due to the reversal of supply shocks and that further substantial cooling of the labor market might be necessary to achieve the desired inflation targets. Conversely, another viewpoint was that many countries were already close to achieving their inflation targets, implying that the fight against inflation was largely won.

- Achieving central bank inflation targets in the current economic context involves navigating several challenges and considerations. CHALLENGES: Volatility of Price Shocks, Supply Chain Disruptions, Labor Market Conditions, Global Economic Uncertainty and Differences Across Economies. CONSIDERATIONS:

- United States:

- The US has experienced shifts in the Beveridge curve, suggesting potential for reducing labor market tightness without significant unemployment increases. This requires careful monitoring of labor market dynamics and productivity growth.

- Euro Area:

- Diverse fiscal responses and initial conditions among member countries necessitate tailored policy measures. Coordination within the eurozone to address these differences is critical for overall stability.

- Japan:

- Japan’s lower initial inflation and reliance on imported goods, particularly food, indicate a need for policies that address exchange rate impacts and import price stability.

- Emerging Markets:

- Emerging economies face additional challenges such as higher volatility in capital flows and greater exposure to commodity price swings. Central banks in these regions need to manage inflation while ensuring financial stability.

- United States:

- The BB model has demonstrated that with some adjustments, it works reasonably well across different economies. It captures the impact of price shocks, such as energy and food prices, on inflation dynamics, which have been common across various regions during the post-pandemic period. The model produces similar decompositions of inflation across different economies, indicating that the fundamental drivers of inflation, as captured by the model, are consistent. This suggests a broad applicability of the model in understanding the primary factors influencing inflation, such as price shocks and supply chain disruptions. Following are some specific characterizations based on each country:

- United States:

- The model shows that price shocks have been a significant driver of inflation, but labor market tightness has also played a more notable role compared to other regions. This indicates the model’s adaptability to account for labor market conditions specific to the US economy.

- Euro Area:

- In the euro area, the model captures the impact of imported inflation, especially from energy prices, and shows limited contribution from labor market conditions. This highlights the model’s flexibility in addressing region-specific factors like the reliance on imported energy.

- Japan:

- Japan’s inflation dynamics, as modeled by the BB model, are heavily influenced by food prices and the depreciation of the yen. The model’s ability to incorporate these factors and reflect Japan’s unique economic structure demonstrates its versatility.

- Emerging Markets:

- While the model is applicable, emerging markets may require additional adjustments to account for higher volatility in capital flows, commodity price swings, and different fiscal policy impacts. The model needs to be tailored to handle these more pronounced economic fluctuations.

- United States:

Why does this study matter?

This study is important because it provides a detailed analysis of the factors driving inflation in various economies, particularly in the post-pandemic period. This understanding is crucial for policymakers to identify the root causes of inflation and implement appropriate measures. It highlights that despite institutional and policy differences, inflation dynamics across economies share common factors, primarily price shocks, which are essential for a unified approach to tackling global inflation. Overall, it It contributes to economic stability and growth by offering insights that help manage inflation effectively in a globally interconnected economy.

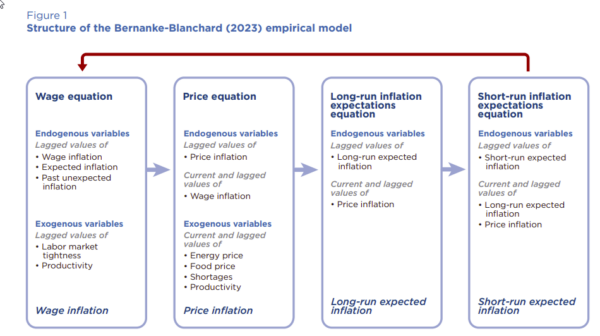

The Most Important Chart from the Paper:

Abstract

We recently proposed a simple model of the inflation process, estimated it on post-1990 US data, and used the results to identify the shocks and transmission mechanisms that have determined US inflation since 2019 (Bernanke and Blanchard 2023, hereafter BB). Ten central banks expressed interest in using our model to study the recent inflation in their own economies, and we agreed to do

a joint project. This paper summarizes and discusses in broad terms the results of the project, leaving details to papers and reports produced by staff at the cooperating central banks.

About the Author: Elisabetta Basilico, PhD, CFA

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.