Working More to Pay the Mortgage

By Elisabetta Basilico, PhD, CFA|May 27th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Behavioral Finance|

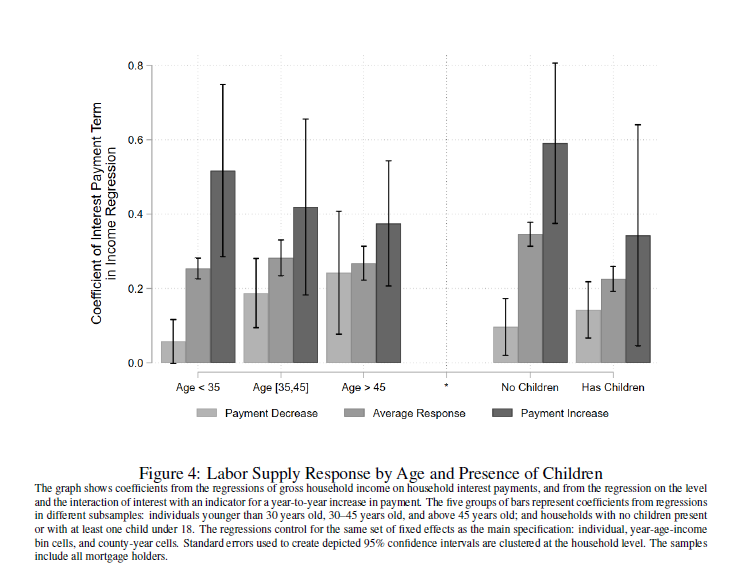

The study examines how households adjust their labor supply in response to changes in mortgage payments due to fluctuating interest rates.

A Good Sketch is Better than a Long Speech

By Elisabetta Basilico, PhD, CFA|May 21st, 2025|Elisabetta Basilico, Factor Investing, Research Insights, Other Insights, Behavioral Finance|

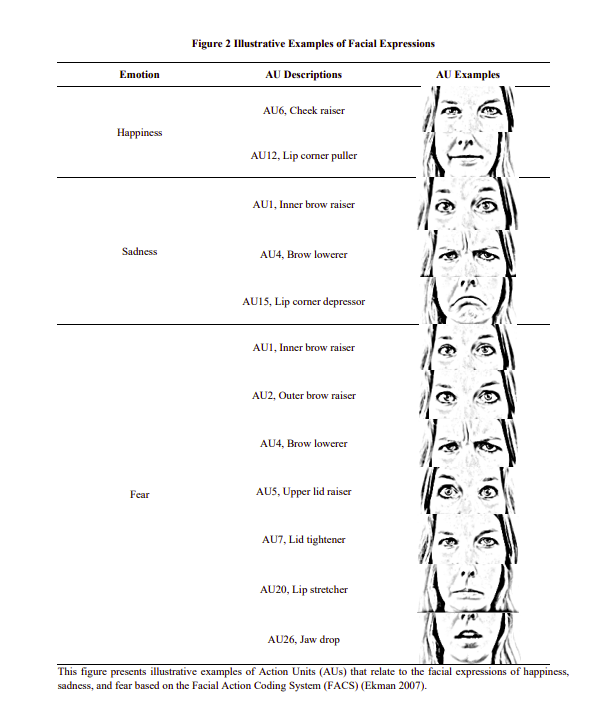

In the evolving landscape of financial technology, innovative methods are emerging to assess creditworthiness. One such approach involves analyzing borrowers' facial expressions during loan applications to predict delinquency risk. This study explores this novel intersection of psychology, machine learning, and finance.

Profitability Retrospective: Key Takeaways for Investors

By Larry Swedroe|May 16th, 2025|Intangibles, Profitability, Quality Investing, Research Insights, Factor Investing, Larry Swedroe, Other Insights, Low Volatility Investing|

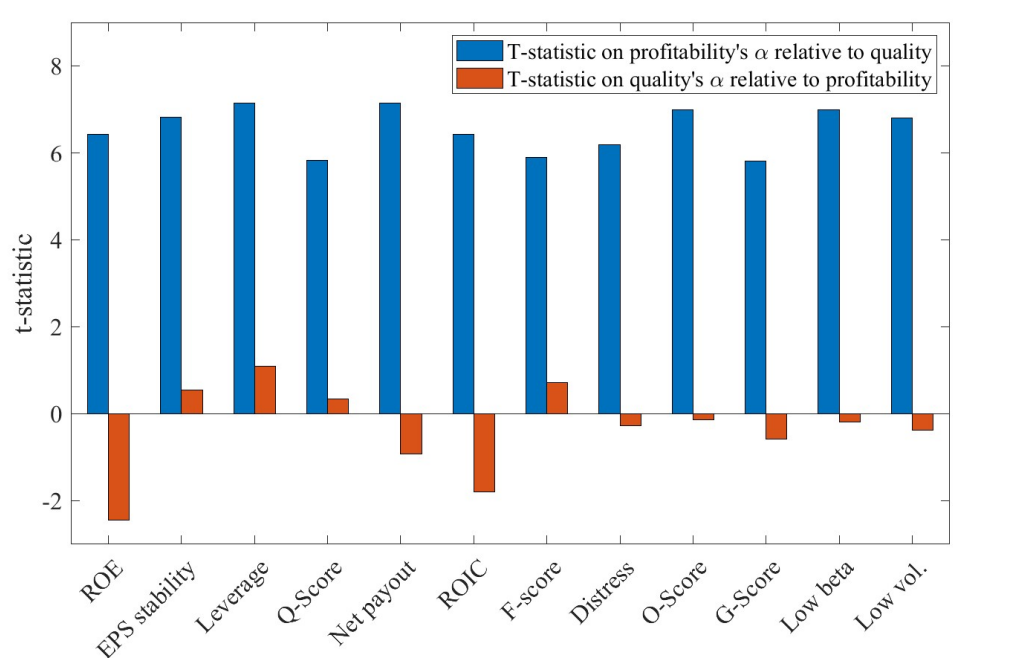

Profitability subsumes all of the quality factor, explaining both the performance of the strategies the investment industry market and the factors that academics employ—none of the quality factors generated significant positive alpha relative to profitability, the other Fama and French factors, and momentum.

The Virtue of Complexity in Return Prediction

By Elisabetta Basilico, PhD, CFA|May 12th, 2025|Predicting Market Returns, Elisabetta Basilico, Factor Investing, Research Insights, AI and Machine Learning, Other Insights|

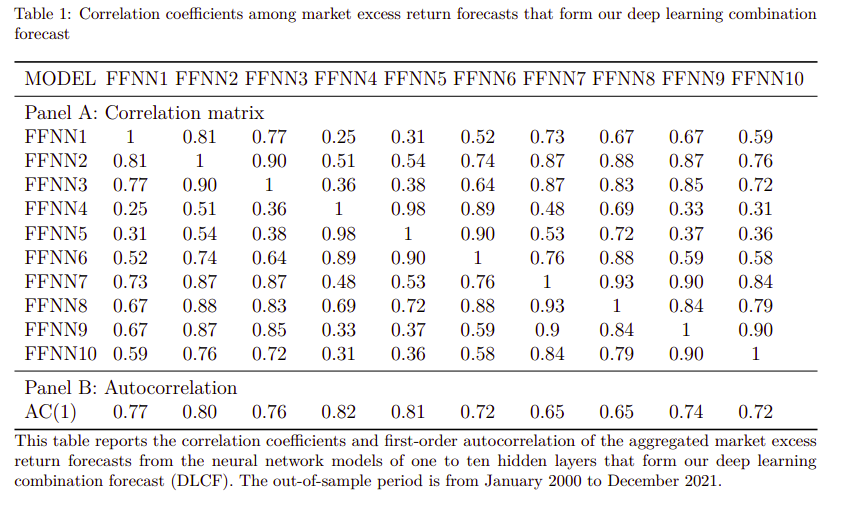

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks.

Cut Through the Noise! These Two Factors Tend to Drive Portfolio Success

By Jose Ordonez|May 8th, 2025|Factor Investing, Podcasts and Video, Research Insights, Investor Education, Value Investing Research, Momentum Investing Research, Size Investing Research|

Let’s break down how to build a robust factor portfolio—without getting lost in the weeds. We investigate which equity factors have the strongest historical returns and diversification benefits from a long-only perspective.

The Aggregated Equity Risk Premium

By Elisabetta Basilico, PhD, CFA|May 5th, 2025|Elisabetta Basilico, Research Insights, Factor Investing, Other Insights|

This article explores how researchers forecast market returns by aggregating expected returns from individual stocks.

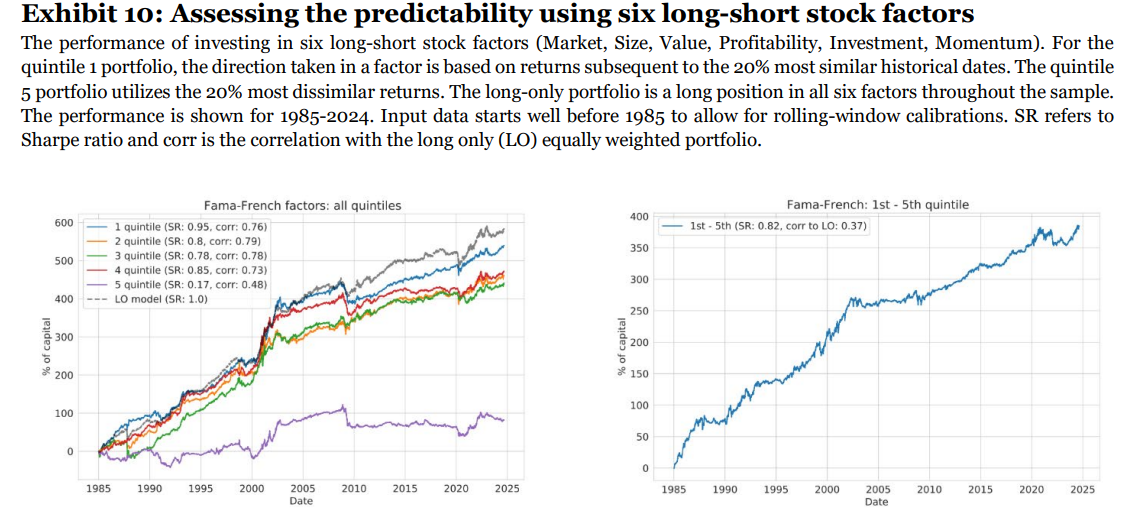

A New Approach to Regime Detection and Factor Timing

By Larry Swedroe|May 2nd, 2025|Research Insights, Factor Investing, Larry Swedroe, Other Insights, Tactical Asset Allocation Research|

The financial research literature has found that the performance of assets (and factors) can vary substantially across regimes - factor premiums can be regime dependent. Unfortunately, the real-time identification of the current economic regime is one of the biggest challenges in finance.

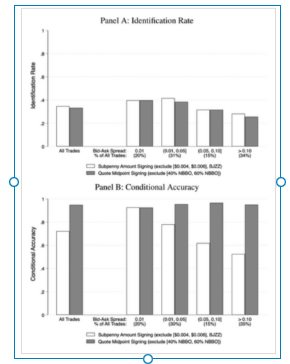

How Tiny Price Differences Help Track Small Investors’ Trades

By Elisabetta Basilico, PhD, CFA|April 28th, 2025|Elisabetta Basilico, Empirical Methods, Transaction Costs, Research Insights, Other Insights, Behavioral Finance|

This article explains how researchers studied small investors' trading habits by looking at tiny price differences, called subpennies, in stock trades. They found that the current method to identify these trades isn't very accurate. By using a new approach, they improved the accuracy, helping to better understand how small investors buy and sell stocks.

Making Factor Strategies Work for Everyone

By Elisabetta Basilico, PhD, CFA|April 21st, 2025|Elisabetta Basilico, Transaction Costs, Research Insights, Factor Investing, Other Insights|

This article explores the difference between tradable and on-paper (theoretical) risk factors in investing. Risk factors are strategies that help explain stock market returns, but many work only in theory and not in real life.

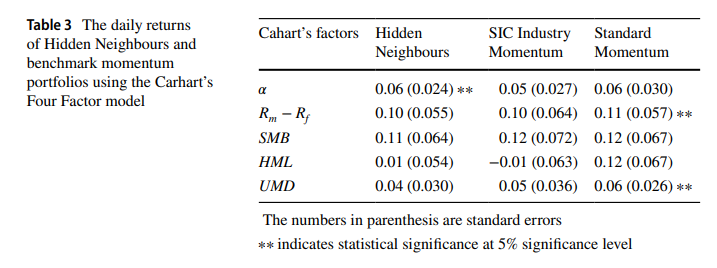

Enhancing Industry Momentum Strategies: Finding Hidden Neighbors

By Larry Swedroe|April 18th, 2025|Research Insights, Larry Swedroe, Factor Investing, Other Insights, Momentum Investing Research|

The main benefit of constructing industry momentum portfolios based on standard ICS is that it is straightforward and reproducible. However, that benefit may come at the cost of accuracy and oversimplification of complex industry relationships between companies.