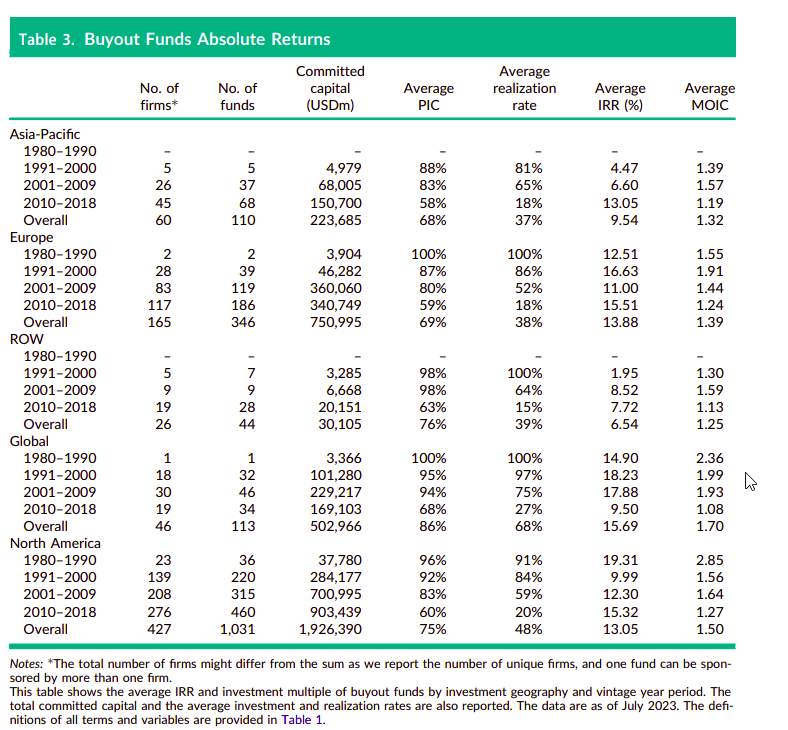

Private Equity Performance Around the Globe

By Elisabetta Basilico, PhD, CFA|March 11th, 2024|Private Equity, Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights|

This study provides valuable insights into how private equity performs in regions outside North America, reflecting broader trends in global investment.

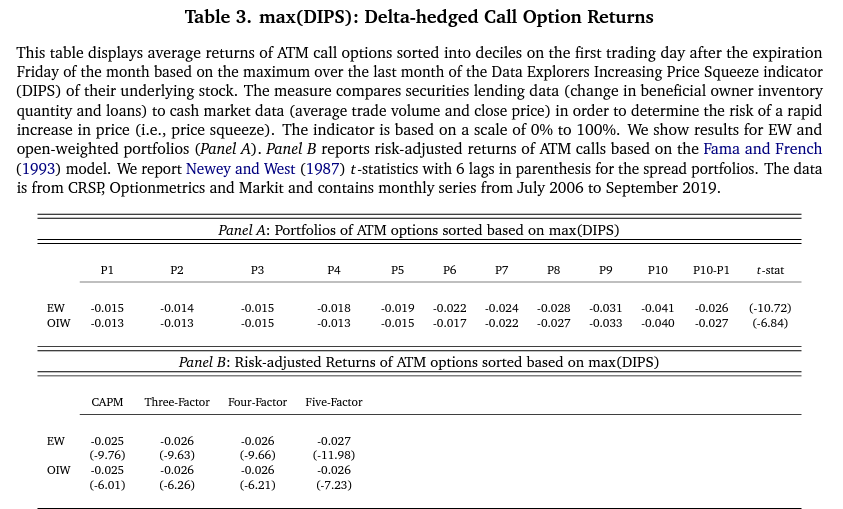

Betting on a Short Squeeze as Investment Strategy

By Larry Swedroe|March 8th, 2024|Skewness, Research Insights, Factor Investing, Larry Swedroe, Guest Posts, Other Insights, Tactical Asset Allocation Research|

Short squeezes are often associated with a large positive jump in the price of a stock. Filippou, Garcia-Ares, and Zapatero demonstrated that skewness-seeking investors try to identify securities that could experience a short squeeze in the near future and are willing to pay a premium for them. That results in an overvaluation of the options and, on average, negative returns. Investors are best served to avoid investments with lottery-like distributions. One way to do that is to turn a blind eye to social media sites like Robinhood and Reddit so you don’t get caught up in the hype and excitement. That’s another example of why retail investors are called “dumb money.” Forewarned is forearmed.

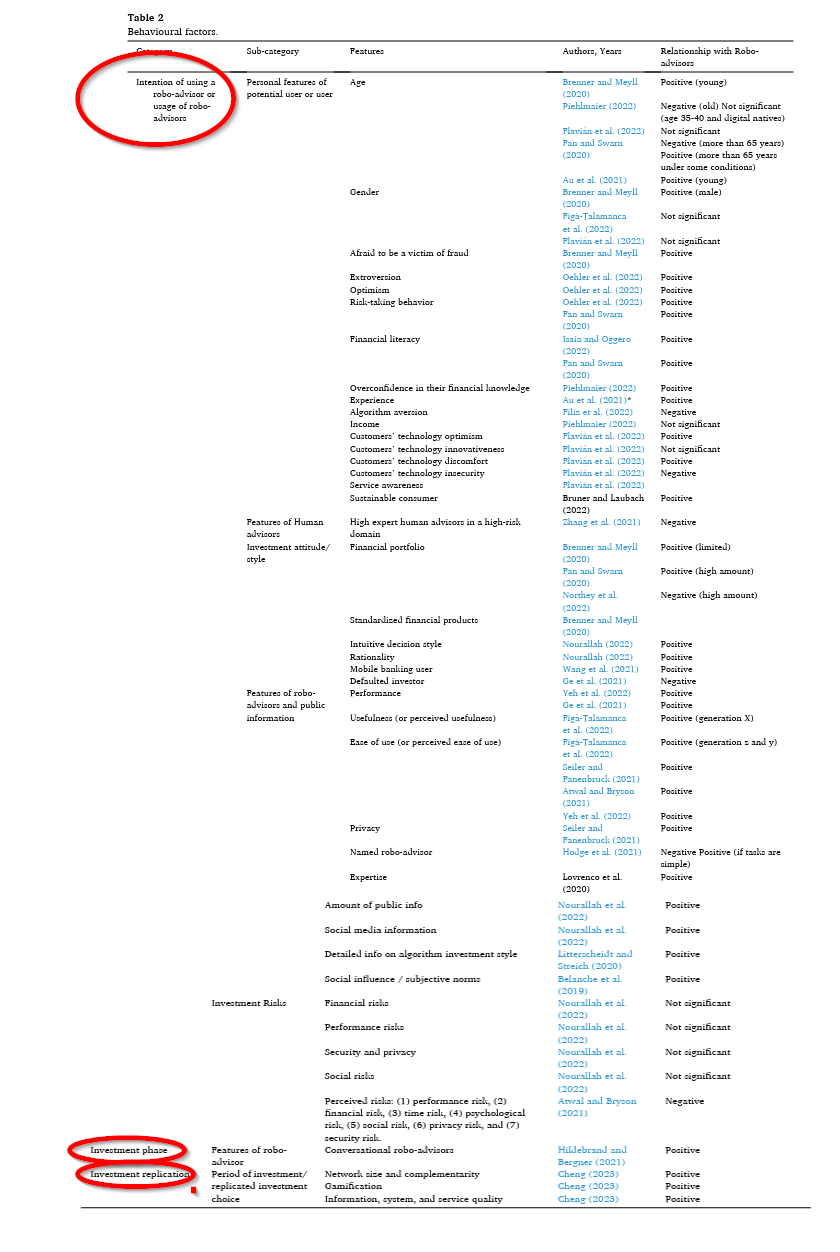

Robo-advisors: A well-researched topic

By Tommi Johnsen, PhD|March 4th, 2024|Financial Planning, Research Insights, Robo Advisor, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

Along with the rapid growth in the utilization of robo-advisors, there has been similar growth in academic interest about robo-advisors. What is the current state and what are the main research streams in the literature?

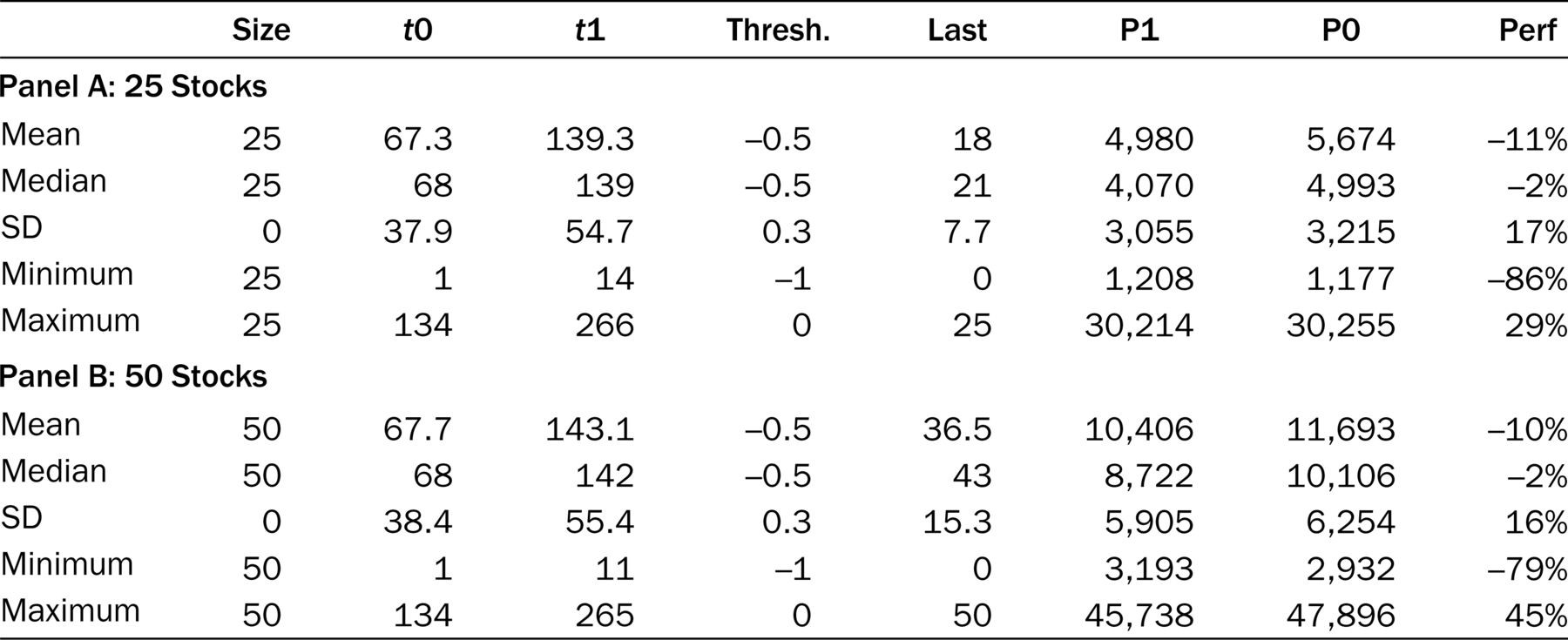

DIY Trend-Following Allocations: March 2024

By Ryan Kirlin|March 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

Cut Your Losses and Let Profits Run?

By Larry Swedroe|March 1st, 2024|Larry Swedroe, Research Insights, Other Insights, Behavioral Finance, Momentum Investing Research|

Be careful before acting on what is considered to be conventional wisdom. Make sure it’s supported by empirical evidence. In this case, the evidence makes clear that “cut your losses and let your profits run” should not be conventional wisdom.

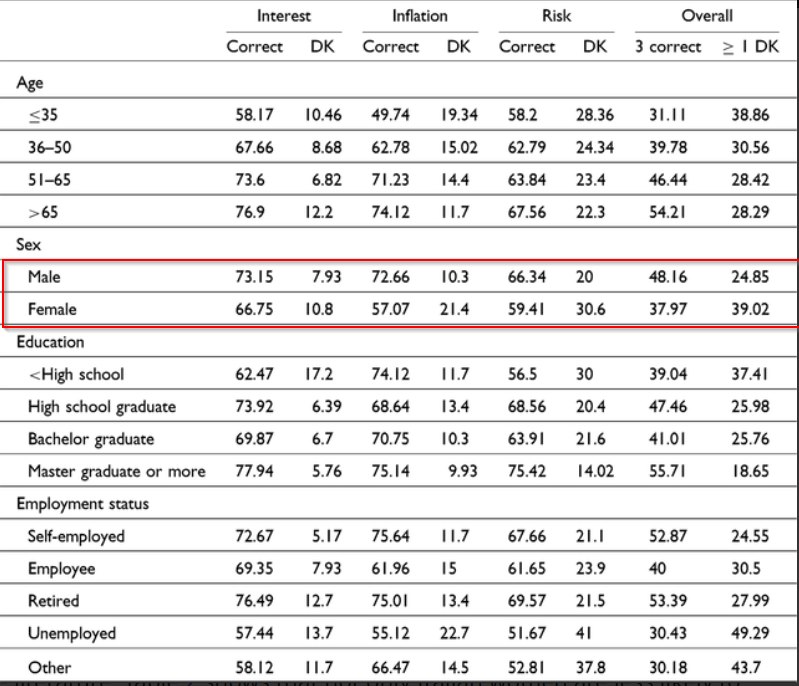

Financial Literacy and Financial Resilience: Evidence from Italy

By Elisabetta Basilico, PhD, CFA|February 26th, 2024|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Corporate Governance|

The paper aims to contribute to the literature by providing insights into the current state of financial literacy in Italy, its implications for financial well-being and resilience, and the demographic disparities therein.

Lottery Preference and Biotech Stocks: Trust the Financials, Not the Science

By Larry Swedroe|February 23rd, 2024|Predicting Market Returns, Larry Swedroe, Factor Investing, Research Insights, Guest Posts|

Making a bet on biotech/pharma firms that have not yet achieved significant revenue is the equivalent of buying a lottery ticket—with the same poor risk/return relationship.

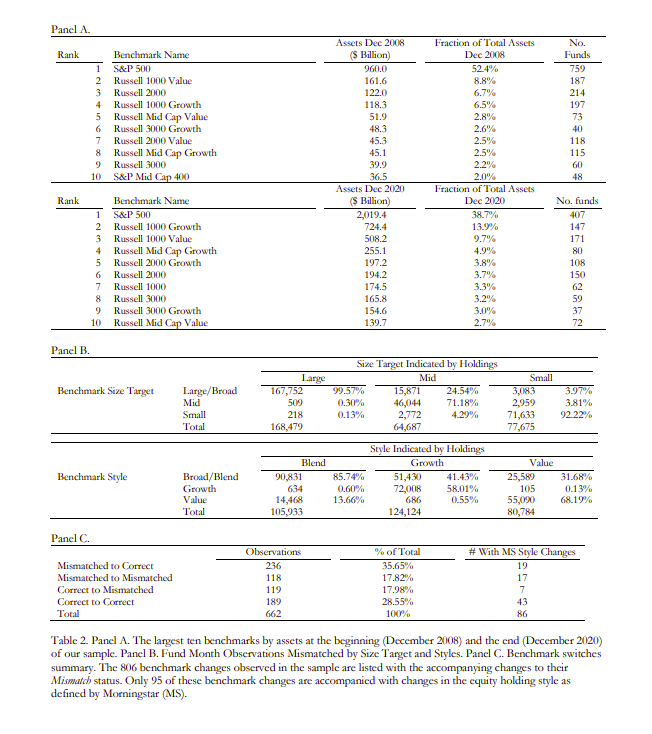

Self-Declared Benchmarks and Fund Manager Intent: “Cheating” or Competing?

By Elisabetta Basilico, PhD, CFA|February 20th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Corporate Governance|

The paper aims to provide insights into the dynamics of benchmark selection, the effectiveness of Relative Performance Evaluation ( RPE ) incentivization, and the broader implications for fund performance and market competition.

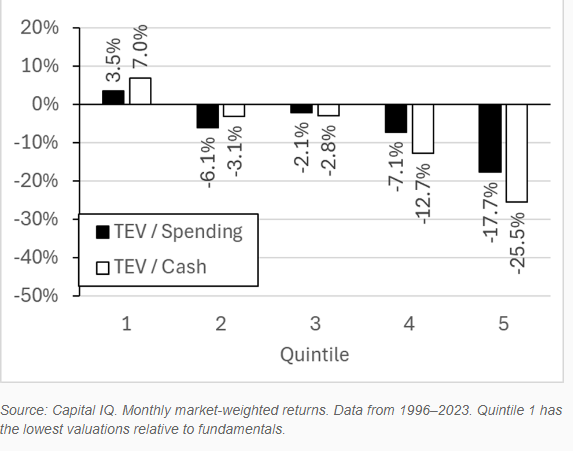

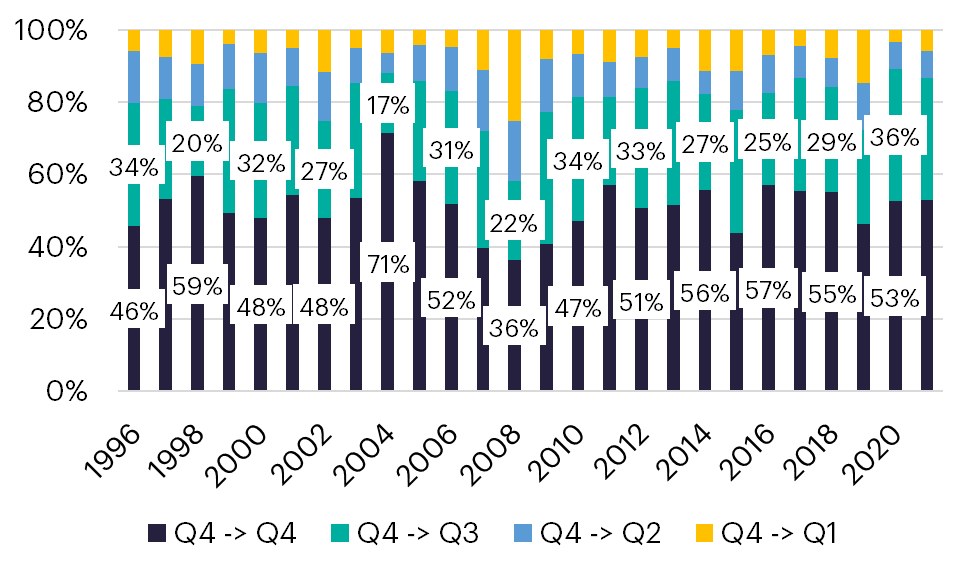

On the Persistence of Growth and Value Stocks

By Larry Swedroe|February 16th, 2024|Asset Growth, Larry Swedroe, Research Insights, Value Investing Research|

While analysts underwrite high growth for companies that have grown quickly and slow growth for companies that have grown slowly in the past, a large body of evidence demonstrates that reversion to the mean of both positive and negative abnormal earnings growth is the norm.

Can ChatGPT Improve Your Stock Picks?

By Tommi Johnsen, PhD|February 12th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, AI and Machine Learning|

One use of the NLP (natural language processing) features of ChatGPT is to search out patterns in the immense amounts of news, data and other sources of information about specific stocks, and then efficiently convert them into summaries valuable for all types of investors. Can this be accomplished with useful results? The authors use the Q2_2023 period to test performance around earnings announcements. Earnings announcements and earnings surprises are informationally rich as well as challenging events for investors to analyze.