Focus on Income Can Undermine Returns: The Case of Covered Calls

By Larry Swedroe|November 24th, 2023|Options, Volatility (e.g., VIX), Research Insights, Larry Swedroe|

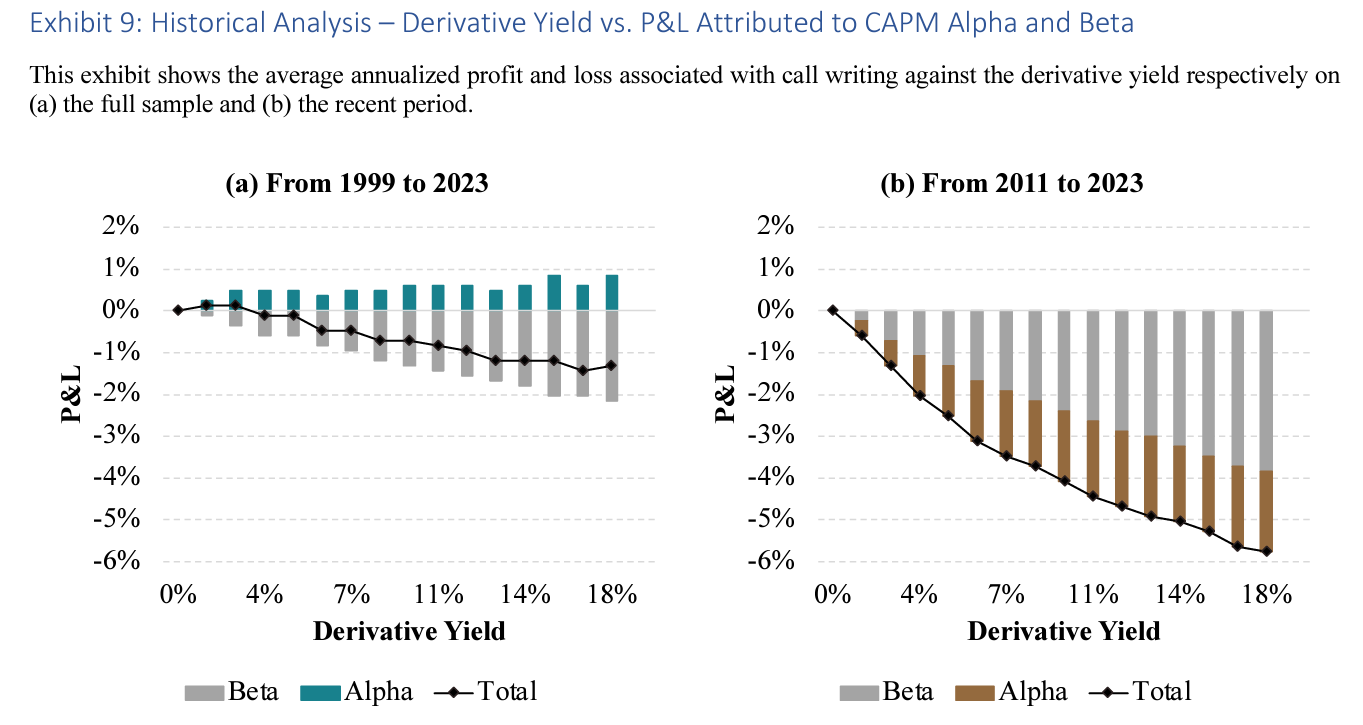

Covered calls implemented to deliver higher derivative income should be expected to have (1) lower total returns, (2) higher tax realizations along the path, and (3) a more negatively skewed return profile. Investors who allocate to these strategies for their income alone, without accounting for these other considerations, might have made a devil’s bargain

A New 1042 QRP Team Member Joins Alpha Architect: Erik Chavez

By Wesley Gray, PhD|November 22nd, 2023|Research Insights, Business Updates|

We are pleased to announce that Erik Chavez has joined Alpha Architect and will work alongside Kyle and Doug to support our 1042 QRP ESOP service (qualified replacement property for ESOP rollovers). While new to our team, Erik has been our friend for a long time. Erik is a multiple-time March for the Fallen survivor -- see below when he is part of the MFTF clean-up crew (cirled in blue).

Is ESG Investing Counterproductive?

By Elisabetta Basilico, PhD, CFA|November 20th, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

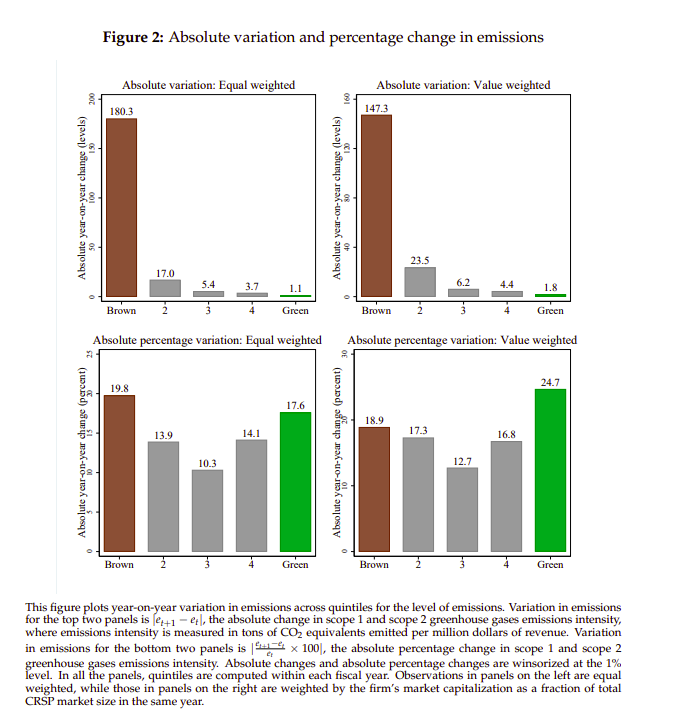

The article introduces a concept called "impact elasticity," which measures how a firm's environmental impact changes in response to shifts in its cost of capital (the "E" in "ESG"). It finds that the dominant sustainable investing strategy, which favors green firms and punishes brown firms by altering their cost of capital, can be counterproductive.

The Magnificent Seven

By Larry Swedroe|November 17th, 2023|Research Insights, Larry Swedroe, Academic Research Insight, Value Investing Research, Size Investing Research|

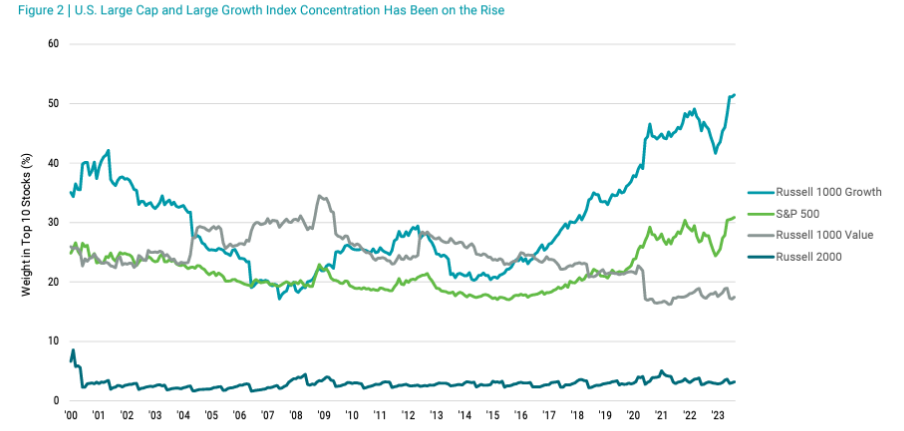

When a small subset of companies makes up a large portion of a portfolio, for better or worse their returns will have a greater impact on overall portfolio results.

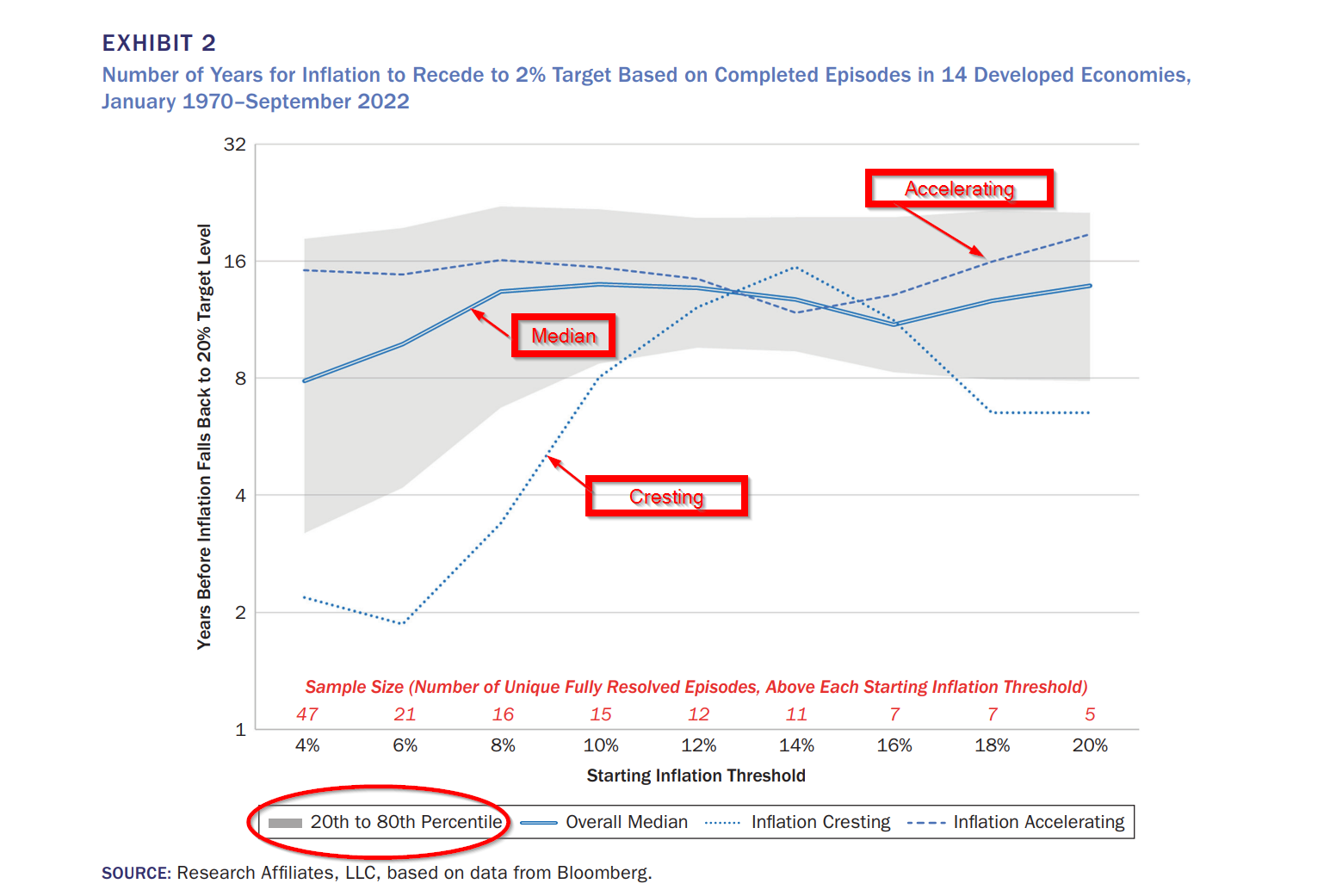

Is Inflation Ever Going to Go Down?

By Tommi Johnsen, PhD|November 13th, 2023|Inflation Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

If inflation surges, how long on average, will it take to subside to a reasonable target rate of 2%?

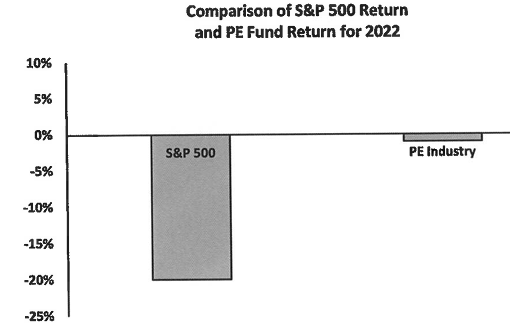

The Performance of Major Private Equity/LBO Firms

By Larry Swedroe|November 10th, 2023|Private Equity, Larry Swedroe|

The claims of superior risk-adjusted performance by the PE industry are exaggerated. Given their lack of liquidity, opaqueness, and greater use of leverage, it seems logical that investors should demand something like a 3-4% IRR premium. Yet, there is no evidence that the industry overall has been able to deliver that.

Global Factor Performance: November 2023

By Wesley Gray, PhD|November 8th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

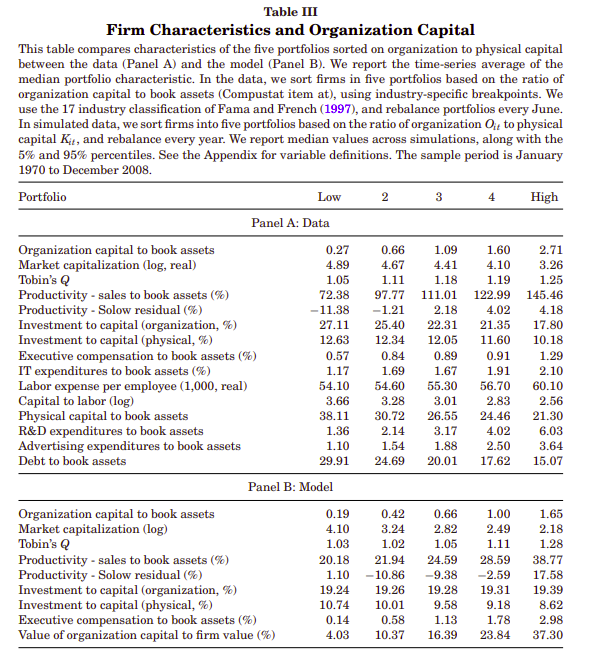

Organization Capital and the Cross-Section of Expected Returns

By Elisabetta Basilico, PhD, CFA|November 6th, 2023|Intangibles, Research Insights, Basilico and Johnsen, Academic Research Insight, Corporate Governance|

This paper focuses on "organization capital," representing intangible assets in a firm's key employees that is not captured by classic value measures such as book-to-market. The authors propose a structural model to analyze the impact of organizational capital on asset prices and argue that shareholders perceive firms with high levels of organizational capital to be riskier than those with more physical capital.

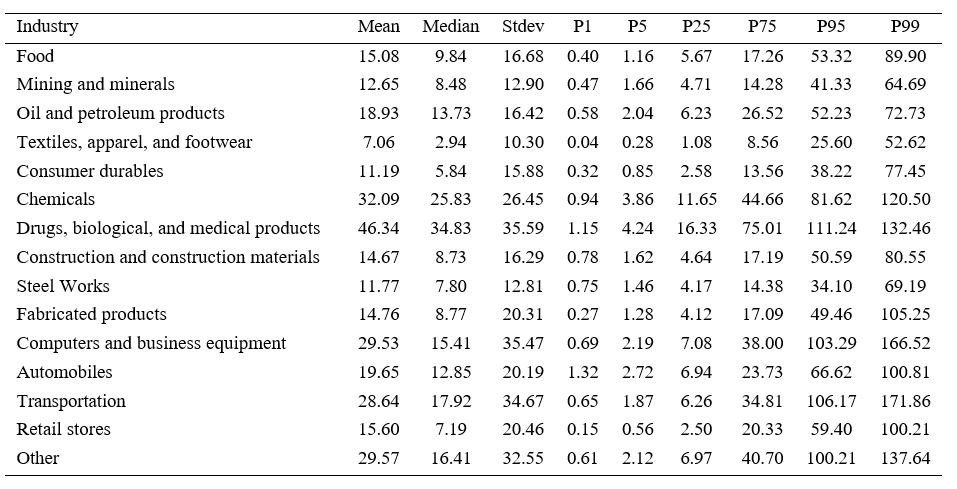

Technology Spillover Impacts Stock Returns

By Larry Swedroe|November 3rd, 2023|Intangibles, Research Insights, Larry Swedroe, Factor Investing, Guest Posts|

The timelier adoption of new technology and the higher likelihood of large-scale technology adoption make the risk associated with technological innovation more systematic, which in turn increases returns required by investors for technology spillover recipients.

DIY Trend-Following Allocations: November 2023

By Ryan Kirlin|November 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Partial exposure to international equities. No exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.