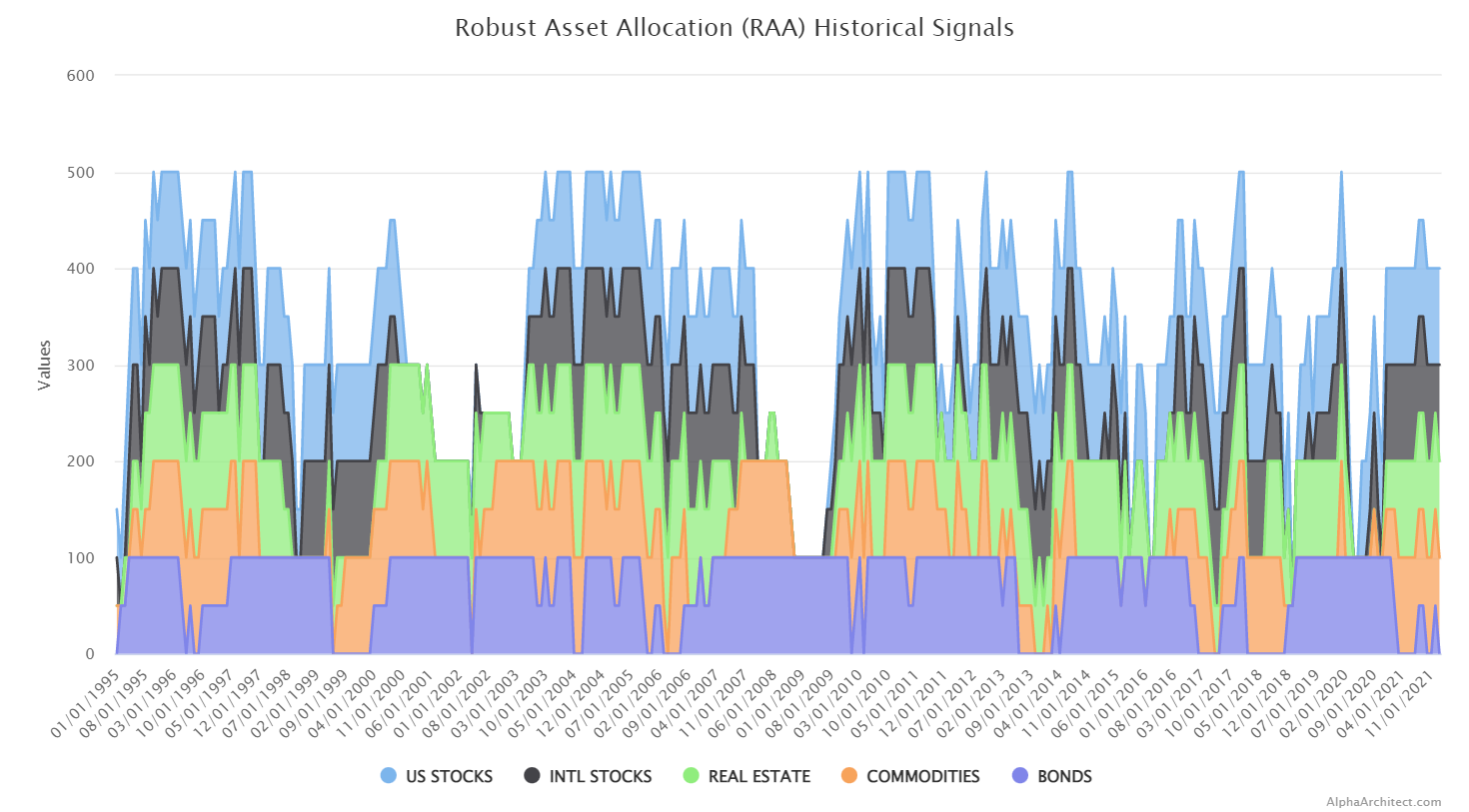

DIY Trend-Following Allocations: October 2023

By Ryan Kirlin|October 2nd, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation Index are posted.

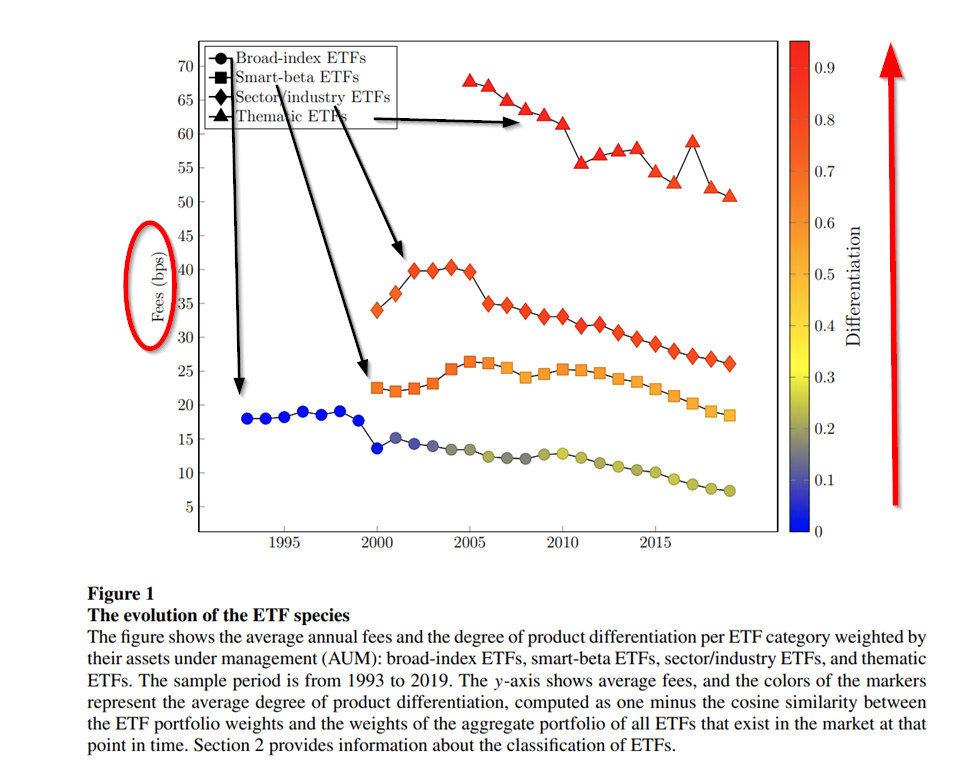

The democratization of investing and the evolution of ETFs

By Tommi Johnsen, PhD|October 2nd, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

The implications of the competitive landscape for ETFs are mixed. On one hand, they have truly democratized investing. Investors now have access to the benefits of financial markets in one instrument that provides diversification at very low fees. Recently advertised fees on broad-based bond funds have fallen to 3bps. On the other hand, ETF providers have been able to satisfy investor demand for increasingly specialized products even though the evidence suggests they underperform. Are investors becoming worse off due to the effectiveness of the marketing strategies by providers of specialized ETFs?

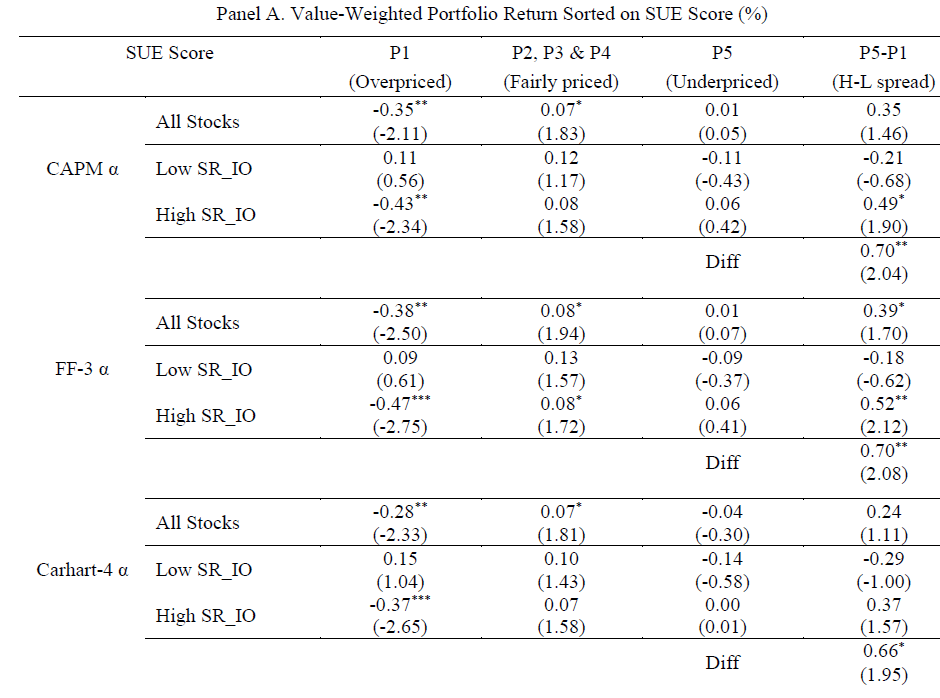

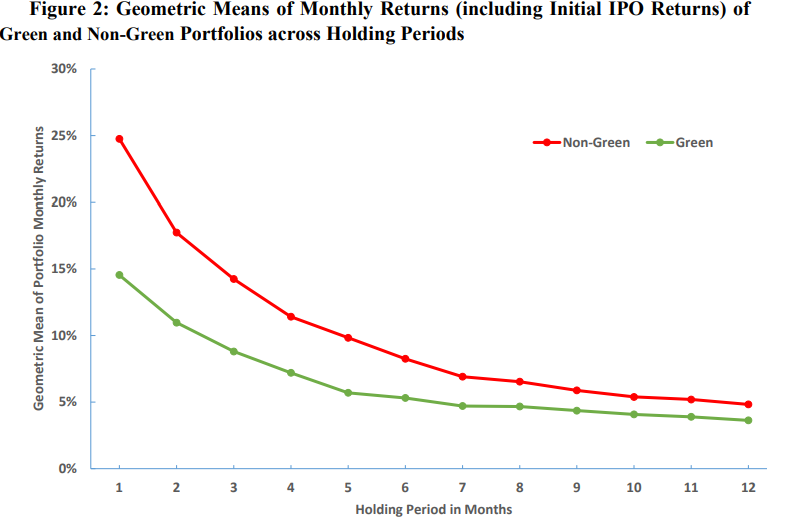

ESG Preferences Negatively Affecting Market Efficiency

By Larry Swedroe|September 29th, 2023|ESG, Research Insights, Larry Swedroe, Guest Posts, Other Insights|

While ESG investors can express their values through their investments, they should expect lower returns from their portfolios—though they also will be taking less investment risk.

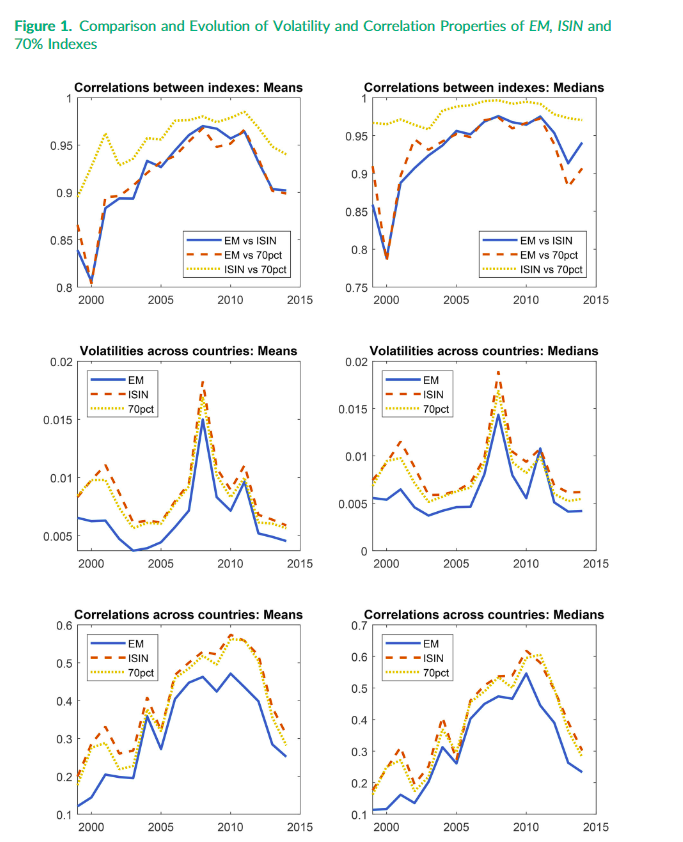

Geographic Investing and Company Operations

By Elisabetta Basilico, PhD, CFA|September 25th, 2023|Empirical Methods, Research Insights, Basilico and Johnsen, Academic Research Insight, Tactical Asset Allocation Research|

The article explores the limitations of traditional country-level stock market indexes that are constructed based on the domicile of issuing firms.

The Research and Development Factor

By Larry Swedroe|September 22nd, 2023|Intangibles, Research Insights, Factor Investing, Larry Swedroe, Guest Posts|

The higher returns to high R&D stocks represent compensation for heightened systematic risk not captured in standard asset pricing models.

A New Wolf in Town? Pump-and-Dump Manipulation in Cryptocurrency Markets

By Tommi Johnsen, PhD|September 17th, 2023|Crypto, Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

Cryptocurrency and the various forms of infrastructure are currently in a stage of rapid innovation. If the manipulation embedded in PADs is widespread then the confidence in and integrity of the crypto market will suffer.

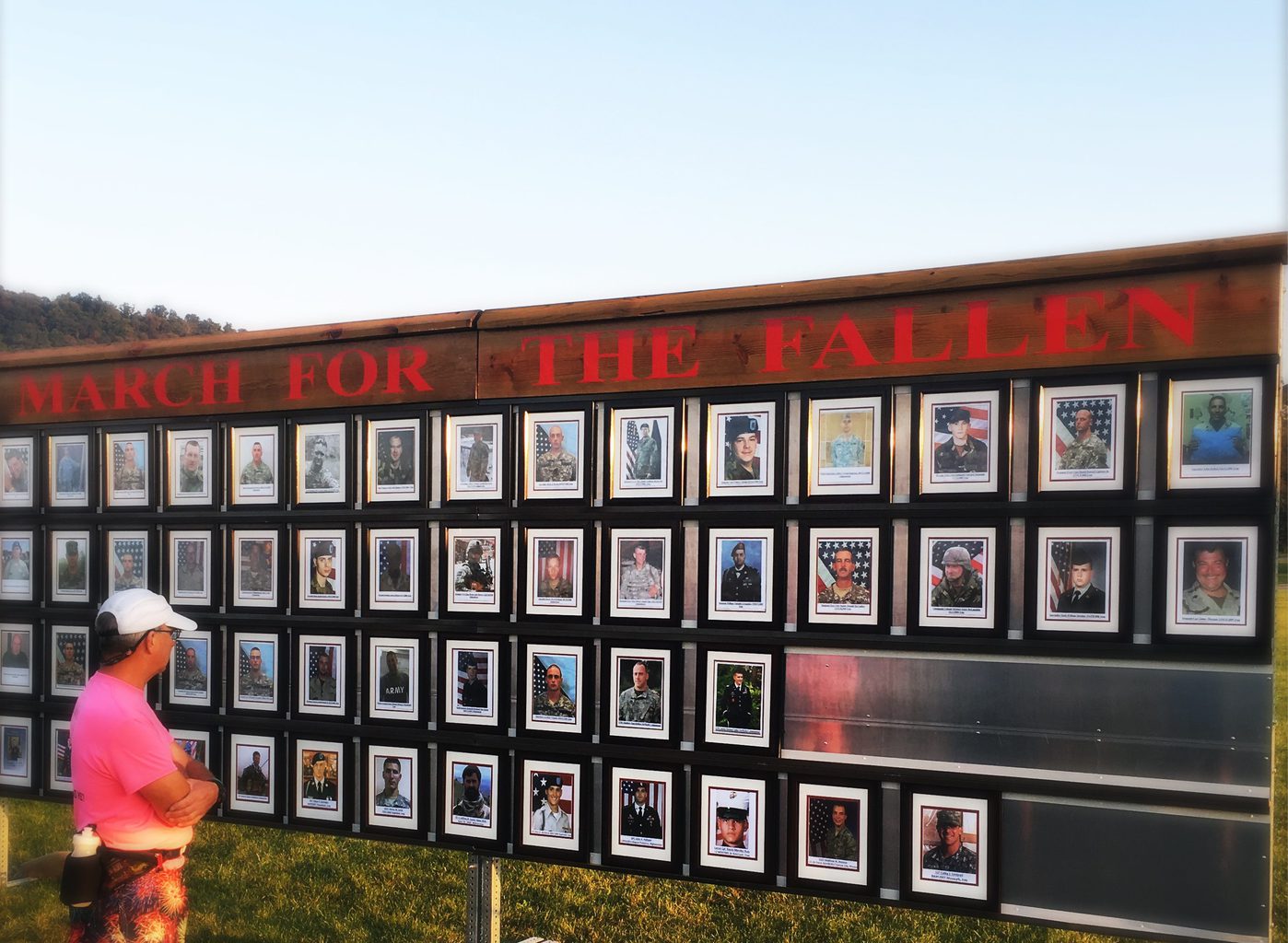

March for the Fallen 2023: Detailed Logistics Outline and What to Expect

By Wesley Gray, PhD|September 15th, 2023|Training Section, MFTF Training Series|

This is going to be an incredible experience and I’m looking forward to hearing a ton of stories over our 28 miles. Sometime during the weekend please find me and introduce yourself. I’m looking forward to meeting everyone.

The Role of ESG in Equity Returns Across Private, Primary, and Secondary Markets

By Larry Swedroe|September 15th, 2023|ESG, Research Insights, Larry Swedroe, Other Insights|

The continued popularity of sustainable strategies could create sufficient cash flows to offset the risk premium in the lower-scoring stocks, at least until an equilibrium is reached.

How to Crush the CFPⓇ Exam ????: Part 1

By Jess Bost|September 12th, 2023|Women in Finance Know Stuff, Guest Posts, Other Insights, Investor Education|

Let’s talk about the right approach(es) and the proper study techniques you need to pass the CFPⓇ exam with confidence and get the certification you need to advance your career in finance and investing.

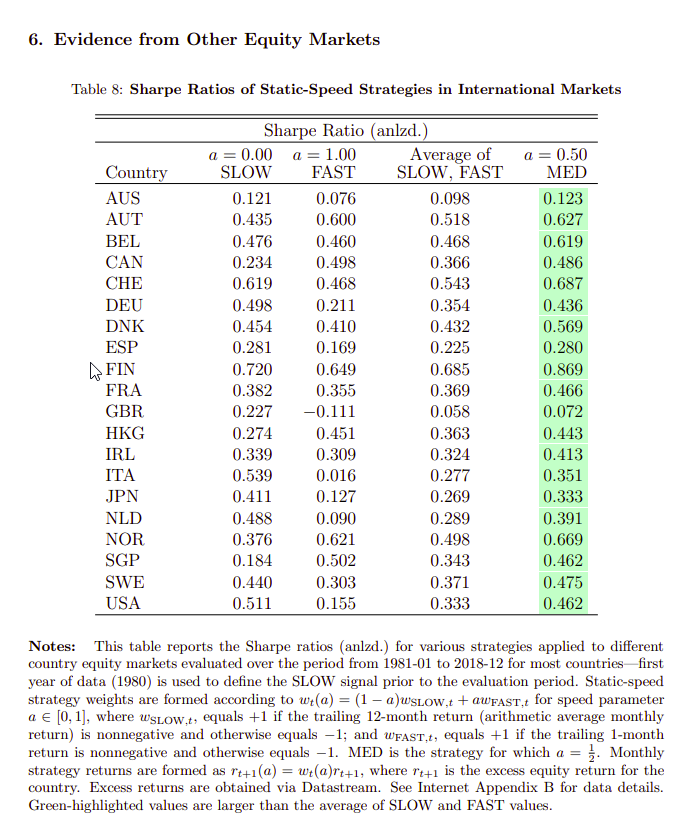

Trend Following and Momentum Turning Points

By Elisabetta Basilico, PhD, CFA|September 11th, 2023|Research Insights, Factor Investing, Trend Following, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Trend follower nerd alert: This study is important because it offers a comprehensive analysis of TS momentum strategies, its unifying framework that links performance to underlying variables, and its practical implications for investors seeking to enhance their understanding of momentum investing and improve their portfolio performance.