Implications of Regime-Shifting Stock-Bond Correlation

By Larry Swedroe|September 8th, 2023|Research Insights, Larry Swedroe, Academic Research Insight, Tactical Asset Allocation Research|

The correlation between stocks and bonds should be a critical component of any asset allocation decision, as it impacts not only the overall risk of a diversified multi-asset class portfolio but also the risk premia one should expect to receive for taking risk in different asset classes. The problem for investors is that the correlation between stocks and bonds fluctuates extensively across time and economic regimes.

Global Factor Performance: September 2023

By Wesley Gray, PhD|September 7th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

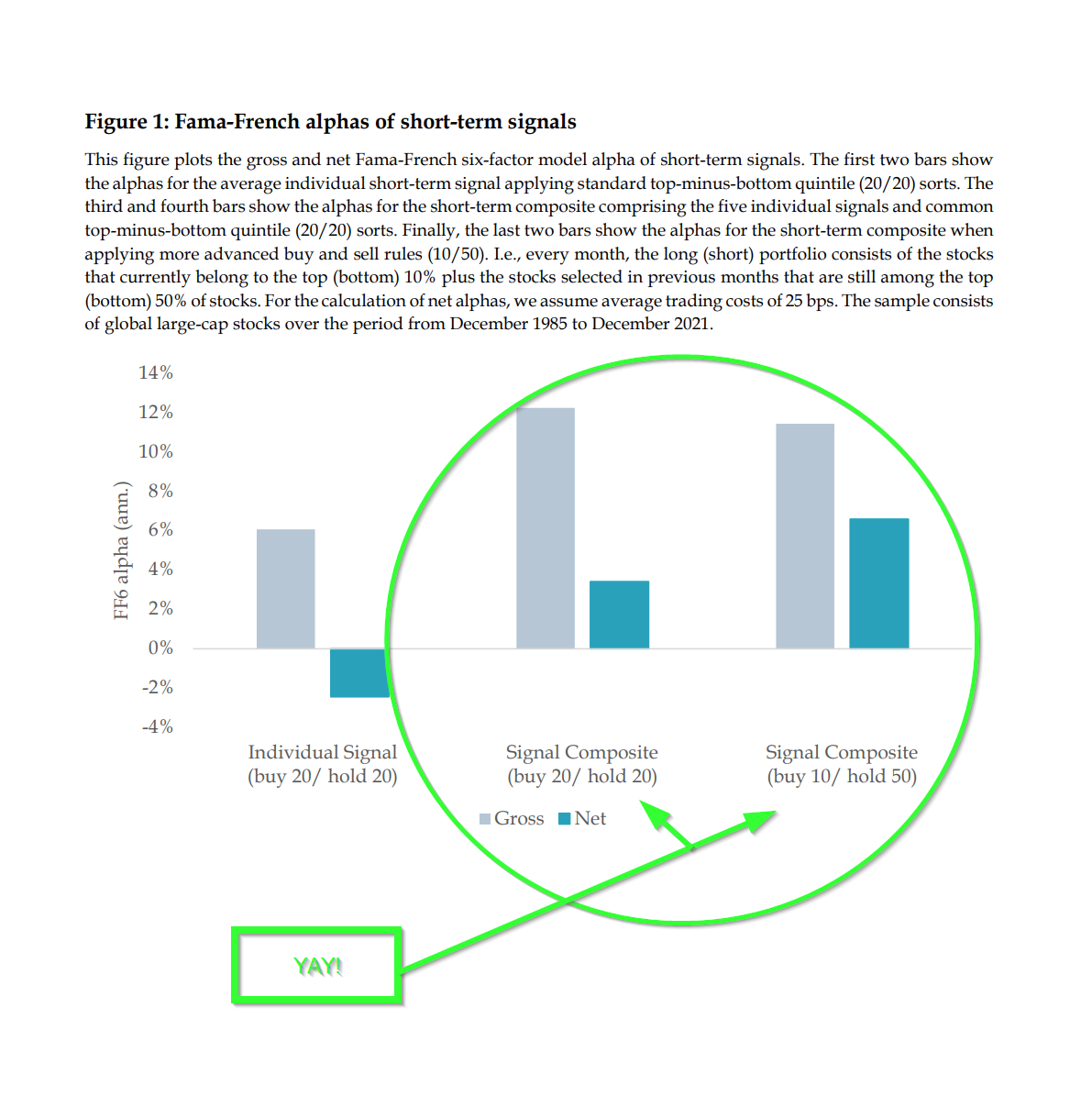

Do Short-Term Factor Strategies Survive Transaction Costs?

By Tommi Johnsen, PhD|September 5th, 2023|Transaction Costs, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Behavioral Finance, Momentum Investing Research|

Short term return anomalies are generally dismissed in the academic literature "because they seemingly do not survive after accounting for market frictions.” In this research, short term “factors” are taken seriously and the authors argue the standard parameters may not apply for short horizons.

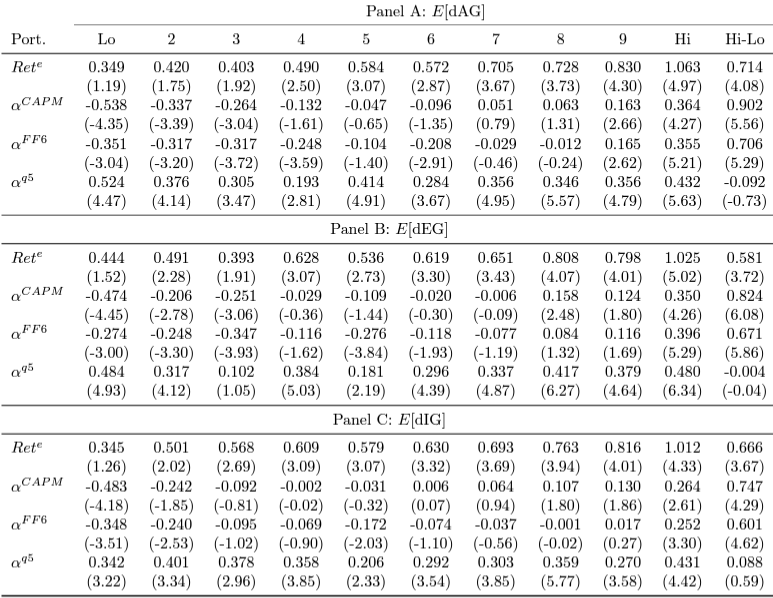

Dissecting the Investment Factor

By Larry Swedroe|September 2nd, 2023|Predicting Market Returns, Asset Growth, Larry Swedroe, Factor Investing, Research Insights|

Investment predicts returns because, given expected profitability, high costs of capital imply low net present value of new capital and low investment, and low costs of capital imply high net present value of new capital and high investment.

DIY Trend-Following Allocations: September 2023

By Ryan Kirlin|September 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. No exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.

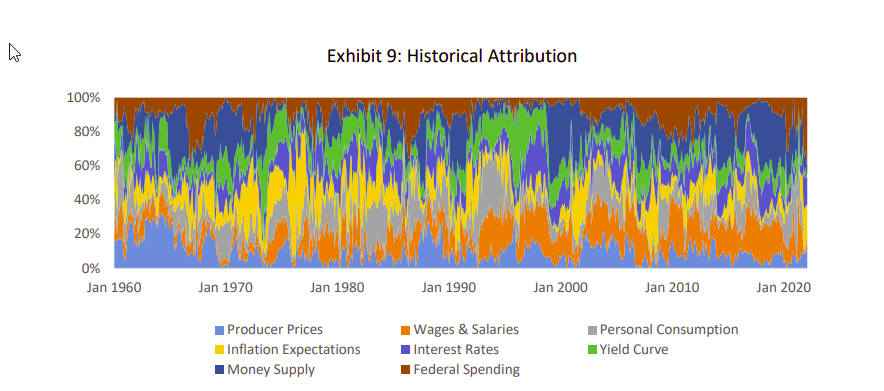

The Determinants of Inflation

By Elisabetta Basilico, PhD, CFA|August 28th, 2023|Inflation Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Macroeconomics Research|

The findings from this Hidden Markov Model analysis provide policymakers with valuable insights into the nature and behavior of inflation regimes. This information can inform the design and implementation of monetary, fiscal, and regulatory policies to effectively manage inflation, stabilize the economy, and promote sustainable economic growth.

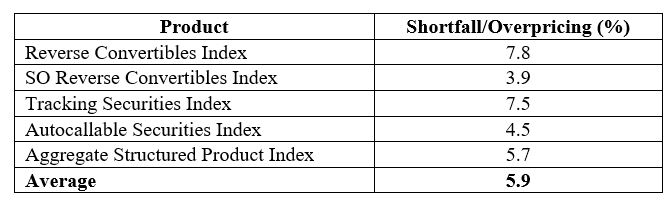

Structured Notes Are Financial Fairy Tales

By Larry Swedroe|August 25th, 2023|Transaction Costs, Larry Swedroe, Research Insights|

Wall Street’s product machine is continuously pumping out fairy tales; structured products should be avoided.

The case for the tax-free conversion of SMAs into an ETF via Section 351

By Bob Elwood|August 24th, 2023|ETF Operations, Research Insights, Guest Posts, Tax Efficient Investing|

This piece outlines the high-level benefits of the ETF structure, which boils down to market access, tax efficiency, and transparency. It covers the considerations for a 351 tax-free conversion and the mechanics and tax consequences of a 351 conversion.

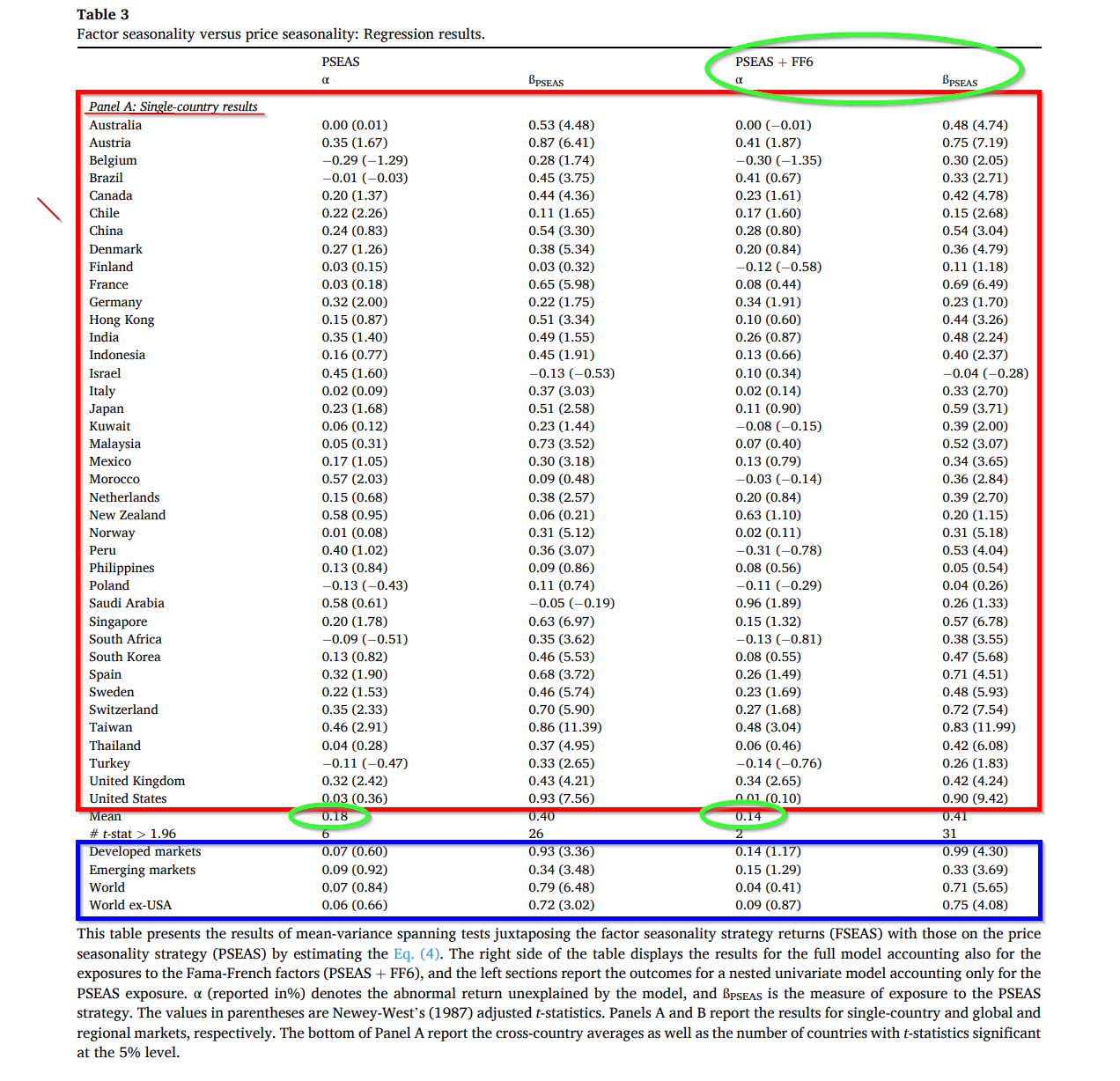

Evidence supporting factor-based seasonalities

By Tommi Johnsen, PhD|August 21st, 2023|Seasonality, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research|

Factor seasonality reflects its own stock-level equivalent. It is not an independent risk factor.

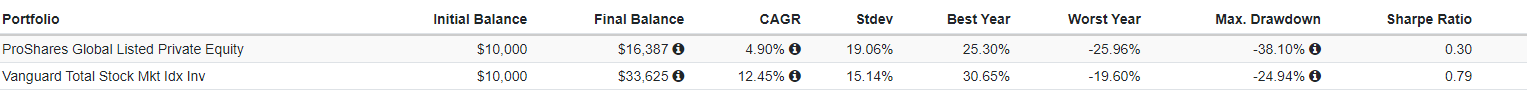

The Performance of Listed Private Equity

By Larry Swedroe|August 18th, 2023|Private Equity, Larry Swedroe, Research Insights|

It is important to diversify the risks of private equity. This is best achieved by investing indirectly through a private equity fund rather than through direct investments in individual companies. Because most such funds typically limit their investments to a relatively small number, it is also prudent to diversify by investing in more than one fund. Unfortunately, the evidence we reviewed suggests that diversifying by investing in LPEs is not an effective strategy. And finally, top-notch funds are likely closed to most individual investors.