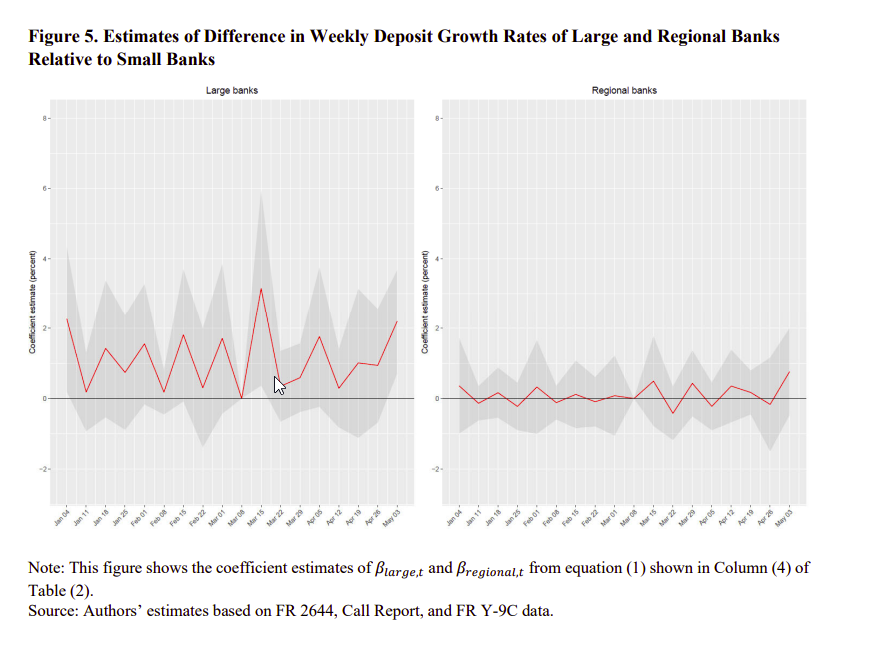

Flight to Safety in the Regional Bank Crisis of 2023

By Elisabetta Basilico, PhD, CFA|August 14th, 2023|Banking Institutions, Research Insights, Basilico and Johnsen, Academic Research Insight|

This article provides insights into the behavior of depositors and the role of large banks during a banking crisis, offering valuable implications for policymakers, regulators, and researchers in the field of banking and finance.

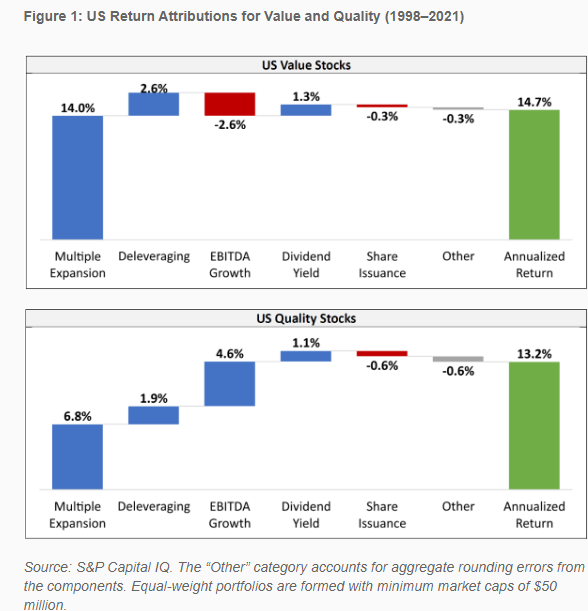

Value and Profitability/Quality: Complementary Factors

By Larry Swedroe|August 11th, 2023|Quality Investing, Larry Swedroe, Factor Investing, Research Insights, Value Investing Research|

There are various measures of value and quality, with one being Marx’s gross profits-to-assets.

Wes Talks with Belle about Creating Your Own ETF

By Wesley Gray, PhD|August 10th, 2023|ETF Operations, Podcasts and Video, Research Insights, Media, Tax Efficient Investing, ETF Investing|

In this episode host Belle Osvath, CFP® talks with Dr. Wesley Gray the founder of ETF Architect and Alpha Architect, about how advisors can create their own ETFs which can be used to help manage client funds and taxes. They discuss the creation process, the cost, and what type of advisory practice would benefit the most from their own ETF.

Global Factor Performance: August 2023

By Wesley Gray, PhD|August 7th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

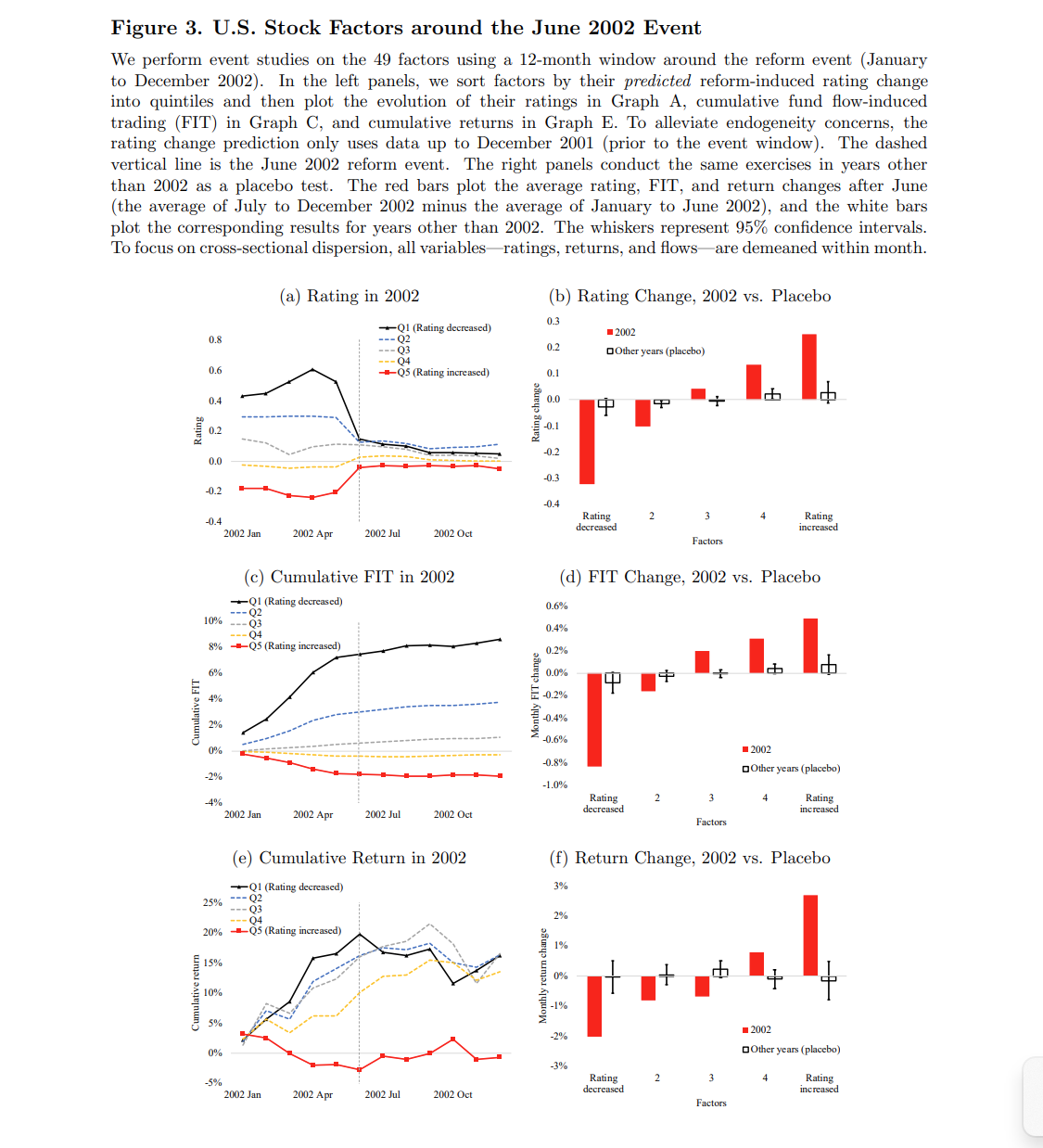

Investor demand, rating reform and equity returns

By Tommi Johnsen, PhD|August 7th, 2023|Price Pressure Factor, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight, Momentum Investing Research, Active and Passive Investing|

The traditional financial theory attributes security returns to market- or factor-based risk, with no role ascribed to other influences. In this research, the authors argue for including investor demand as an additional variable in explaining returns. Can changes in investor demand generate systematic changes in security returns?

The Quality Factor and the Low-Beta Anomaly

By Larry Swedroe|August 4th, 2023|Larry Swedroe, Factor Investing, Research Insights, Low Volatility Investing|

The empirical evidence demonstrates that returns to the low-beta anomaly are well explained by exposure to other common factors, and it has only justified investment when low-beta stocks were in the value regime, after periods of strong market and small-cap stock performance, and when they excluded high-beta stocks that had low short interest.

Doug Discusses 1042 QRP and ESOP Transactions

By Wesley Gray, PhD|August 3rd, 2023|Podcasts and Video, Research Insights, Media, Momentum Investing Research|

Doug Pugliese, the head of our 1042 QRP business, was recently invited on the ScuttleButt Podcast to discuss the ESOP landscape and the costs and benefits of 1042 QRP transactions. (article on the topic is here).

DIY Trend-Following Allocations: August 2023

By Ryan Kirlin|August 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. Partial exposure to commodities. No exposure to intermediate-term bonds.

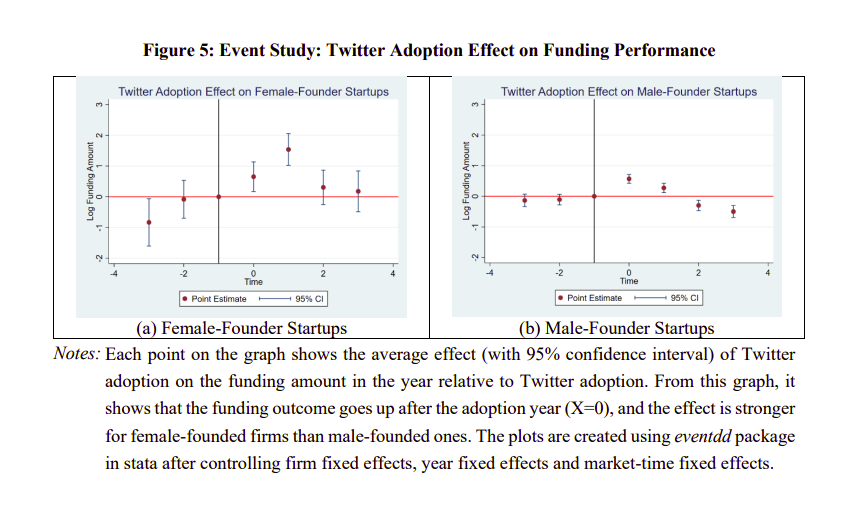

Social Media and Inequality in Venture Capital Funding

By Elisabetta Basilico, PhD, CFA|July 31st, 2023|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

The article aims to examine the role of social media in venture capital financing, its impact on disparities faced by underrepresented groups, and the mechanisms through which social media usage can facilitate venture capital funding.

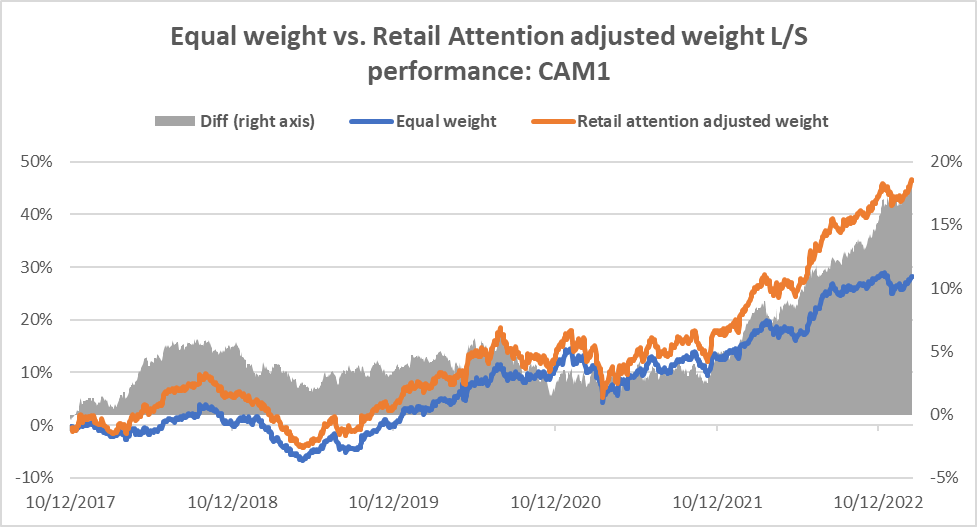

Conditioning anomalies using retail attention metrics

By Vinesh Jha|July 28th, 2023|Relative Sentiment, Research Insights, Factor Investing, Guest Posts|

By using a novel measure of investor attention, generated from InvestingChannel’s clickstream data on online financial news consumption, we can identify broad groups of stocks which are less efficiently priced and therefore where anomalies such as Value and Momentum are likely to produce greater cross sectional differentiation in returns. We also apply these groupings to proprietary ExtractAlpha stock selection signals.