Global Factor Performance: May 2023

By Wesley Gray, PhD|May 9th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

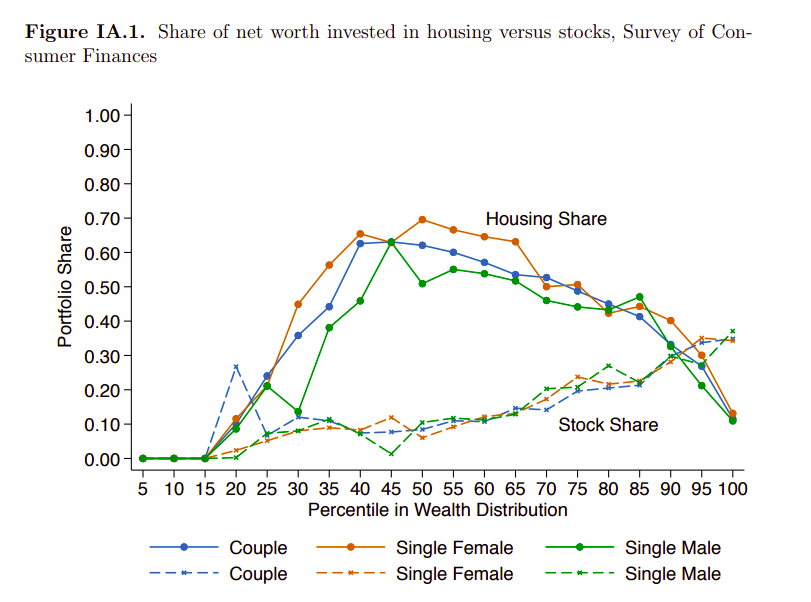

The Gender Gap in Housing Returns

By Elisabetta Basilico, PhD, CFA|May 8th, 2023|Real Estate, ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

Do men and women differ in their financial returns on housing investments? What are the main drivers?

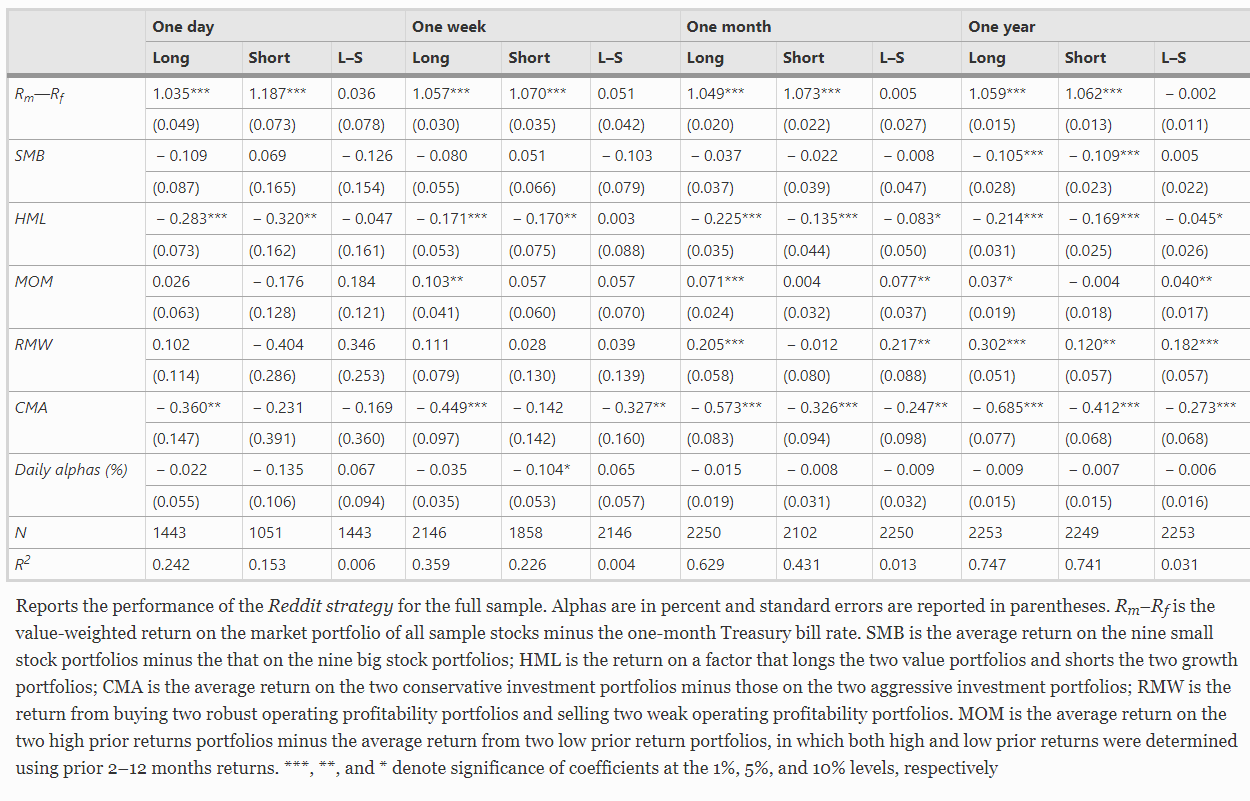

The Reddit Road to Riches?

By Larry Swedroe|May 5th, 2023|Larry Swedroe, Research Insights, Guest Posts, Behavioral Finance|

No surprise: reddit message boards don't lead to alpha generation.

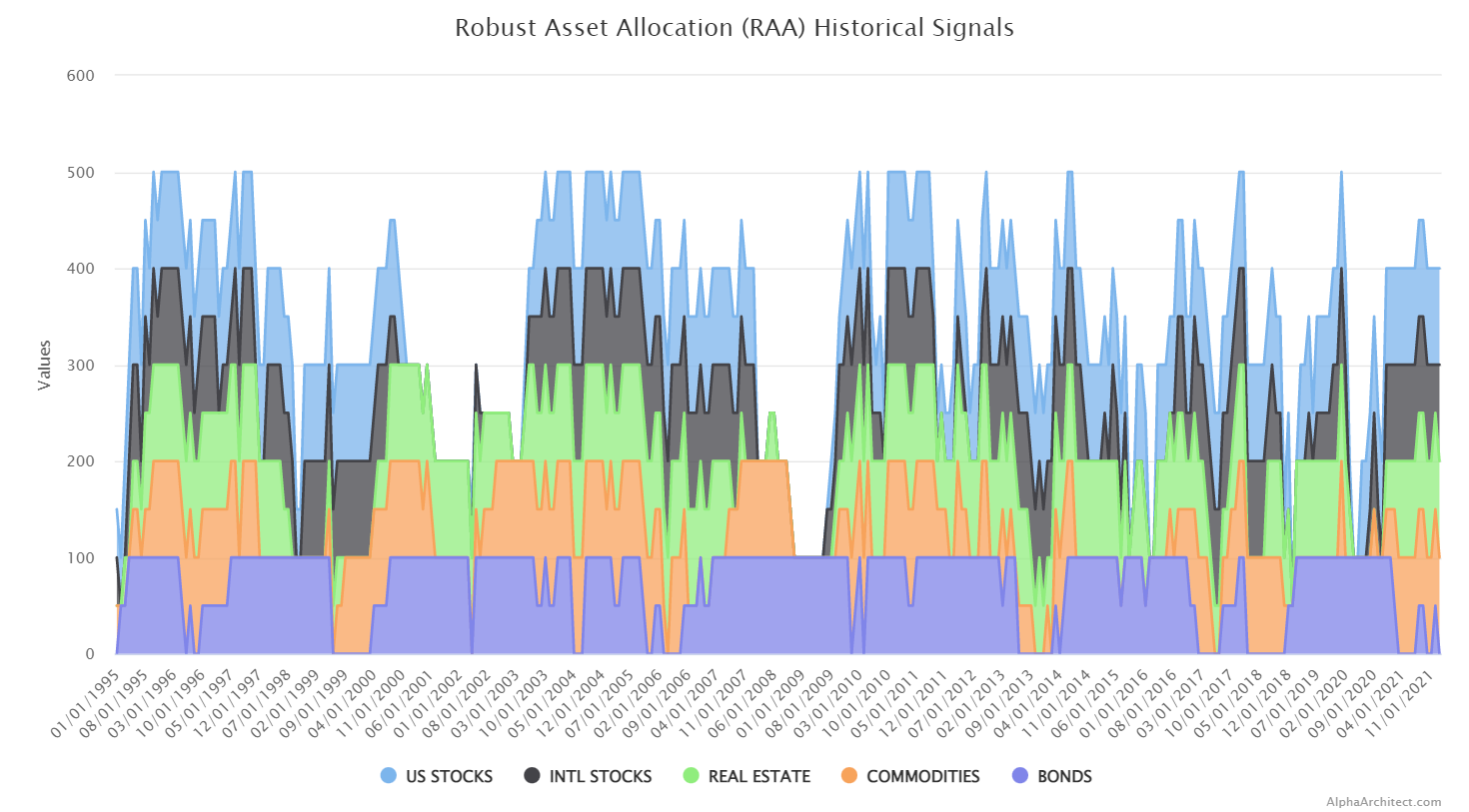

DIY Trend-Following Allocations: May 2023

By Ryan Kirlin|May 1st, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Partial exposure to domestic equities. Full exposure to international equities. No exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

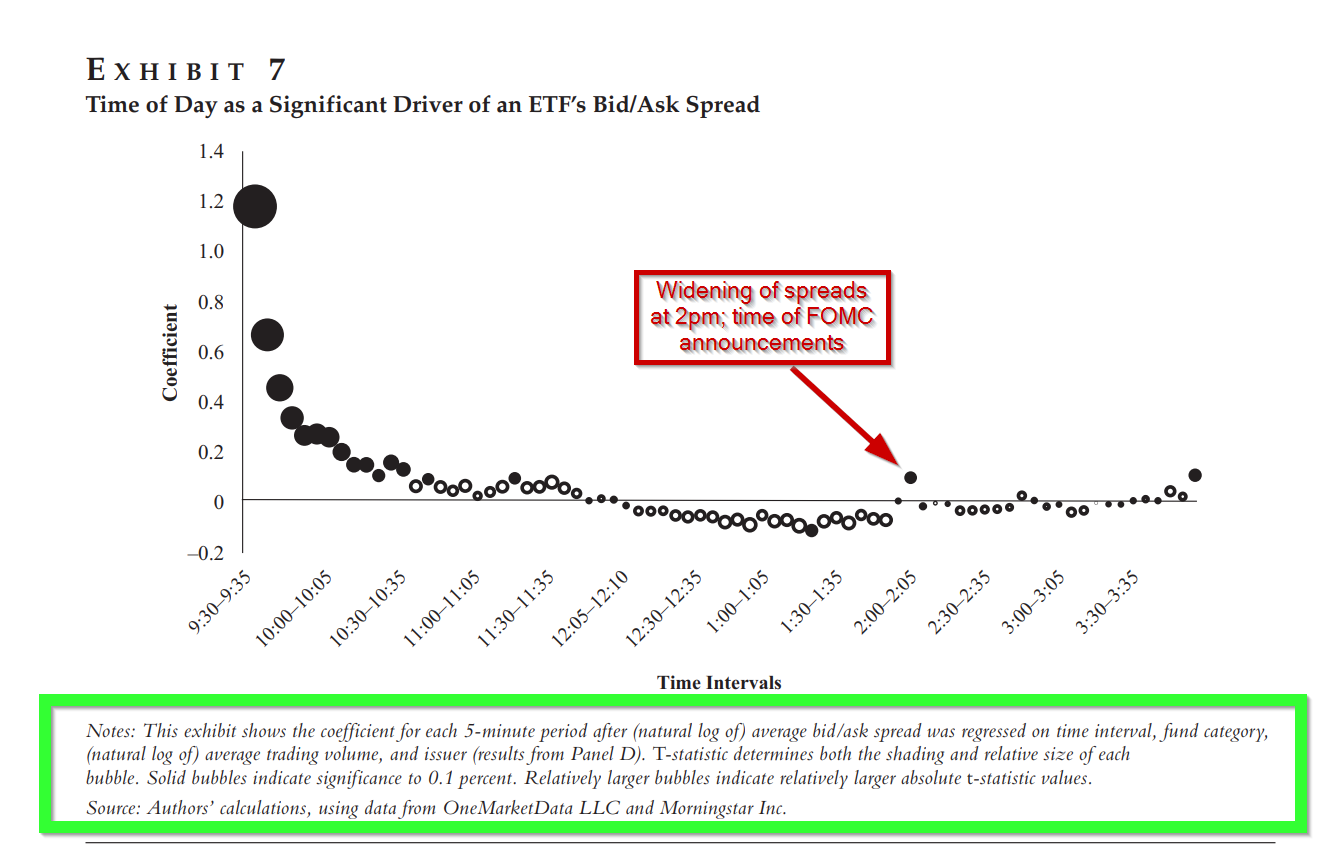

What are the Best Times for ETF Investors to Trade?

By Tommi Johnsen, PhD|May 1st, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, ETF Investing|

The expense ratio aside, the cost of transacting in an ETF depends on the size of the bid/ask spread at any point in time during the trading day. The ETF investor should make evidence-based trading decisions since the bid/ask spread can range from 1 basis point (bp) to several hundred bps. What are some intelligent guidelines for ETF investors--avoid the open, avoid the close, and what about everything in-between? This article provides data on the effect of the time of day on the average bid/ask spread for ETFs.

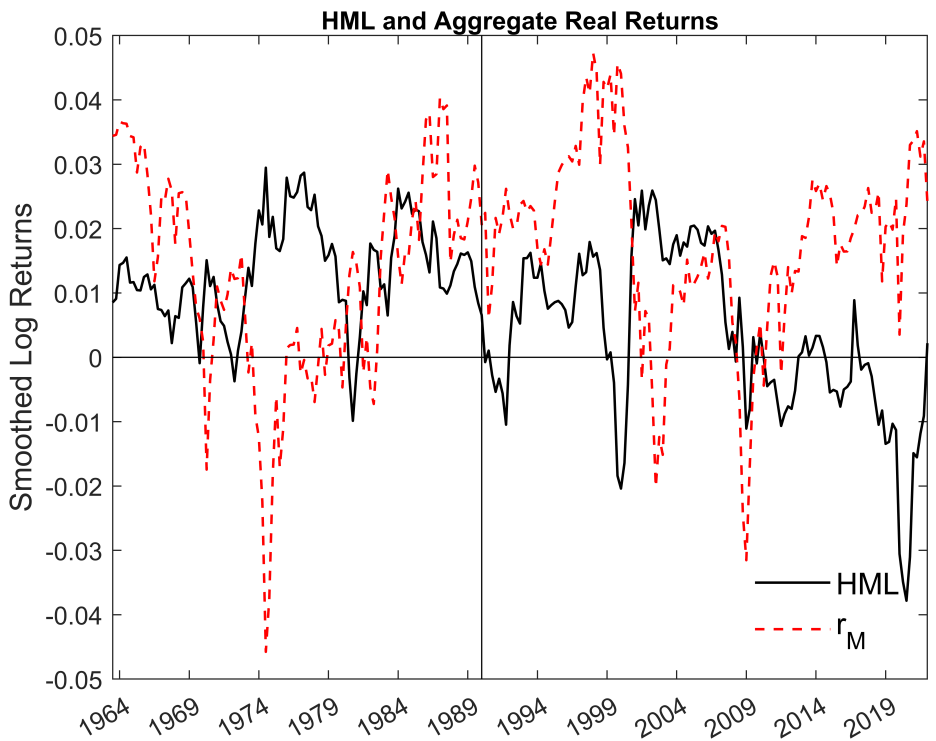

The Drivers of Booms and Busts in the Value Premium

By Larry Swedroe|April 28th, 2023|Factor Investing, Research Insights, Value Investing Research|

John Campbell, Stefano Giglio, and Christopher Polk, authors of the March 2023 study “What Drives Booms and Busts in Value?,” sought to determine which factors drive value’s booms and busts. They interpreted the returns to the standard value strategy through the lens of Robert Merton’s intertemporal CAPM (ICAPM).

Democratize Quant 2023 is Live. Sign-up!

By Wesley Gray, PhD|April 26th, 2023|ESG, Factor Investing, Research Insights, Investor Education, Conferences, Value Investing Research, Momentum Investing Research|

Eric Balchunas, Cliff Asness, Kai Wu, Que Nguyen, Corey Hoffstein

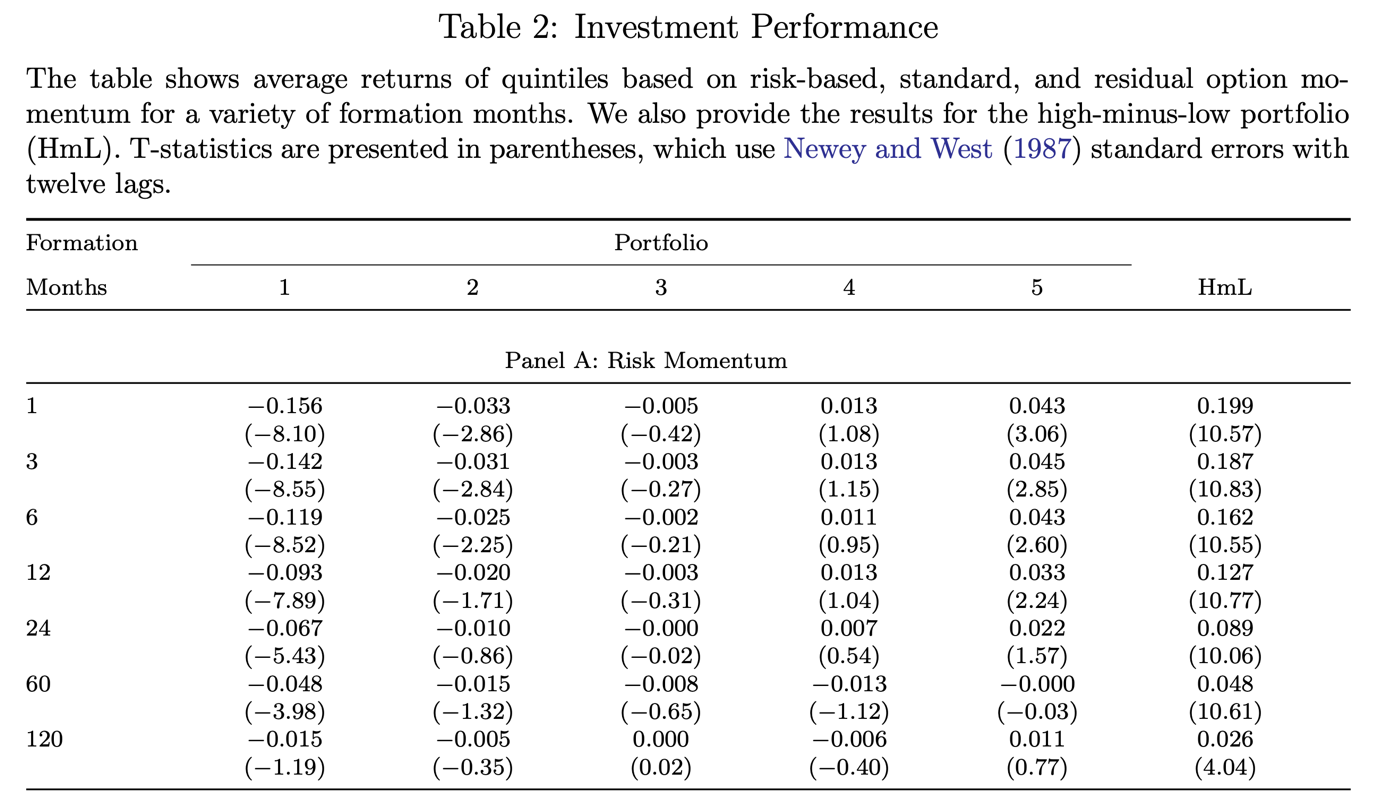

Novel explanations for risk-based option momentum

By Heiner Beckmeyer|April 25th, 2023|Options, Research Insights, Guest Posts, Momentum Investing Research|

In this paper, we propose a cross-sectional option momentum strategy that is based on the risk component of delta-hedged option returns. We find strong evidence of risk continuation in option returns.

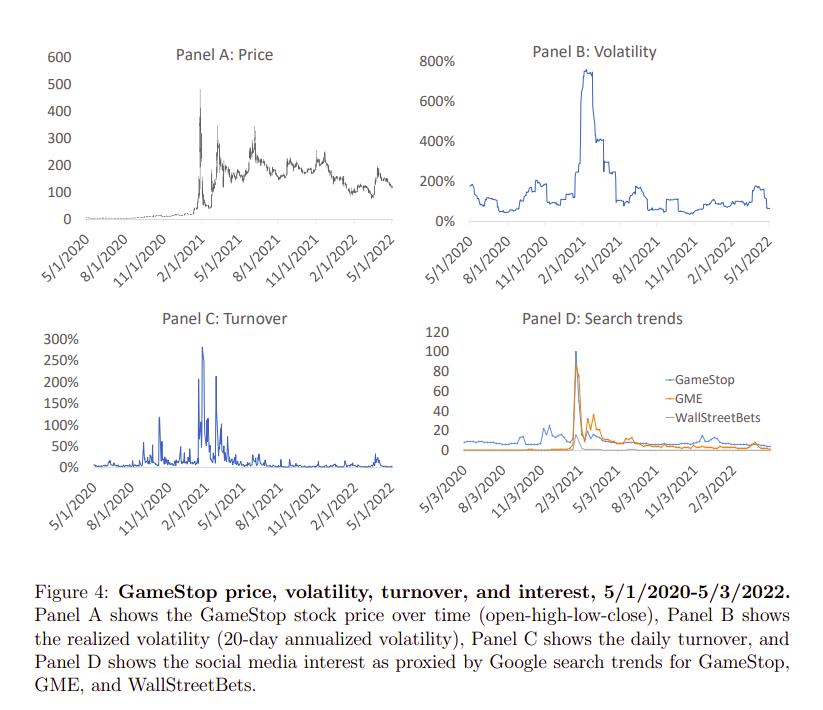

Game On: Social Networks and Markets

By Elisabetta Basilico, PhD, CFA|April 24th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Behavioral Finance|

This article studies how investment ideas can propagate through a social network and affect market behavior and prices.

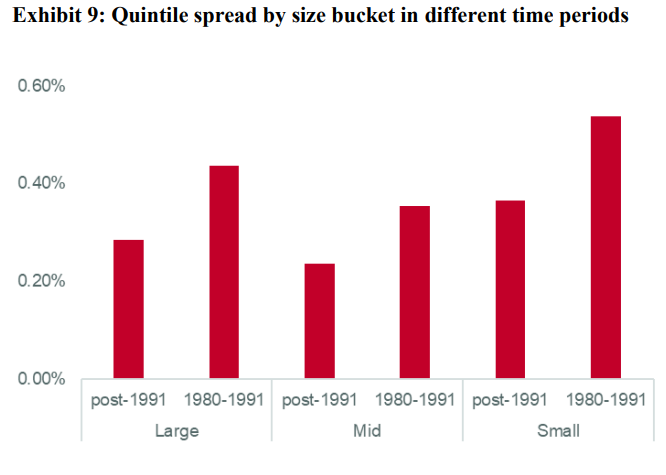

Improving the Quality Factor by Incorporating Intangible Intensity

By Larry Swedroe|April 21st, 2023|Intangibles, Factor Investing, Research Insights|

In this paper we explain the answer to the question of if intangibles can be used to improve the performance of the quality factor.