How factor exposure changes over time: a study of Information Decay

By Tommi Johnsen, PhD|April 17th, 2023|Quality Investing, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research, Momentum Investing Research, Low Volatility Investing|

Factor strategies need to be rebalanced in order to maintain their factor exposure. But different factors decay at different rates and this affects how they should be rebalanced. For example, momentum needs to be rebalanced more than value. This study digs into these questions.

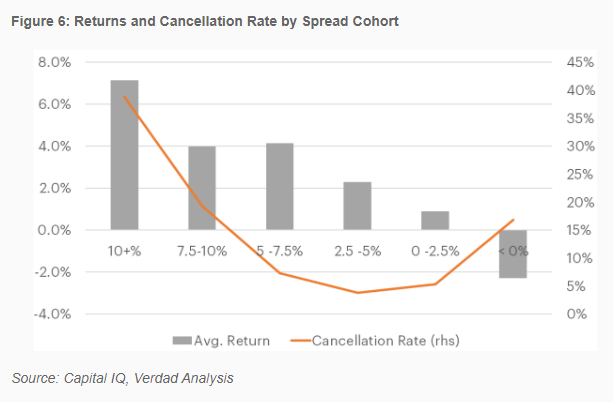

Merger Arbitrage as Diversification Strategy

By Larry Swedroe|April 14th, 2023|Event Driven Investing, Research Insights, Larry Swedroe|

Merger arbitrage is an investment style in which investors seek to buy shares of firms that are acquisition targets with the objective of realizing the difference between the amount for which the target is being acquired and the stock price of the target shortly after the acquisition is announced. The stock price of the target company typically sells below the acquisition price, reflecting the uncertainty of the deal being completed (the arbitrage spread). Betting on mergers is a classic hedge fund arbitrage strategy.

Trend-Following Filters – Part 6

By Henry Stern|April 12th, 2023|Research Insights, Trend Following, Guest Posts|

This article analyzes six trend-following indicators from a digital signal processing (DSP) frequency domain perspective in which the indicators are considered as digital filters and their frequency response characteristics are determined.

Global Factor Performance: April 2023

By Wesley Gray, PhD|April 11th, 2023|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

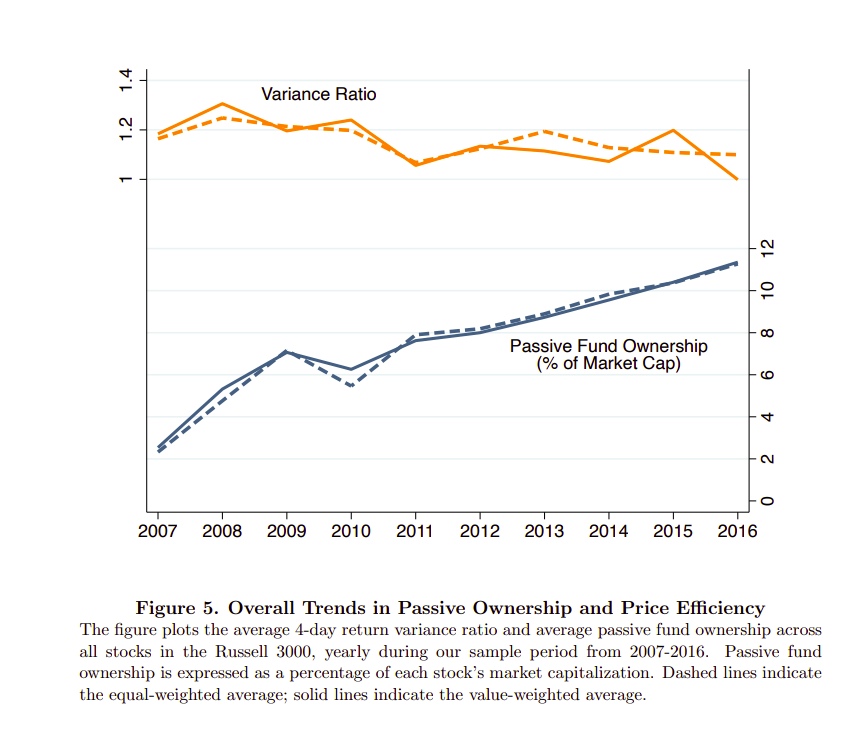

Index Investing and the Informational Efficiency of Stock Prices

By Elisabetta Basilico, PhD, CFA|April 10th, 2023|Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing, Macroeconomics Research|

This article studies whether index investing has implications for the informational efficiency of stock prices.

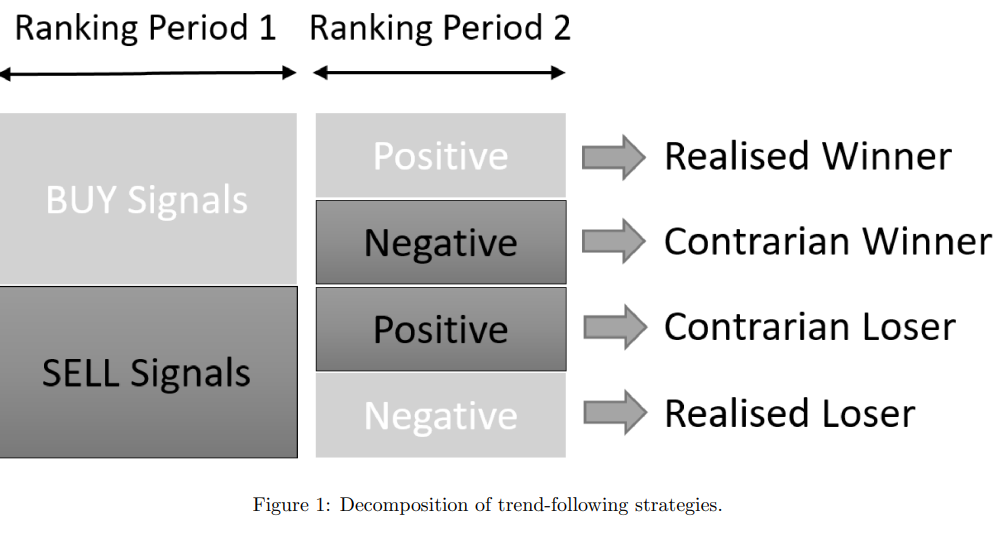

Combining Reversals with Time-Series Momentum Strategies

By Larry Swedroe|April 7th, 2023|Larry Swedroe, Research Insights, Trend Following, Momentum Investing Research|

Jiadong Liu and Fotis Papailias contribute to the momentum literature with their study “Time Series Reversal in Trend-Following Strategies,” published in the January 2023 issue of “European Financial Management,” in which they examined the reversal property of various financial assets.

Wes Discusses Value Investing Foundations with Isaiah Douglass

By Wesley Gray, PhD|April 6th, 2023|Factor Investing, Podcasts and Video, Value Investing Research, Tax Efficient Investing, ETF Investing|

On this week's episode, Isaiah is joined by expert Dr. Wesley Gray, CEO of Alpha Architects, to discuss the concepts of value ???? investing.

How Did the FTX collapse Affect Traditional Assets?

By Tommi Johnsen, PhD|April 4th, 2023|Crypto, Research Insights, Basilico and Johnsen, Academic Research Insight|

In this study, the impact of the FTX collapse and bankruptcy is investigated across global financial markets.

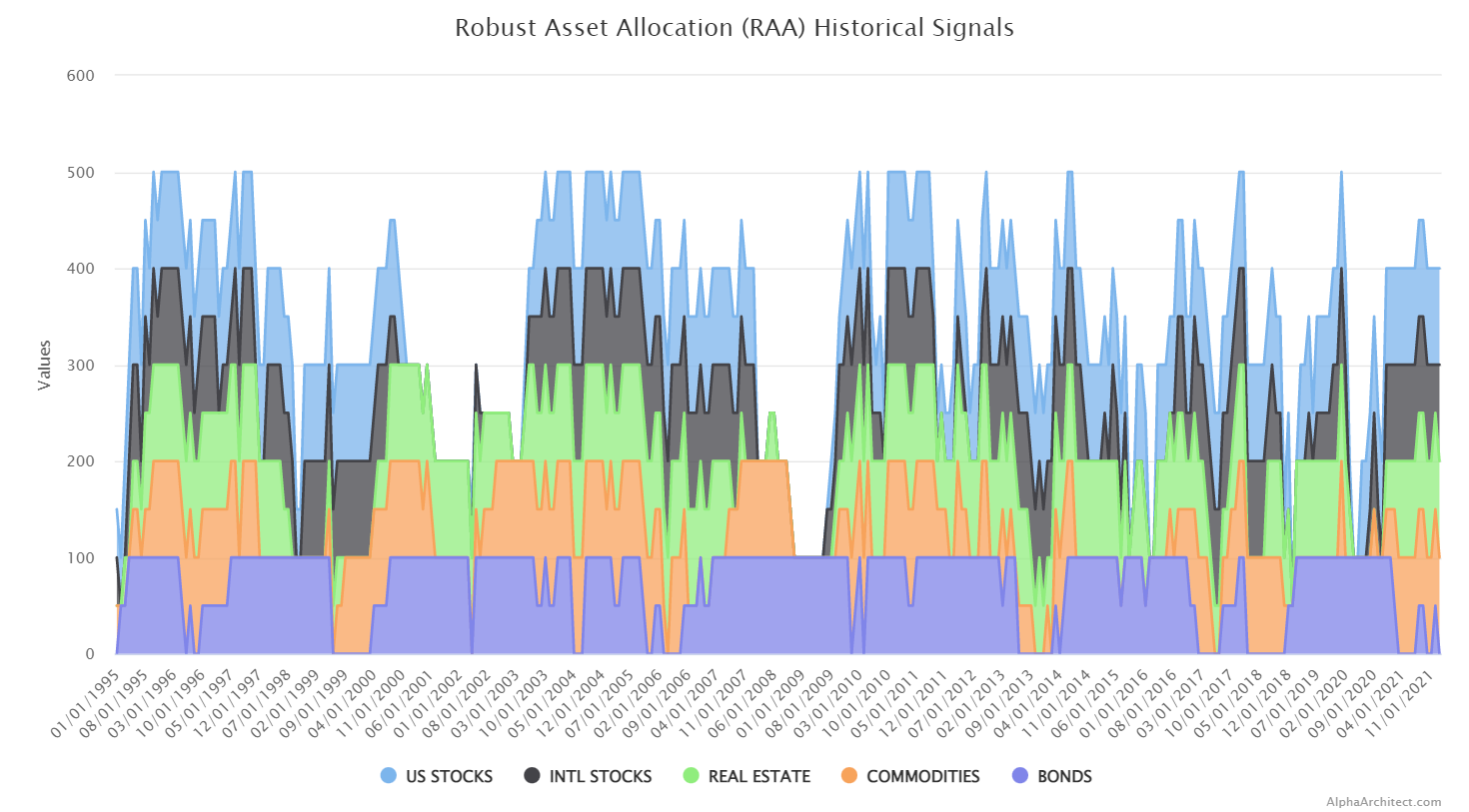

DIY Trend-Following Allocations: April 2023

By Ryan Kirlin|April 3rd, 2023|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Partial exposure to domestic equities. Partial exposure to international equities. No exposure to REITs. No exposure to commodities. Partial exposure to intermediate-term bonds.

Is a Naive 1/N Diversification Strategy Efficient?

By Larry Swedroe|March 31st, 2023|Larry Swedroe, Research Insights, Tactical Asset Allocation Research|

A simple 1/N factor diversification strategy will likely be at least as efficient as more “sophisticated” versions.