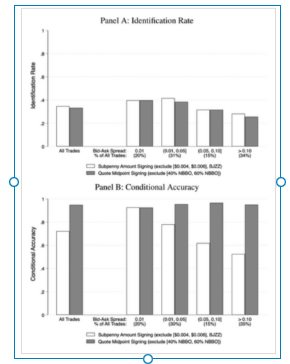

How Tiny Price Differences Help Track Small Investors’ Trades

By Elisabetta Basilico, PhD, CFA|April 28th, 2025|Elisabetta Basilico, Empirical Methods, Transaction Costs, Research Insights, Other Insights, Behavioral Finance|

This article explains how researchers studied small investors' trading habits by looking at tiny price differences, called subpennies, in stock trades. They found that the current method to identify these trades isn't very accurate. By using a new approach, they improved the accuracy, helping to better understand how small investors buy and sell stocks.

Making Factor Strategies Work for Everyone

By Elisabetta Basilico, PhD, CFA|April 21st, 2025|Elisabetta Basilico, Transaction Costs, Factor Investing, Research Insights, Other Insights|

This article explores the difference between tradable and on-paper (theoretical) risk factors in investing. Risk factors are strategies that help explain stock market returns, but many work only in theory and not in real life.

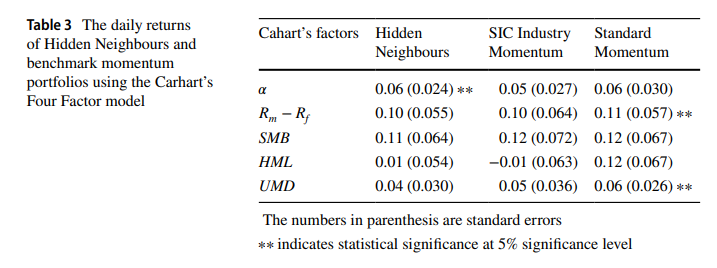

Enhancing Industry Momentum Strategies: Finding Hidden Neighbors

By Larry Swedroe|April 18th, 2025|Factor Investing, Larry Swedroe, Research Insights, Other Insights, Momentum Investing Research|

The main benefit of constructing industry momentum portfolios based on standard ICS is that it is straightforward and reproducible. However, that benefit may come at the cost of accuracy and oversimplification of complex industry relationships between companies.

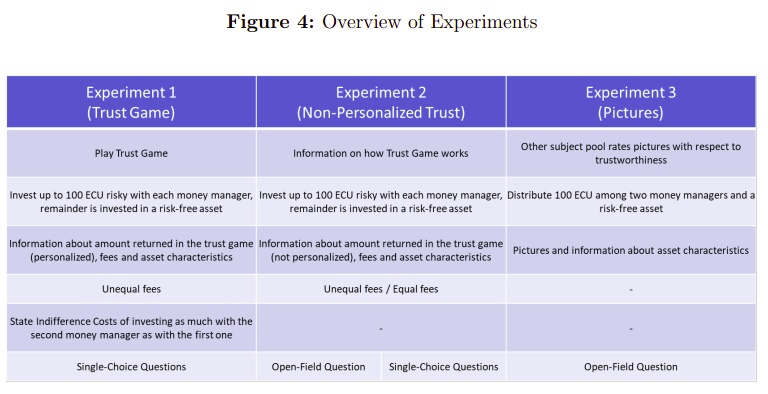

How Trust in Financial Advisors Affects Investment Choices

By Elisabetta Basilico, PhD, CFA|April 14th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Behavioral Finance|

A study found that when investors trust their advisors more, they are more likely to invest in riskier assets, even if the advisor charges higher fees.

Investing Isn’t About Being Mostly Right

By Jose Ordonez|April 8th, 2025|Financial Planning, Skewness, Research Insights, Podcasts and Video, Trend Following, Academic Research Insight|

Investing isn’t about being mostly right. In fact you can be mostly wrong and beat portfolios that were mostly right! Today, we’ll explore how investors can potentially improve portfolio outcomes by targeting two seemingly contradictory but deeply complementary systems as outlined in the latest Mauboussin-Callahan paper, Probabilities & Payoffs: The Practicality and Psychology of Expected Value. But understanding this counterintuitive reality requires a shift in mindset—one that embraces uncertainty and focuses on the power of diversification.

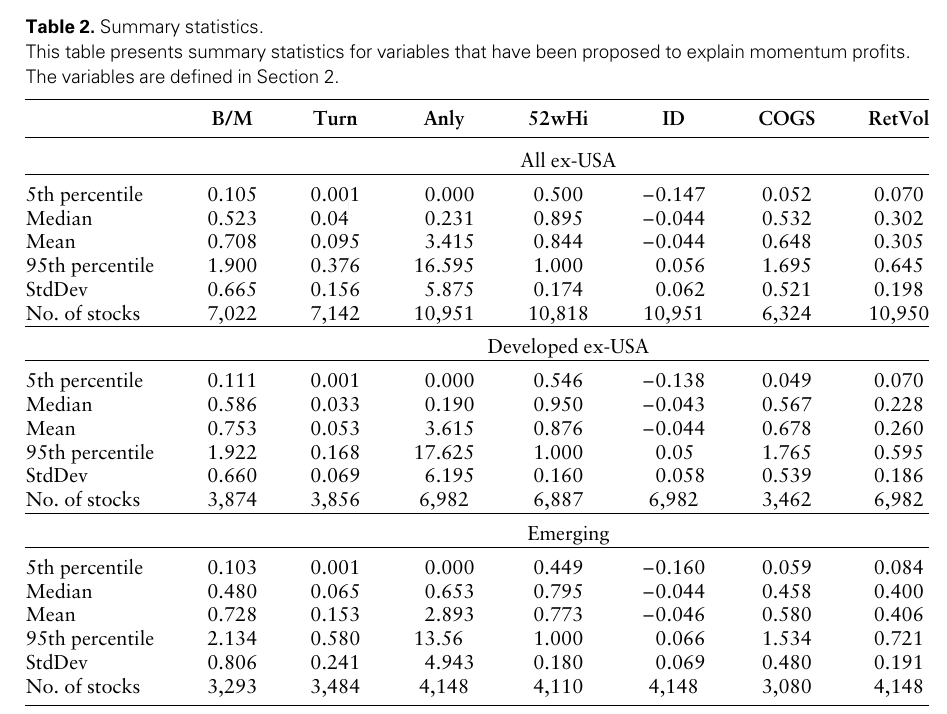

Understanding What Drives Momentum in Global Stock Markets

By Elisabetta Basilico, PhD, CFA|April 7th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Momentum Investing Research, Tactical Asset Allocation Research|

When information about a company comes out gradually, investors might not react strongly, leading to momentum. Other factors, like how a company's value is perceived, also play a role, but to a lesser extent.

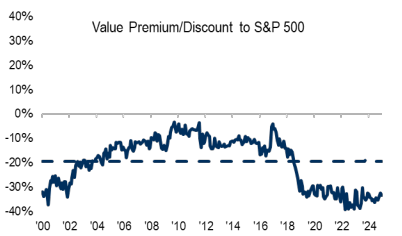

US Value Stocks Trading at Historically High Discounts

By Larry Swedroe|April 4th, 2025|Research Insights, Factor Investing, Larry Swedroe, Other Insights, Value Investing Research|

For equity investors there have been two major narratives over the last 17 calendar year period 2008-2024. The first is that US stocks have far outperformed international stocks. The other narrative has been the outperformance of growth stocks relative to value stocks.

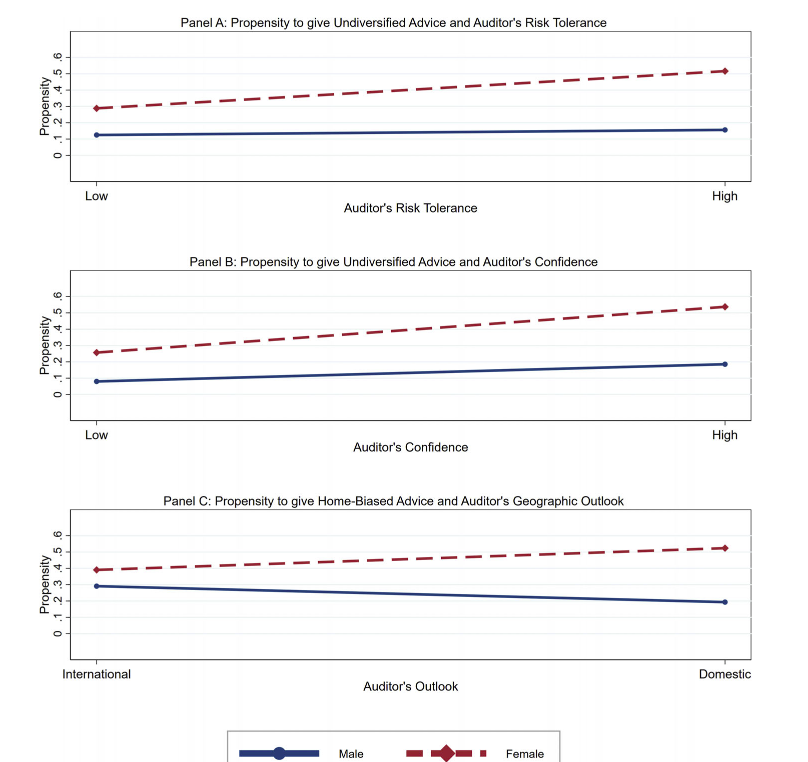

Do Women Receive Worse Financial Advice?

By Elisabetta Basilico, PhD, CFA|April 3rd, 2025|Elisabetta Basilico, Financial Planning, Research Insights, Other Insights, Tactical Asset Allocation Research|

A study based in Hong Kong by using undercover auditors found that female clients were more likely to be advised to invest in individual or local securities instead of getting a mix of different investments.

Portfolio Tax Strategies: Section 351 vs. Exchange Funds vs. Long/Short Tax-Loss-Harvesting

By Wesley Gray, PhD|April 1st, 2025|Research Insights, Tax Efficient Investing|

Three powerful strategies may help investors diversify concentrated positions while deferring or minimizing immediate capital gains taxes: ✅ Section 351 transactions (often used to seed new ETFs) ✅ Exchange funds (offered by firms like UseCache and traditional private banks) ✅ Long/short tax loss harvesting strategies (offered by firms like AQR or Quantinno using active trading to generate offsetting losses)

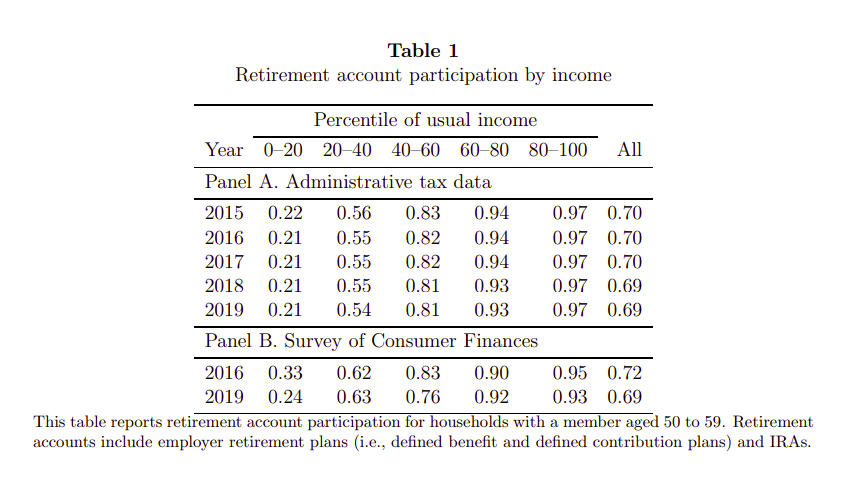

Understanding Financial Inclusion in the United States

By Elisabetta Basilico, PhD, CFA|March 24th, 2025|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

This article explores how many American households have retirement and bank accounts, focusing on those with lower incomes.