Portfolio Tax Strategies: Section 351 vs. Exchange Funds vs. Long/Short Tax-Loss-Harvesting

By Wesley Gray, PhD|April 1st, 2025|Research Insights, Tax Efficient Investing|

Three powerful strategies may help investors diversify concentrated positions while deferring or minimizing immediate capital gains taxes: ✅ Section 351 transactions (often used to seed new ETFs) ✅ Exchange funds (offered by firms like UseCache and traditional private banks) ✅ Long/short tax loss harvesting strategies (offered by firms like AQR or Quantinno using active trading to generate offsetting losses)

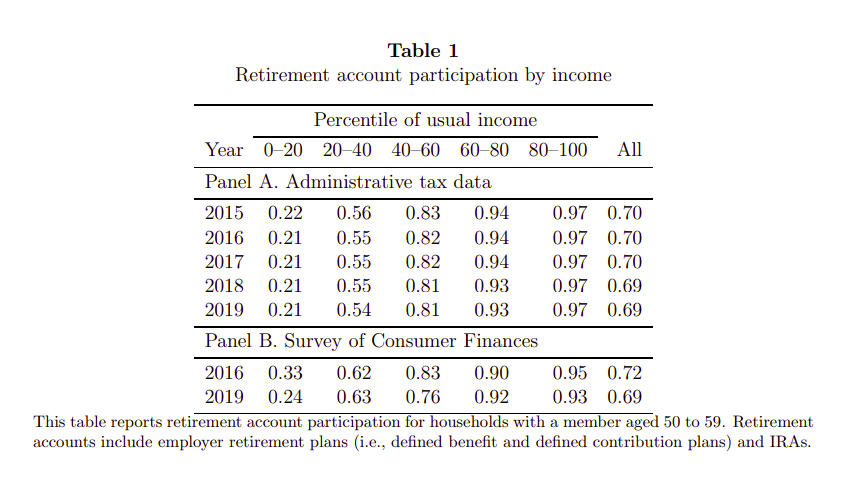

Understanding Financial Inclusion in the United States

By Elisabetta Basilico, PhD, CFA|March 24th, 2025|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

This article explores how many American households have retirement and bank accounts, focusing on those with lower incomes.

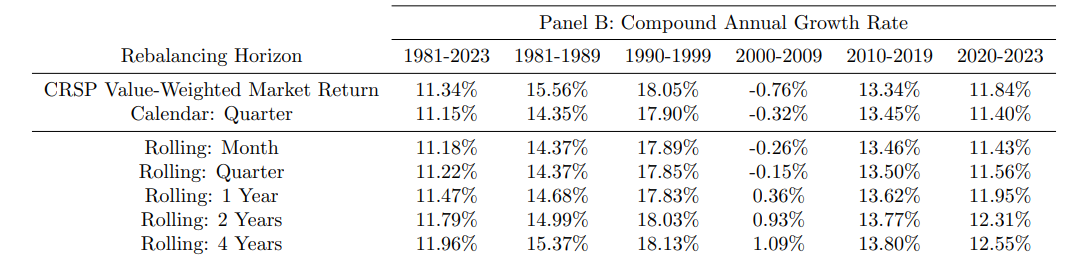

Adverse Effects of Index Replication

By Larry Swedroe|March 21st, 2025|Factor Investing, Larry Swedroe, Research Insights, Other Insights, Active and Passive Investing|

The empirical research we have reviewed shows that the (hidden) costs of index construction and rebalancing policies to investors are about 10 times the expense ratios.

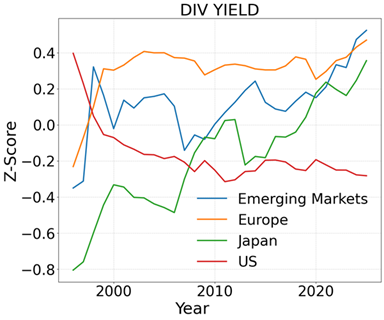

Anti-Dividend Investing: Yield Matters—But Not How You Think!

By Jose Ordonez|March 18th, 2025|Dividends and Buybacks, Research Insights, Factor Investing, Podcasts and Video, Academic Research Insight|

Dividends are the comfort food of investing. Who wouldn’t love feeling like they’re getting a seemingly “free” payout just for holding onto a stock? As with all good things, there's a little more—perhaps a whole lot more—to the story. Here’s why: even in a tax-free setting, selling stocks before dividend payouts can lead to abnormal returns.

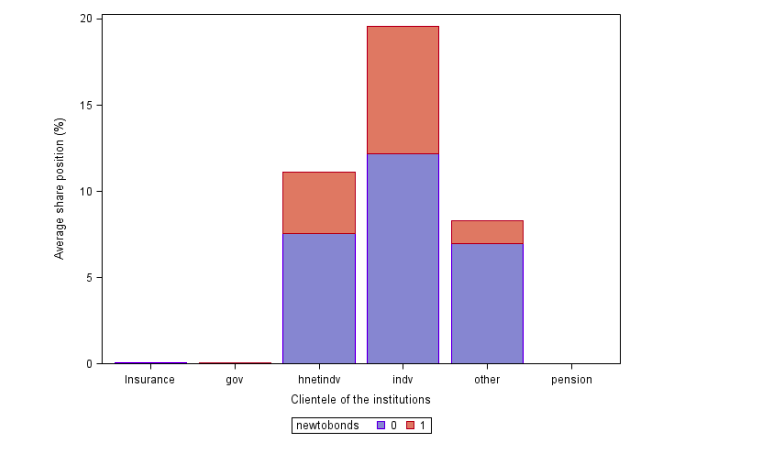

How Bond ETFs Make Trading Easier and Cheaper

By Elisabetta Basilico, PhD, CFA|March 10th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Tactical Asset Allocation Research, ETF Investing|

Bond ETFs have attracted new investors who previously never owned bonds or bond funds. Bond ETFs have made it easier for more people and institutions to start investing in bonds.

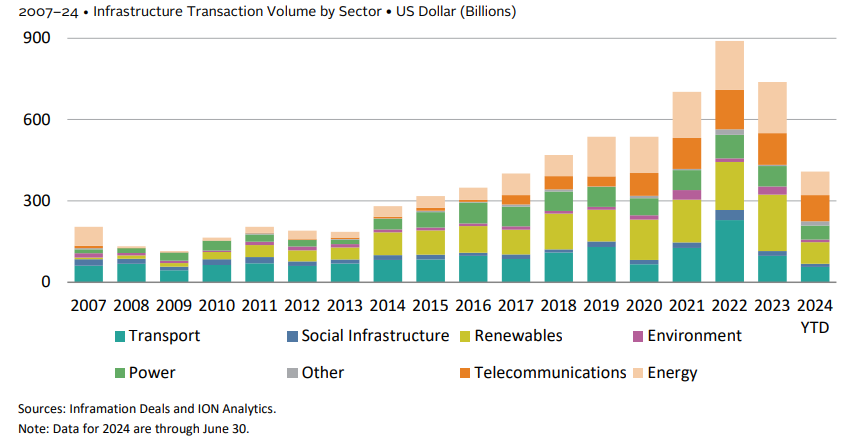

Private Infrastructure as an Asset Class

By Larry Swedroe|March 7th, 2025|Private Equity, Research Insights|

This paper provides an introductory overview of infrastructure investing, exploring its characteristics, benefits, challenges, and potential role in a diversified portfolio.

What is Trend Following? A Painful Journey to Smarter Investing

By Jose Ordonez|March 4th, 2025|Podcasts and Video, Factor Investing, Research Insights, Trend-Following Course, Trend Following, Behavioral Finance, Tactical Asset Allocation Research, Managed Futures Research|

Trend following, at its core, is a strategy where investors buy an asset when it's going up and sell when it’s going down. But unlike panic-driven investors who sell at the worst possible moment, trend followers adhere to a rules-based approach in an attempt to remove emotion from the equation.

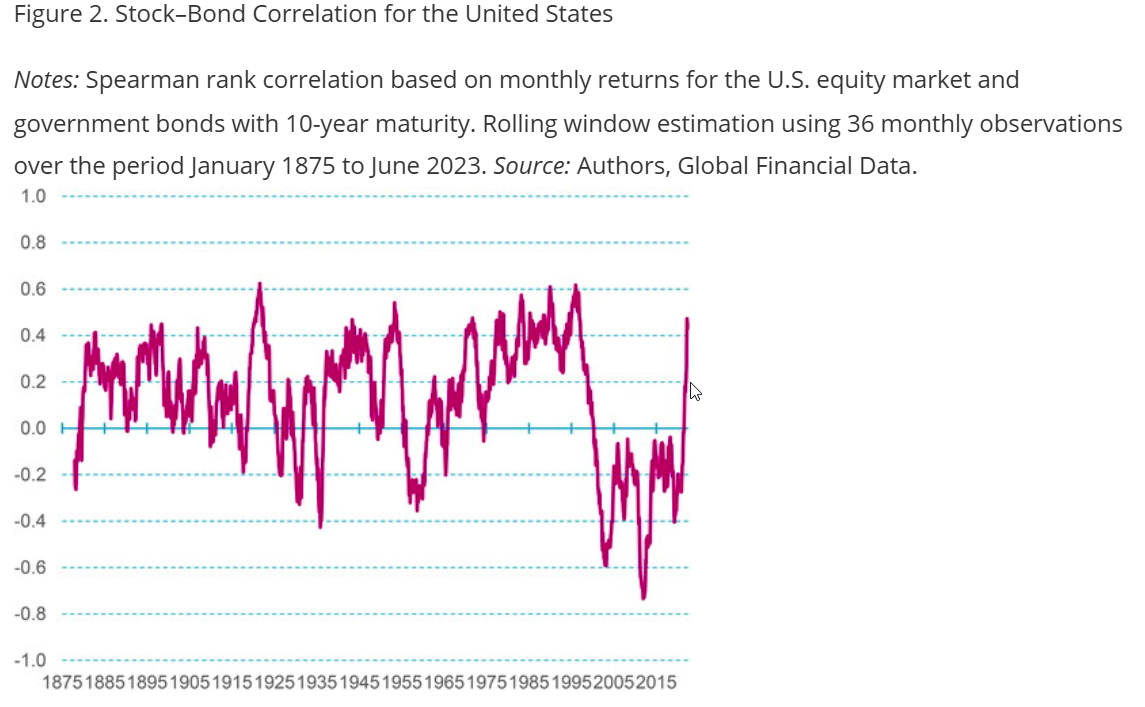

Understanding the Stock–Bond Correlation

By Elisabetta Basilico, PhD, CFA|March 3rd, 2025|Elisabetta Basilico, Research Insights, Other Insights, Tactical Asset Allocation Research|

With over nearly 150 years of data, the study finds that when inflation and interest rates rise, stocks and bonds tend to move together, reducing diversification benefits. This has critical implications for portfolio construction and risk management.

Valuations Reflect U.S. Exceptionalism

By Larry Swedroe|February 28th, 2025|Larry Swedroe, Factor Investing, Research Insights, Other Insights, Value Investing Research, Macroeconomics Research|

US exceptionalism provided the same explanation for the outperformance of US stocks in the 1990s. However, that regime changed. From 2000-2007, while the S&P 500 Index returned just 1.9% per annum (underperforming riskless one-month Treasury bills by 1.3% per annum), the MSCI EAFE Index returned 5.6% per annum, and the MSCI Emerging Markets Index returned 15.3% per annum.

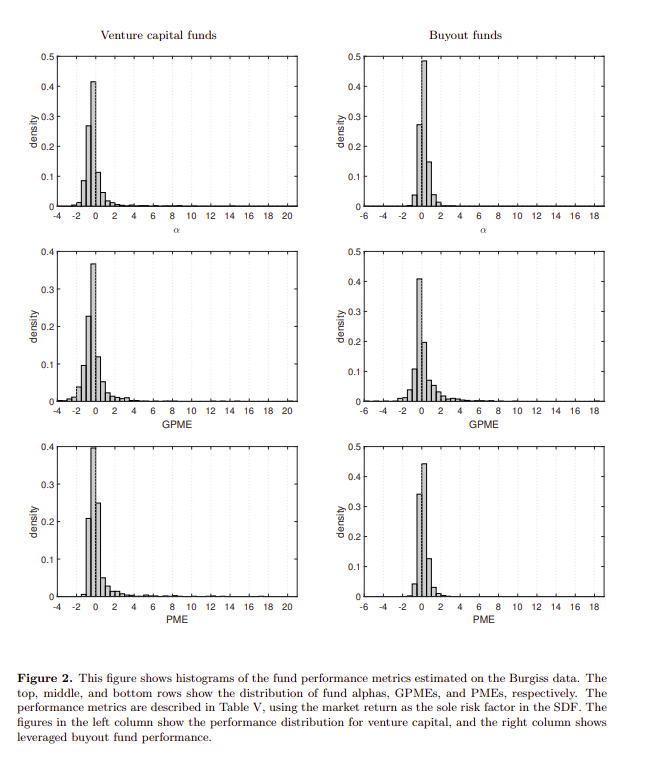

A New Metric for Private Equity Risk Adjusted Returns

By Elisabetta Basilico, PhD, CFA|February 25th, 2025|Elisabetta Basilico, Private Equity, Research Insights, Other Insights|

This study improves how private equity (PE) fund performance is evaluated, which is crucial for investors making allocation decisions.