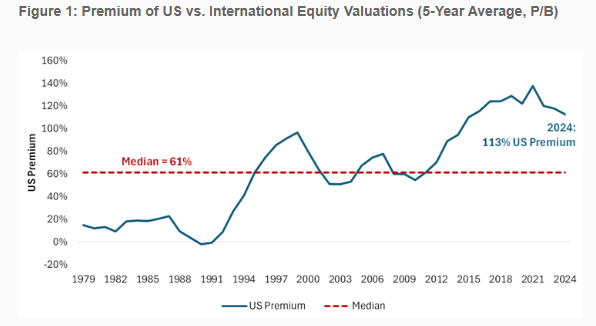

Listing Domicile Driving Valuations

By Larry Swedroe|February 21st, 2025|Research Insights, Factor Investing, Larry Swedroe, Other Insights|

The listing domicile explained about 50% of the valuation gap. In other words, US-listed stocks are substantially more expensive than internationally listed stocks for no reason other than the place of listing.

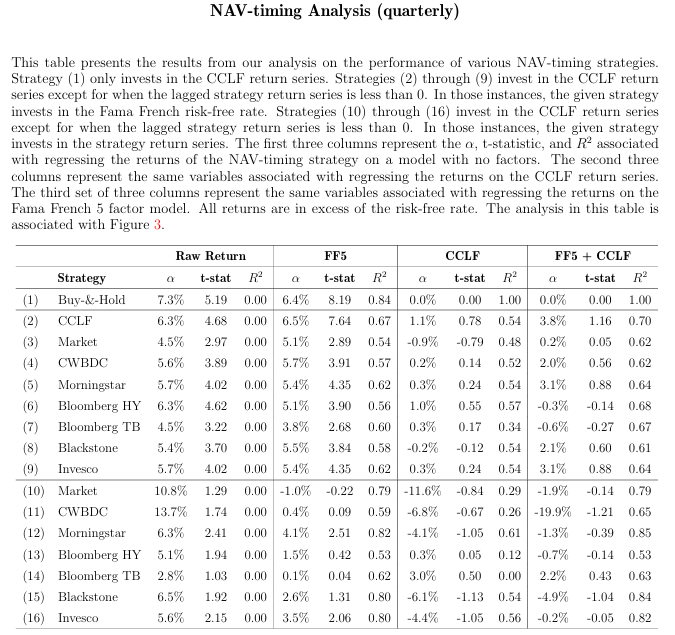

The Ability to NAV Time Interval Funds

By Larry Swedroe|February 14th, 2025|Private Equity, Research Insights, Larry Swedroe, Other Insights|

NAV timing investors could potentially create trading strategies which would systematically transfer wealth from buy-and-hold investors to themselves.

A Navy SEAL says Making Better Decisions is SIMPLE.

By Andrew Sridhar|February 13th, 2025|Research Insights, Guest Posts, Corporate Governance|

The following guest piece outlines the SIMPLE framework (SIMPLE) for making better decisions. SIMPLE was developed by a Navy SEAL with combat and business experience. An application of the SIMPLE framework, applied to financial advisors, is at the end of the piece.

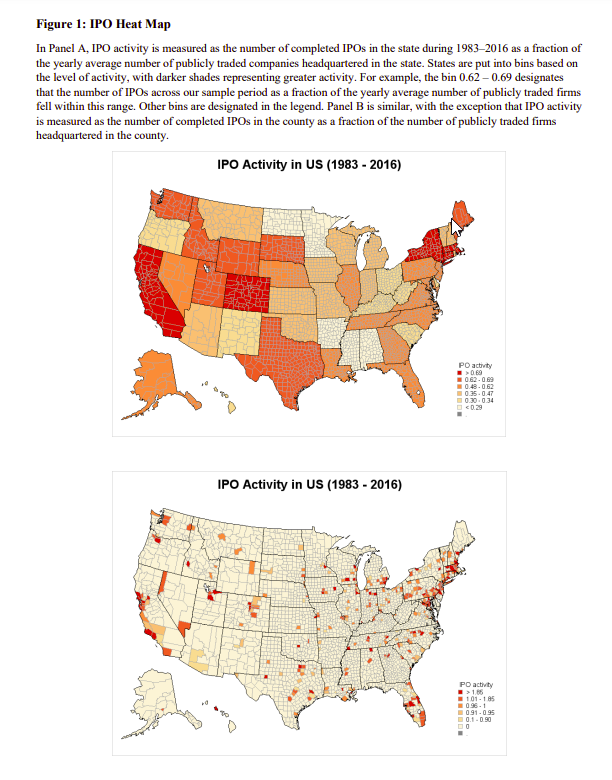

Local IPOs and Household Stock Market Participation

By Elisabetta Basilico, PhD, CFA|February 11th, 2025|Elisabetta Basilico, Research Insights, Other Insights, Behavioral Finance, Macroeconomics Research|

This paper seeks to address three pivotal questions that explore the broader economic and social impacts of IPO activity, particularly its role in influencing stock market participation through localized attention and wealth effects.

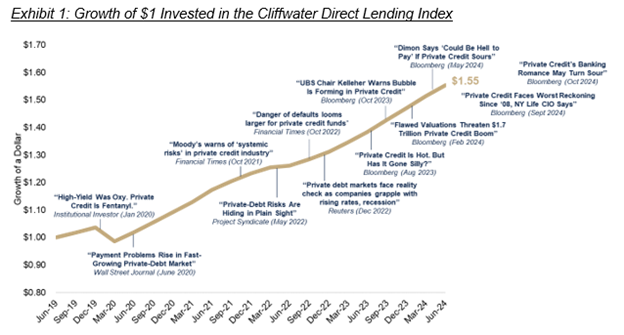

Is There A Bubble In Private Credit?

By Larry Swedroe|February 7th, 2025|Private Equity, Larry Swedroe, Research Insights, Other Insights, Key Research, Investor Education|

While the media headlines are preaching doom, the fundamentals are telling a very different story—credit spreads have widened, and EBITDA multiples are the lowest they have been in a decade. The bottom line is that for investors able to accept its limited liquidity, private, senior, secured and sponsored by private equity direct lending continues to be a compelling component of a diversified portfolio deliver what has always attracted investors: high current income, resilience through market cycles, and a disciplined approach to risk management. We are far from a bubble.

Is It Time to Ditch International Stocks?

By Jose Ordonez|February 5th, 2025|Predicting Market Returns, Research Insights, Podcasts and Video, Media, Tactical Asset Allocation Research, Macroeconomics Research|

Since 2010, the S&P 500 has beaten the International Developed market in all but three years. This led the U.S. market to outperform International Developed by an astounding 8.14% compounded per year. Wowza! Talk about pain if you’re a global investor.

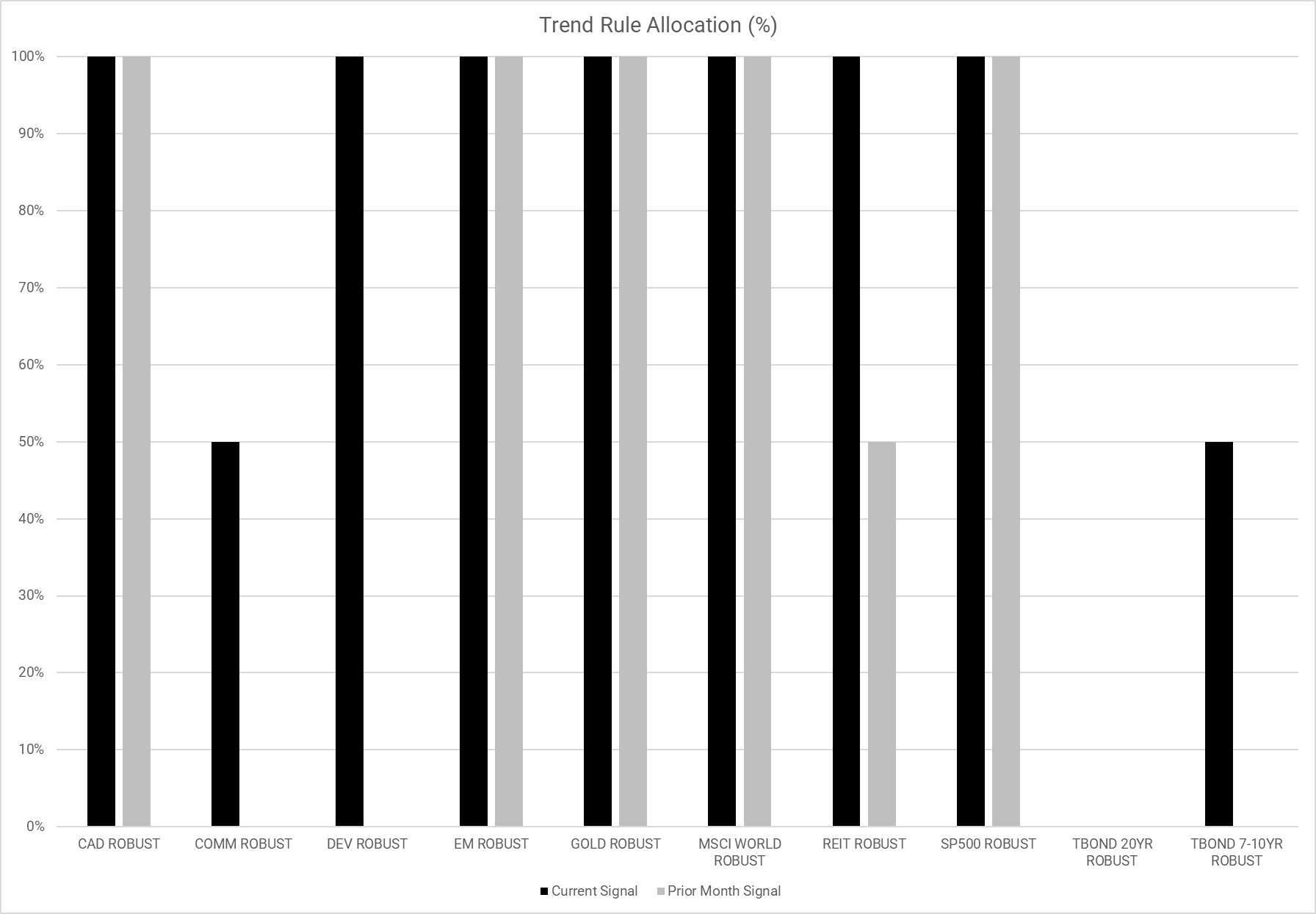

DIY Trend-Following Allocations: February 2025

By Ryan Kirlin|February 3rd, 2025|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

International equity moving from full hedge to no hedge. Commodities moving from full hedge to partial hedge. Real estate moving from partial hedge to no hedge. Intermediate bonds moving from full hedge to partial hedge.

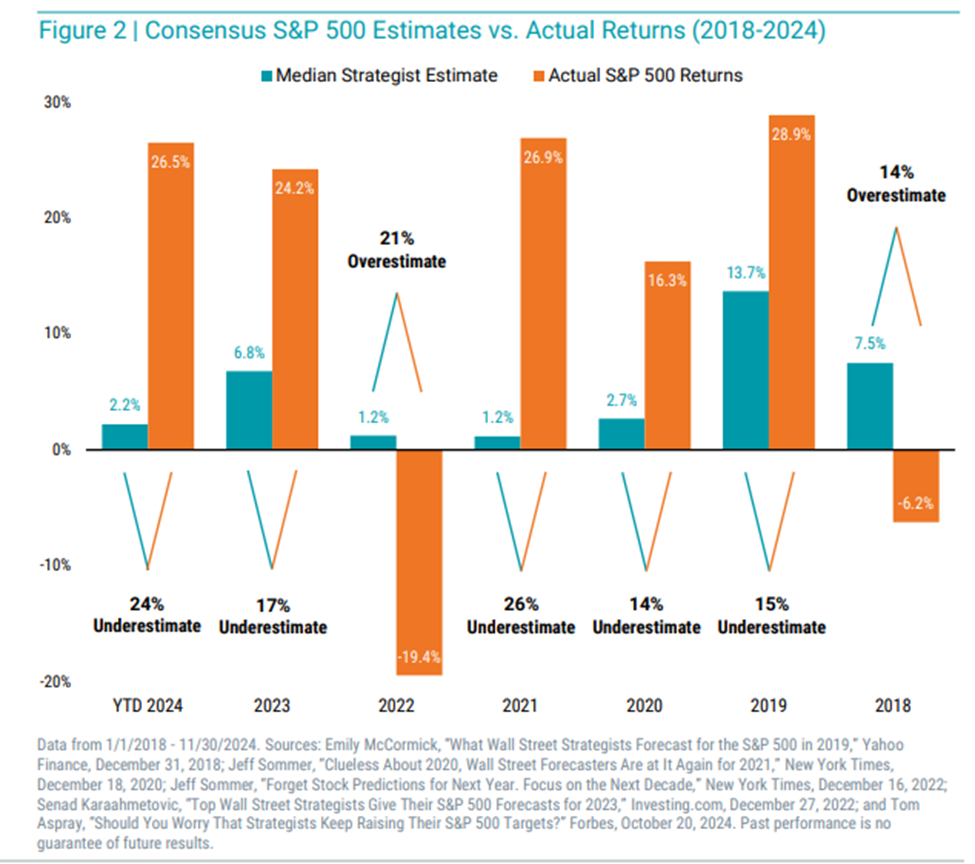

Nine Lessons the Market Taught in 2024

By Larry Swedroe|January 31st, 2025|Research Insights, Larry Swedroe, Other Insights, Key Research, Investor Education|

In 2024 investors were provided with nine lessons. Many of them are repeats from prior years. Unfortunately, too many investors fail to learn them—they keep making the same errors.

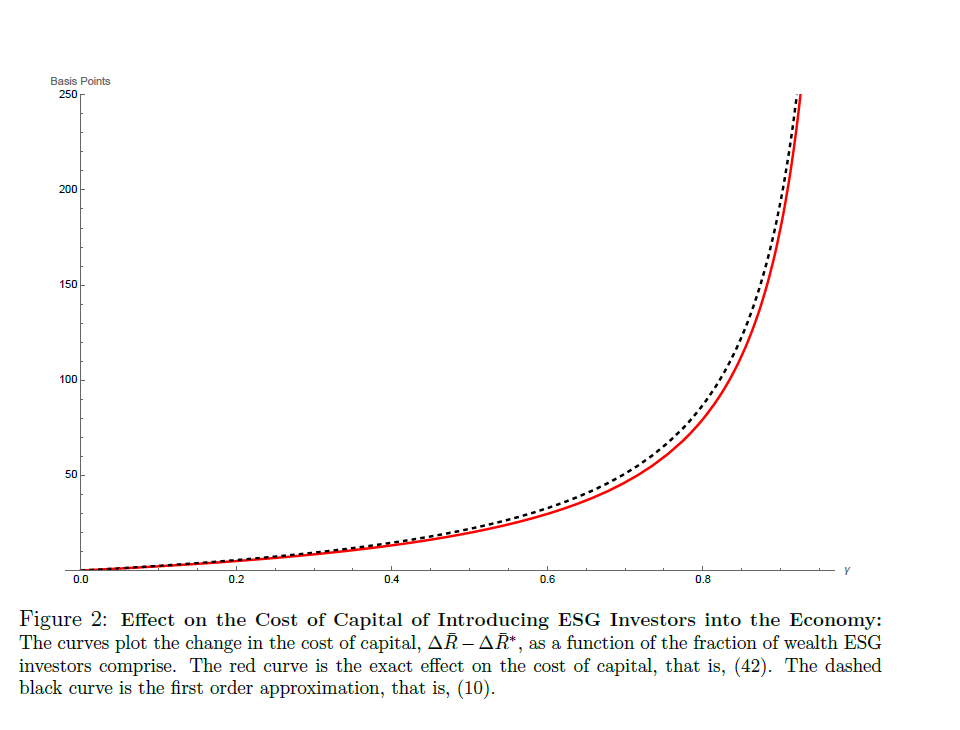

The Impact of Impact Investing

By Elisabetta Basilico, PhD, CFA|January 27th, 2025|ESG, Elisabetta Basilico, Research Insights, Other Insights|

Divestment, a commonly used strategy, involves withdrawing support from companies that contribute to these issues, with the intention of creating positive societal change. Despite its appeal, the connection between divestment actions and their actual impact on society remains unclear.

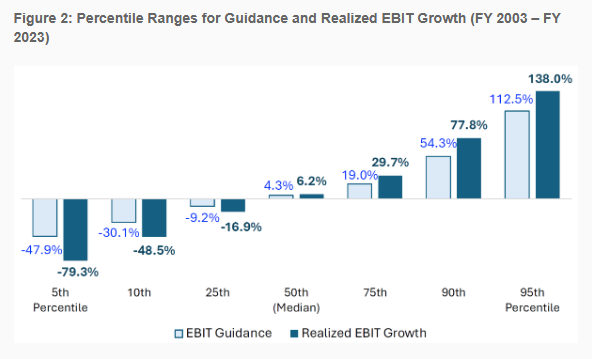

Growth Predictions, Growth Surprises, and Equity Returns

By Larry Swedroe|January 24th, 2025|Asset Growth, Predicting Market Returns, Research Insights, Larry Swedroe, Factor Investing, Other Insights|

What matters is not the expectation of future growth, but the deviation between projected growth and realized growth, which, by definition is a surprise, and, thus, is not forecastable.