Are Quant Approaches Best for Sustainable (ESG) Investing?

By Tommi Johnsen, PhD|March 21st, 2022|ESG, Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight|

After 40 years or so, quantitative investing has evolved into a thriving practice. A major feature of the quantitative approach involves developing underlying numerical models and testing them on a historical (data) record and then forecasting where alpha may be embedded into the prices of a set of stocks. Whether you agree or disagree with this approach, it is difficult to deny that with the advanced state of data access and computational skill, “quants will win the day in ESG investing”. Such is the premise of this article and happily, it is accompanied by a compelling argument.

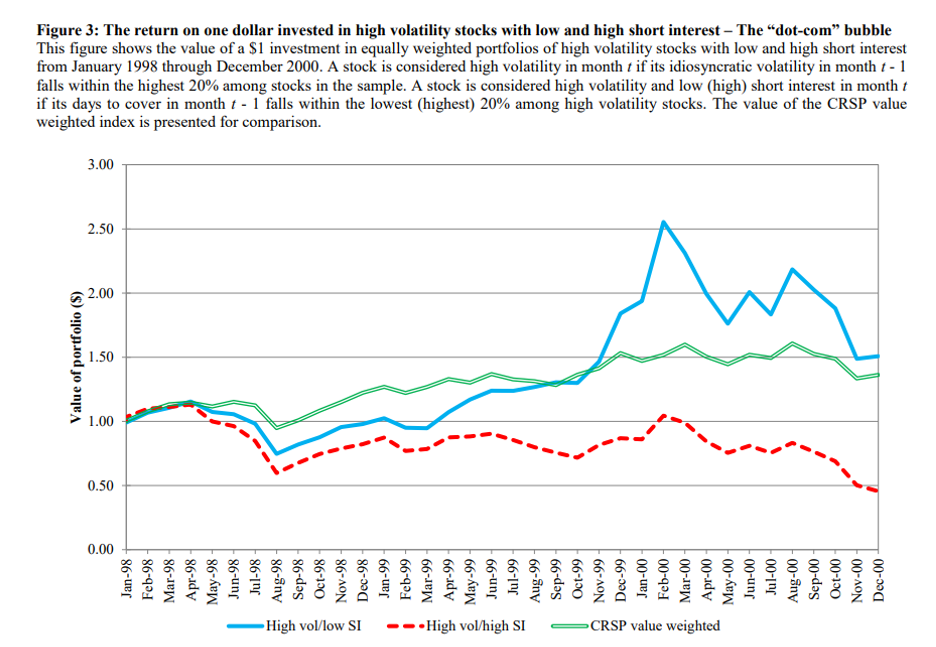

A Deep Dive into the Low Beta Premium

By Larry Swedroe|March 17th, 2022|Research Insights, Factor Investing, Larry Swedroe, Academic Research Insight, Low Volatility Investing|

The superior performance of low-volatility stocks was first documented in the literature in the 1970s—by Fischer Black in 1972, among others —even before the size and value premiums were “discovered.” The low-volatility anomaly has been shown to exist in equity markets around the world. Interestingly, this finding is true not only for stocks but for bonds as well. In other words, it has been pervasive...but

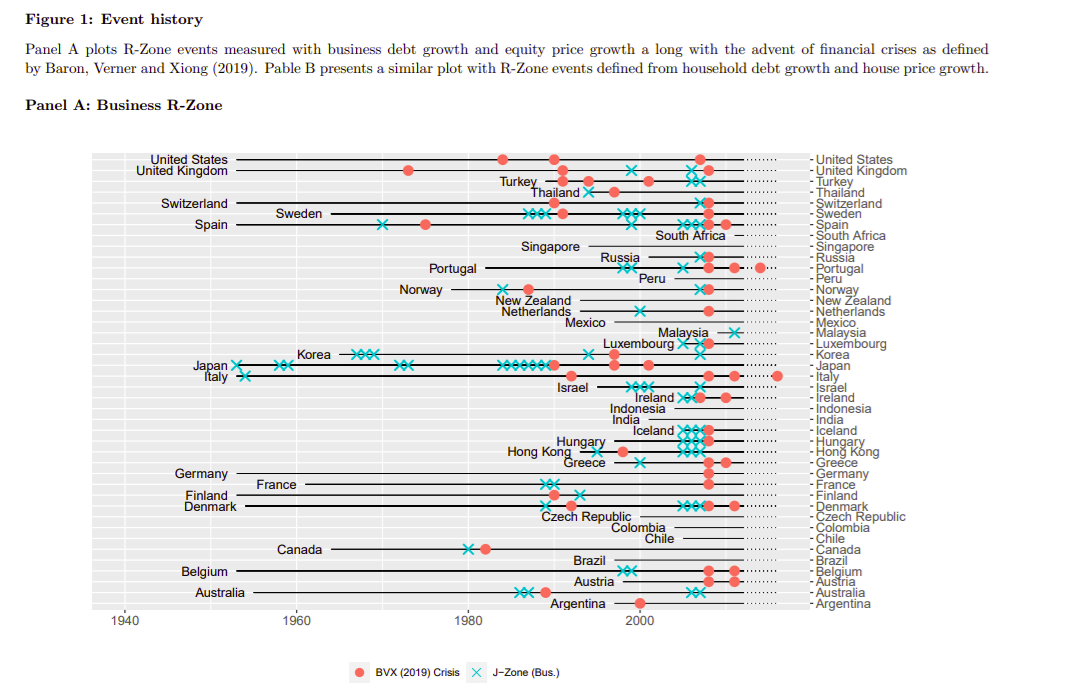

Are Financial Crises Predictable?

By Elisabetta Basilico, PhD, CFA|March 14th, 2022|Crisis Alpha, Research Insights, Factor Investing, Basilico and Johnsen, Trend Following, Academic Research Insight, Managed Futures Research|

Who among us wouldn't want to be the savior that predicts a market crisis and saves our clients from losses in capital -- or even better -- profits from them? A central topic of interest for academics is whether there are more precise tools to predict financial crises. Those who believe so dedicate their efforts to finding early warning indicators.

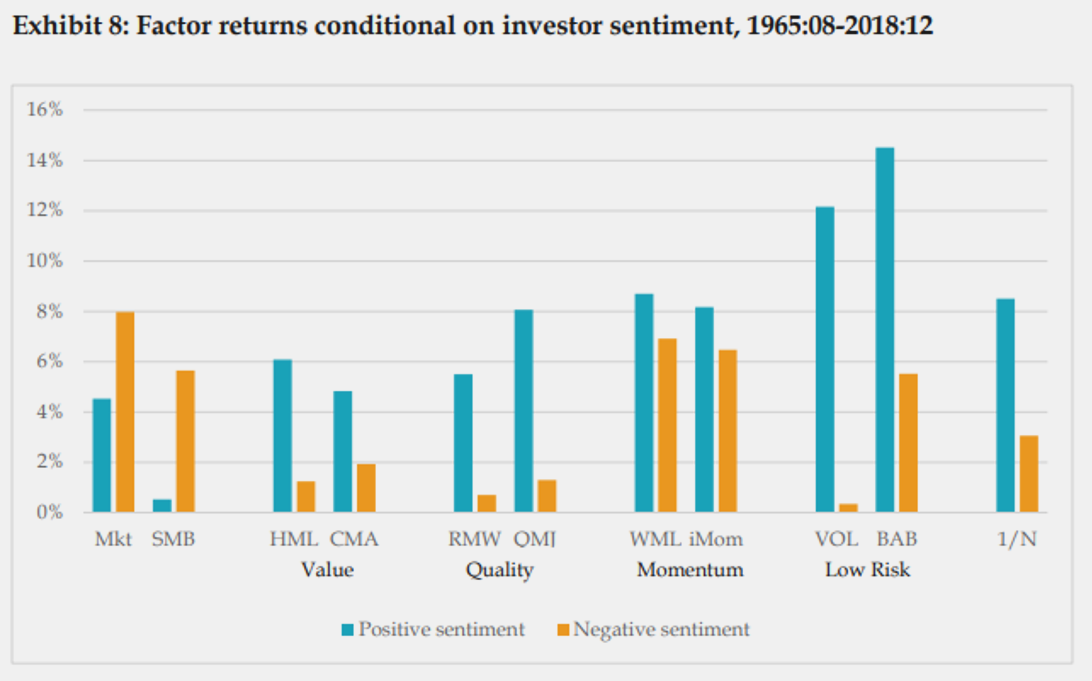

Factor Investing Premiums and the Economic Cycle

By Larry Swedroe|March 11th, 2022|Research Insights|

The main takeaway is that because factor timing is a strategy “fraught with opportunity,” investors should accept the fact that all risk strategies go through extended periods of poor (and unforecastable) periods of poor performance. As Blitz noted: “Even though investor sentiment may be more effective than the other metrics, its discriminatory power remains limited because expected factor premiums are still positive in all instances.” Thus, the prudent strategy is one of diversifying across many unique sources of risk so that not all of your risk eggs end up in the wrong basket at the wrong time.

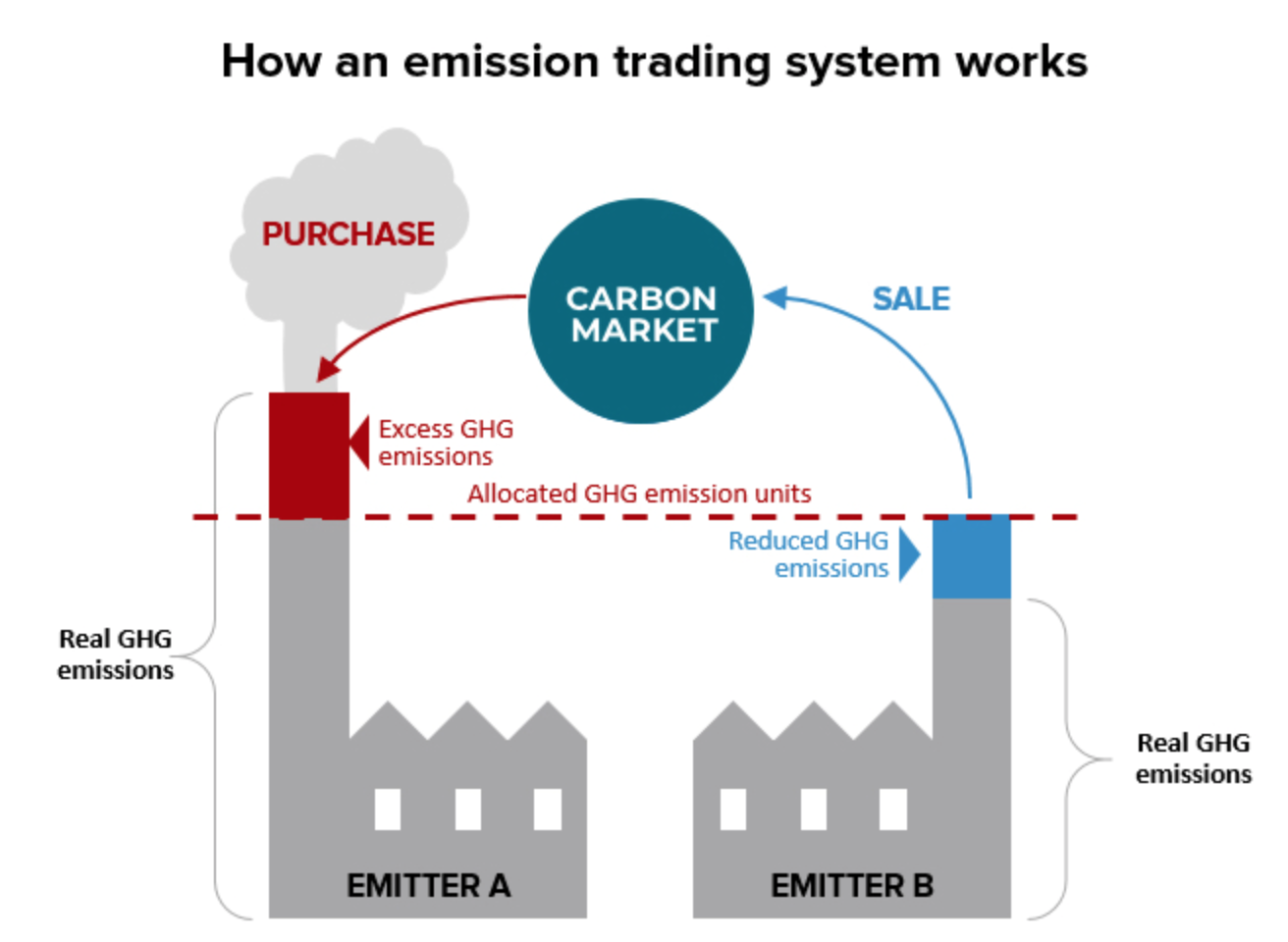

An Introduction to Investing in Carbon Markets

By Adam Solomon|March 10th, 2022|ESG, Research Insights, Guest Posts, Other Insights|

Carbon markets are quickly making their way to the forefront of Environmental, Social, and Governance (ESG) investing, as well as the finance community as a whole. The Kraneshares Global Carbon ETF, (Ticker: KRBN) (whose holdings I’ll dive into shortly) was one of the top 5 performing ETFs in 2021 on a % return basis (Ferringer, Best performing ETFs of the Year - etf.com). However, it doesn’t appear that 2021 was a one-hit-wonder for Carbon Markets, but instead, the beginning of a new and very real trend.

Our 5th Annual Democratize Quant 2022 is Live. Sign-up!

By Wesley Gray, PhD|March 9th, 2022|ESG, Factor Investing, Research Insights, Investor Education, Conferences, Value Investing Research, Momentum Investing Research|

We will be hosting our 5th annual Democratize Quant conference later this month via Zoom. The event is 100% free but we do screen participants to enforce our "no spammers" policy. https://alphaarchitect.com/democratizequant/

Global Factor Performance: March 2022

By Wesley Gray, PhD|March 8th, 2022|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Factor Updates for: Standardized Performance Factor Performance Factor Exposures Factor Premiums Factor Attribution Factor Data Downloads

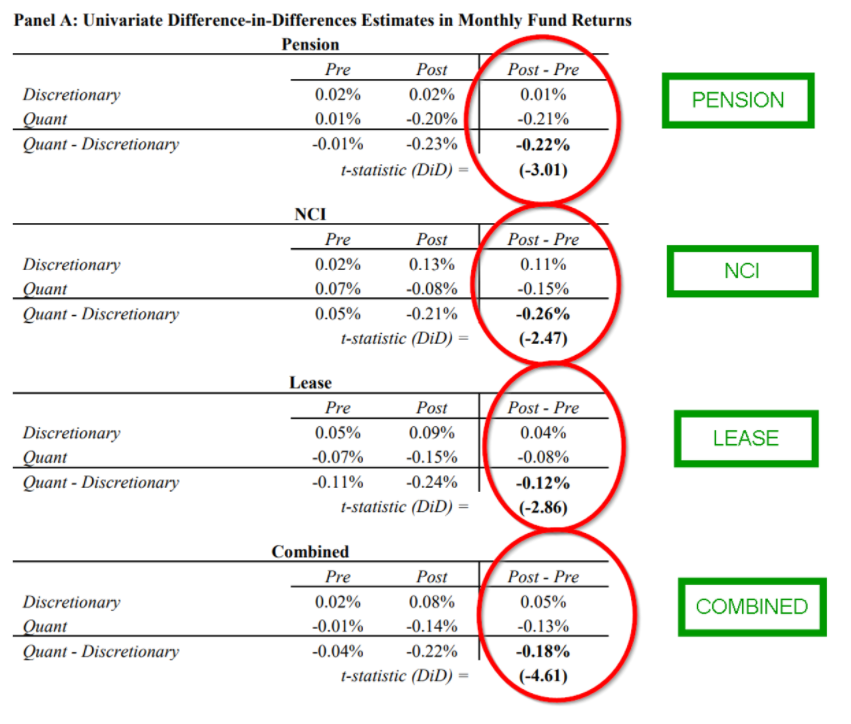

New Accounting Standards and Factor Investing

By Tommi Johnsen, PhD|March 7th, 2022|Research Insights, Factor Investing, Basilico and Johnsen, Academic Research Insight, Value Investing Research, Momentum Investing Research, Size Investing Research|

How well do quantitative investors navigate around the changes to the accounting standards that are endemic to the financial data used in quantitative strategies? The numbers reported on financial statements are wholly governed by regulation and by each firm’s interpretation of those accounting standards. So how do quants stick to their empirical evidence on old data methods or do they react in terms of the strategy when the change in standards is material?

Factor Investing: Are Internally Generated Intangibles Worthless?

By Larry Swedroe|March 3rd, 2022|Intangibles, Research Insights, Factor Investing, Larry Swedroe, Academic Research Insight|

As mind-bending as it sounds, although a company’s internally generated intangible investments generate future value, they are currently not accepted as assets under US GAAP. Omission of this increasingly important class of assets reduces the usefulness and relevance of financial statement analysis that uses book value. In fact, Amitabh Dugar and Jacob Pozharny, authors of the December 2020 study “Equity Investing in the Age of Intangibles,” concluded that the relationship between financial variables and contemporaneous stock prices has weakened so much for high intangible intensity companies in both the U.S. and abroad that investors can no longer afford to ignore the changes in the economic environment created by intangibles.

DIY Asset Allocation Weights: March 2022

By Ryan Kirlin|March 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Half exposure to international equities. Full exposure to REITs. Full exposure to commodities. No exposure to intermediate-term bonds.