Do sell-side analysts say “buy” while whispering “sell”?

By Tommi Johnsen, PhD|December 26th, 2024|Insider and Smart Money, Tommi Johnsen, Research Insights, Academic Research Insight, Other Insights|

Managers are more likely to vote for analysts who exhibit greater “say-buy/whisper-sell” behavior toward these man agers. This suggests that analysts reduce the accuracy of their public recommendations, thereby maintaining the value of their private advice to funds.

Intangibles and the Performance of the Value Factor

By Larry Swedroe|December 20th, 2024|Intangibles, Research Insights, Factor Investing, Larry Swedroe, Other Insights|

Systematic factor-driven value strategies have underperformed broad market indices (such [...]

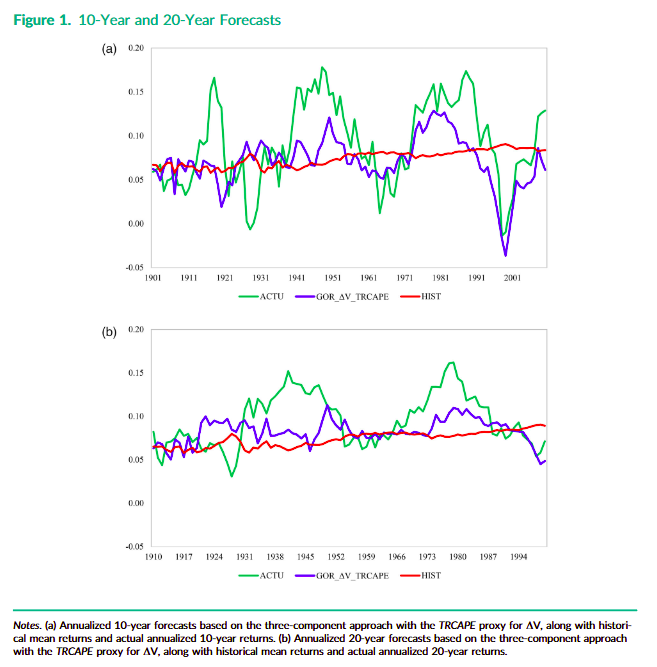

Estimating Long-Term Expected Returns

By Elisabetta Basilico, PhD, CFA|December 16th, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Macroeconomics Research|

This study addresses a critical gap in financial forecasting by improving the accuracy of long-term expected return (E(R)) predictions. By evaluating various frameworks and proxies out-of-sample, free from biases like look-ahead bias, it provides more reliable methods for investors to make informed decisions about asset allocations.

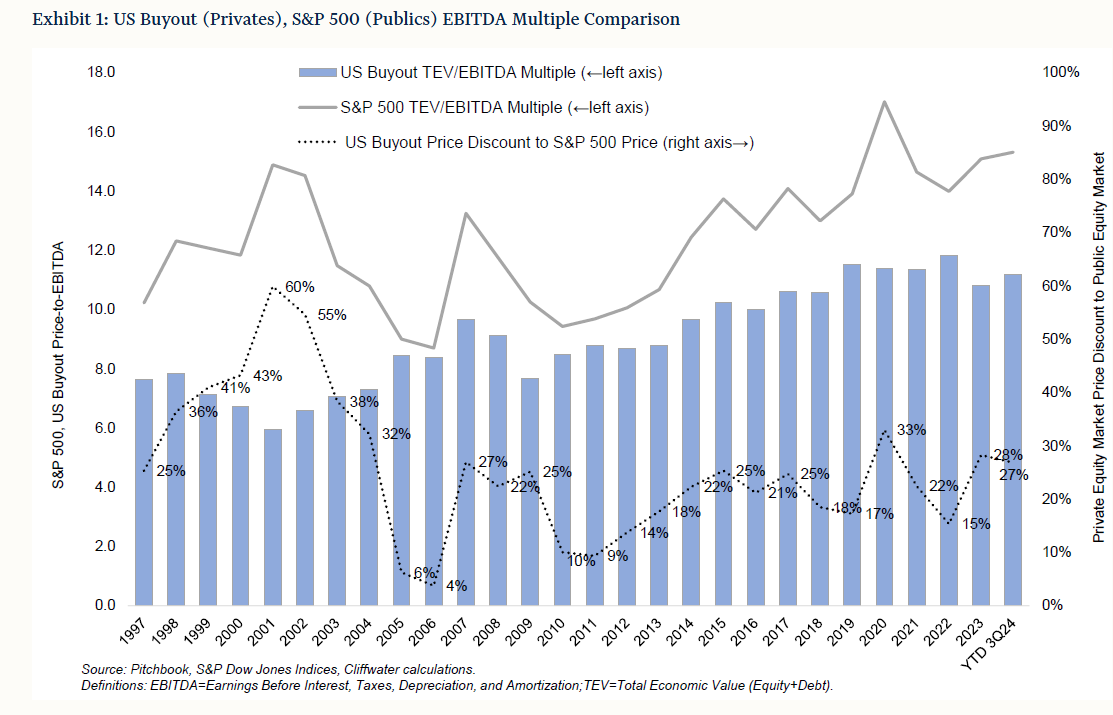

Private Equity Versus Public Equity Returns

By Larry Swedroe|December 13th, 2024|Private Equity, Larry Swedroe, Research Insights, Other Insights|

Cliffwater found that private equity allocations by state pensions produced a 11.0% net-of-fee annualized return over the 23-year period ending June 30, 2023. Over the same period the CRSP 1-10 Index (U.S. total market) returned 7.2% and the MSCI All Country World ex USA Index returned 4.4%.

Frog in the Pan Momentum: International Evidence

By Tommi Johnsen, PhD|December 9th, 2024|Tommi Johnsen, Factor Investing, Research Insights, Academic Research Insight, Other Insights, Momentum Investing Research|

Underreaction to continuous news plays a key role in generating momentum internationally.

Global Factor Performance: December 2024

By Wesley Gray, PhD|December 9th, 2024|Index Updates, Research Insights, Factor Investing, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.

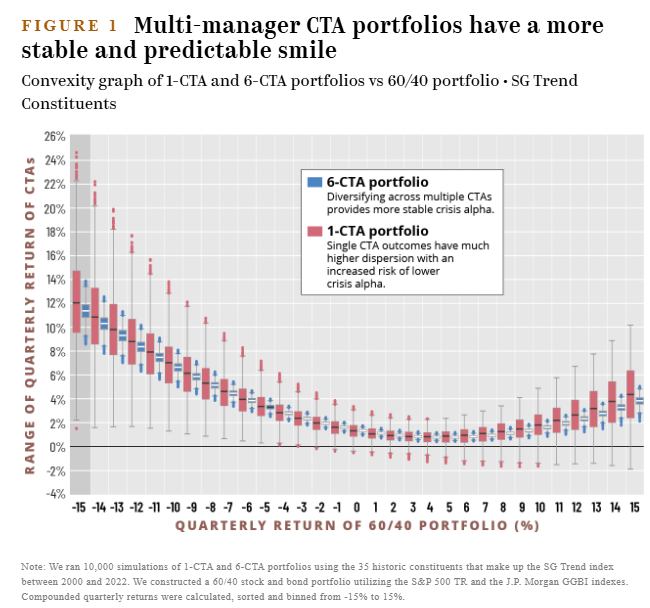

Diversifying Trend Following Strategies Improves Portfolio Efficiency

By Larry Swedroe|December 6th, 2024|Research Insights, Trend Following|

Allocation to trend following can further improve the efficiency of their portfolio by also adding allocations to the other uncorrelated strategies, further reducing tail risks by reducing the dispersion of potential outcomes.

DIY Trend-Following Allocations: December 2024

By Ryan Kirlin|December 3rd, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Do-It-Yourself trend-following asset allocation weights for the Robust Asset Allocation [...]

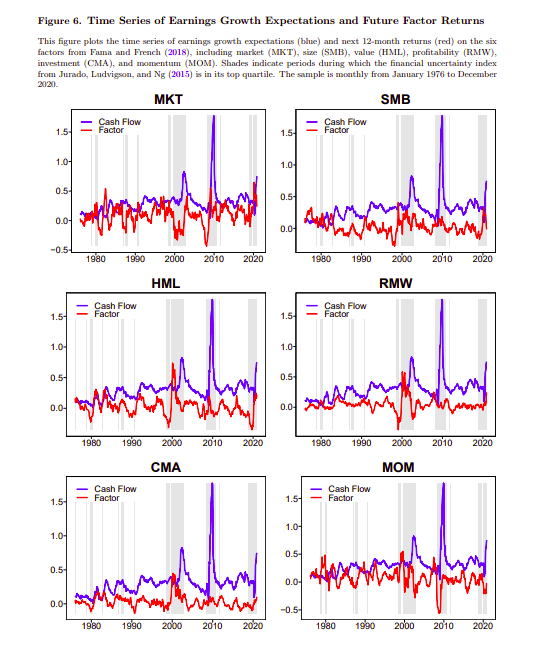

Time-Varying Drivers of Stock Prices

By Elisabetta Basilico, PhD, CFA|December 2nd, 2024|Elisabetta Basilico, Research Insights, Academic Research Insight, Other Insights, Behavioral Finance|

This paper examines the time-varying roles of subjective expectations in driving stock price and return variations.

Calendar Anomalies, Much Ado About Nothing

By Larry Swedroe|November 29th, 2024|Seasonality, Factor Investing, Larry Swedroe, Research Insights, Other Insights|

An anomaly is a pattern in stock returns that deviates [...]