I recall that during my first job on Wall Street, my boss had me generate a page of “comps,” or comparable companies with summary statistics for a valuation project I was working on. It was easy to understand the P/E, or Price to Earnings ratio, as I had seen that everywhere in the financial press. In addition to P/E, however, there were some new ratios that I was unfamiliar with. In particular, I remember seeing EBIT and EBITDA, which I knew a little bit about, along with a new concept for me — Enterprise Value. I was confused as to why Price was compared to Earnings, yet EBIT and EBITDA were compared to this mysterious Enterprise Value. If you are a professional investor, then you know all about EBITDA and EV, and you can move along, there’s nothing to see here. But if you are not such a capital markets expert, then read on.

The “P” in the P/E ratio is obviously the stock price, while “E” represents Earnings per Share. You can get the same result by dividing the Market Capitalization by the Net Income of the firm. In calculating Net Income, you have taken out any interest payments on debt, so this income flows directly to the equity owners of the firm, since the debt holders have already been paid their interest. Market Capitalization represents the value of the equity interest, which has an exclusive claim on Net Income. So it makes sense to compare Net Income to Market Capitalization.

Next, looking at EBIT, or Earnings Before Interest and Taxes, and EBITDA, which adds Depreciation and Amortization, we can see that with these concepts we have not yet made any interest payments on existing debt. Thus, they represent cash flows available to all stakeholders – both the equity and the debt holders. Here’s where Enterprise Value comes in.

Enterprise Value is the market value of equity, plus the value of debt, minus cash. This is the value you would pay for the entire Enterprise. If you just own the equity in a company and there is debt on the books, then as an equity holder you don’t really own the whole company: the debtholders have a claim against the assets, and they would be first in line to get paid in a bankruptcy or liquidation. Equity owns what is left after the debtholders get paid. So you need to add the equity and the debt together to account for the value of the enterprise. Additionally, if you buy a firm that has debt and cash, you can immediately use the existing cash to pay down the debt, although the value of the enterprise wouldn’t change as a result of that repayment. You can therefore think about the debt as “net debt,” or debt minus any cash available to pay it down.

I had a colleague once explain it to me like this: if you bought a house, and there was a bunch of cash in a cookie jar in the kitchen, you could reduce your notional purchase price for the house by that amount, since you would immediately get that cash back once you bought the house. Furthermore, to continue with this admittedly dubious house example, you don’t particularly care how the previous owners financed their house. They may have a small or a large mortgage, or no mortgage at all, but this doesn’t matter to you since all you care about is the house itself – the enterprise – and what you are willing to pay for it.

So here’s the important point. Since EBIT and EBITDA represent cash flows available to both the equity and the debt holders, it makes no sense to compare them to the firm’s Market Capitalization, since that represents only the value of equity. You want to compare these to the value of the Enterprise, which represents the ownership interest of both the equity and the (net) debt combined. Likewise, you wouldn’t compare Net Income, which belongs to the equity owners, to Enterprise Value, which represents both equity and debt holders; as discussed above, you would compare Net Income to the value of the equity, or the Market Capitalization. In this way, with EBIT or EBITDA versus EV, and NI versus MV, you are always comparing apples to apples in the nominator and the denominator.

When you talk to anyone in Private Equity or in, say, an LBO shop, they’re going to talk to you all day long about how they “paid 5X EBITDA” for thus and such business. EBITDA is sort of a universal term, the coin of the realm in finance, and plus it makes them sound cool. The thinking is that because D&A, or Depreciation and Amortization, are non-cash charges to Net Income, if you want to know how much cash the business will throw off to the Enterprise, you can look at EBITDA. But this is a little dishonest. Although D&A does get added back to Net Income to compute cash flow, it also represents the accrued expenses on investments the firm has made over time to enable its growth (or keep it from shrinking). D&A (or really Depreciation alone) is therefore a rough proxy for Capital Expenditures, or investment in the business. Indeed, a decent metric for evaluating a business is whether recent CapEx has exceeded Depreciation (usually when the company is growing), or vice versa (usually when the company is shrinking). Regardless, especially with a capital intensive business, it seems unrealistic to expect that all of that D&A cash flow could be paid out to the equity and debt holders, without having any effect on the business. Yet you still hear people throw the term around a lot. Go figure.

This is why many valuation practitioners prefer EBIT. With EBIT, you do not assume that D&A cash flows will be available to be paid out. You assume that the D&A represents the cash you need to invest in the business to maintain (or grow) its cash flows, so-called “Maintenance Capex.” In many ways, EBIT is therefore more representative than EBITDA of steady state Free Cash Flow, or cash available to both equity and debt holders, since it accounts for this required investment in the business.

Another popular valuation metric is Free Cash Flow. Free Cash Flow is just Operating Cash Flow, minus Capital Expenditures. Operating Cash Flow – CapEx offers an alternative to EBIT in that you also account for any changes in working capital (changes in non-cash current assets and current liabilities), which can be significant over time. To “unlever” Free Cash Flow, or undo the effects of leverage, you add back pre-tax interest payments. This unlevered Free Cash Flow number represents actual cash flow available to all stakeholders over time and thus is a useful metric. It should therefore be compared to Enterprise Value when thinking about valuation.

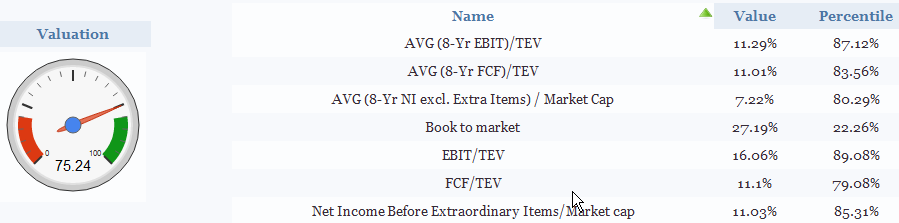

Let’s tie it all together and look at some Turnkey Analyst output:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

At this point, you will recognize NI, EBIT, FCF, as well as TEV, which is simply Total Enterprise Value. You will also understand why EBIT and FCF have TEV in the denominator, while NI has Market Cap. You will not see EBITDA, for the reasons discussed above. Another thing to note is that rather than look at multiples, such as a P/E of 10X or an EV/EBIT ratio of 6X, we use the reciprocal, which provides a yield figure. The rationale behind this is that when we use this Turnkey PhD-inspired method, you get a sense of the cash flow yield on the value of the enterprise, or the NI yield on Market Cap, and it is thus easier to compare with, say, the yield you might consider when looking at a bond or the cap rate on a piece of real estate.

This particular stock happens to be Microsoft, and so the Normalized (8yr average) FCF/TEV figure is telling you that if you happen to have the $172 billion required to purchase the equity and net debt of MSFT, you would have a trailing 8-Year Average Free Cash Flow yield of 11% on your investment. LTM FCF/TEV is also about 11%, so MSFT cash flows somewhat resemble the rock of Gibraltar. And this strkes me is a decent return, especially when 30-year Treasuries are yielding 2.78%.

So go forth and generate Turnkey’sup Shareholder Yields output with confidence. The output can tell you a lot about firm value, which is an important thing to understand if you want to take money from Mr. Market, which of course is why you’re on this site in the first place.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.