CXO Advisory highlights an interesting paper with the tagline: “Momentum Not Working?”

Here’s the link:

http://www.cxoadvisory.com/subscription-options/?wlfrom=%2F17440%2Fmomentum-investing%2Fmomentum-not-working%2F

Here is the link to the source:

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1951137

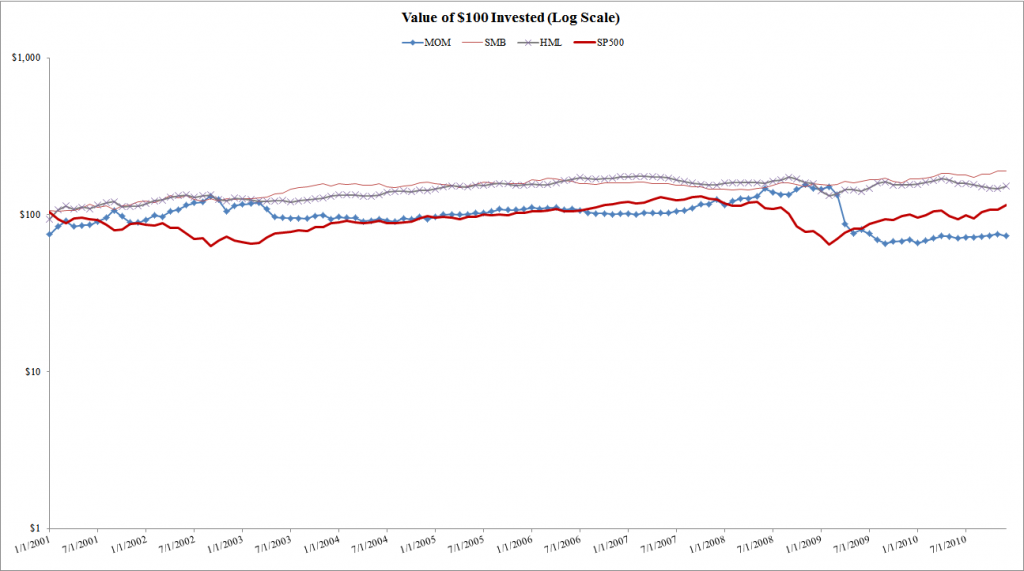

This work inspired me to run the Size, Value, and Momentum factors through our systems and see what has happened over the past few years.

- All returns are from Ken French’s website.

- MOM=L/S Momentum=”Momentum factor”

- SMB=L/S Size=”Size Factor”

- HML=L/S Value=”Value Factor”

- 1/1/2001–12/31/2010

Returns:

- Size and value worked.

- Momentum was working, then fell off a cliff.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

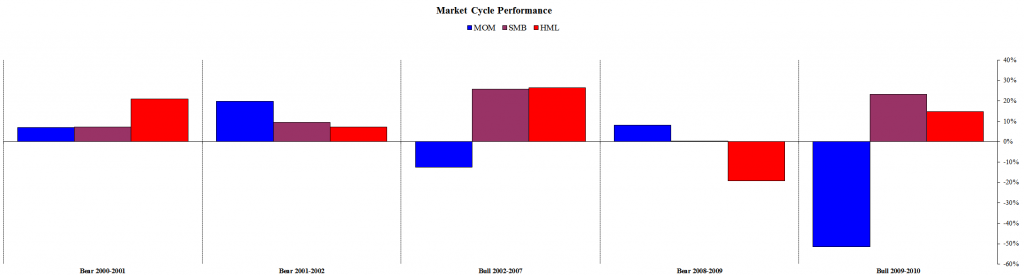

Market Cycles:

- Value got killed in the 2008 debalce

- Momentum got killed in the post 2008 runup

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

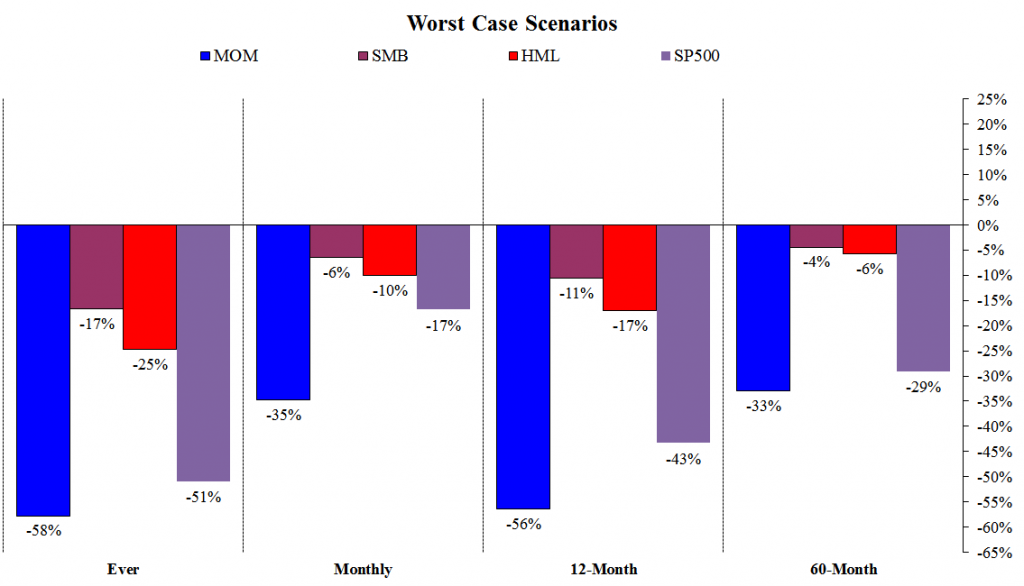

Drawdowns:

- Momentum: UUUUGGGLLLLYYY!

- Value/size did a fairly good job preserving capital relative to the SP 500

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

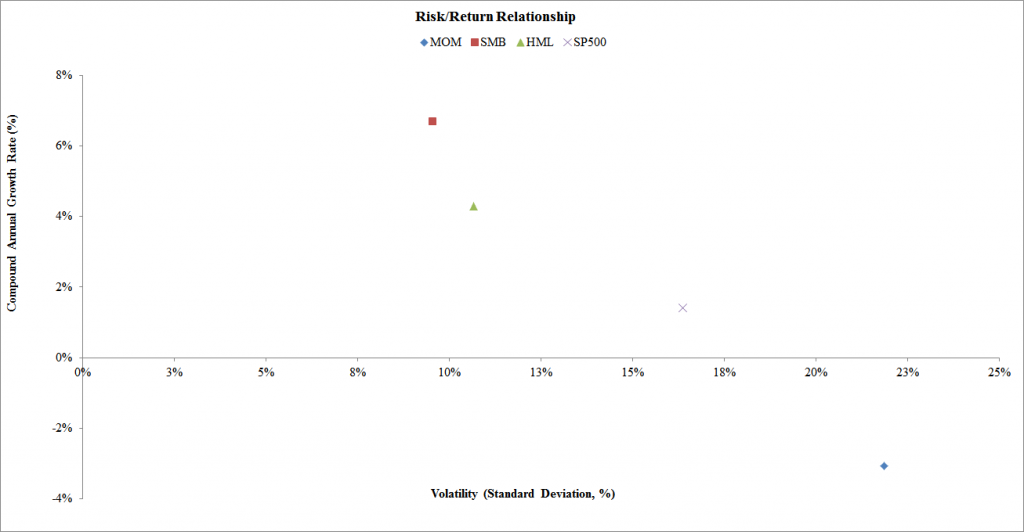

Risk/Reward:

- Market=Mediocre at best.

- Value=Good to go.

- Size=Good to go.

- Momentum=Terrible.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Conclusions:

Momentum returns are a lot like Bill Miller’s returns: they were on an epic winning streak, but gave almost all the gains back in a short period of time. My hunch is that momentum can still add alpha over the long haul, but the trick is finding a way to capture the alpha, without dying in the short-term. All the short-term volatility is likely due to the fact that momentum is a very crowded trade among quants–every pitchbook I’ve seen from a quant involves some form of momentum.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.