In “Value Creation or Destruction? Hedge Funds as Shareholder Activists,” by Chris Clifford, the author examines and measures the powerful effects created by hedge fund activists.

Clifford observes that hedge funds may be better positioned to drive excess returns through activism than, say, pension funds or mutual funds. After all, among other advantages they possess, hedge funds have lower liquidity constraints, can “lock up” investor capital for long periods, and can use leverage and options to increase their ownership. Perhaps most important, they have a powerful negotiating tool: the threat to buy the entire firm. As in, “You won’t make the change I’m suggesting? Maybe I’ll buy all your equity, fire you as CEO, and make the change personally.” In short, it appears that for these reasons shareholder activism by hedge funds may be more effective than by entities with other organizational forms.

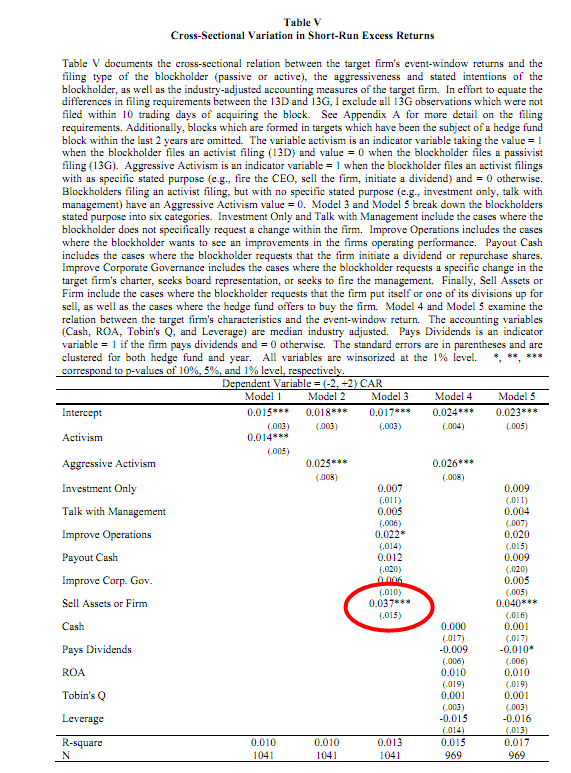

When a hedge fund’s ownership interest in a firm exceeds 5% it must make a filing announcing its intentions. In the case of funds that want to influence the firm, or become otherwise “active,” this is a 13d filing (the alternative is a “passive” 13g filing). An interesting feature of a 13D filing is that the fund must reveal its intentions. This disclosure requirement allows Clifford to examine excess returns associated with different specific requested changes, such as selling assets, paying out cash (dividend, share repurchase), improve operating performance, etc. And guess what? Yes, Virginia, there is a Santa Claus because there is one activist request that demonstrates particularly high abnormal returns: sell assets or the firm. As you can see from the Table below, holding all else equal, firms targeted by hedge funds with this goal generated 3.7% in additional event returns around the filing.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Unfortunately for us, as investors we can’t capture all of this 3.7%. Since Clifford was focused on the question of excessive returns associated with activist investing, the event returns above are calculated based on starting prices from 2 days prior to the 13d filing, and holding for 5 days. So it’s unclear how much this alpha return would be whittled down by purchasing at time 0 (day of filing) or time 1 (day after filing). Regardless, this does demonstrate that some forms of activist investing seem to work in the short run. Other papers, such as this one, talk more about activist-following strategies.

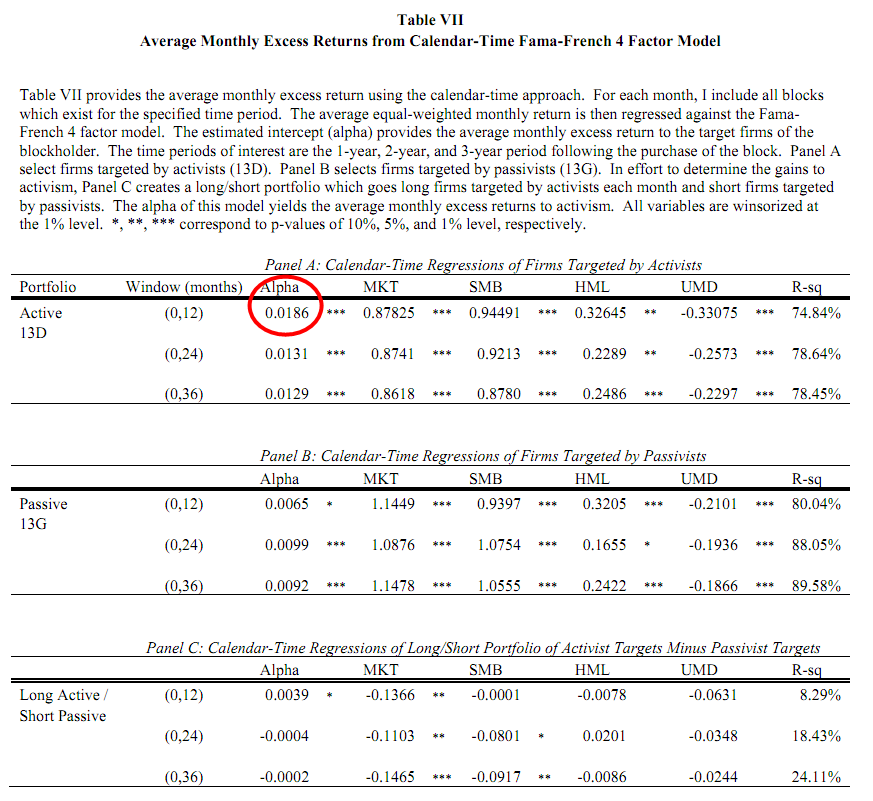

Ok, so if the short run is cloudy, what about the longer run? Can we make some money leveraging our newfound knowledge of potential activist alpha over longer periods of time? Clifford looked at the 1-year returns to firms targeted by activists and found excess returns of 1.86% per month, or 22.3% per year:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

We can see from the table above that we could achieve this 22.3% excess return (1.86% per month) if we bought firms targeted by activists in the month of the 13d filings. Ok, sure, we are not mind readers, so we can’t buy in advance of the filing, but we know that the highest alpha around the event, was 3.7%, as discussed above. So even if you subtract that generous 3.7% from the 22.3% over a year, you still get a lot of remaining alpha. The strategy seems intuitively sound. BUYER BEWARE. Clifford also mentions the following in the paper:

These results should be viewed with some caution. The estimation of the long-run returns is sensitive to both estimation window and choice of benchmark. In unreported results, I remove month 0 returns and begin estimating long-run returns one month following the block filing to remove the previously documented increase in stock price surrounding the filing date. This change in methodology has a meaningful effect on the interpretation of the results. While firms targeted by both activists and passivists continue to outperform the benchmark portfolio for up to one year after the acquisition of the block, I am unable to distinguish that excess returns earned by firms targeted by activists are statistically different from those earned by firms targeted by passivists. Further, for the 2-year and 3-year period following the filing, the returns to firms targeted by both activists and passivists are statistically indistinguishable from zero.

Nonetheless, I provide evidence that firms targeted by activists do not earn smaller long-run returns than firms targeted by passivists (i.e., do not receive short-term price increases at the detriment of long-term value), and that not surprisingly, markets appear able to quickly price in the value of activism following the blockholder filing.

Clifford has some additional statistics that show that these activist target firms demonstrate subsequent operational efficiencies consistent with the sale of under performing assets. This may suggest that if you only bought target firms which were targeted for asset sales/firm sale you might be able to further enhance the above alpha statistics, but that is a subject for another day and another academic.

So to summarize the strategy:

- Monitor 13d filings

- Invest in 13d target firms where the stated goal is to sell assets and/or the entire firm.

- Hold for 1 year (excess returns diminish over 2 or more year periods)

- Make money

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.