Legislating Stock Prices

- Lauren Cohen, Karl Diether, Christopher Malloy

- A version of the paper can be found here.

Abstract:

“In this paper we demonstrate that legislation has a simple, yet previously undetected impact on firm stock prices. While it is understood that the government and firms have an important relationship, it remains difficult to determine which firms any given piece of legislation will affect, and how it will affect them. By observing the actions of legislators whose constituents are the affected firms, we can gather insights into the likely impact of government legislation on firms. Specifically, focusing attention on “interested” legislators’ behavior captures important information seemingly ignored by the market. A long-short portfolio based on these legislators’ views earns abnormal returns of over 90 basis points per month following the passage of legislation. Further, the more complex the legislation, the more difficulty the market has in assessing the impact of these bills. Consistent with the legislator incentive mechanism, the more concentrated the legislator’s interest in the industry, the more informative are her votes for future returns.”

Data Sources:

Primary source of data is the complete legislative record of all Senators and all Representatives on all bills from the 101st through 110th Congresses. Full-text of all bills being voted on are from the websites of the Government Printing Office (GPO) and from the Thomas database. Returns and fundamentals are from CRSP/COMPUSTAT.

Discussion:

Intuitively, legislation should affect industries and firms, but it is difficult for us to know which firms will be affected and how. By observing the actions of legislators, this paper test whether information from legislature is incorporated into financial markets.

The authors form a “Long” portfolio that buys the firms in each industry that is assigned to a bill (weighted by market capitalization) when the bill passes, and a “Short” portfolio when the bill fails. The returns to this naïve strategy for signing bills are essentially zero. Also, there does not appear to be any price run-up in the period prior to and including the month of passage/failure of a bill. This suggests that there is no new information in when a bill passes or fails.

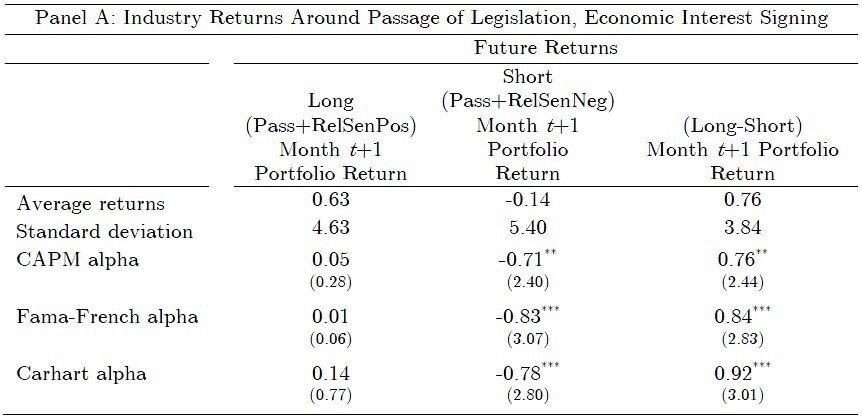

Next, the authors form a long portfolio that buys the firms in each industry where the Economic Interest signing measure is positive (If the interested legislators vote more in favor of a bill covering their vested industries than uninterested legislators, this is coded as a positive bill for the underlying industry. Otherwise, it is coded as negative.), and a “Short” portfolio that sells the firms in each industry when a bill’s Economic Interest signing is negative.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Using excess returns, CAPM alphas, Fama-French alpha, or Carhart alphas, the Long/Short portfolio consistently earns large abnormal returns, ranging from 76 basis points per month (t=2.44) to 92 basis points per month (t=3.01).

The authors provide more evidence on the proposed mechanism of interested legislators, and find that abnormal returns are larger on the industries that are likely to be most impacted and make up an especially large part of the economic activity in a legislator’s state. In addition, the return predictability is more significant for complicated bills than for routine bills, consistent with the idea that the market has a much harder time deciphering the likely impact of complicated pieces of legislation relative to more mundane bills.

Investment Strategy:

- Sign the impact of each bill, as positive or negative, for the relevant industries it affects.

- Compute “Economic Interest”

- Form a long portfolio that buys the firms in each industry that are assigned to a bill with positive economic interest.

- Short a portfolio of firms in each industry that are assigned to a bill with negative economic interest.

- Rebalance portfolios.

- Make money.

Commentary:

This strategy takes some legwork and returns are concentrated in the short leg. Overall, an intriguing idea worth further exploration.

About the Author: Tian Yao

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.