We’ve chattered a bit on gold recently:

Cam Harvey and Claude Erb have chattered a lot more on gold:

- http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2078535

- http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2148691

We went ahead and prepared an executive summary of what this research tells us (with chart porn and all!)

6 reasons for owning gold as per Erb/Harvey:

- gold is an “inflation hedge”

- gold is a “currency hedge”

- gold is an “asset allocation alternative to assets with low real returns”

- gold is a “safe haven/tail risk protect policy”

- “the world is de facto returning to a gold standard/gold is money”

- gold is “under owned” argument.

1) Gold is an “inflation hedge”

Example: Bernanke is insane and central banks are going nuts printing money. I’ll use gold to protect against this future inflation.

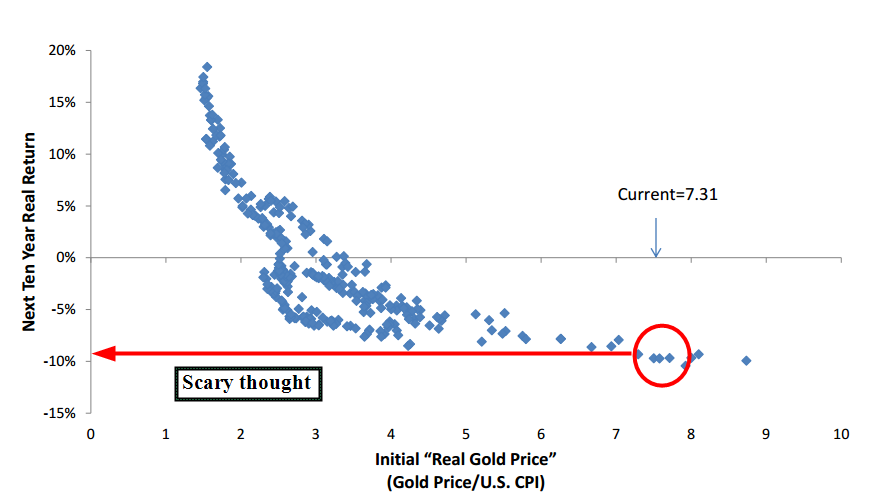

First, a scary historical relationship between real gold prices and 10-year real returns…looking at a 10% negative return on gold holdings at their current levels (gold has dropped since they published this paper, so maybe it is at the -5% level now)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

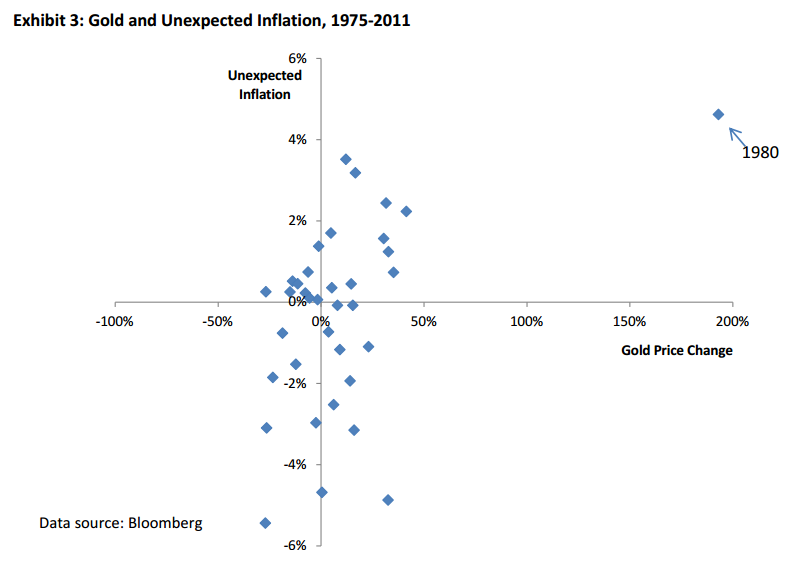

There doesn’t seem to be a clear relationship between gold and unexpected inflation…the authors provide much more detail in their paper.

The highlight seems to be that gold is not an effective short-term hedge, but might be a good long-term hedge…but “long-term” in this context represents time periods that outlast a human’s lifespan.

From the authors:

A claim that gold could have “equity-like” returns in the future needs to be reconciled with the past. Starting 2000 years ago in the year 12 A.D. one dollar compounding at just 1% a year, turns into $439 million over 2,000 years. If the rate of return is increased to 1.62%, the ending value is $100 trillion – more than the today’s combined capitalization of world stock and bond markets. In “normal” times, gold does not seem to be a good hedge of realized or unexpected short-run inflation. Gold may very well be a long-run inflation hedge. However, the long-run may be longer than an investor’s investment time horizon or life span. In the short-run the real price of gold has been the dominant driver of the price of gold and the returns from gold. We will return to the inflation argument when we explore the “safe haven” argument where we explore hyperinflation.

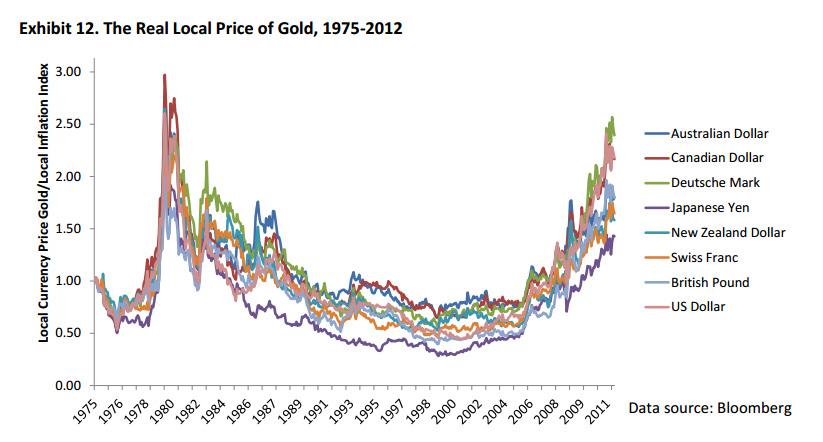

2) Gold is a “currency hedge”

Example: $ depreciates 10% against the yen, but gold increases by 10% ==> currency hedge

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The evidence seems to suggest that the real price of gold is independent of currency changes across all major currencies.

From the authors:

Is gold a currency hedge? It appears the answer is no. Do currency returns help explain movements in the real price of gold? No.

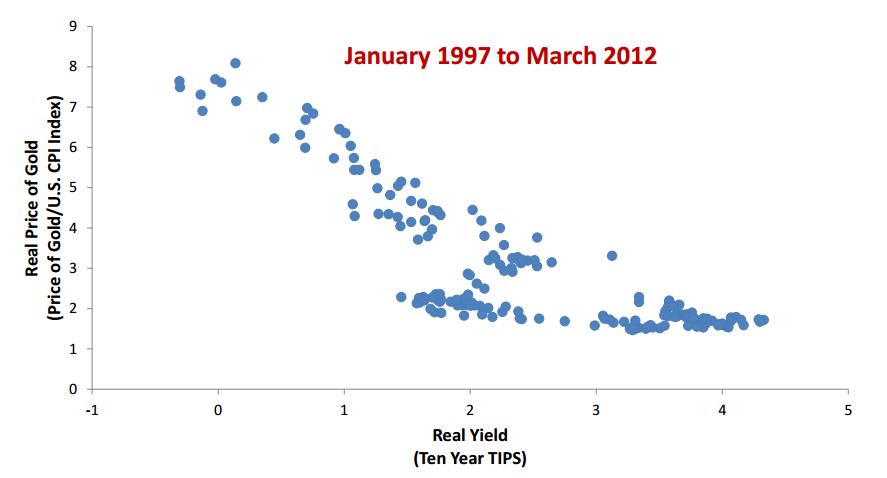

3) gold is an “asset allocation alternative to assets with low real returns”

Clear evidence that low real yields cause high real prices of gold?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

From the authors:

It is important to avoid the “correlation implies causation” trap. The negative TIPS real yield-gold real price correlation of -0.82 is a measure of the linear correlation of real yields with real gold prices. While it is possible to argue that historical data suggest that low real yields “cause” high real gold prices(Gibson’s paradox), it is equally possible to argue that causality runs in the other direction and that high real gold rices actually “cause” low real yields. Alternatively, it is possible that both low real yields and high real gold prices are driven by some other influence, such as a possibly immeasurable fear of hyperinflation.

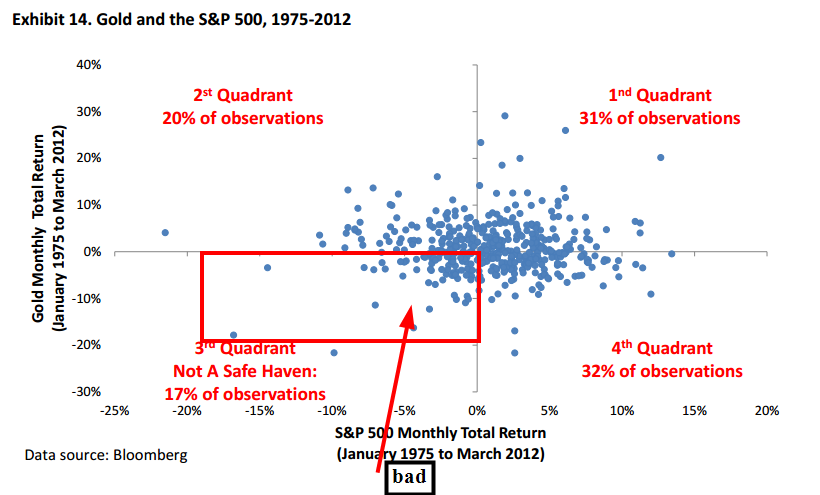

4) Gold is a “safe haven/tail risk protect policy”

Let’s be honest–you own gold for the doomsday event… hyperinflation or a significant currency debasement!

How does gold work to protect against financial market meltdowns? Not that great.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

An interesting observation from the authors regarding safe havens–this made me think! A safe haven needs to maintain its value AND be accessible when the hell storm breaks loose!

The Hoxne Hoard is an example of what can happen when trying to make a safe haven investment. The Hoxne Hoard is the largest collection of Roman gold and silver coins discovered in England. Evidence suggests that the hoard was buried sometime after 400 A.D. by a wealthy family seeking a safe haven for some of its wealth. The 5th century A.D. was a time of great social stress and political turmoil in England as the Western Roman Empire unraveled. The fact that the hoard was discovered in 1992 means that the family failed to reclaim its safe haven wealth. Indeed, the Hoxne Hoard is an example of an “unsafe haven”.

Another fascinating story is the observation that gold is not a safe haven for the owner of the gold, but for whomever controls the gold (i.e., in the doomsday, the man with the guns who can control the gold gets the save haven, not the man who buried it in his backyard, but was unable to protect it!)

And then there is the logistics of carrying your gold around town to purchase assets on firesale from those who didn’t have the foresight to own gold–@$1,600/oz, $10mm is 429 lbs of gold. I imagine the “people” would open the man with all the gold with open arms and sell them their homes and assets…can you say, “breakdown in typical business relationships.”

But what about the hyperinflationary moment?

The authors use the experience of Brazil as illustrative:

Imagine a Brazilian investor in 1980 who possessed perfect foresight of how Brazilian inflation would unfold between 1980 and 2000. Exhibit 15 shows that from 1980 to 2000 Brazil had an average annual inflation rate of about 250%, the currency was renamed and devalued numerous times, and the nominal price of gold rose substantially in Brazilian currency terms. Yet, using the IMF’s measure of Brazilian inflation, the real price of gold fell by about 70% between 1980 and 2000. This means, broadly and illustratively speaking, that by the year 2000, an ounce of gold had 30% of its 1980 inflation adjusted purchasing power. This is similar to the real price decline of gold faced by a U.S. investor during the same time period.

My interpretation of the Brazil experiment is that gold helps one maintain their value relative to a -100% currency loss (Thank God it is good for something!), but aiming for a 70% loss vs. a 100% loss isn’t exactly my idea of a “great deal.” That said, perhaps gold is the only asset that will work in hyperfinflation? If the hyperinflation is global, probably, if the hyperinflation is regional, perhaps general global diversification works just as well? Who knows.

Another question the authors raise? What is the actual probability of hyperinflation? Historically, hyperinflations are concentrated in “off the grid” countries experiencing internal turmoil. Also, what is the chance that all countries across the world experience hyperinflation simultaneously? I mean, seriously. If we enter this sort of world, owning gold isn’t helping anyone–owning guns and knowledge of military tactics will carry the day. Why? Because he who has the guns will own the gold in the end! Long guns and ammo.

5) “the world is de facto returning to a gold standard/gold is money”

I defer to the paper here…

6) Gold is “under owned” argument.

From the authors:

The “gold is underowned” argument has probably been an important driver of the increase in the real price of gold. A rising level of gold investment by emerging market central banks in an illiquid gold market could lead to a rising real price of gold. A rising level of “keeping up with the Joneses” motivated gold purchases could lead to a rising real price of gold. The rising real price of gold could act as a signal to momentum based investors to allocate capital to gold. As long as some central banks are insensitive to the real price they pay for gold the possible move into gold could drive the real price of gold much higher.

Conclusions:

These papers are awesome and make you think. My confidence in projecting the future of gold has been solidified at 0% prediction ability. Thanks to Harvey and Erb for making me feel stupid. Really appreciate it, guys.

Disclosure:

Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only.

Past performance is not indicative of future results, which may vary.

There is a risk of substantial loss associated with trading commodities, futures, options and other financial instruments. Before trading, investors should carefully consider their financial position and risk tolerance to determine if the proposed trading style is appropriate. Investors should realize that when trading futures, commodities and/or granting/writing options one could lose the full balance of their account. It is also possible to lose more than the initial deposit when trading futures and/or granting/writing options. All funds committed to such a trading strategy should be purely risk capital.

Hypothetical performance results (e.g., quantitative backtests) have many inherent limitations, some of which, but not all, are described herein. No representation is being made that any fund or account will or is likely to achieve profits or losses similar to those shown herein. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently realized by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can adversely affect actual trading results. The hypothetical performance results contained herein represent the application of the quantitative models as currently in effect on the date first written above and there can be no assurance that the models will remain the same in the future or that an application of the current models in the future will produce similar results because the relevant market and economic conditions that prevailed during the hypothetical performance period will not necessarily recur. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results, all of which can adversely affect actual trading results. Hypothetical performance results are presented for illustrative purposes only.

Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

There is no guarantee, express or implied, that long-term return and/or volatility targets will be achieved. Realized returns and/or volatility may come in higher or lower than expected.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.