Limited Attention and the Earnings Announcement Returns of Past Stock Market Winners

- David Aboody, Reuven Lehavy, and Brett Trueman

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

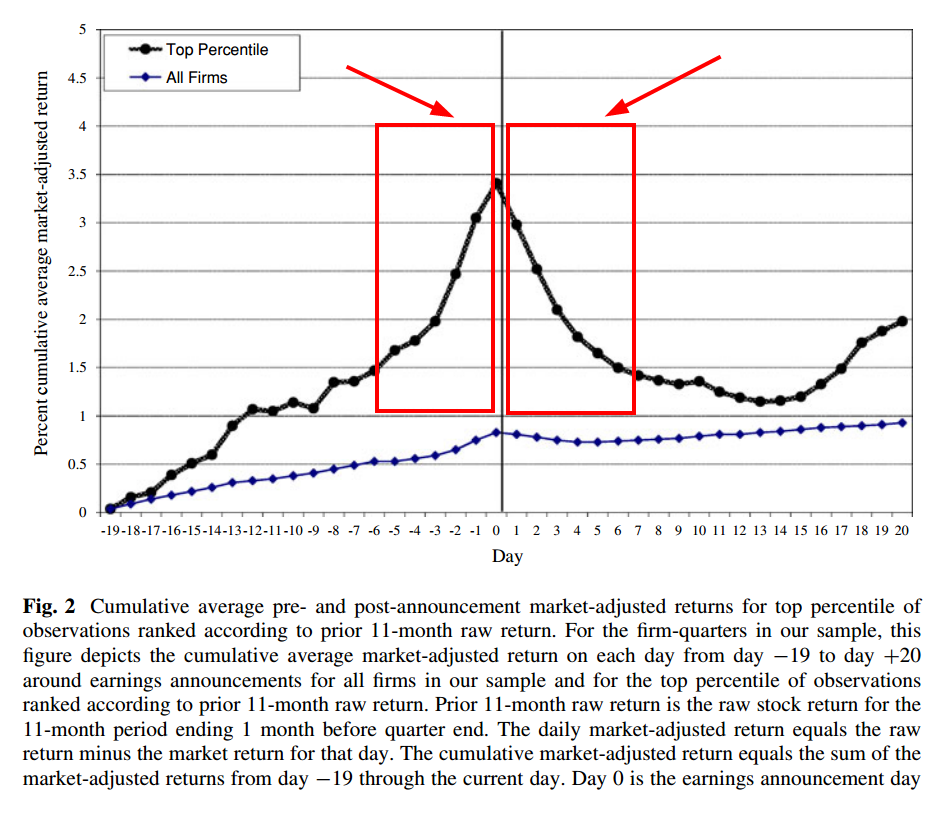

We document that stocks with the strongest prior 12-month returns experience a significant average market-adjusted return of 1.58 percent during the five trading days before their earnings announcements and a significant average market-adjusted return of 1.86 percent in the five trading days afterward. These returns remain significant even after accounting for transactions costs. We empirically test two possible explanations for these anomalous returns. The first is that unexpectedly positive news hits the market over the few days prior to these firms’ earnings announcements, and that unexpectedly negative news comes out just afterwards. The second possibility is that stocks with sharp run-ups tend to attract individual investors’ attention, and investment dollars, particularly before their earnings announcements. We do not find evidence for an information-based explanation; however, our analysis suggests the possibility that the trading decisions of individual investors are at least partly responsible for the return pattern we observe.

Data Sources:

CRSP, Factiva, and COMPUSTAT from 1971-2005.

Alpha Highlight:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Compute the 12-month momentum ending the last trading day of quarter t-1 for all stocks above $5 .

- Sort firms into percentiles, and select the firms in the 99th percentile (highest) of past 12-month returns.

- Using the earnings announcement in quarter t as day 0, firms in the top percentile for past 12-month returns on average earn cumulative market-adjusted returns of:

- 1.58% from day -4 to 0 and -1.86% from day +1 to +5.

- When restricting the sample to announcements outside of normal trading hours:

- Buying on day -4 and selling on the open of day +1 on average earns a cumulative market-adjusted return of 3.09%, while initiating the short position on the open of day +1 and holding this position until day +5 on average earns a cumulative market-adjusted return of -3.05%.

- Last, the paper finds that trading decisions of individual investors (small and medium investors) who focus their limited attention to high performing stocks contribute to the increasing pre-announcement stock price.

Commentary:

- Only trading the top 1% of momentum stocks would leave investors with a small number of stocks to trade.

- While on average the returns to the strategy work, investing in 1 stock and holding throughout an earnings announcement could lead to large losses if there is bad news about the firm.

- Half of the returns come from the short-side, which may be costly and difficult to implement for smaller firms.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.