Predictive efficiency of two multivariate statistical techniques in comparison with clinical predictions

- Alexakos, C.E. Journal of Educational Psychology, 57, 207-306

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

The college grade-point average of academically superior high school students was predicted by statistical methods (regression and discriminant analyses) on the basis of 19 independent variables, and by clinical counselors on the basis of all information collected through counseling interviews and testing during the 4 high school years. The obtained results indicated that the statistical were slightly superior to the clinical predictions; however, both types of prediction were not as efficient as one would wish them to be. Weighed combinations of the 3 methods increased the efficiency by 37% in the least favorable case and by 106% in the most favorable. It was concluded that combinations of clinical-statistical predictions could be more efficient and more useful in counseling college-oriented students than any single method.

Prediction:

Prediction of 2nd year college GPA for high school students. The prediction variables and model estimates are as follows:

[Click to enlarge] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Alpha Highlight:

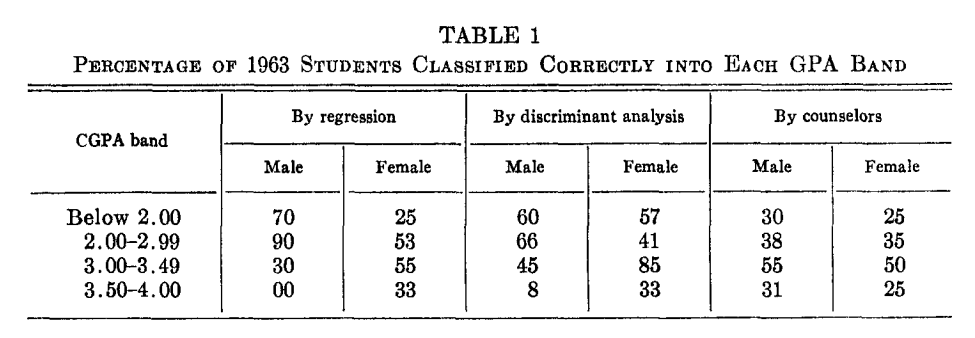

There are many interesting tests in this paper. The table below highlights the key results: machines were better at identifying high school students that will perform poorly in college, but humans were better at predicting the students that will excel in college. The authors also find evidence that machines are better at predicting results for female students (across all GPA bands), but do worse for male students.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

This paper also shows that combining human and machine estimates can improve performance.

These results conflict with prior research by Meehl: “The clinicians systematically over-predicted grade average.”

Thoughts on the paper?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.