A Field Test of Implications of Laboratory Studies of Decision Making

- Ashton, A. H.

- The Accounting Review, 59, 361-375

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

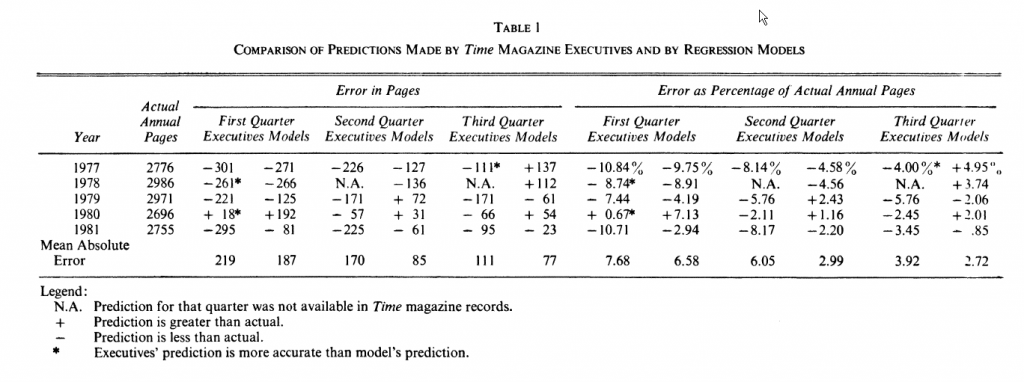

This study provides real-world evidence about the validity of the results of an experimental lens model study evaluating the prediction accuracy of corporate executives versus that of regression models. The decision task involves predictions of annual advertising page sales used in current operating budgets at Time magazine. Actual quarterly predictions by Time executives for the years 1977-1981 are compared with predictions made by regression models that were based on data available to the executives when they made their predictions. Comparisons of executives and models are based on an accuracy criterion of actual absolute error. The present results agree with prior experimental results, which show that models predict more accurately than people. Therefore, one of the principal conclusions from lens model research-that simple models might successfully replace people in certain time-consuming, repetitive decision tasks-is supported. However, consistent underprediction by executives is observed. A crude correction for mean error is applied to predictions made by executives and by regression models, with the result that the executives’ corrected predictions are more accurate than the models’ corrected predictions.

Prediction:

Can a simple regression model outperform predictions of corporate executives when confronted with the task of estimating annual advertising page sales?

The author feeds the regression model the following variables:

- The quarter to which the data apply (first, second or third);

- Total advertising pages actually published in the magazine during the quarter

- Total advertising pages for the quarter in the alcoholic beverages

- Total advertising pages for the quarter in the automotive

- Total advertising pages for the quarter in the smoking materials categories

- Bookings-to-date

- New (i.e., incremental) bookings for the quarter

- Cumulative actual advertising pages for the year-to-date.

Alpha Highlight:

Table 1 highlights executives vs model results. * represent observations where the executives beat models. As you can see, there aren’t many “stars.” In general, executives underpredict (conservative bias?). In no cases are the prediction results by the executives better than the results from the models. Models win this round.

Thoughts on the paper?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.