The value of information in a multi-agent market model

- Bence Toth, Enrico Scalas, Jurgen Huber and Michael Kirchler

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

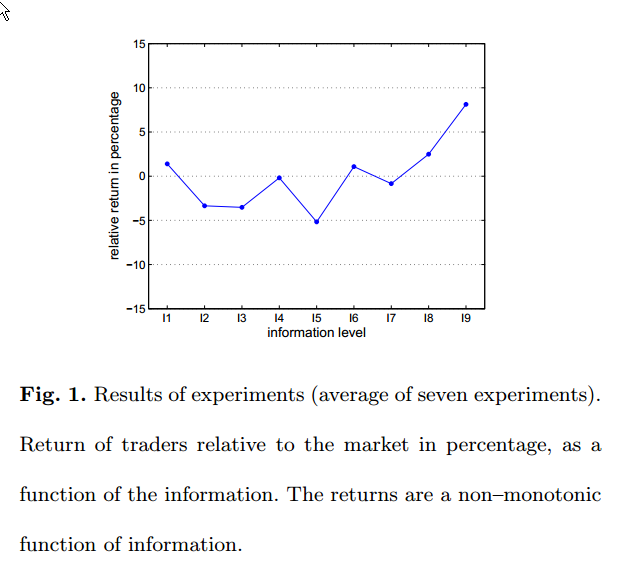

We present an experimental and simulated model of a multi-agent stock market driven by a double auction order matching mechanism. Studying the effect of cumulative information on the performance of traders, we find a non monotonic relationship of net returns of traders as a function of information levels, both in the experiments and in the simulations. Particularly, averagely informed traders perform worse than the non informed and only traders with high levels of information (insiders) are able to beat the market. The simulations and the experiments reproduce many stylized facts of stock markets, such as fast decay of autocorrelation of returns, volatility clustering and fat-tailed distribution of returns. These results have an important message for everyday life. They can give a possible explanation why, on average, professional fund managers perform worse than the market index.

Data Sources:

Experimental evidence.

Alpha Highlight:

The experiments are set up in such a way that certain traders receive different levels of information in a simulated trading environment. The question the authors address is whether or not more information translates into better performance. If agents are perfectly rational we should see a monotonic relationship between information and returns (on average).

Of course, readers of Turnkey Analyst already understand that humans aren’t perfectly rational. And of course, the results bear this truth out once again…

From the authors:

The results suggest that only those traders with near perfect information can beat the market. Of course, attaining perfect information in real-world markets is equivalent to attaining insider information that is generally unavailable to the marketplace (unless you like dressing up in chains).

Time for some more channel checks to confirm the discounted cash flow model is correct?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.