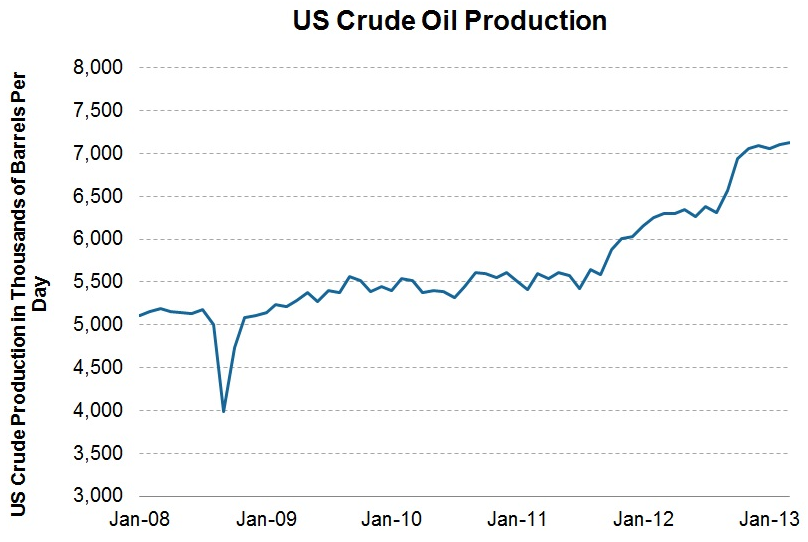

The evolution of new horizontal drilling and fracking techniques has revolutionized production of oil in the U.S.

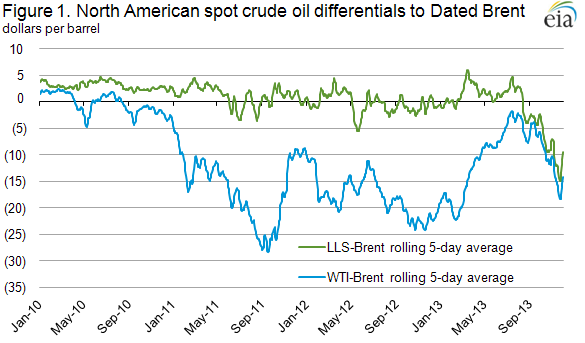

The huge volume of light sweet production coming out of the shales, such as the mammoth Bakken, have widened the spreads between domestically produced crude (WTI or LLS) and international crude (Brent). The graph below depicts several dynamics at work.

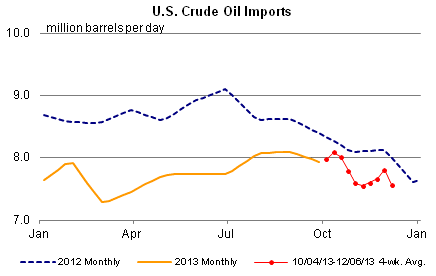

There are several things going on in this graph which charts US domestic prices (both WTI and LLS) against international crude prices (Brent). Both domestic indexes, the WTI and the LLS, both currently trade at ~$10 per barrel discount to Brent, representing international prices. Note that the LLS, which previously traded near parity with Brent (and at times a steep premium to WTI) now trades at a discount to Brent. This comparatively recent development is being driven by increasing supply of light sweet crude from the shales. This huge volumes of crude from shale production have also curtailed oil imports:

The above graph shows overall crude imports. What it doesn’t show is that most of the decrease is due to reductions in light sweet imports, which have essentially ceased in the gulf coast. If there are huge volumes of light sweet crude coming from the Bakken and elsewhere, why would you need to import any?

Here is where things really get interesting…

Since the 1970s energy crisis, it has been illegal to export domestically produced oil. Huh? Yes, that’s right, now that light sweet imports have essentially ceased, the continuing flow of light sweet from the shales has NOWHERE TO GO. There is a growing supply glut.

Exxon is screaming bloody murder about this and wants to be allowed to export:

http://www.foxbusiness.com/industries/2013/12/12/report-exxon-wants-crude-export-limits-lifted/

Ok, let’s see. Big oil wants to make a legislative change that will increase prices in the U.S.?

Yeah, good luck with that.

Now, let’s turn to the refiners.

Refineries are actually fairly simple businesses. They take an input (crude oil), and create outputs in the form of refined derivative products, such as gasoline, heating oil, distillate fuel oil, kerosene, and petrochemical feedstocks. These refined petroleum products typically trade at a premium to the crude required to make them, and if the refinery can operate at a cost per barrel below that premium spread they can be profitable.

This is known as the crack spread.

A key difference between domestically-produced oil and these refined petroleum products is that while the former cannot be exported, the latter can. As a consequence, prices for refined products will tend to be set by the international markets, which presumably will represent the marginal buyer at a higher price point, since the Brent oil inputs abroad are more expensive.

We’re going out on a limb and making a macro call here.

- Disclaimer: Yes, I know we are typically focused on quantitative things. And as avid readers of psychology, we put zero faith in our macro calls, but we enjoy playing Nostradamus like everyone else :-)

If you believe that oil production in the shales will continue, and supply has nowhere to go, and if you believe that crack spreads will therefore widen, supported by international markets, then it seems reasonable to conclude that crack spreads for Gulf-based refiners should widen. And they are cheap today.

A basket consisting of Valero Energy Corporation (VLO), Marathon Petroleum Corporation (MPC), and Hollyfrontier Corporation (HFC) trades at a collective EBITDA/EV yield of approximately 20%. There are many other names in the space–all reasonably cheap.

We believe this dynamic might usher in a golden age for refiners. This might be a reasonable way to play this bold macro call if you are so inclined. Good luck.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.