Long-Term Impact of Russell 2000 Index Rebalancing

- Jie Cai and Todd Houge, CFA

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

The study reported here examined the long-term impact of Russell 2000 Index rebalancing on portfolio evaluation. A buy-and-hold index portfolio outperformed the annually rebalanced index in the 1979-2004 period by an average of 2.22 percent over one year and 17.29 percent over five years. Although short-term momentum and the poor long-term returns of new issues partially explain these returns, index deletions were found to provide significantly higher factor-adjusted returns than index additions. Some small-capitalization fund managers appear to capture a portion of these benefits. The strongest performing funds enhanced their factor-adjusted returns by an average of 1.45 percent per year by holding index deletions and/or avoiding index additions. Among the weakest performing funds, higher returns from holding index deletions were offset by the poor returns of new issues added to the index. Thus, index methodology may provide a structural incentive for portfolio managers to drift from their benchmarks.

Data Sources:

CRSP/Compustat 1979 to 2004.

Alpha Highlight:

Rebalance less, make more!

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- For majority of sample, construction of the Russell 2000 is fairly simple. Using May 31 market capitalization, for all firms with stock price above $1, the largest 1000 firms are in the Russell 1000, while the firms ranked 1001-3000 on market capitalization are in the Russell 2000. The rebalance occurs on June 30th.

- Excludes preferred issues, convertible securities, closed-end mutual funds, limited partnerships, “royalty trusts,” “bulletin board” securities, “pink sheet” stocks, foreign securities, and American Depository Receipts.

- September 2004, began to include IPOs on a quarterly basis (if fall within market capitalization rank).

- R2K used quarterly rebalancing from 1979-1986, semi-annual rebalancing from 1987-1989, and annual rebalancing since June 30, 1989.

- Rebalancing has a major impact on turnover, as an average of 457 companies (23% of index holdings) are replaced each year.

- Table 1 compares a buy-and-hold strategy with no rebalancing with the annually rebalanced R2K for holding periods of up to five years after each reconstitution date.

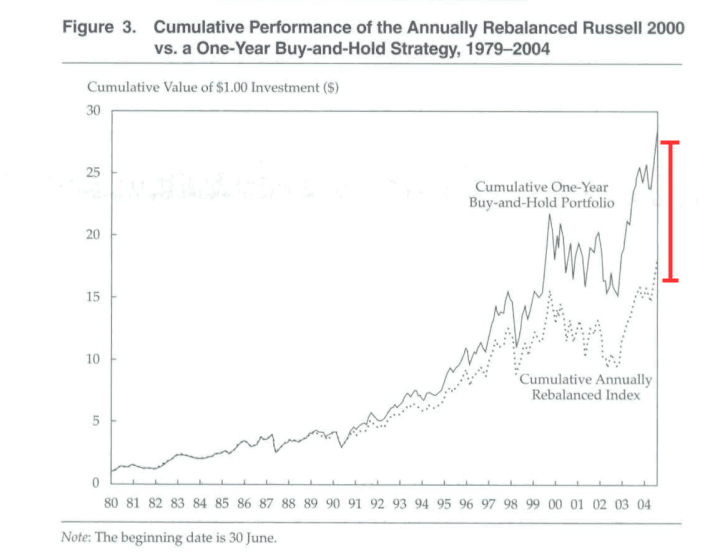

- The buy-and-hold portfolio outperformed the R2K by a statistically significant average return of 2.22% (17.29%) during the first year (5 years) after portfolio reconstruction.

- $1 invested in the R2K index would have grown to $17.77, while $1 invested into to a buy-and-hold portfolio that waits one year to rebalance would have grown to $28.42.

- Figure 4 shows that this outperformance is driven by those deleted companies from the R2K index. A portfolio of deleted R2K firms outperforms a portfolio of new R2K firm by 40.1% over a five year period!

- Primarily driven by large companies that continued to do well (deleted because they became too large – now in the R1K).

- A deletions minus additions portfolio (DMA) generates a statistically significant 7.9% per year return.

- Significant alpha when controlling for market, size, value, and momentum. Large growth companies heavily influence the returns.

- Last, examine the returns of 865 small cap mutual funds.

- These funds hold on to firms after they have been deleted from the R2K index.

- Winning funds generate larger returns due to holding onto these deletions, while losing funds have lower returns due to exposures to new issues (IPOs) which had lower returns.

Strategy Commentary:

- Less rebalancing may be better?

- Less taxes, less complication!

- Simple way to beat the index

- Ride the momentum wave!

Who’s ready for a better R2K?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.