Rituals Enhance Consumption

- Vohs, J., Y. Wang, F. Gino, and M. I. Norton.

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

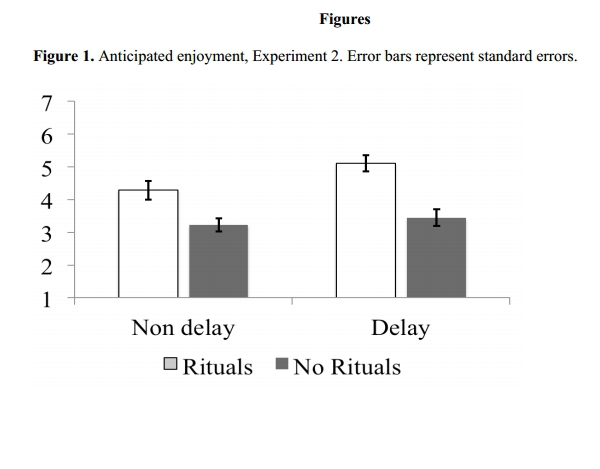

Four experiments tested the novel hypothesis that ritualistic behavior potentiates and enhances the enjoyment of ensuing consumption – an effect found for chocolates, lemonade, and even carrots. Experiment 1 showed that ritual behaviors, compared to a no-ritual condition, made chocolate more flavorful, valuable, and deserving of behavioral savoring. Experiment 2 demonstrated that random gestures do not boost consumption like ritualistic gestures do. It further showed that a delay between a ritual and the opportunity to consume heightens enjoyment, which attests to the idea that ritual behavior stimulates goal-directed action (to consume). Experiment 3 found that performing rituals oneself enhanced consumption more than merely watching someone else perform the same ritual, suggesting that personal involvement is crucial for the benefits of rituals to emerge. Last, Experiment 4 provided direct evidence of the underlying process: Rituals enhance consumption enjoyment due to the greater involvement they prompt in the experience.

Alpha Highlight:

We often wonder why investors are so prone to believing in stories that simply aren’t true and/or engaging in rituals that will enhance their investment decisions. The evidence from this study suggests that we get a certain level of utility from performing a ritual. The dangerous thing about rituals is they can potentially cloud our decision-making process, making something appear more valuable and enjoyable than it really is.

Figures 1 shows how a ritual enhances the anticipated experience of an action.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Figure 2 shows how a ritual enhances the actual experience of an action.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Summary:

Always ask yourself:

Are my stock market rituals adding value, or simply making me feel better about my decisions?

Perhaps your ritual helps you maintain discipline? (probably a good thing) Or perhaps your rituals are detracting from investment value, but making you feel better? (probably a bad thing).

Whatever situation you face, make sure you are cognizant of how ritualistic behavior might be affecting your behavior.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.