Looking for Someone to Blame: Delegation, Cognitive Dissonance, and the Disposition Effect

- Chang, Solomon, Westerfield

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We analyze brokerage data and an experiment to test a cognitive-dissonance based theory of trading: investors avoid realizing losses because they dislike admitting that past purchases were mistakes, but delegation reverses this effect by allowing the investor to blame the manager instead. Using individual trading data, we show that the disposition effect — the propensity to realize past gains more than past losses — applies only to non-delegated assets like individual stocks; delegated assets, like mutual funds, exhibit a robust reverse-disposition effect. In an experiment, we show increasing investors’ cognitive dissonance results in both a larger disposition effect in stocks and also a larger reverse-disposition effect in funds. Additionally, increasing the salience of delegation increases the reverse-disposition effect in funds. Cognitive dissonance provides a unified explanation for apparently contradictory investor behavior across asset classes and has implications for personal investment decisions, mutual-fund management, and intermediation.

Disposition Effect in Stocks:

This paper reinterprets a well know behavioral bias, the “Disposition Effect”, which depicts investors’ greater propensity to sell assets at a gain than at a loss. We describe the disposition effect in “Sell Winners Too Early and Hold Losers Too Long.”

The authors first highlight a psychological explanation that helps investors understand such reluctance to realize losses: People will experience discomfort or psychological pain when encountering new information which contradicts their existing beliefs.

To be specific, an investor who has created the self-image of being a good decision-maker does not like to admit that he is wrong. Thus, he will be reluctant to realize losses when investment performance is bad, which leads to the “disposition effect.” He wants to reduce the mental costs of admitting mistakes or at least delay such pain.

Reverse-Disposition Effect in Funds:

This paper also finds that the disposition effect is reversed in the case of delegated assets, such as in mutual funds. That is, investors have a greater propensity to sell losing funds compared to winning funds. This behavior is consistent with behavioral psychology: when fund performance is bad, investors tend to blame fund managers and sell the related assets as a consequence. By blaming a scapegoat, investors feel mitigation of pain associated with losses, while still maintaining a positive self-image.

Key Findings:

1. Paper run regressions (see Part II) with several dummy variables to test for the disposition effect. Data include 128,829 accounts from 1991 to 1996.

- Results (Table II and III) confirm the hypothesis: the disposition effect in stocks and the reverse-disposition effect in actively managed funds holds for the same investors at the same time.

2. It is worth mentioning that the paper designs two experiments to provide direct evidence of cognitive dissonance as a cause of the disposition effect. 520 undergraduates participated in their online trading experiments, which lasted over 12 weeks. Each student was given an initial endowment of $100,000 and randomly assigned to trade either stocks or mutual funds. There were two treatments:

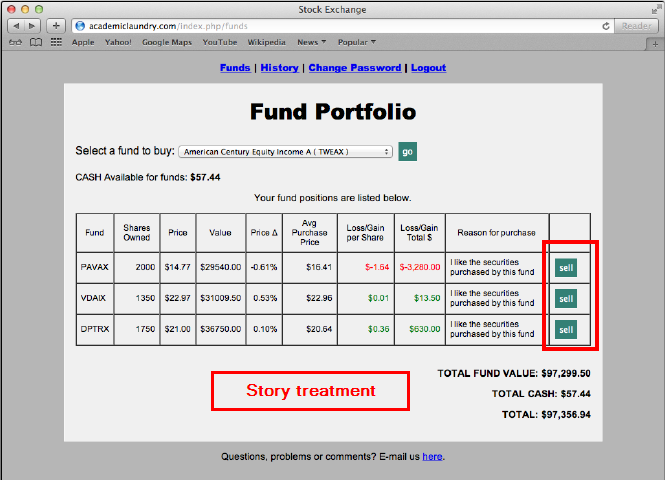

- “Story” treatment: This treatment is designed to increase cognitive dissonance. All students have to present a reason for their buy decisions and they are reminded frequently about their stated reasons during the experiments, especially when they move to sell the asset.

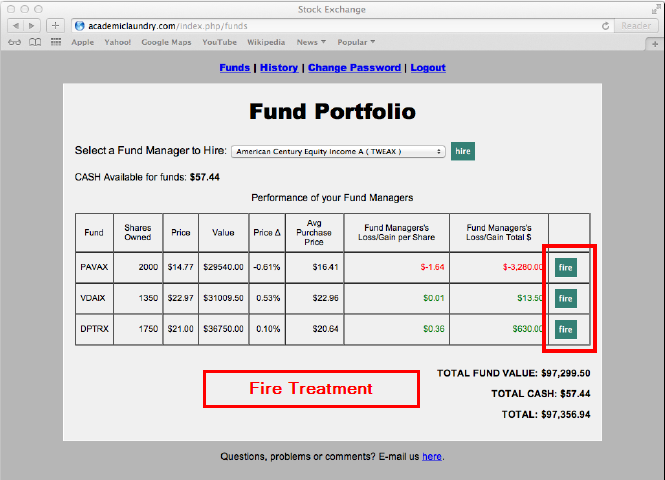

- “Fire” treatment: This treatment is designed to increase the salience of the fund manager. Students are provided with choices of “Hire”, “Fire”, and “Fund Manger’s performance/gain/loss” rather than “Buy”, “Sell” and “Portfolio performance/gain/loss”. In addition, students in the fire treatment are provided with a fund managers’ bios.

The experiment’s results can be found from Table VI.

- The higher the level of cognitive dissonance, the larger the disposition effect in non-delegated assets (stocks) and the larger the reverse-disposition effect in delegated assets (funds).

- The bigger the effect of delegation, the bigger the reverse-disposition effect. In other words, if investors focus more on the role of the fund manager instead of their own role, they feel mitigation of pain associated with realizing losses.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.