Last week, Wes had a short post entitled, Where are the Cheap Firms?

The post showed that when we look at the cheapest stocks in the U.S. stock market, we see that a few industries predominate today, notably energy (mostly oil-related) and consumer discretionary.

We wondered what things looked like in developed international markets, but at a country level. That is, when we look at the cheapest stocks available worldwide, in which countries will we find the cheapest stocks?

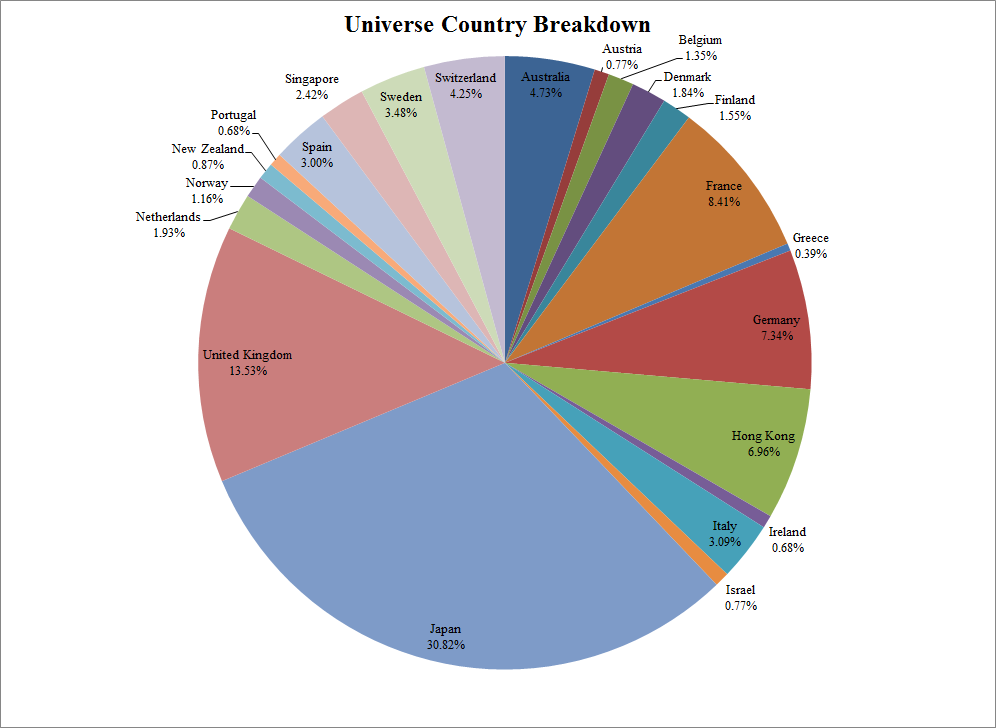

First, what does the universe look like? We examine 1035 securities that are deep and liquid in the developed markets:

It is worth noting that Japan has many more tradeable stocks than many of these other countries.

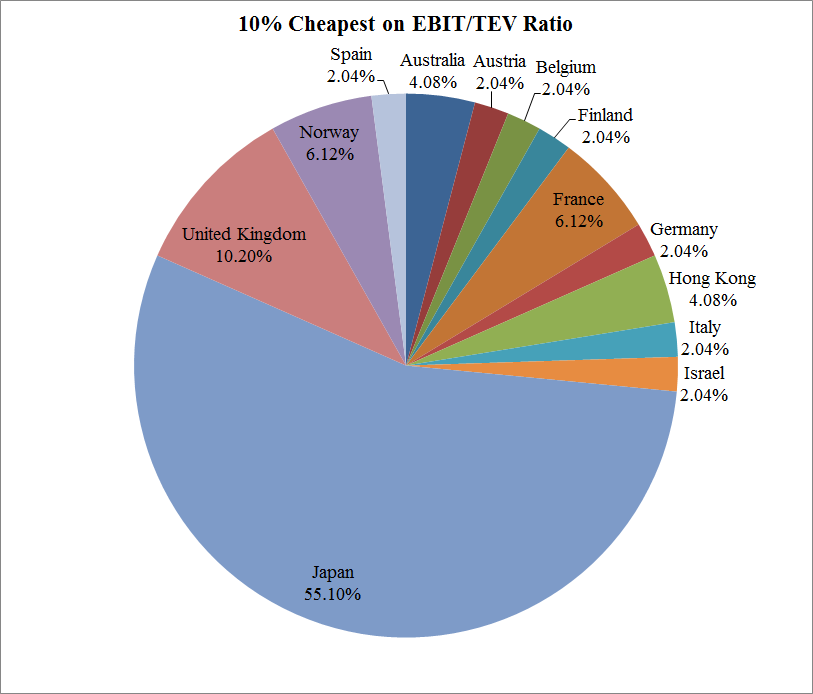

Country weigths based on stock-selection using EBIT/TEV:

Norway, with a 6% weight, actually has a higher EBIT/EV yield (at 20.22%) in its cheapest decile than Japan (at 14.69%), it has many fewer stocks, and so receives a lower allocation versus Japan’s 55% weight. In general, the world’s cheap stocks reside in Japan.

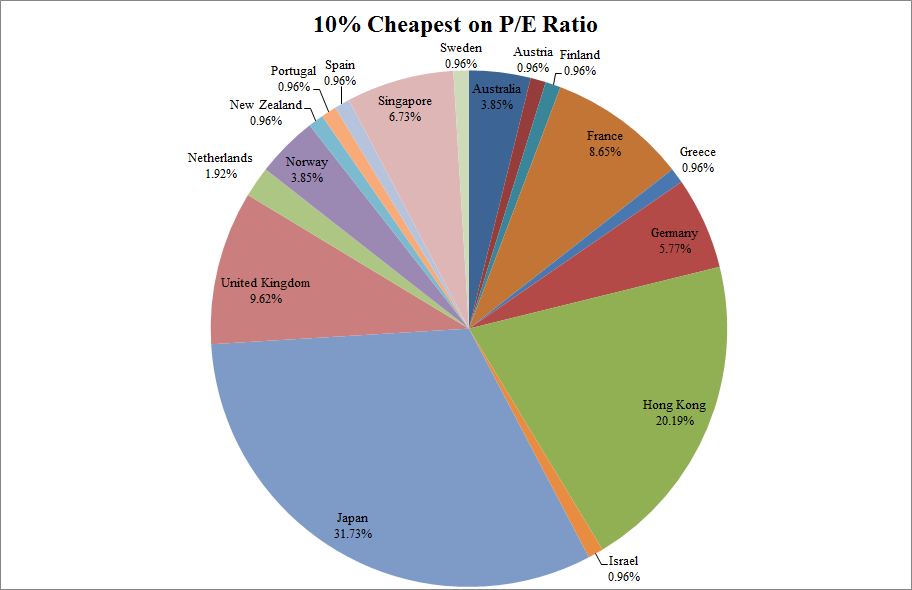

How about another valuation metric? P/E:

A different story here: Japan has a huge weight, but Hong Kong plays a much bigger role.

What is “cheap” depends on how you define cheapness. However, some interesting bargain hunting can be found in Japan, Norway, and Hong Kong.

Good luck!

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.