Zahi Ben-David has an excellent new summary paper on the state of academic research on exchange traded funds with colleagues Rabih Moussawi and Francesco Fanzoni.(1)

The fact Zahi is a thought leader on ETFs and we are in the ETF business is kinda interesting because Zahi and I were definitely not talking about ETFs when we first met nearly 15 years ago! (2)

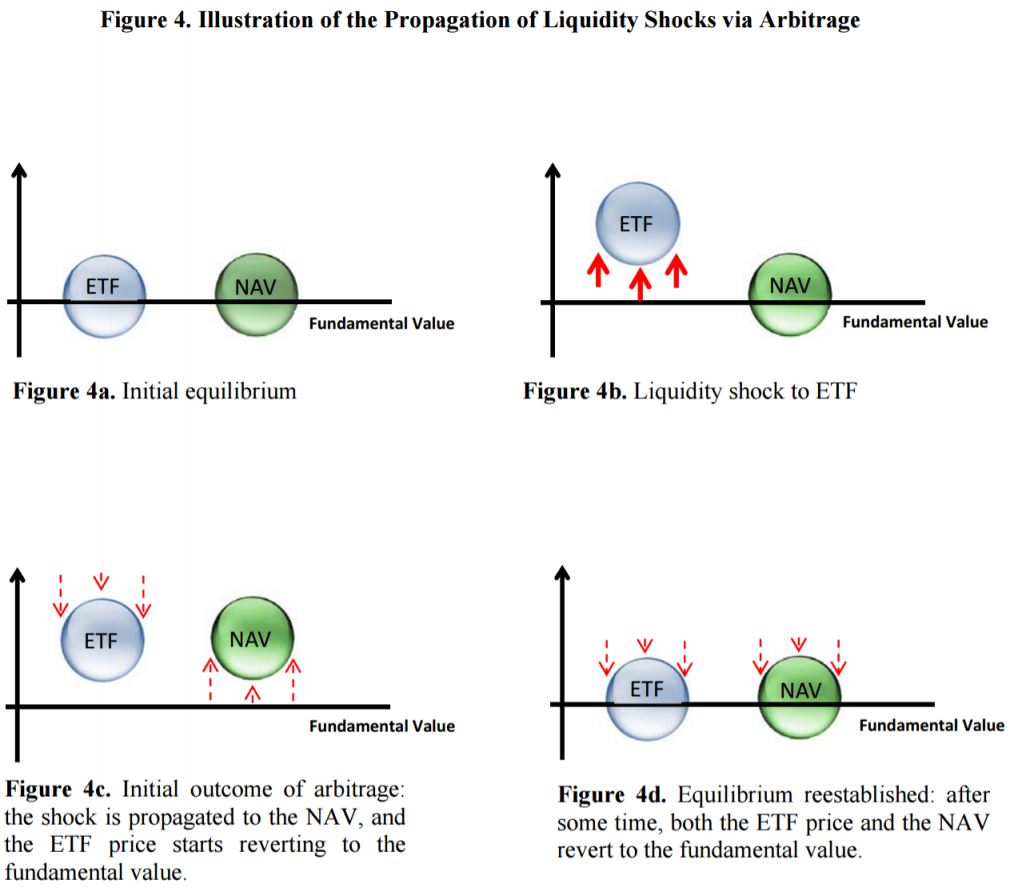

I love the graphic from the paper that outlines how ETF abritrage works, which also helps investors understand the dynamics of how ETFs trade in the secondary market. See below:

Here is the abstract and a link to the paper if you’d like to dig in:

Over two decades, ETFs have become one of the most popular investment vehicle among retail and professional investors due to their low transaction costs and high liquidity, taking market share from traditional investment vehicles such as mutual funds and index futures. Research has shown that in addition to the benefits of enhanced price discovery, ETFs add noise to the market: prices of underlying securities have higher volatility, greater price reversals, and higher correlation with the index. Arbitrage activity is a necessary component in minimizing the price discrepancy between ETFs and the underlying securities. During turbulent market episodes, however, arbitrage is limited and ETF prices diverge from those of the underlying securities.

We’ll be following up with Zahi to get some in-depth answers on his thoughts about the future of the ETF marketplace. Stay tuned!

References[+]

| ↑1 | We focused on Zahi for this interview, but Rabih and Francesco have some wonderful research articles at their websites. |

|---|---|

| ↑2 | We entered the finance PhD program at the University of Chicago in 2002. I was a 22 year old with no clue and Zahi had years of experience, a wife, 2 kids, and a successful academic career ahead of him. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.