There is still no value in bonds today.

The typical knee-jerk reaction to bold bond statements (such as the one above) is as follows:

- This guy is a total idiot

- This guy is a total genius

I claim I’m simply trying to be a disciplined value investor, but let’s dig a bit deeper into the claim that bonds lack “value,” even with this quarter’s 85 basis point back-up in 10-year treasury note yields.

One way to view value within non-credit fixed income assets is to deconstruct interest rates into their nominal and real components, while also recognizing that investors typically demand a term premium to hold interest rate-sensitive bonds. Recent research summarized in this article advances the measurement of both real rate and the term premium. Unfortunately, I’m of the opinion that neither real rates nor term premiums are paying bond investors enough to make it worth the risk associated with locking away their money and accepting potentially high-interest rate volatility.

Estimating Expected Inflation and Real Interest Rates

At their core, interest rates compensate investors for delaying the gratification of spending money today instead of the future. The biggest component of making that decision is usually how the cost of purchases you hope to make today compares to their expected cost in the future. In other words, what is expected inflation?

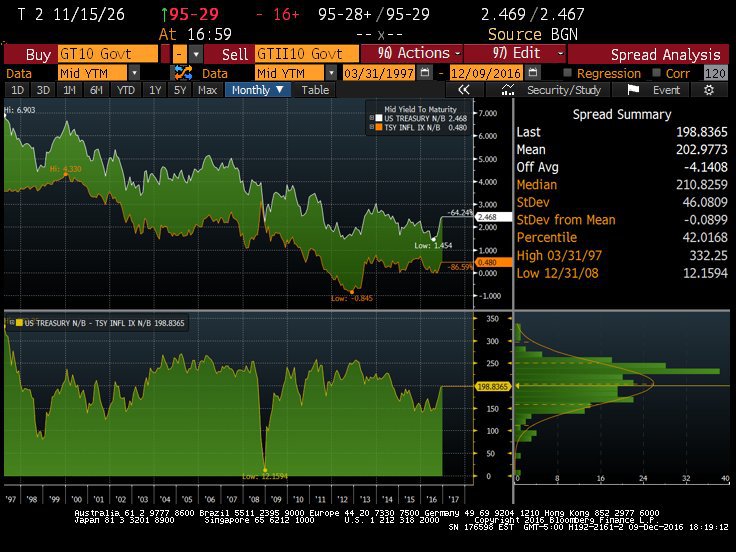

Since the advent of TIPS (Treasury Inflation-Protected Securities) which, as their name implies, are protected from inflation, we can back into expected inflation (the break-even rate or difference between the nominal Note and TIP yields), at least in a risk-neutral world that doesn’t take into account liquidity risk, risk of deflation, or risk of inflation (captured longer term by the term structure of interest rates). When graphed over longer periods of time, you can see the drop in yield of both the 10 year Treasury note and in the “real” interest rate — what you really earn after taking into account inflation as measured by the 10-year TIP yield. Over the last few years, that real interest rate amount has been paltry and has even gone negative.

10 Year Real Rates and Expected Inflation

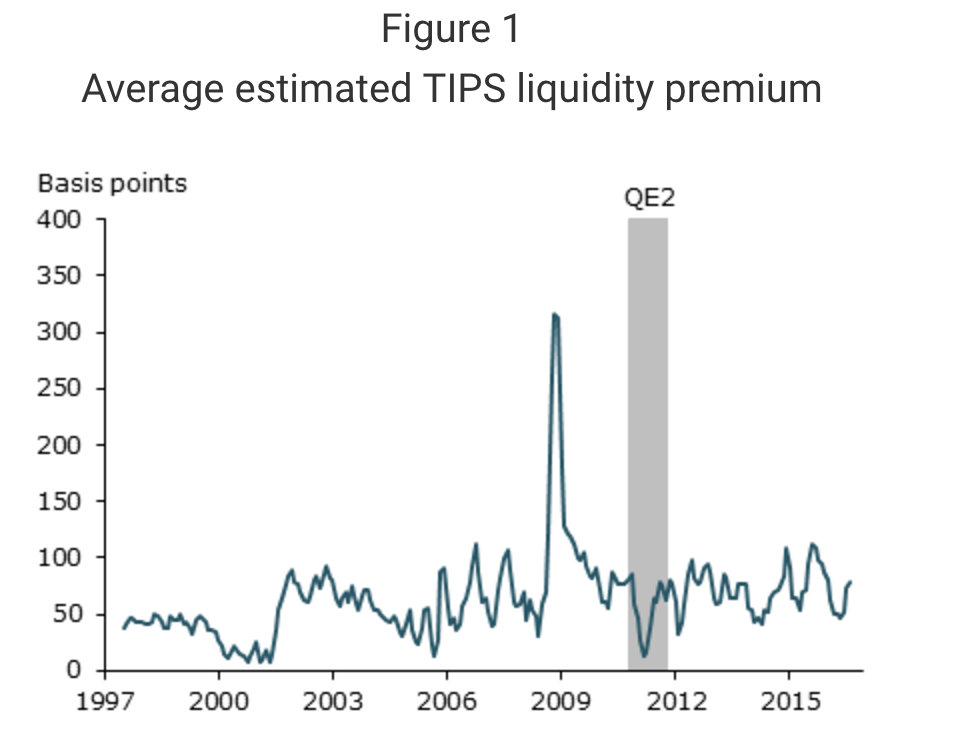

As I mentioned, TIPS provides a measurement of expected inflation, but only in a risk-neutral world. As both academics and traders know, TIPS can also be much less liquid than their corresponding Treasury Notes. In a new Economic Letter from the Federal Reserve Bank of San Francisco, this liquidity premium, which makes TIPS trade at a higher interest rate, can be substantial. (1). In fact, as pictured in the graph below, incorporating liquidity risk fully explains the blip we see in the prior graph in later 2008, but arguably still rests comfortably above 50 basis points. In other words, adjusting for liquidity, the “real” interest rate of TIPS are likely negative which doesn’t seem like such great value.

Source: http://www.frbsf.org/economic-research/publications/economic-letter/2016/november/tips-liquidity-and-the-outlook-for-inflation/

I view real interest rates as one proxy for the “value” in bonds. When real rates are well above historical rates, we can expect to earn high expected returns adjusted for inflation. When real rates are low, as they still are today, especially when taking into account liquidity risk, we can expect to earn a lower expected return on inflation-adjusted bonds.

Term Premium

Another proxy for “value” in bonds is the premium you earn to compensate you for the risk that rates will go up and your bond or bond fund’s current value will go down. The compensation for this second risk is known as the term premium. If you placed no value on this risk, you’d expect the same return from rolling forward investments in, say T-bills over 10yrs, as you would for simply investing in the 10 year Treasury note. Intuitively, when investors are more worried about deflation than inflation, as they have been, this term premium will be low.

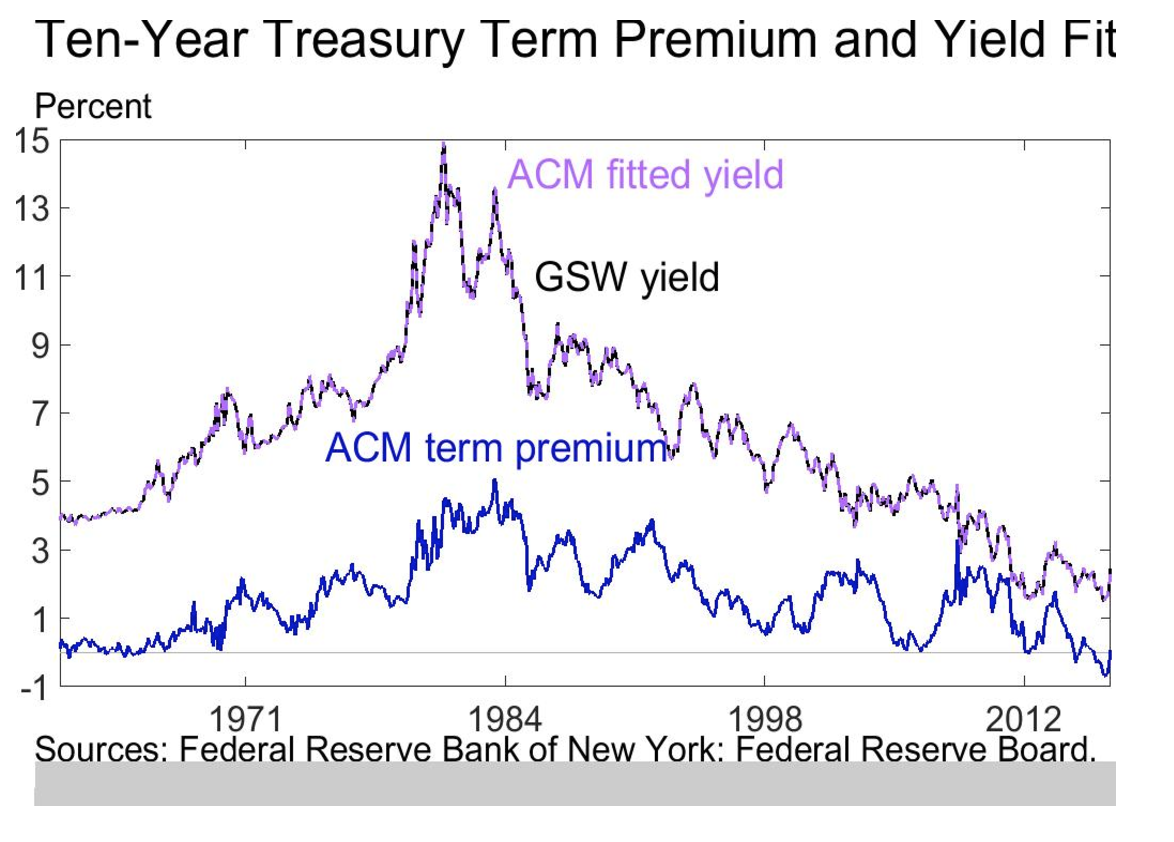

In fact, as shown in the graph below, the term premium can even be negative and recently has been for the first time since the 60s, at least according to the most accepted estimate, the ACM term premium outlined in The Federal Reserve Bank New York’s Staff Report updated in 2013. Updated data can be found on their website here and is graphed below. For simplicity’s sake, view the other two graphed yields that overlap each other as the actual 10-year yield. Again, at basically zero, the term premium doesn’t seem to offer much value.

10 Year ACM Treasury Term Premium and Nominal Rates

Real Rates Stink; Term Premium Stinks — But isn’t that because of Slower Expected Economic Growth?

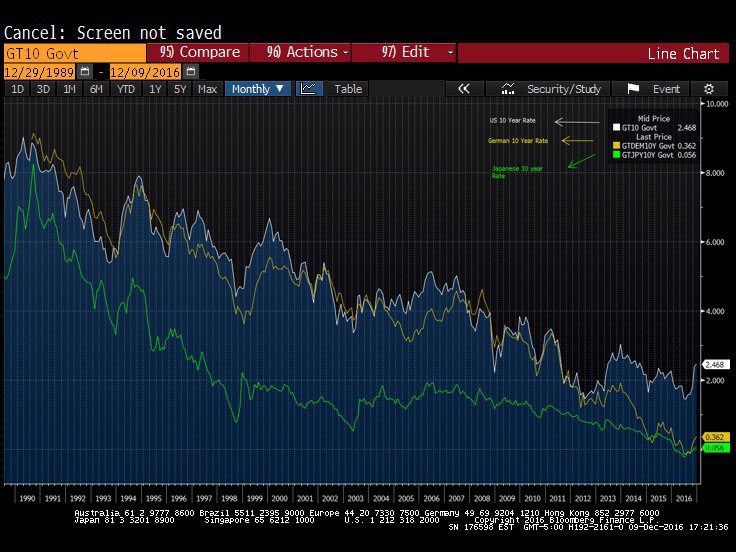

We can also expect to earn a lower rate of return when other alternative investments are few and far between, usually the product of a slow economy and one of the reasons Japan’s interest rates have been so low for so long. The fear of anemic growth going forward in the US is strong, and the effects on long-term rates can be significant. The slow-growth trend is global markets is even more pronounced (e.g., the gap between US and German yields is now at a 27 year high!).

Historical Global 10 Year Rates

And Don’t Bonds Serve as Insurance?

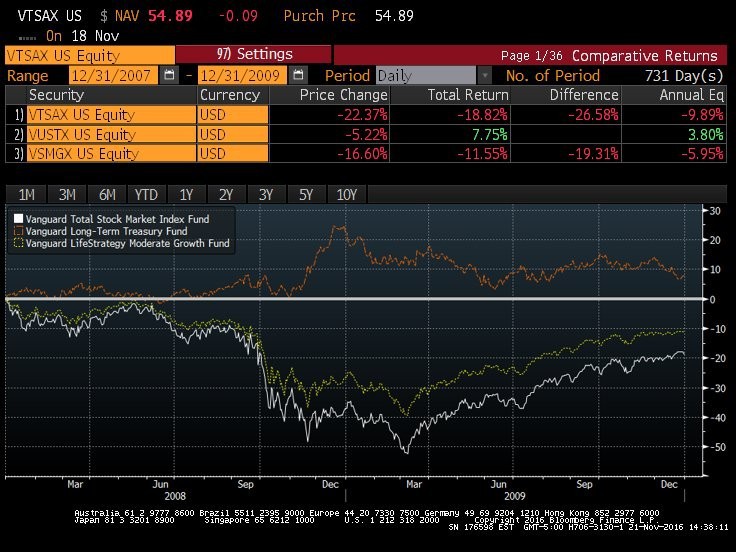

Along with perceived relative value versus the rest of the world, the case to invest in long-term US Treasuries can be credibly made, given their historical flight-to-quality characteristic. For example, in 2008 bonds acted as a buffer to the miserable return of stocks (gained 20.5% as measured by the Vanguard Long-Term Treasury Fund). On the flip side, in 2009 the index as tracked by the Vanguard Total Bond Fund sank 12.1%, yet the stock market (as measured by the Vanguard Global Stock Fund) rose 28.3%.

As seen below, during 2008 and 2009, Treasuries (VUSTX) rallied and had you been invested in a balanced fund (VSMGX), you would have had a much more restful couple of years than if you were only in stocks (VTSAX).

Evidence of fixed income’s historical dampening effect on Equities

Note, that the strong performance of fixed income in 2008 occurred when 10-year TIP rates were at 1.7% and the estimated term premium was 1.1%. Now we are at 0.5% (and likely negative when adjusting for the liquidity premium) and 0%, respectively. Given this much lower starting point, would interest-sensitive bonds provide enough “crisis alpha” to justify their lack of value in terms of term premium and real rate levels? How well will bonds protect us when the equity market blows up? Prior research on this blog suggests that the crisis alpha associated with T-Bonds might not be as great as it has been in the past. Other research, as covered by The Economist here, argues that the positive skew (more upside than downside) typically found in government bond returns disappears and even turns negative when rates are low.

Value Investors Don’t Bet on the Future…for Good Reason

But let’s be honest here. Both assessments of future crisis alpha and projections of slow growth rely on forecasts, and the value investor mantra is not to predict the future, but rather to buy assets others are avoiding and thus trade “cheap,” with what Ben Graham deemed a “margin of safety.” Perhaps growth stock managers willing to bet that future consumers will all gleefully drive Tesla’s while frantically buying goods at Amazon and checking Facebook will be right and propel these growth stocks higher. Value-centric equity portfolio managers would then lag behind in their Ford Fiestas. Or maybe we’ll have slow economic growth forever and even a crisis igniting a run to safety. If so, those investors holding treasury bonds will tap dance on my grave. We just don’t know the future nor do we try to.

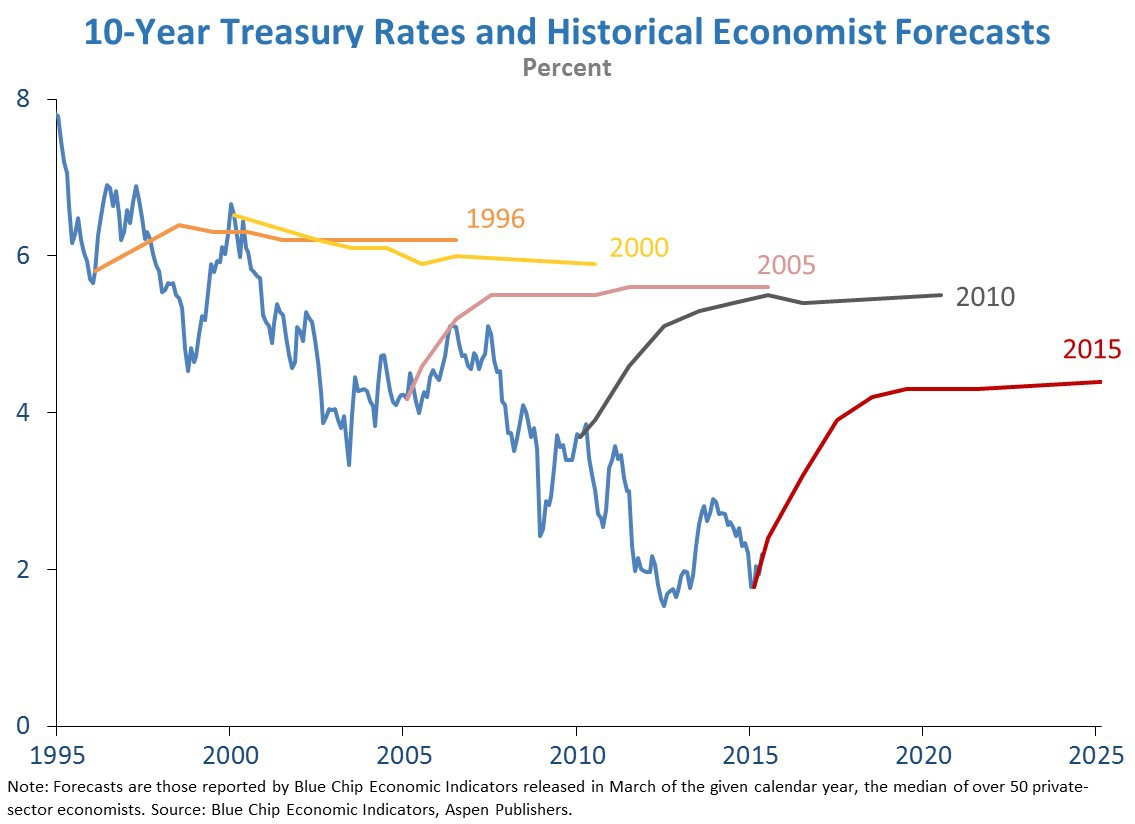

If we did forecast, it’s hard to argue we’d be any better than the “experts” who are shockingly bad at predicting bond markets (or really much of anything). For example, the graph below (lifted from a refreshingly honest 2015 Council of Economic Advisers report found here) aptly reminds us of the futility of trying to predict the movement of interest rates.

The blue line is the actual movement in 10-year Treasury rates while the colored lines are the composite expert directional forecasts at each year. Note that “the experts” consistently err, believing rates will return to a higher long-term average whereas actual rates have continually marched lower. (2)

Where is the Value in Fixed Income?

If you are willing to free yourself from the fixed income benchmark, you can often find better relative value assuming credit and liquidity risk across a broad range of fixed income assets instead of accepting near-zero real rates and near-zero term premiums. These sectors include older hybrid preferred shares of major financial firms that soon reset from fixed to floating rate coupons, seasoned, deleveraged bonds backed by first mortgages, leveraged loan ETFs, and even closed-end funds.*

As with equity investing, you do not need to try and predict the unpredictable to manage your fixed-income assets. It does pay (often only over a very long time period) to incorporate a value bias. Of course, interest rates may rally again or stay low forever, but that is a risk we are willing to take given interest-rate-sensitive bonds’ expected return.

*If you are interested in closed-end funds, I recently wrote about this here.

References[+]

| ↑1 | Here is another take on TIPS that suggest they may be undervalued. h.t. Wes |

|---|---|

| ↑2 |

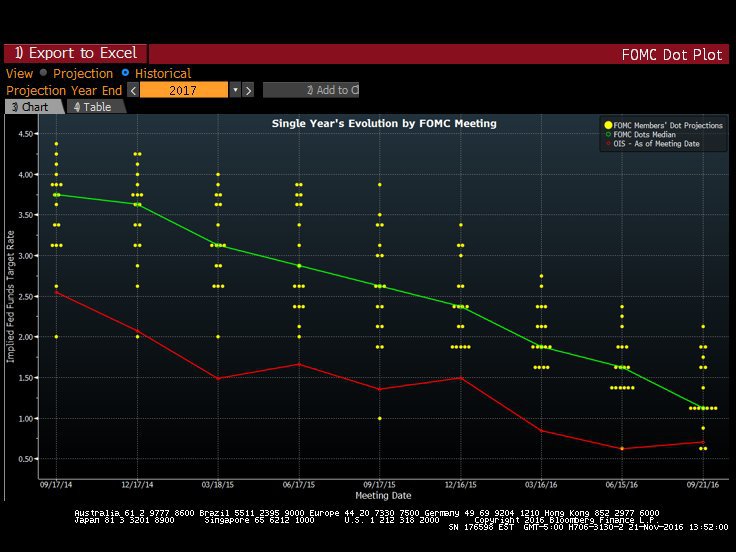

Even the Federal Reserve, which sets short-term interest rates (theoretically feeding into long-term rates) has a horrible track record of predicting its own actions. The “dot plot” below plots the historical predictions for year-end 2017 by sitting fed members and board presidents for the federal funds rate (the short-term rate they directly control). The green line is the median of these projections over the last two years, while each dot represents an individual prediction.  The Fed’s Historical Predictions of 2017 Year-End Fed Funds The red line reflects the market’s historical “expectations” as implied by Overnight Index Swaps (OIS). Again, this is only a true expectation in a risk-neutral world, and either way, the market has also had a lousy track record. |

About the Author: Jonathan Seed

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.