The Holy Grail for mutual fund investors is the ability to identify in advance, which of the active mutual funds (or ETFs nowadays) will outperform in the future. The evidence suggests this task is almost impossible. To date, the overwhelming body of academic research has demonstrated that past performance not only doesn’t guarantee future performance (as the required SEC disclaimer states), but it has virtually no value whatsoever as a predictor. The only value of past performance being that poor performance tends to persist — with the likely explanation being high expenses. (Mark Carhart’s 1997 paper, “On Persistence in Mutual Funds,” is a great example, and one of the oldest sources, in this line of this research.)

Believers in active management were offered hope that the Holy Grail had been found with the publication in the September 2009 issue of The Review of Financial Studies of the study by Martijn Cremers and Antti Petajisto “How Active Is Your Fund Manager? A New Measure That Predicts Performance.”

The authors concluded the following:

Active Share predicts fund performance: funds with the highest Active Share significantly outperform their benchmarks, both before and after expenses, and they exhibit strong performance persistence.

Active share is a measure of how much a fund’s holdings deviates from its benchmark index and the funds with the highest active shares have the best performance. Thus, while there’s no doubt that in aggregate active management underperforms, and the majority of active funds under-perform every year (and the percentage that underperforms increases with the time horizon studied), if an investor can identify the few future winners by using the measure of Active Share, active management can be the winning strategy. After publication, questions were raised about the findings.

Does Active Share Really Predict Future Winners?

In my blog post on January 7, 2011, “Does the Evidence Behind Active Share Hold Up?” I raised several issues.

Among the issues I discussed:

- The results could be due to a skewed distribution; a few highly concentrated funds may have enormous returns, increasing the average for the stock pickers. It would have been helpful to report the median.

- When funds are sorted by both fund type and fund size, only the very smallest quintile of stock-picking mutual funds showed a statistically reliable abnormal return. This tells us that the only funds that generated reliable out-performance were the very smallest of the stock pickers. This reinforces the idea that skewness could be driving the results. In addition, their success would attract assets which raises the hurdles to delivering alpha.

- The smallest funds typically are young funds. Thus, the well-documented incubation bias could be driving the results. (Incubation bias results when a mutual fund family wishing to launch a new fund nurtures several at a time. Funds that beat their benchmarks go public while poorly performing ones never see the light of day.) If this bias exists, the reported returns for small funds don’t mean much.

In May 2012, Vanguard Research took a look at the issue of Active Share as a predictor. Their study covered the 1,461 funds available at the beginning of 2001. The final fund sample comprised 903 funds. Because the study only covered surviving funds, there’s survivorship bias in the data.

The following is a summary of their conclusions:

- Even with survivorship bias in the data, higher levels of active share didn’t predict outperformance.

- The higher the active-share level, the larger the dispersion of excess returns.

- The higher the active-share level, the higher the fund costs.

The bottom line is that while active share didn’t predict performance it did increase risks as the dispersions of returns increased — investors paid more for the privilege of experiencing greater risk without any compensation in the form of greater returns.

Petajisto updated his study in 2013, adding six more years of data. He found the following: “Over my sample period until the end of 2009, the most active stock pickers have outperformed their benchmark indices even after fees and transaction costs [by 1.26 percent per annum]. In contrast, closet indexers or funds focusing on factor bets have lost to their benchmarks after fees.” The specific recommendation was to avoid funds with active shares below 60 percent.

Using the same database that was used in the Petajisto studies, Andrea Frazzini, Jacques Friedman, and Lukasz Pomorski of AQR Capital Management examined the evidence and the theoretical arguments for active share as a predictor of performance and presented their findings and conclusions in their March 2015 paper “Deactivating Active Share” which was published in the March/April 2016 issue of the Financial Analysts Journal. https://www.aqr.com/library/aqr-publications/deactivating-active-share.

The following is a summary of the findings from the AQR paper:

- The empirical support for the measure is weak and is entirely driven by the strong correlation between Active Share and the benchmark type — high Active Share funds and low Active Share funds systematically have different benchmarks. A majority of high Active Share funds are small caps and a majority of low Active Share funds are large caps.

- While Active Share correlates with benchmark returns, it doesn’t predict actual fund returns — within individual benchmarks, Active Share is just as likely to correlate positively with performance as it is to correlate negatively.

- Active Share results are very sensitive to the choice of comparing funds using benchmark-adjusted returns rather than total returns. Over this sample period, small-cap benchmarks had large negative four-factor alphas compared to large-cap benchmarks and this was crucial to the statistical significance of the results.

- Controlling for benchmarks, Active Share has no predictive power for fund returns, predicting higher fund performance within half of the benchmark indexes and lower fund performance within the other half.

Wes and his team have a discussion of the back and forth debate between the academics and AQR here.

And interested readers can read the comprehensive response to the AQR paper from Petajisto here. (1) In the words of Antti Petajisto:

All of the key claims of AQR’s paper were already addressed in the two cited Active Share papers: Petajisto (2013) and Cremers and Petajisto (2009)… So clearly ignoring large and essential parts of the original Active Share papers is simply not the way to conduct impartial scientific inquiry.

They also have a follow on paper, “Do Mutual Fund Investors Get What They Pay For? The Legal Consequences of Closet Index Funds,” which is covered in detail by Alpha Architect here. The authors suggest that active share is such an important aspect of the investment purchase decision that statistics like active share should be required disclosures. Clearly this debate isn’t over and low-active share closet-indexers are on watch.

But the large asset managers with generally low active share are responding. A more recent contribution to the debate on active share comes from Ananth Madhavan, Aleksander Sobczyk and Andrew Ang of BlackRock, Inc. with their October 2016 paper “Estimating Time-Varying Factor Exposures with Cross-Sectional Characteristics with Application to Active Mutual Fund Returns.” Their study used cross-sectional risk characteristics (such as valuation ratios and market capitalization) to determine if active share predicted returns. Their database included 1,267 mutual funds with $3.3 trillion in assets under management, and covered the period from September 2010 through June 2015. This period is out-of-sample from the period covered by Martijn Cremers and Antti Petajisto in their 2009 paper “How Active is Your Fund Manager? A New Measure That Predicts Performance.” They found that the measure of active share proposed by Cremers and Petajisto actually was negatively correlated (-0.75) to fund returns after controlling for factor loadings and other fund characteristics. Thus, they concluded that “it is not the case that high conviction managers outperform.” While they noted that there clearly were active managers with skill, active share isn’t the way to identify them ahead of time. And they didn’t suggest another method.

Wait a Minute: Maybe Active Share Does Predict Winners?

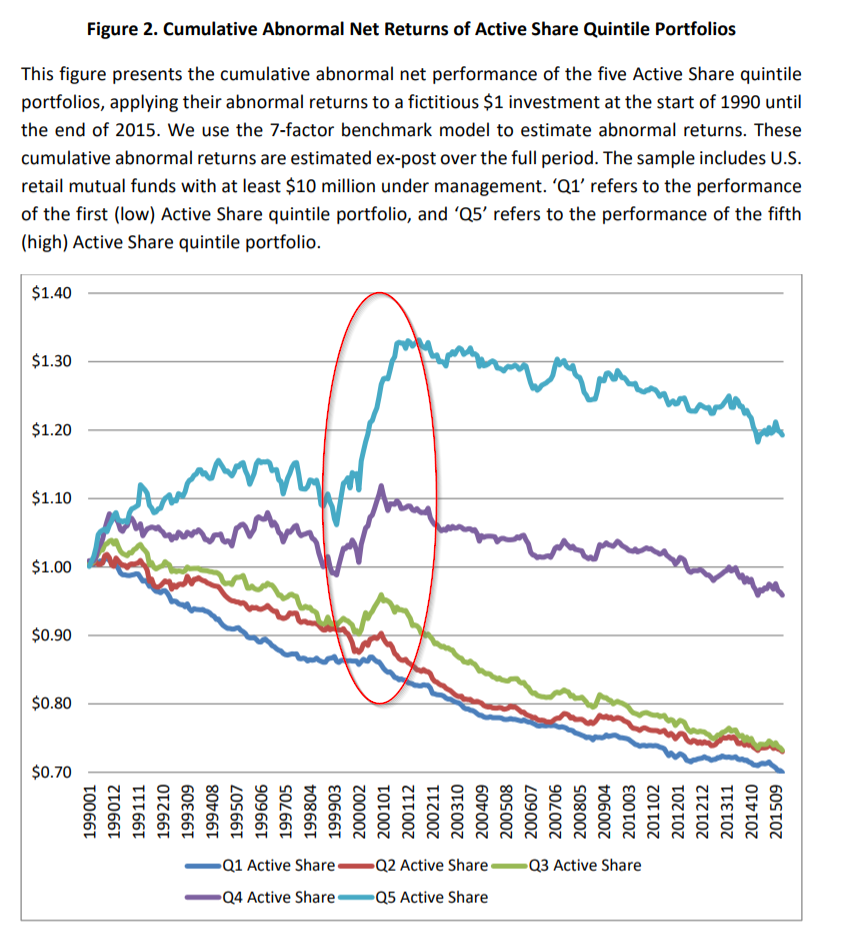

There’s one other recent paper we need to review, Martijn Cremers’ August 2016 study “Active Share and the Three Pillars of Active Management: Skill, Conviction and Opportunity.” Cremers introduced a new measure of active share that emphasizes that a fund’s active share is reduced by its overlapping holdings. His study covered the period from 1990 through 2015 and is free of survivorship bias. Using quintile sorts, comparing high and low active share funds generally meant comparing funds with an active share of 95 percent or greater to funds with an active share below 60 percent. He also compared performance against two factor models, a seven-factor model (which uses the market factor, small and mid-cap size factors and small, mid-cap, and large value factors, as well as momentum) and the standard Fama-French-Carhart four-factor model (beta, size, value and momentum). Cremers also examined the impact of turnover on performance.

The following is a summary of his findings:

- Using the 7-factor model, the quintile of funds with the highest active share had an abnormal (unexplained) return of 0.71 percent per year. While economically significant, the abnormal return was not statistically significant as the t-statistic was just 1.37. Importantly, a chart in the appendix appears to show that all of the cumulative outperformance over time occurred in the brief period from 1999 through 2001 (during which the tech bubble burst—indicating that the high active share funds were able to sidestep the bubble). The low active share funds exhibited underperformance throughout the period.

- Using the 4-factor model, the high active share quintile’s abnormal performance was -0.36% per year, with a t-statistic of -0.49.

With these two findings it seems hard to make a compelling case for active share alone being a predictor of future performance. However, Cremers also examined the impact of turnover on performance. Funds in the highest turnover quintile had average holdings of about eight months, while those in the lowest turnover quintile had average holdings of at least two years. Using an independent 5×5 sort on active share and fund holding duration (a measure of the average holding period of the fund), the annualized 7-factor and 4-factor intercepts for the high active share/high duration (low turnover) portfolio are 1.88 percent and 1.69 percent, respectively. The corresponding t-statistics are 2.35 and 1.71. However, as mentioned earlier, a caution is noted in that the chart of the cumulative abnormal 7-factor performance over time indicates that it peaked around 2002 and has declined since then. Cremers did note that the high active share/low turnover funds did outperform from 2007 through 2013, while they underperformed from 2002-2006 and again from 2014 through 2015.

Cremers concluded that while he believes that active share matters, both in large cap and small cap funds, investors should use only funds with low turnover (under 50 percent). He noted that the evidence that high active share funds outperformed low active share funds was considerably stronger for funds with low expense ratios. Ranking funds by their expense ratio Cremers found that the average expense ratio was 0.71 percent per year in the lowest quintile, and 1.79 percent in the fifth quintile. Thus, investors should consider active funds that have high active share and low turnover. A more detailed analysis of this concept is provided in Cremers and Pareek (2016), “Patient Capital Outperformance: The Investment Skill of High Active Share Managers Who Trade Infrequently.” (Alpha Architect review is here).

Given that the chart in the paper seemed to indicate that the outperformance had occurred prior to 2002 (see figure below), I contacted Professor Cremers and asked him if he had the performance for the period 2002 through 2015.

| Quintile | 1 | 2 | 3 | 4 | 5 |

| Alpha | -1.05 | -1.11 | -1.43 | -0.68 | -0.50 |

| T-Stat | (4.4) | (4.2) | (5.4) | (2.0) | (1.1) |

The active managers in each of the quintiles produced negative alphas, with only the highest active share quintile not showing statistical significance. The evidence does suggest that if you are going to use an active manager you are better served by choosing one with a high active share. However, it also shows that while perhaps it was once true that active share predicted future outperformance, that time may have gone with the wind.

This evidence is entirely consistent with the thesis of the book I co-authored with Andrew Berkin, The Incredible Shrinking Alpha. In our book we provide the evidence and the explanations for why, over time, it has become persistently more difficult to generate alpha as the markets have become more efficient and the competition for alpha has gotten tougher.

Some Parting Thoughts on Active Share as a Prediction Measure

You can decide for yourself whether you find the evidence on active share compelling enough to use actively managed funds. With that said, Cremers makes a compelling case that if you are going to use active funds you should avoid all funds with low active share, high turnover and high expense ratios. I would certainly agree. With that said, I would add that when it comes to picking mutual funds, investors should care less about alpha (by whatever measure) and more about actual returns.

I want to own a fund that provides me with exposure to factors I care about such as market beta, size, value and momentum. I’m then happy to have minimal alpha so long as I get the beta (loading on a factor I am seeking) which leads to higher returns. In other words, I would rather own a low-cost, passively managed small value fund that provides me with high loadings on those factors, and minimizes or even eliminates the negative exposure to momentum that is typical of value funds, and has no alpha, than an active fund with less exposure to those factors even if it generates a positive alpha — the positive alpha would have to be great enough to overcome the loss of returns due to the lower loading on the factors. To illustrate this point, consider the following example.

We’ll compare the returns, loadings on factors, and alphas for two funds from the same asset class (U.S. large value), the actively managed Vanguard Equity Income Fund (VEIPX) and Dimensional Fund Advisors passively managed DFA U.S. Large Cap Value III Portfolio (DFUVX). I chose these funds because they both have long track records, VEIPX is currently a five-star rated fund by Morningstar, Vanguard’s active funds generally have the lowest fee, and DFA is a leader in passively managed, structured portfolios. The data is from the first full month of performance for DFUVX, March 1995 and ends April 2017 (the latest date factor data was available as of this writing). The annual factor premiums are calculated based upon data from French’s site. The alpha, standard deviation, and Sharpe ratio are annualized from monthly data.

| March 1995-April 2017 | VEIPX | DFUVX | Annual Factor Premium |

| Market Beta | 0.79 | 1.04 | 6.0 |

| Size | -0.21 | -0.03 | 4.3 |

| Value | 0.36 | 0.56 | 6.1 |

| Momentum | -0.03 | -0.10 | 12.3 |

| Annual Alpha | 1.35 | 0.21 | |

| R-squared | 90 | 93 | |

| Annualized Return | 10 | 10.8 | |

| Annualized Standard Deviation | 12.8 | 17.5 | |

| Sharpe Ratio | 0.63 | 0.54 |

First, note that the r-squareds are very high, indicating that the model is doing a good job of explaining returns. Second, as you can see, while VEIPX produced a positive annual alpha of 1.35 percent and DFUVX produced a much lower alpha of 0.21 percent, a difference of 1.14 percent, DFUVX outperformed 10.8 percent versus 10 percent. The reason for the outperformance is clear. In general, DFUVX had much higher (or less negative in the case of the size factor) loadings on factors that delivered premiums. The exception was that DFUVX had a slightly more negative loading on momentum. These differences in loadings allowed DFUVX to overcome the 1.14 percent difference in alpha. The higher loading on market beta provided about 1.5 percent in incremental returns, the higher loading on size provided about 0.8 percent in incremental returns and the higher loading on value added about 1.2 percent. (Note that the incremental differences account for the difference in returns for the average monthly return, but doesn’t necessarily foot to the compounded returns.) It’s also worth noting that DFUVX fund also benefited from a slightly lower expense ratio, currently 0.13 percent versus 0.26 percent for VEIPX.

The bottom line is that while alpha is nice, you only get to spend returns. Thus, it’s important to consider all of these issues, including turnover, expense ratios, and loading on factors.

References[+]

| ↑1 | The team at O’shaughnessy Asset Management also have thoughts on the contentious debate. |

|---|

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.