In this article we discuss what the academic research says about ETF trading spreads and premiums.

- INEFFICIENCIES IN THE PRICING OF EXCHANGE TRADED FUNDS

- ANTTI PETAJISTO

- FINANCIAL ANALYST JOURNAL, I Q 2017 (version here)

What are the research questions?

The article provides new empirical evidence on the state of market efficiencies in ETFs by studying the following questions:

- What is the magnitude of the ETF premiums across all US-listed ETFs and underlying asset classes over time?

- In particular, what is the magnitude of “true” ETF premiums when stale NAVs are accounted for?

- What do these premiums depend on?

- What is the economic magnitude of the mispricing?

What are the Academic Insights on ETF trading spreads?

The author studies a sample of 1,813 funds with an aggregate $ 1.97 trillion in assets over the period from 2007 to 2014. He finds the following:

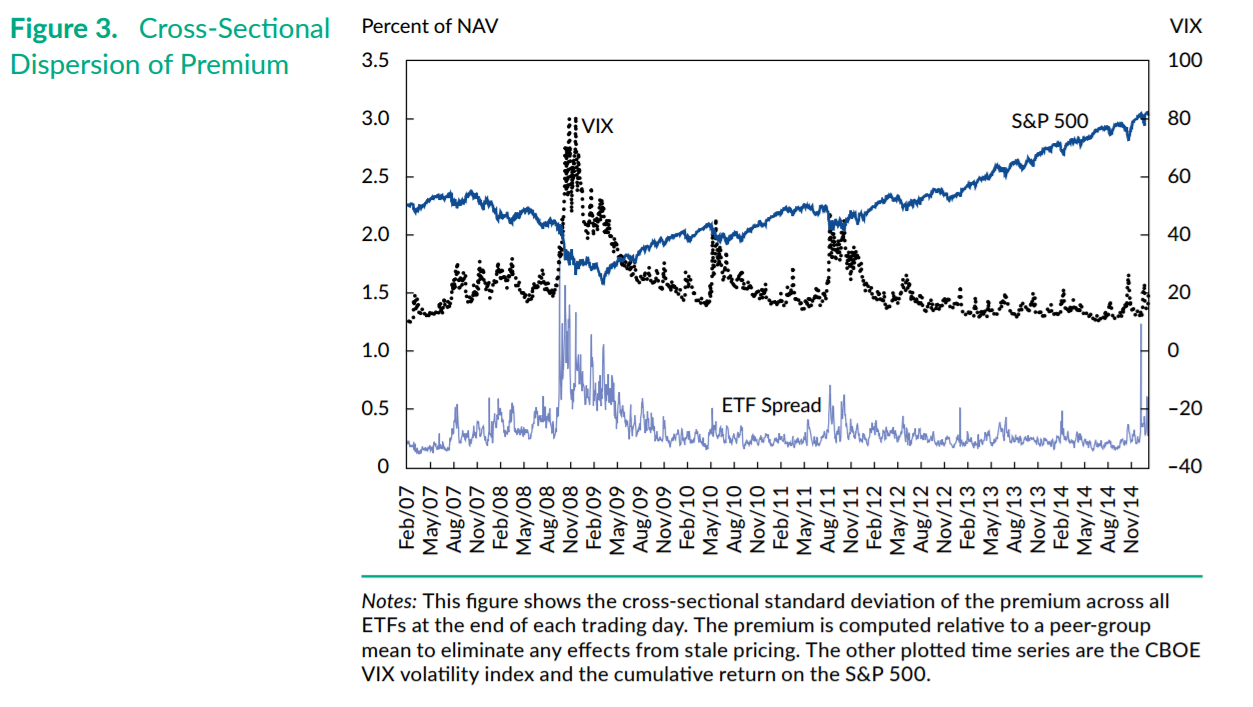

- While the average premium across all funds is 6 bps, the volatility of the ETF premium is 49 bps. This means that with 95% probability, a fund is trading at a premium between about -96 bps and +96 bps, or with a 192 bps band. Specifically, the author finds that international equities, international bonds, municipal and high yield bonds exhibit volatilities between 40-140 bps around NAVs. In terms of persistence, the premiums are short lived: half a day for equities and 2-3 days for non-Treasury bonds.

- By proposing a new methodology to deal with stale pricing (he compares each ETF price deviation from its peer group mean), the author finds that this adjustment reduces the premiums on funds with international or illiquid holdings but still leaves them fluctuating within a pricing band of 100-200 bps, which is economically significant.

- Stale pricing explains part of the premiums but it is not a complete explanation. The author investigates bid-ask spreads but finds that they are relatively tight for commonly traded ETFs.

- The author calculates that the total premiums across all ETFs add up to $41 billion. When including the stale price adjustment methodology, the premium still add up to $20 billion. This is a proxy for costs of suboptimal timing of ETF trades (and conversely, earnings from liquidity provisions). As a comparison, the entire ETF industry is estimated to earn $6 billion a year in management fees.

Why does it matter?

Some ETF funds compete by reducing a few basis points off their fees to bring them below 10 bps a year. Investors should be aware that by focusing only on the expense ratio, they may be overlooking a potentially bigger cost: the effect of an adverse premium on the transaction price.

This article provide evidence that trading ETFs with non-Treasury bonds or international securities as the underlying assets exposes the investor to the risk of poor trade timing because of premiums. The author proposes three methodology to improve the timing of the trade:

- Compare the ETF’s price to the “intraday indicative value (IIV)- but in case of illiquidity or different time zone it may not be readily available

- Utilize the peer-group approach proposed in the article

- Look at the latest official premiums and trade only when markets have been flat for the last few days

The Most Important Chart from the Paper:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.