- Title: GENDER AND CONNECTIONS AMONG WALL STREET ANALYSTS

- Authors: LILY FANG AND STERLING HUANG

- Publication: THE REVIEW OF FINANCIAL STUDIES, V.30, SEPTEMBER 2017 (version here)

What are the research questions?

By studying a sample of Wall Street analysts from 1993 to 2009, their demographic characteristics and their social ties, the authors research whether women and men benefit from their social networks professionally to the same extent.Specifically, they ask the following questions:

Specifically, they ask the following questions:

- What is the gender distribution among Wall Street analysts? And among the subsample of All American (AA) analysts? Is there a gender gap in the AA pool?

- Do connections help improve men’s and women’s job performance—earning forecast accuracy and recommendation price impact equally?

- Do connections help improve men and women’s career advancement—being voted as AA analysts equally?

Wall Street is a highly demanding work environment, only the most competitive women will enter this work force (Kumar 2010). This self-selection removes the large gender difference in risk aversion and competitiveness that the literature has documented in the general population.

What are the Academic Insights?

The authors find the following:

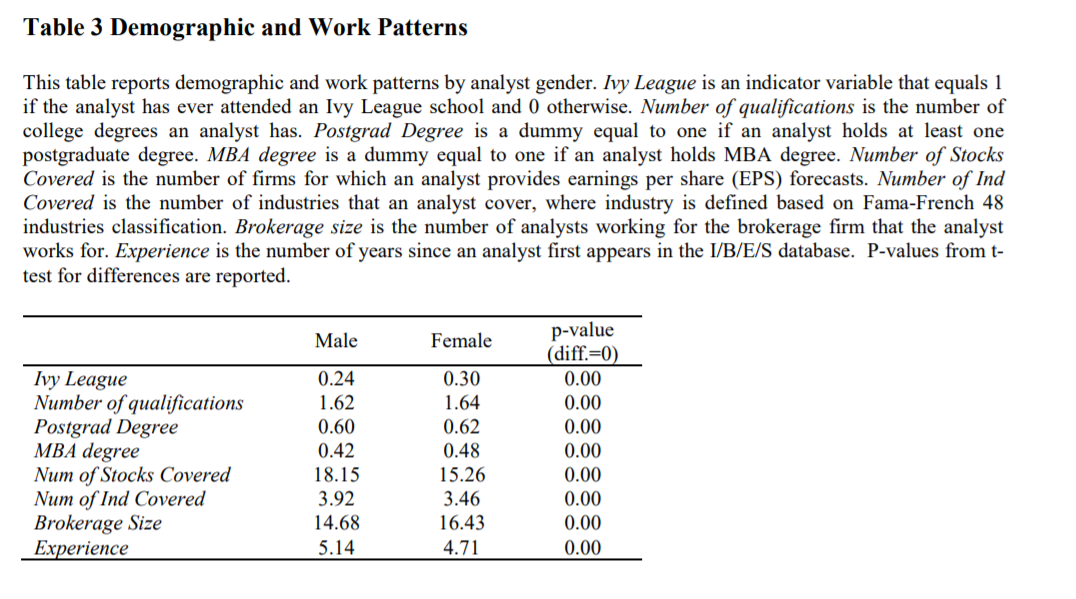

- NO – While “representation” is low (women are 12% of total analysts in this sample, which is consistent with the numbers found in other sectors), there appears to be no gender gap in the overall odds for male and female analysts to be elected to star analysts (about 14%). Also, female analysts appear to have stronger education backgrounds than male analysts. But they tend to be less experienced and have a slightly lower workload.

- YES- connections help improve men’s and women’s job performance, BUT the effect is two to three times bigger for men as for women.

- YES- connections help improve men and women’s career advancement, BUT this effect is “substitutive” for men while it is “complementary” for women.

Several robustness tests were performed.

Why does it matter?

While numbers show that there appears to be no gender gap among Wall Street analysts (female analysts are as likely to be voted AAs as their male colleagues are), this paper finds that the factors driving success are not entirely the same between men and women. In general, men reap more benefits from their connections than women.

The general literature documents that, outside Wall Street, there is persistent gender gap with few women at the top. To climb the corporate ladder you need both outstanding performance and positive subjective evaluations by others. This paper adds to this literature because it shows asymmetries between how men and women benefit from social ties. In the words of the authors:

If men benefit more from connections on both fronts, their advantages can persist and even widen as their careers progress.

The Most Important Chart from the Paper:

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.