When an owner sells their business, the IRS and state taxing authorities will be there to take as much of it as they lawfully can. This one tax bill can be the single largest tax payment an owner will ever make and may represent over a third of their entire net worth. Furthermore, it comes after years of paying income/payroll taxes, working harder, and generally taking more risks than non-business owners.

And when an owner wants to retire, the process is significantly more complicated than an employee who simply has to give a few weeks’ notice and maybe rollover a 401K. That’s because a business owner’s life’s savings is locked up in the value of their business. In fact, selling their business IS their retirement plan. So, accessing that wealth at the best possible price, in a way that is tax and cost efficient, is critical to their retirement.

In this article, we introduce a unique service offering that can significantly reduce the impact of taxes and increase the price when selling a business. We’ve designed it to be used by business owners and their financial advisors (Wealth Managers, CFP’s, M&A Advisors, CPAs, etc.). If you are a business owner, or operate on behalf of business owners, read on.

How to Sell a Business Tax Efficiently

There are two versions of our solution that can accommodate the scenarios business owners often find themselves. These situations are as follows:

- The Immediate Tax Sale

- Some business owners need to sell a business as soon as possible. In these situations, we outline a tax sale solution that can be implemented in a short period of time. This option provides significant tax benefits, although it limits the Value Enhancement step due to time constraints.

- The One Year Tax Sale

- For business owners who have the luxury of time and can wait 12 months or more, we outline a solution that can provide both tax and value enhancement benefits. This is a great way to minimize tax losses while also maximizing the selling price of a business and fund a retirement account. It includes all of the steps outlined in this article.

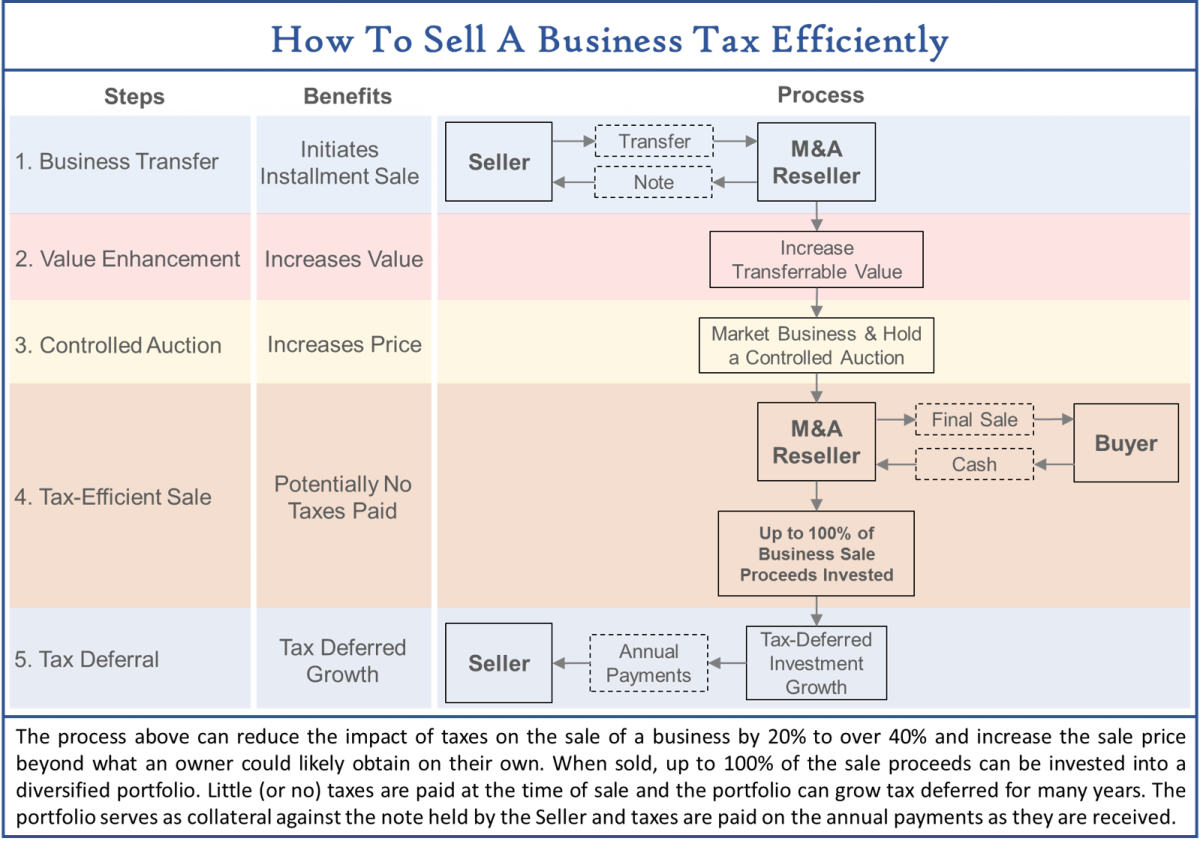

We illustrate the full process below. If it’s a little confusing at first glance, don’t worry. We’ll walk you through the steps, show you how and why it works, and explain the tax law supporting the structure.

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

The structure above is commonly called a “structured installment sale.” See the FAQ for background on the approach.

What’s Alpha Architect’s Role in This Process?

Our role is twofold:

- First, for reasons outlined in the FAQ section, business owners and their financial advisors can’t implement this on their own. IRS statutes require that unrelated third parties be used to set up these structures and manage (or sub-manage) the tax-deferred investment accounts. Our role is to manage the tax-deferred investment accounts (or sub-manage them for financial advisors) while providing a wall of separation between the business owner, their financial advisor, and the investments.

- Second, we’ve designed this to be a tool that financial, tax, and M&A advisors can efficiently plug into their practice. We’ve had the privilege of working with ultra-high net worth families and nationally recognized tax authorities to develop these niche, and often underutilized, solutions. So rather than reinvent the wheel, at your request, our network of tax and M&A professionals can implement these solutions for you or on behalf of your clients.

Bottom line: We aren’t lawyers. We aren’t CPAs. We aren’t investment bankers. We are investment managers. But we also know how to herd the cats lawyers, CPAs, and investment bankers to make a deal happen. We’ve utilized structured installment sales in the past for our clients and we can process them cost efficiently. We’re interested in affordably and transparently managing the pool of assets (not the broader wealth management relationship) associated with these transactions and we receive no compensation outside of the management fees associated with our asset management services. We’re always looking for win-wins, not win-lose transactions. We can work with other advisors and explain the costs and benefits of our niche solution.

Let’s now review each of the steps. If you have any questions, feel free to post them below or to contact us (ask for Adam T.).

Steps to Tax Efficiently Sell Your Business via A Structured Installment Sale

Step 1: Business Transfer

The first step is for an owner to transfer their business (or a part of their business) to an M&A Reseller. This is a legal entity that will provide investment banking or M&A services while also forming a distinct separation (for tax purposes) between the Seller and the Buyer.

At the time of the initial transfer, the business might be worth $10 million. However, the M&A Reseller might purchase the business for $12.5 million in the form of a note, payable with interest, over several years. This increased price reflects the value that the M&A Reseller thinks they can sell the business for in a controlled auction, after value and price enhancements have been made.

This initiates an installment sale, which is discussed in greater detail in the FAQ section of this article. However, the high-level benefits of the transaction structure are as follows:

- The Seller will not pay any taxes on the sale of the business until they receive payments on the note, which occur over several years.

- If the business is ultimately sold for $12.5 million or less, the M&A Reseller will recognize no gain on the sale because they purchased it for the same price. Therefore, nearly all of the proceeds can be invested into a diversified portfolio where it can grow tax-deferred. Note, that there may be some taxes due depending on how the business transfer and final sales are structured (i.e. an asset sale or a stock sale and the presence of any depreciation recapture).

It’s important to mention that the Seller and their management team will remain with the business and continue to have operational control of the company for the duration of this process. Furthermore, if the business is ultimately not sold or a buyer can’t be found to offer a price that can support the installment note, the note will default and the business will return to the Seller.

Step 2: Value Enhancement

Note: The Value Enhancement step is eliminated under the Immediate Tax Sale structure due to time constraints.

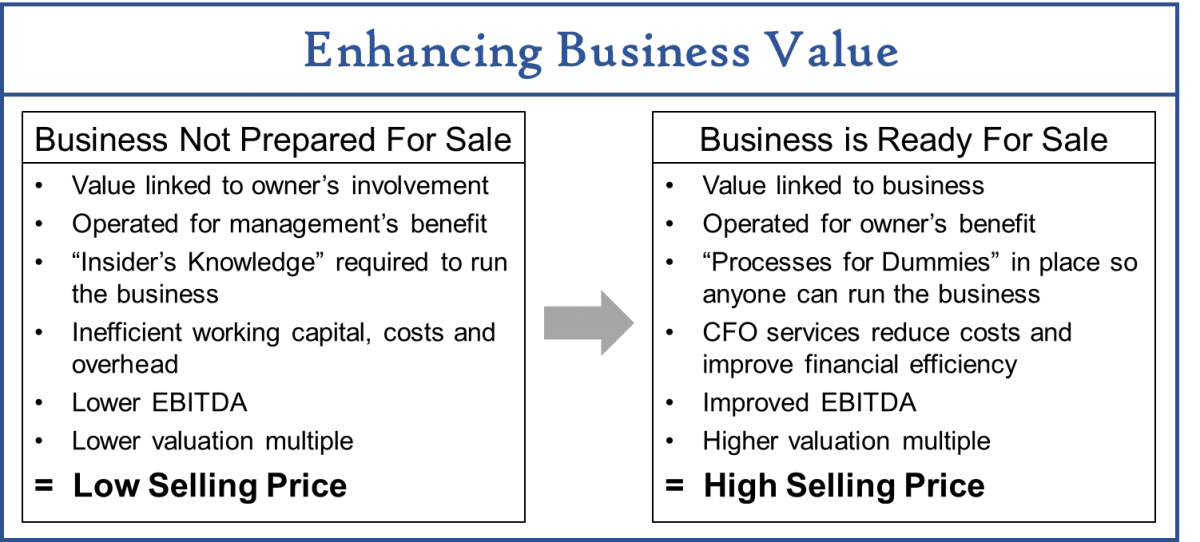

As a strategic tax advisor who has worked with numerous middle market businesses, I can attest that most businesses are not ready to be sold. And if they should be sold, in an “unready” condition, money is needlessly left on the table. I’ve seen this happen fairly regularly as entrepreneurs are often buried and focused on managing their businesses – not on preparing their business (or their life) for a strategic transaction.

To mitigate this loss of value associated with poor planning, the “value enhancement” step in our process requires that the M&A Reseller work directly with the CEO/Owner to drive value enhancement activities and prepare the business for sale. The graphic below depicts some of the ways a business can be prepared for a sale:

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

As shown above, the value of many businesses often rests on a single entrepreneur or owner who is integral to the running of the business. Without them, there’s little transferable value to a buyer who isn’t familiar with the inside knowledge required to keep the business running (e.g., Registered Investment Advisors (RIAs) with tight client relationships are faced with this situation when they try to sell their businesses to another RIAs).

Therefore, one of the best ways to prepare a business for sale is to transform it from one run by insider knowledge to something of a franchise system that can be picked up by any competent manager in the future. This requires, “Processes for Dummies,” to be set in place so that a buyer who is new to your business, can realize the value created by your company. This may also include adding key staff, as required, to ease the burden currently borne by the owner, and to enable a new owner to seamlessly take over.

Another value enhancement area is to find efficiency improvements that are often hidden in plain sight. After decades of operating, or “doing it the way we’ve always done it,” many owners never take a step back and ask fundamental questions about their business. It often takes an outsider to ask these questions and the value enhancement can be significant.

Therefore, the second step we take with businesses is to look for ways to increase a company’s profitability and revenues. This includes a financial audit of all the company’s costs, expenditures, products, client lists, tax liabilities, and pricing strategies. Pareto’s Principle plays a major role: Most likely, 80% of a business’ profits come from 20% of their products, services, and clients. Also, there are probably one or two simple changes that can drive significant value for a business, such as asking for a tax break (a specialty of mine!).

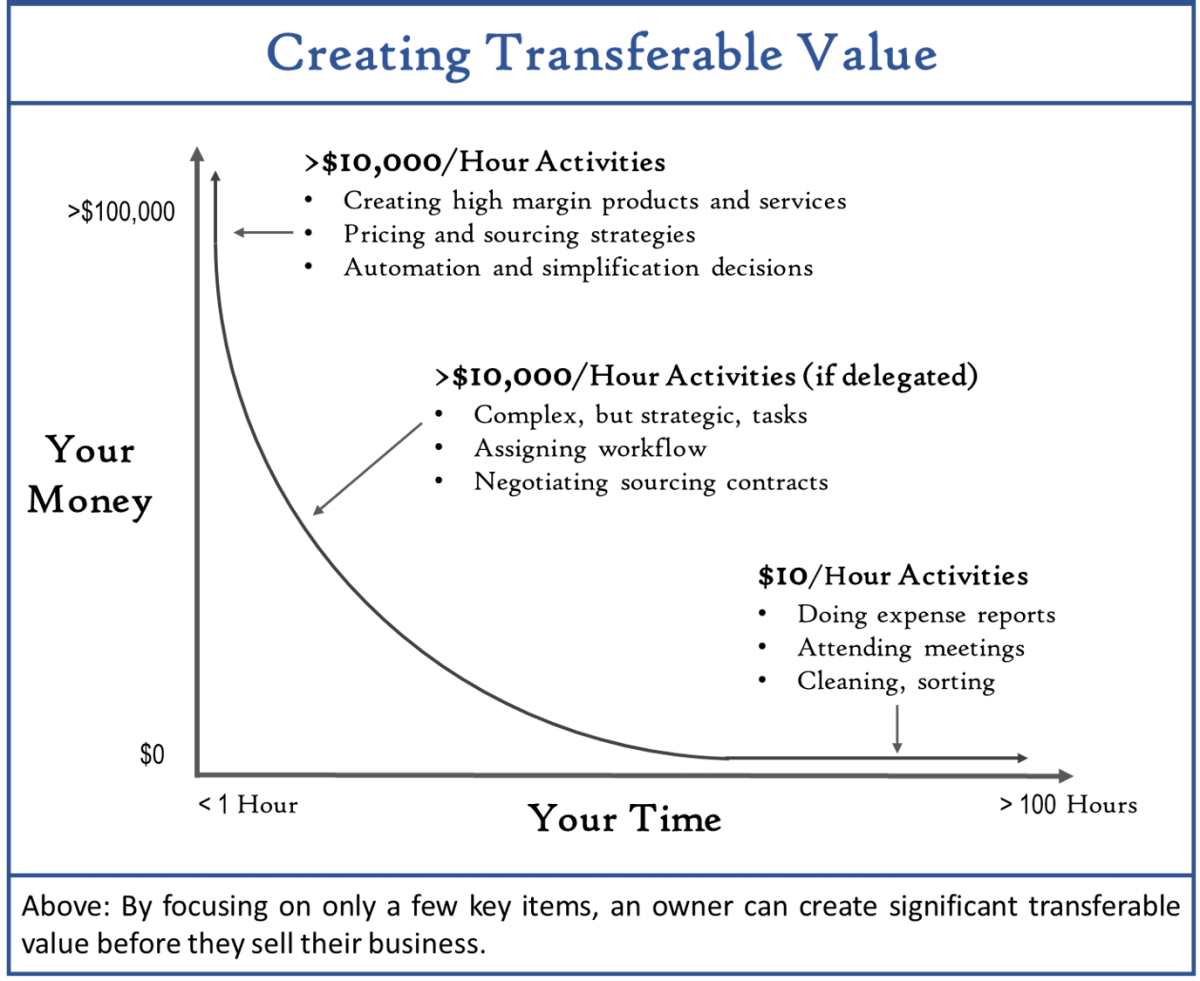

An example of how this works: A CEO I know did this for a company he worked with. When he first started, he was an outsider to the firm and was able to see things from a fresh perspective. So, when he encountered a legacy pricing system that offered breakpoints for larger orders, he looked a little deeper. Upon review, it was determined that due to automation, the actual cost to produce each widget was flat. There were no economies of scale. Therefore, the new CEO decided to eliminate the breakpoints and offered a flat $/widget fee with a built-in profit margin. Revenues immediately increased by 15% without increasing costs. Assuming that this one decision increased EBITDA by $500,000, this would have increased the selling price by $2,000,000 to $3,000,000 or more.

That one simple decision created massive value, took very little time, and cost nothing to implement. It was “free” money. Here below is a chart that illustrates this point and can help you as an owner, determine where to spend your time so as to create transferable value in your business:

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

The beauty of this process is that an owner can do this anytime, even if they don’t plan to sell their business in the near future. And once completed, a business will be transformed from an owner-focused organization to one that has maximized its transferable value and is ready to be marketed to potential buyers.

Some of these actions can take little to no time to implement, but they do require some time for the benefits to show up on a company’s financials and be visible to a buyer. For this reason, we suggest that owners take about six months to a year or more to implement these before a sale.

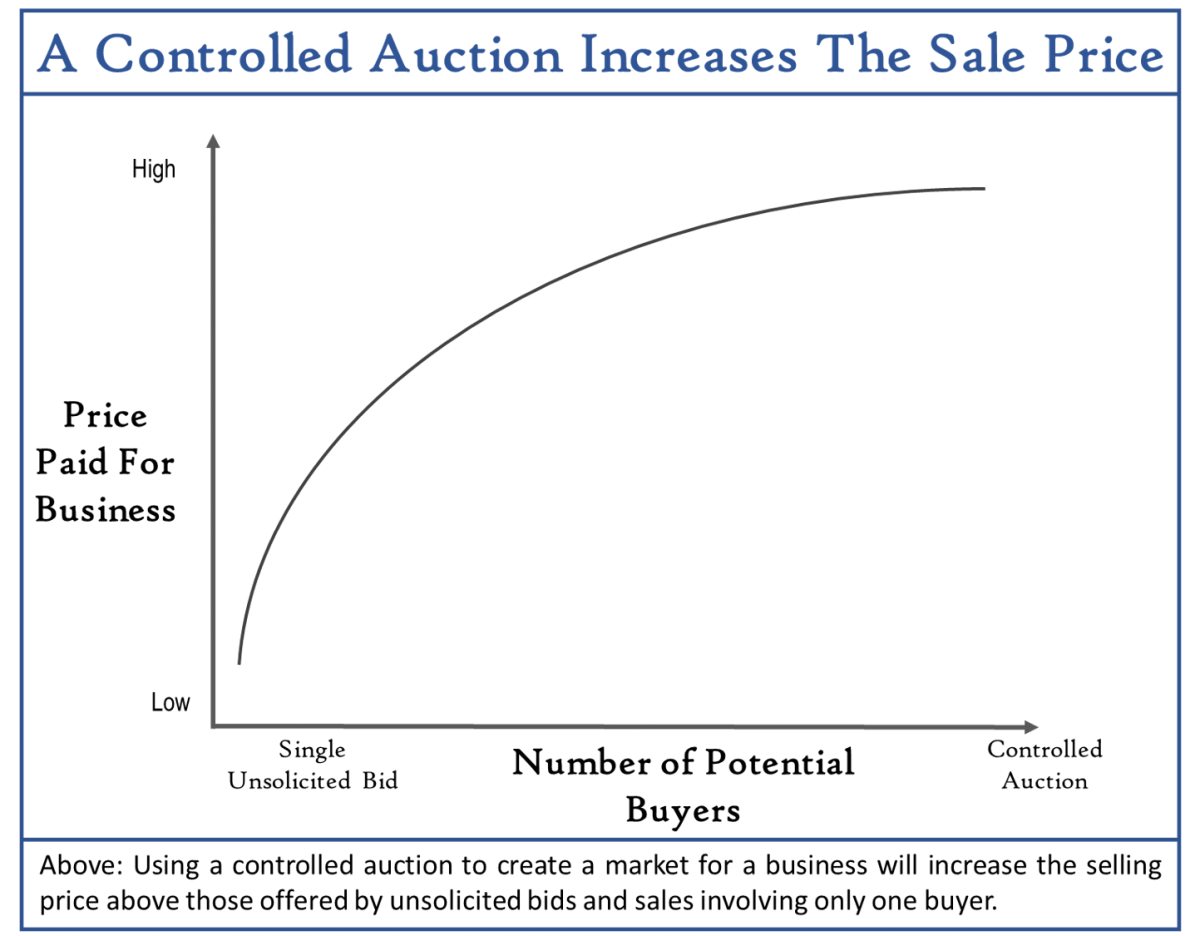

Step 3: Controlled Auction

The best way to increase the selling price of a business is to effectively market the business for sale and to hold a controlled auction. Proper marketing and a controlled auction are signals to buyers that an owner is serious about selling and forces them to pay the highest price to buy the company. Without a controlled auction and at least two interested buyers, leverage and value are lost.

Many of my business owner clients have received unsolicited bids and offers for the purchase of their business. However, unsolicited bids are the lowest priced offers in the market. To receive buyer interest and multiple bids, an owner must market their business to potential buyers in a way that makes the business, its management and its value, stand out.

Proper marketing of a business can include the following:

- Creating a professionally designed pitch deck

- Using film and video to introduce buyers to a business and its management in 60 to 120 seconds

- Building a dedicated website to showcase the business in the best light possible

- Soliciting interest from private equity firms, investors, competitors, vendors, and potential strategic buyers in parallel industries.

Once an owner has the interest of at least two buyers, they can manage the negotiation with a controlled auction and increase the final selling price (as shown below.)

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

Step 4: Tax Efficient Sale

The next step in our process occurs when the M&A Reseller sells the business to a buyer that offers the highest price.

We refer to this as a tax-efficient sale, because if done correctly, there is little to no immediate taxable gain to the M&A Reseller and no taxes are due at the time of the sale. This is because the business owner transferred the business to the M&A Reseller for a price premium and the M&A Reseller, in turn, sold the business to the Buyer for a price equal to, or close to, this amount. Since the basis, or price paid for the business would be near equal to the selling price, there is little to no taxable gain and therefore little to no taxes are due.(1)

If the business were sold for a value greater than the M&A Reseller’s basis, taxes would be payable by the M&A Reseller on any gain. Depending on the holding period, some assets would be taxed at either long-term or short-term capital gains rates.

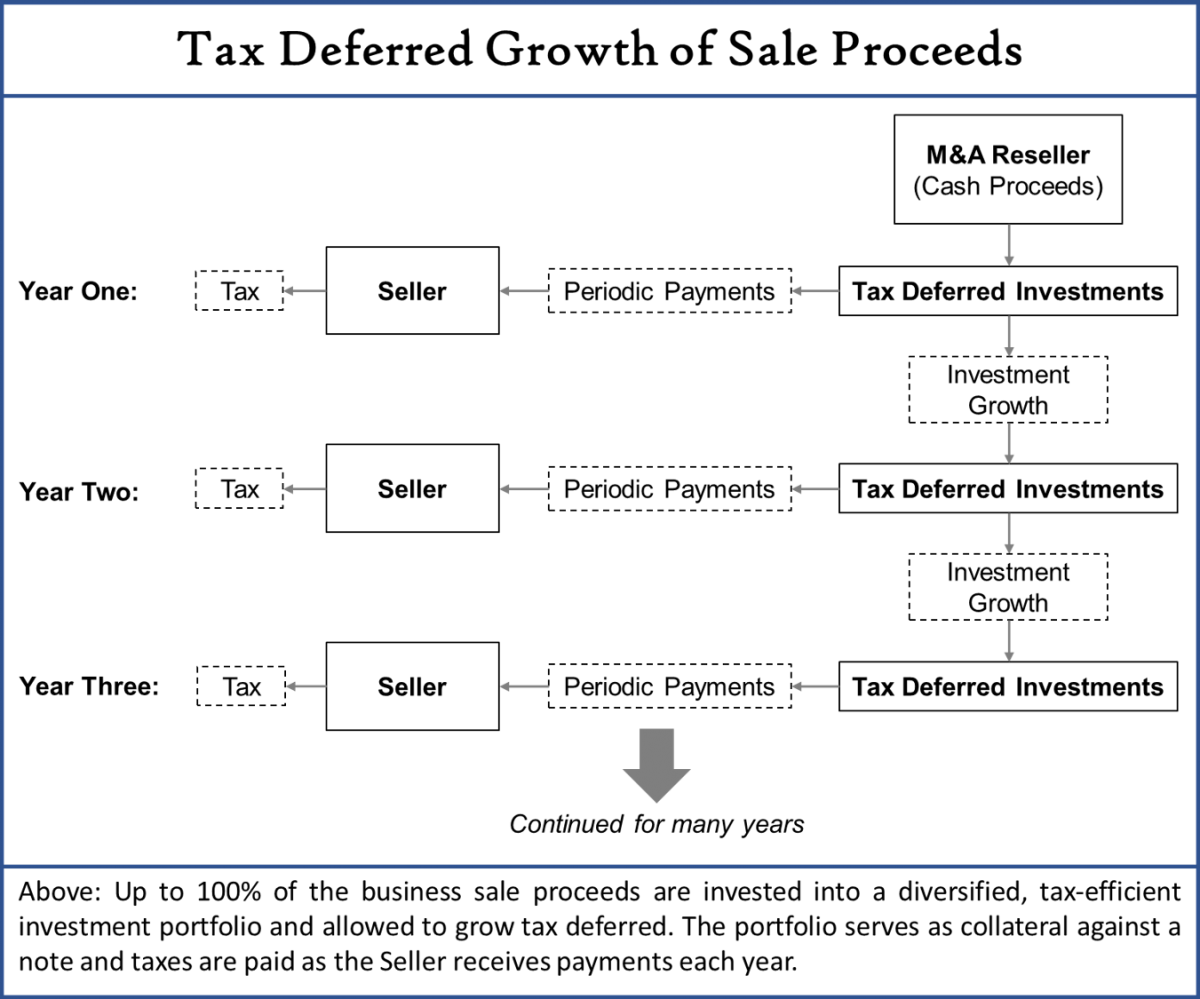

Step 5: Tax Deferral

The proceeds from the tax-efficient sale are then placed into a diversified, tax-efficient investment portfolio (e.g., our robust asset allocation solution or strategies tied to our Value Momentum Trend Index) that grows generally tax-deferred to the Seller. The portfolio will be used to pay off the note held by the Seller and will also serve as collateral against the note.

The graphic below shows how this works from year to year:

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

The Seller is not considered to have control, or “constructive receipt,” of the sale proceeds so long as they are held in an unrelated, third-party investment account (i.e. in one of our standardized collateral accounts). This means that the IRS will not view the Seller as having received payment while the funds are invested in the portfolio, but only after the Seller receives payment each year against the note. And while the funds are invested, the growth of those funds support the interest payments to the Seller.

However, in order to preserve the tax deferral benefits, the IRS dictates that an owner’s control over the collateralized investment portfolio must be, “Subject to substantial limitations or restrictions” (see Treasury Regulation Section 1.451-2). Our third party, unrelated, and standardized collateralized investment accounts, provide a significant degree of separation between a business owner and their direct control over the portfolio. It also provides an additional layer of separation between an investment advisor and their client such that the IRS is much less likely to view a business owner as having investment control through their longstanding relationship with their advisor.

In this way, the Seller will not have to pay taxes when the business is sold, but only on the smaller annual payments as they are received. Due to graduated tax brackets, much of these payments can be taxed at lower rates than if the proceeds were received in one lump sum in a single tax year. Furthermore, the invested principal can grow tax-deferred and support a larger income stream to the Seller than would be possible otherwise.

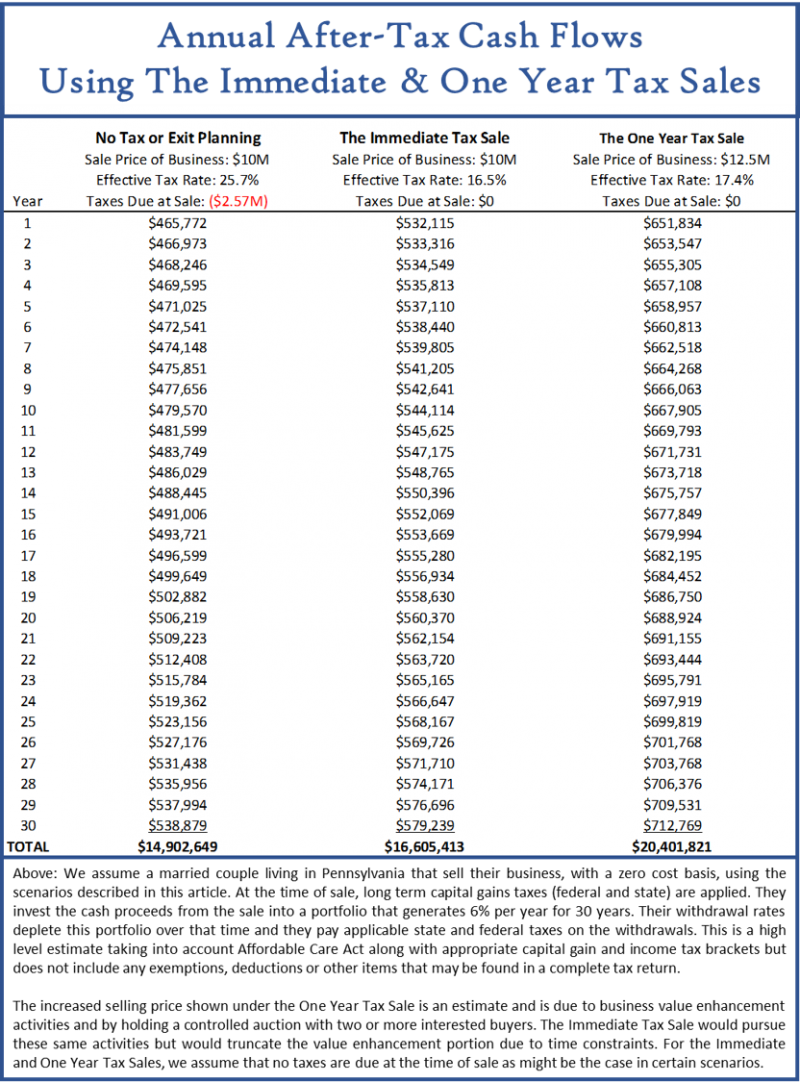

Quantifying the Tax Benefits of a Structured Installment Sale

The benefits of the Immediate Tax Sale and the One Year Tax Sale are dependent on the many factors that influence anyone’s tax liability from year to year. However, for the sake of illustration, we present a hypothetical benefit analysis for a business owner who resides in Pennsylvania (PA generally doesn’t allow installment sale treatment, but we will use this example to illustrate the mechanics).

Pennsylvania taxes income and capital gains at a rate of 3.07%. These benefits outlined here would be greater for owners living in higher tax states (i.e. California) and a little less for those in low-tax states (i.e. Florida). These benefits also tend to increase when the deferral period is greater or when an owner moves to a lower tax state after the sale of a business. For those who really wish to maximize the impact of this strategy, trusts can be set up in lower tax states that offer the ability to eliminate state taxes altogether. These trusts can provide significant estate planning benefits and they will be covered in another article, but feel free to ask us about it if you’re interested.

Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor. The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

As shown above, the Immediate Tax Sale and the One Year Tax Sale can offer considerable after-tax benefits to an owner when selling their business. These tax saving estimates are based on tax models we’ve developed around hypothetical, yet common, business sale transactions. If you’d like a tax model based on your specific situation (or if you’re an investment advisor or M&A advisor, for your client’s situation), please contact us and ask for Adam.

How to Work with Us on a Tax-Efficient Structured Installment Sale

If you or your client are interested in the One Year or the Immediate Tax Sale solutions, we’d like to help. For reasons that we outline in the FAQ section below, business owners and their financial advisors can’t accomplish this themselves. In fact, IRS statutes would seem to require that unrelated third parties implement these structures (and sub-manage the investments) in order to preserve the tax benefits.

Our role in helping you and your clients obtain these tax benefits fall into two areas:

- First, the IRS dictates that in order to preserve the tax benefits, an owner’s control over the collateralized investment portfolio must be “subject to substantial limitations or restrictions” (see Treasury Regulation Section 1.451-2). Our third party, unrelated and standardized collateralized investment accounts provide a significant degree of separation between a business owner and their direct control over the portfolio. And when financial advisors work with us, we provide that additional layer of separation so that the IRS is much less likely to view their clients as having investment control through their longstanding relationship with their investment advisor. We work with financial advisors in sub-account roles and offer low-cost wholesale pricing so they can manage their clients’ assets from the sale of their business and provide financial planning services.

- Second, we’ve worked with nationally recognized tax authorities to develop these solutions for our clients. Rather than reinvent the wheel, at your request, our network of tax and M&A professionals will implement these solutions for you or your client.

If you would like to work with us in the above capacities or have any questions, please contact us and ask for Adam. A good first step is to obtain an estimate of the tax benefits specific to your situation (or if you’re an investment advisor or M&A advisor – for your client’s situation), so feel free to ask us about this. In most cases, depending on the fact pattern, we estimate that the tax savings can range from 20% to over 40% and we’ll narrow this down so you can understand if this makes sense for you.

Frequently Asked Tax Questions on Structured Installment Sales

What are Installment Sales?

Deferral of tax is allowed under IRS Section 453 in what is known as an Installment Sale. There are over 130 IRS Public Letter Rulings (PLR’s) and decades of case law dealing with installment sales, so they can be relied upon as an approved method for deferring taxes, provided that certain rules are followed.

With an installment sale, the seller receives at least one payment after the tax year in which the sale occurs. The seller can defer the recognition of income (and payment of taxes) until later years when payments are received. This can result in advantageous tax deferral but it is subject to some risks and restrictions.

A simple example would be in the case of an earn out when a buyer agrees to pay the seller over a period of several years as certain business milestones are achieved. If a milestone is realized in a subsequent year, the buyer will pay the seller and taxes would be due on gain attributed to that year’s payment.

This introduces payment and credit risk. What if the milestones are not achieved? And if the milestones are achieved, will the buyer still pay? With a traditional installment sale, the seller accepts some risk that payments will not be realized and in return, the IRS will not force a payment of taxes until the payments are actually or constructively received.

What are Structured Installment Sales?

With a structured installment sale, the credit risk of the buyer making future payments is greatly reduced. As with an installment sale, the buyer and the seller agree to periodic payments over several years but the obligation to make those payments is further guaranteed in a collateralized investment account.

The transaction outlined in this article is a Structured Installment Sale. Initially, the business itself serves as collateral against the note and once the business is sold, the investment account serves as collateral.

How are Structured Installment Sales taxed?

The benefit of a structured installment sale is that taxes are not due until after the Seller receives payment in future years, not when the business was originally sold. The proceeds of the sale are then able to grow tax-deferred for many years while the taxes are paid over time. With that in mind, here’s how the installment payments will be taxed:

Installment sale payments are composed of three parts.

These are as follows:

- Return of adjusted basis

- Capital gain, and

- Interest income

The return of adjusted basis is the Seller’s original cost basis in the company, which includes certain selling expenses. The capital gain is the amount the business sold for in excess of the basis. The interest income is the rate applied to the installment note, subject to certain minimum rates as set by the IRS with their Applicable Federal Rates or AFR’s.

No taxes are due on the return of adjusted basis. The appropriate capital gain tax rate is applied to the capital gain portion of the payment and interest income is taxed as ordinary income.

To determine how much of each payment is composed of interest income, a Seller can use an amortization table and calculate it in much the same way as with any loan, mortgage or bond.

The remaining portion of the payment is prorated between the capital gain and the adjusted basis. The gain portion is calculated with the ‘Gross Profit Ratio’ which is the total gain on the sale divided by the total price. For example, if a piece of real estate is sold for $5 million and the basis is $1 million, the Gross Profit Ratio is $4 million (total gain) divided by $5 million (total selling price) or 80%. So, 80% of the remaining, non-interest portion, is considered capital gain and 20% is considered a return of basis.

How does the “Business Purpose” doctrine apply to this structure?

The Business Purpose Doctrine is used by the IRS to disallow excessive tax shelters. It states that if a transaction has no substantial business purpose other than tax avoidance or reduction of income tax, the law will not respect the transaction.

It is intended to keep taxpayers from setting up numerous entities and step transactions with the sole purpose of avoiding tax. With the process outlined in this article, there are substantial business purposes that add economic benefit to all involved parties.

These are as follows:

- The M&A Reseller provides business valuation enhancement services, creates a market for a business and seeks to sell the business at the highest price possible. These serve as valid business purposes to engage in the transaction.

- The M&A Reseller has a valid economic profit motive to sell the business at the highest possible price. Fees are traditionally based on the sale price and in addition, once the note has been paid off, they hope to obtain excess returns on the invested capital, much like a private equity firm.

- The Seller is relying on the M&A Reseller to provide value and price enhancement services and is not motivated by taxes alone. In return, the seller receives a premium on the sale of the business and assumes some risk that these services and the benefits will be realized. Otherwise, sellers would legitimately seek other avenues to dispose of their property.

- The Seller’s assumption of risk and expectation of return as mentioned in the above point is consistent with basic economic theory. If the transaction had no business purpose other than tax avoidance, this economic risk would not be present.

What are your thoughts regarding constructive receipt?

The constructive receipt doctrine prohibits a taxpayer from willfully turning their back on income and the liability to pay the associated income tax. The classic example is an employee who is given a bonus check at the end of the year but chooses to cash the check in January the following year. The employee must report the income and pay the taxes in the year he had access to, or constructive receipt of the funds. It doesn’t matter when he actually cashes the check. What matters is when he had access to, or constructive receipt of, the money.

For an owner to avoid constructive receipt of the sale proceeds, their access to the funds held in the investment portfolio must be “subject to substantial limitations or restrictions” (see Treasury Regulation Section 1.451-2).

This is accomplished through the existence of IRS regarded entities that hold and control the portfolio (M&A Reseller via the collateralized investment account). There is significant case law that supports the use of collateralized accounts to support installments sales and avoid constructive receipt.

Important note: Neither Alpha Architect nor its affiliates provide tax advice. IRS Circular 230 disclosure: To ensure compliance with requirements imposed by the IRS, we inform you that any tax advice contained in this communication was not intended or written to be used, and cannot be used, for the purpose of (i) avoiding tax-related penalties under the Internal Revenue Code or (ii) promoting, marketing or recommending to another party any matters addressed herein. You should seek advice based on your particular circumstances from an independent tax advisor.

The information contained in this communication is not meant to substitute for a thorough estate planning and is not meant to be legal and/or estate advice. It is intended to provide you with a preliminary outline of your goals. Please consult your legal counsel for additional information.

Frequently Asked Questions for Business Owners and Practitioners

I’m interested, how can I learn if this is right for my business or my clients and advisory practice?

We invite business owners or their financial, tax and M&A advisors to contact us to learn more (ask for Adam.) We’d be happy to discuss your situation with you and to help you determine if this is a fit for you personally or for your advisory practice.

How much does this all cost?

We think it is important to reduce the costs of selling a business while also not losing sight of the overall goal – getting more money in your pocket after paying all taxes and fees. Nevertheless, fees are a fact of life and we’ve listed below what you can expect to pay. Note that for each of the following services, we have worked with certain firms and can make recommendations, or offer the services directly as in the case of the collateralized investment account.

Setting this structure up may include the following costs:

Legal structure: Depending on the specific situation and time involved to execute, the legal structures and documents can range significantly. These fees might be reduced if you are willing to pay them up front.

M&A Enhancement and Selling Services: This will ultimately depend on which M&A or investment bank you work with (we can recommend a few). Firms may charge a fee based on the sale proceeds according to the Lehman Scale for larger deals and “Double Lehman” or twice this amount for smaller deals. The Lehman Scale is:

- 5% of the first million dollars of sale proceeds;

- 4% of the second million dollars of sale proceeds;

- 3% for the third million dollars of sale proceeds; and

- 1% of sale proceeds thereafter.

An alternate fee schedule may be a percentage of the overall increased value that an M&A firm is able help create and realize throughout the enhancement and selling process.

Collateralized Asset Management: We work with investment advisors to help them implement these types of solutions for their clients at wholesale rates. Their fees, not ours, average 1% of the assets under management which would also include financial planning, tax and estate planning. These additional services could be well worth the fees when selling a business and we suggest you not overlook them. For those business owners interested in working with us directly, we can manage assets at fee rates well below one percent.

What’s the catch?

There are a few things to keep in mind when considering these options. The first, aside from the periodic payments on the note, an owner does not have any access to the portion of a business sale that is deferred in this manner. Those funds must be invested and the process can’t be reversed without incurring IRS penalties.

Second, should the returns in the portfolio exceed expectations, all or a portion of the funds that remain in the account after the note has been paid off are remitted to the M&A Reseller. This serves as a profit motive and is intended to keep the IRS happy with the arrangement. The risk of this occurring can be reduced by proper alignment between the size of the note, the interest rate and estimating the value of the business among others.

How long does this process take?

We offer two versions of this tax deferral model. One is for owners seeking to sell their business immediately and one for those who can take 10 to 12 months to plan their sale more strategically. Both scenarios can be accommodated.

What can I invest in?

To avoid constructive receipt (and the tax liability), there must be “substantial limitations or restrictions” placed between the Seller and the collateral of an investment portfolio. This means that the Seller is not allowed to place discretionary trades or make investment decisions in the portfolio. However, prior to starting the process, should you decide to work with us, we would explain how the portfolio would be invested (i.e. our robust asset allocation solution). Our processes are long-standing, automated, and there are internal controls that ensure we minimize IRS compliance issues.

Also, we do encourage all investors to bear in mind the FACTS (Fees, Access, Complexity, Taxes and Search) when making an investment decision. Our experience suggests that the vast majority of taxable family offices and high net worth individuals should focus on strategies with low costs, high liquidity, simple investment processes, high tax-efficiency, and limited due diligence requirements. Tax structuring is complicated enough, and adding complexity upon complexity is rarely a good idea.

Can I use a 5, 10, 20 or even a 30-year installment note?

Yes, the face value, interest rate and term of the note is negotiable with an M&A Reseller and should be scaled to meet your needs. Depending on the specific transaction, an owner may want a very short-term deferral so they can sell their business while living in a high tax state and then receive the funds over a few years after they’ve moved to a lower tax state. Additionally, it may make sense to transfer the funds to a trust as soon as possible for estate planning purposes.

How do I incorporate estate planning and retirement planning with this?

The method outlined in this article can greatly increase the funds available for retirement and can be an integral part of an estate plan and a business exit strategy. Since each situation is unique, and estate planning is beyond the scope of this article, we do acknowledge that this method works very well with many trusts used in estate planning. Trusts can also eliminate state-level tax on the sale of a business and provide a step up in basis for heirs of an estate. This topic will be covered in a later article, but feel free to ask us about it.

What size of business does this work for?

If certain rules are followed, a married couple could defer $45 million through this structure within 13 months – all without paying onerous interest charges assessed by the IRS.

The rules limit $5 million of deferral per owner, per year. So, a married couple could defer $10 million in December of Year 1, plus they could set up a trust to do the same for an additional $5 million for a total of $15 million in deferral. Then in January of Year 2, they could defer another $15 million using the same method. Finally, in January of Year 3, they could defer another $15 million for $45 million in total deferral.

For larger transactions, well in excess of this amount, an owner may be willing to pay the interest charges for a few years while they relocate to a lower tax state or finalize estate plans to avoid state taxes altogether. After a period of a couple of years, the sale proceeds could be paid to a trust and the transaction exited while state taxes are avoided.

What if I’ve already identified a buyer?

If you have a potential buyer already lined up, they can be invited to participate in the auction process and it’s likely that their offer will increase.

What happens if investment returns are greater or less than expected?

If the portfolio’s investment returns are less than expected (i.e., stocks and bonds have lower than expected returns), then the investment account is depleted and the note held by the Seller is defaulted. The Seller would have benefited from tax deferral and participated in the stock and bond markets as anticipated, but the note will not have been paid off in full. This is a rare event that good planning can likely avoid.

If the portfolio’s investment returns are greater than expected (i.e., stocks and bonds have greater than expected returns), then the note will have a greater likelihood of being paid off in full and the Seller benefits. If the portfolio’s investment returns are significantly greater than expected, then the note will be paid off in full and the Seller will receive the full value and tax benefit.

However, any remaining funds will be considered profit to the M&A Reseller. In the eyes of the IRS, there has to be a profit motive for the M&A Reseller and a distinct business purpose to be regarded by the IRS. The model we outline achieves this. Finally, there needs to be “substantial limitations or restrictions” on the funds to avoid constructive receipt and for the Seller to benefit from the tax deferral. This restriction on excess investment returns serves that purpose.

Notwithstanding the above paragraph, the M&A Reseller’s primary profit motive is to create value and earn a transaction fee, not wait 30 years for unlikely excess returns. Therefore, the long-term note would be sized and constructed appropriately to accommodate large returns in the investment portfolio, yet small enough to limit the size of the interest payments which are taxed at ordinary rates.

What happens if my business is not sold?

The business serves as collateral against the note held by the Seller. If the business is not sold, the note will default and the business will be returned to the Seller.

Before the process begins, the Seller and the M&A Reseller agree to a period of time that will be required to prepare, market and sell the business. During this period, payments on the note might only be interest bearing or alternatively, no payments could be made and interest accrued to the note. Regardless, if by the time a large payment is due on the note and the business has not sold, the note can be declared in default and the business returned to the Seller. The seller might even negotiate a consulting agreement with the M&A reseller in order to remain close to the business and provide support during the value-enhancement phase.

Next Steps

If you would like to learn more about this process, have a question or would like to receive a model based on a fact pattern specific to your situation, feel free to contact us here at Alpha Architect (ask for Adam).

References[+]

| ↑1 | To be clear, there may be some taxes due depending on how the business transfer and sale are structured. If both are stock sales, then there would likely be no taxes payable at the time of sale. However, if the final sale is an asset sale, some depreciation recapture might be payable. |

|---|

About the Author: Adam Tkaczuk

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.