Volatility in equity markets and monetary policy rate uncertainty

- Iryna Kaminska and Matt Roberts-Sklar

- Journal of Empirical Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Financial theory asserts a clear link between the risk-free interest rate and the pricing of equity securities, regardless of the time horizon. Therefore, the market’s opinion about the uncertainty of rates should improve models forecasting equity volatility in the short and long run. This article asks one basic question:

- Do measures reflecting investor opinion of monetary rate changes improve the short and long-term performance of models that forecast volatility of equity returns?

What are the Academic Insights?

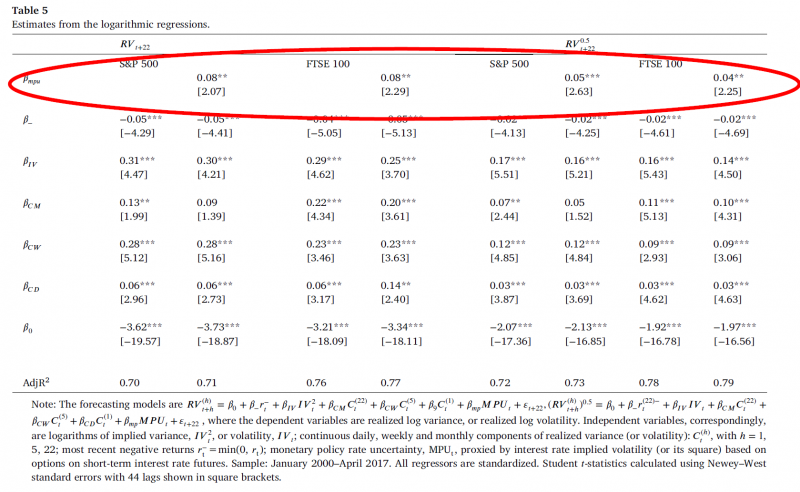

- YES. As expected, a positive, significant relationship is observed over weekly, monthly, and quarterly horizons. Dependent variables tested include: lagged and recent return variances, negative return shocks, lagged squared option-implied volatility, and interest rate implied volatility from options on short-term interest rate futures. Also included, although with a weaker effect, was a component of the EPU index-the Monetary Policy Uncertainty component and a news-based monetary policy uncertainty index developed in previous research. The forecasting analysis was conducted for the realized weekly, monthly and quarterly return variances for the S&P 500, FTSE 100 and EuroStoxx 50 indices. All proxies for monetary uncertainty significantly improved the forecasting performance for volatility and variance of the 3 equity indices across weekly, monthly and quarterly time horizons.

Why does it matter?

The results presented in this article provide support for the notion that the market’s opinion of changes in the path of interest rates and monetary policy improves the prediction of equity price volatility. Furthermore, the methodologies described and used to analyze the main hypothesis, are useful for anyone attempting to forecast short and long-term volatility in equity prices. Advancements in the estimation of the variance risk premium via the improvement in estimates of the conditional variance, for equity indexes, is presented.

One caveat: In the methodology they use, the authors directly address two empirical issues that could limit the validity of this research: the well-known problem of endogeneity in monetary policy, and the fact that monetary policy and equity prices react to the same variables.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Asset pricing models assume the risk-free rate to be a key factor for equity prices. Hence, there should be a strong link between monetary policy rate uncertainty and equity return volatility, both in theory and data. This paper uses regression-based projections for realized variance to examine the relationship between short horizon forecasts of equity variance and proxies for monetary policy rate uncertainty. By assessing various projection models for UK, US and euro area equity indices, we show that the proxies for monetary policy rate uncertainty have a significant and positive predictive power for the equity return variance. Adding monetary policy rate uncertainty variables can significantly improve forecasting models for equity variance and volatility at weekly, monthly and even quarterly horizons. The findings imply that market views of short-term interest rate developments may indeed be embedded in equity prices and their variations.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.