Are Financial Constraints Priced? Evidence from Textual Analysis

- Matthias Buehlmaier and Toni Withed

- Review of Financial Studies, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

- Can textual analysis better measure and understand financial constraints?

- What is the relationship between financial constraints and stock returns?

What are the Academic Insights?

The authors use an improved (compared to counting words) textual analysis method based on estimating a probability model on three different training samples and then imputing constraint status on the rest of the sample. The authors study data (focusing on the MD&A section of 10Ks) from three databases (Compustat, CRSP and Edgar) over a time span from 1994 to 2010.

They find the following:

- YES- All three of the financial constraints measured studied do a good job of capturing the financial characteristics that are typical of financially constrained firms.

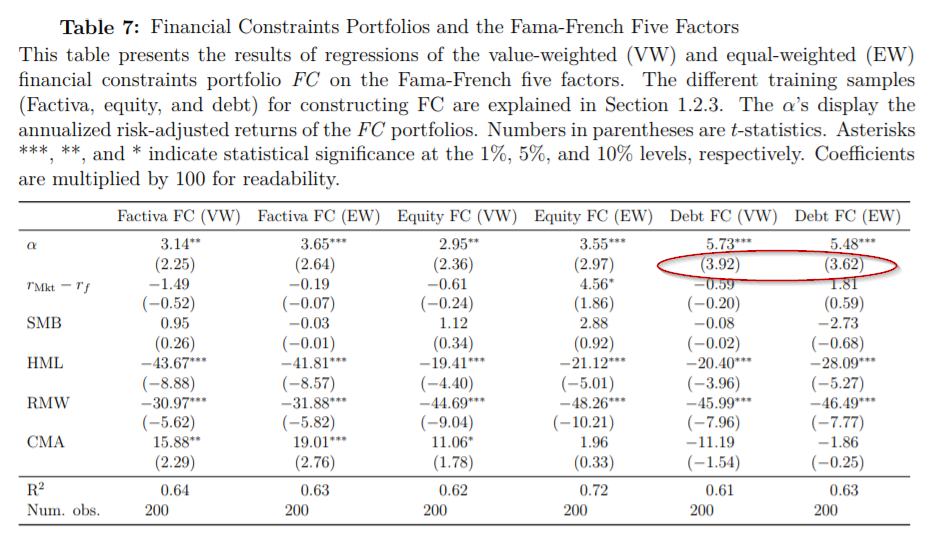

- YES- There is a strong relation between financially constrained firms and future stock returns. Specifically, the authors find that excess returns are higher for financially constrained firms. Additionally, they find that firms constrained in debt markets have the highest stock returns and that the risk premium is not concentrated in small stocks, indicating that illiquid stocks don’t drive the results. By regressing the portfolio on the five Fama-French factors yields respectively 6.5% for the debt constraints measure, 3.7% for the general constraints measure and 3% for the equity one. The equity market is not overly concerned about a firm’s capacity to raise money through the stock market and instead prices its ability to raise money in debt markets.

The authors perform a series of robustness checks to confirm that their new measures of financial constraints contain novel information beyond investment and equity/debt issuance. Additionally, they account for trading costs in their portfolio simulations.

Why does it matter?

The fact that predicted returns are not concentrated in small and illiquid firms means that one can form a trading strategy based on financial constraints. Additionally, using successfully textual analysis promises to enrich many other areas of inquiry in finance, especially for difficult to observe corporate characteristics.

The Most Important Chart from the Paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We construct novel measures of financial constraints using textual analysis of firms’ annual reports and investigate their impact on stock returns. Our three measures capture access to equity markets, debt markets, and external financial markets in general. In all cases, constrained firms earn higher returns, which move together and cannot be explained by the Fama and French (2015) factor model. A trading strategy based on financial constraints is most profitable for large, liquid stocks. Our results are strongest when we consider debt constraints. A portfolio based on this measure earns an annualized risk-adjusted excess return of 6.5%.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.