Performance of Female CEOs

- Srinidhi Kanuri, James Malm

- Journal of Investing, Spring 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the Research Questions?

- Do firms with female CEOs outperform the market ( proxy by S&P 1500 and Russell 3000)?

What are the Academic Insights?

By analyzing U.S. firms with female CEOs from January 1996 to December 2014 ( as of this date there are 55 firms with women serving as CEOs), the authors find the following:

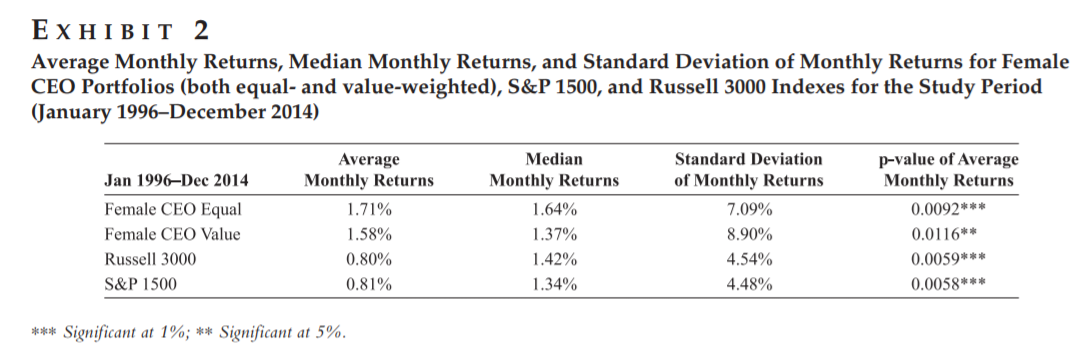

- YES- Firms with female CEOs have higher average monthly and median returns, higher risk-adjusted performance (Sharpe, Sortino and Omega ratios) and significantly positive alphas with both the Carhart four-factor and the Fama-French five-factor model.

Why does it matter?

This study contributes to an emerging body of research on gender and finance. Gender diversity benefits corporations.(1)

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

The authors examine the performance of companies led by women from January 1996 to December 2014. The results show that companies headed by women outperformed the U.S. market, as proxied by the S&P 1500 and Russell 3000 indexes. Firms with female CEOs have higher average and median monthly returns, higher risk (standard deviation of monthly returns), and higher risk-adjusted performance (Sharpe, Sortino, and Omega ratios). Female-led companies also have significantly positive alphas with both the Carhart four-factor model and the Fama–French five-factor model when they form equally weighted and value-weighted portfolios of these firms. These results indicate that firms led by women have created significant value for their investors during the period of our study.

References[+]

| ↑1 | Here is another piece on the subject by Wes |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.