The Impact of Flows into Exchange Traded Funds: Volumes and Correlations

- Ananth Madhavan and Daniel Morillo

- Journal of Portfolio Management, summer 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

- Have ETFs flows affected the correlation structure of returns?

- Have ETFs flows affected the liquidity of underlying securities?

- Have ETFs flows affected the ability of managers to generate alpha?

What are the Academic Insights?

By examining these issues empirically, considering the longer historical and macroeconomic context using daily U.S. equity returns from 1926 to 2017, the authors find the following:

- NO-The historical evidence is consistent with the authors’ idea that higher correlations today are not the result of passive indexing, but rather reflect the macro environment and common factor risks. Additionally, by performing a regression of annual correlation on ETF assets under management (AUM) and common proxies for macroeconomic risk, the authors confirm that accounting for the macroeconomic environment calls into question the significance of ETFs as a driver of recent changes in correlation levels.

- NO- If there is indeed a substitution effect, common stock and ETF volumes, both in levels and changes, should be negatively correlated. In fact, the opposite is true: The correlation between ETP and stock dollar volumes, measured on a daily basis, is 0.765. The magnitude of correlations of log volume changes on a daily basis is similarly high at 0.791.

- NO- At any correlation level, active managers (defined as those who deviate from the cap-weighted distribution of holdings in the universe) must, by definition, have average performance equal to the benchmark return less fees. As such, correlation really is not linked to the success of active management; rather, it is the dispersion of returns that matter.

Why does it matter?

The potential impact on underlying assets from large inflows into passive investment vehicles, such as ETFs, is a source of considerable concern for practitioners. This is especially true for asset managers concerned with portfolio diversification, security selection, price discovery, and liquidity in a higher correlation environment.

However, as this paper shows, concerns that the growth of ETFs has had a negative impact on the underlying markets are not supported by logic or the data.

The Most Important Chart from the Paper:

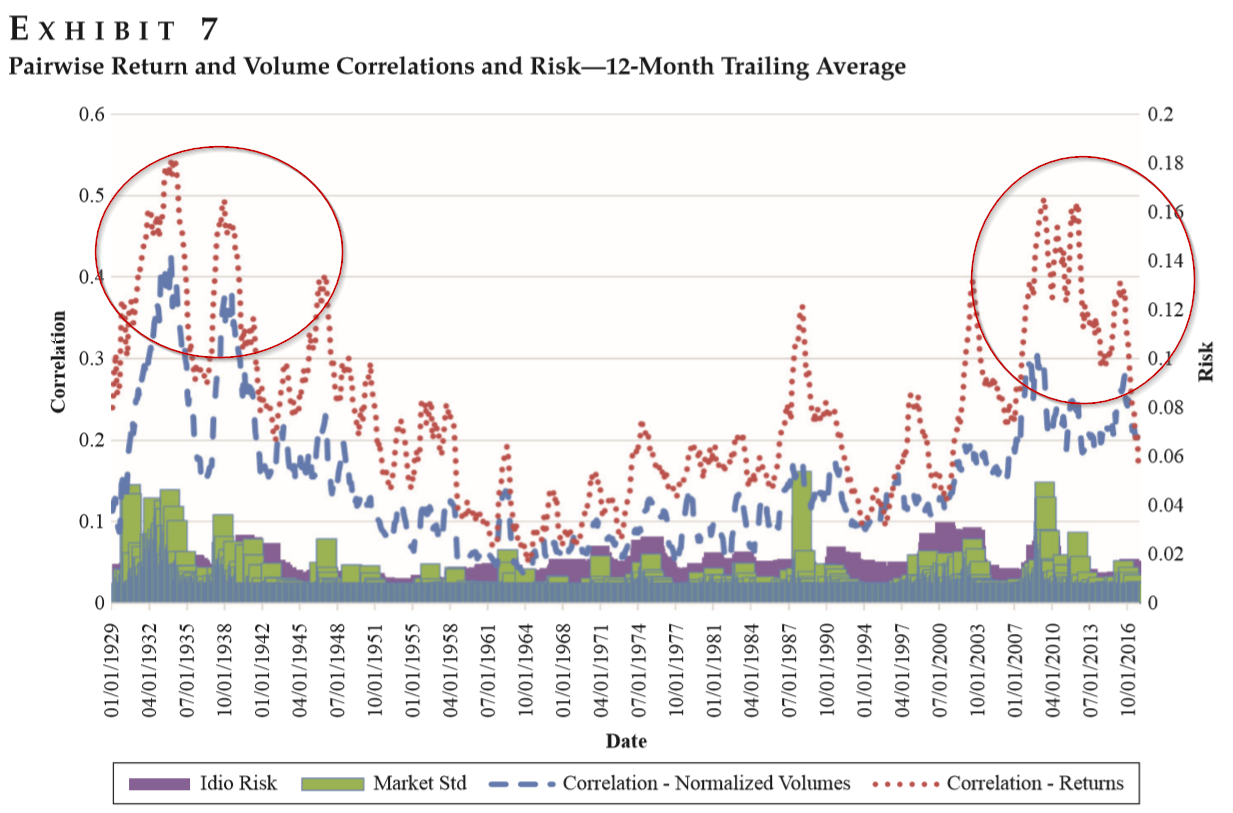

Exhibit 7 shows that the broad historical pattern of pairwise correlations (left-hand scale) is quite similar across returns and volumes. This is consistent with the authors’ evidence that the co-movements in returns and liquidity (trading activity) are driven by the same set of common factors.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

There is a common perception that the recent growth in passive index investing through exchange-traded funds (ETFs) has had detrimental effects on the market quality of the underlying basket securities. In particular, there is concern that ETF trading substitutes for and takes away from liquidity in the underlying securities and increases the co-movement in their returns. In turn, it is argued that increased pairwise correlation among stocks impairs price discovery and the ability of active managers to generate alpha. In this article, the authors find no evidence to support these perceptions. Volume changes in ETFs and their underlying securities are positively, not negatively, correlated. Furthermore, this research indicates that the rise in cross-stock correlations is due to the macro environment, not ETF growth.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.