For those interested in the literature on factor-based investing, a new paper by Robert Arnott, Campbell Harvey, Vitali Kalesnik and Juhani Linnainmaa, “Alice’s Adventures in Factorland: Three Blunders That Plague Factor Investing,” focuses on why, in some ways, it has failed to live up to its promise (or hype). Their study covers the period July 1963-June 2018.

The authors raise the following concerns:

- Risk of data mining

- Overcrowding of factors post publication

- Unrealistic trading cost expectations

- Misunderstanding of downside shocks

- Misunderstanding of the diversification benefits of factors

These are important issues because the failure to address and understand them can lead to exaggerated expectations about factor performance and the benefits of factor diversification. Given the legitimacy of these concerns, it’s important they be addressed. With that in mind, we’ll take a deep dive into each of the issues. We’ll begin by addressing the very real risks of findings being the result of data mining exercises—searching for outcomes without first having a theory about why the outcome should be expected.

Risk of Data Mining

Hundreds of factors have been identified in the literature, many of which could be the result of data mining exercises. However, most of them can be ignored because they cannot pass the five tests detailed in “Your Complete Guide to Factor-Based Investing.” In order to be considered for investment, a factor must provide incremental explanatory power to portfolio returns and have delivered a premium (higher returns). Additionally, the factor must have the following characteristics:

- Persistent—It holds across long periods of time and different economic regimes.

- Pervasive—It holds across countries, regions, sectors and even asset classes.

- Robust—It holds for various definitions (for example, there is a value premium, whether it is measured by price-to-book [P/B], earnings, cash flow or sales).

- Investable—It holds up not just on paper but also after considering actual implementation issues, such as trading costs.

- Intuitive—There are logical risk-based or behavioral-based explanations for its premium and why it should continue to exist.

Using these qualities as screens, we can reduce the number of factors worth considering to just these few: market beta, size, value, momentum, profitability/quality and term. Jack Vogel wrote a very interesting piece on creating two million trading strategies using data mining here.

We now turn to the concern about crowding—the risk that cash flows following publication lead to

Overcrowding

First, it’s important to note that if there are risk-based explanations for a factor’s historical premium, risk cannot be arbitraged away. For example, while the market beta premium is well known, no one expects it to disappear. However, popularity can lead to cash flows, rising valuations, and a shrinking premium. This is important to note because so much of the criticism about factor investing ignores the fact that what is true for other factors can also be true of market beta (e.g., it can experience large drawdowns and long periods of underperformance). That said, popularity (resulting in cash flows) can reduce the size of premiums. Andrew Miller wrote about this in his February 2017 post “Will ETFs Destroy Factor Investing? Nope.”

R. David McLean and Jeffrey Pontiff, authors of the 2016 study “Does Academic Research Destroy Stock Return Predictability?” reexamined 97 factors published in tier-one academic journals and were able to replicate the reported results for only 85 of them. They also found that following publication, the average factor’s return decays by about 32 percent—returns do not decay to zero but remain positive. Of course, some premiums (those that could not meet our established criteria) could have disappeared entirely, while others remained relatively unchanged.

McLean and Pontiff also found that factor-based portfolios containing stocks that are costlier to arbitrage decline less post-publication. This is consistent with the idea that costs limit arbitrage and protect mispricing. They state: “Decay, as opposed to disappearance, will occur if frictions prevent arbitrage from fully eliminating mispricing.”

We have further research on the issue of overcrowding. Martin Lettau, Sydney Ludvigson and Paulo Manoel contribute to the literature with their December 2018 study “Characteristics of Mutual Fund Portfolios: Where Are the Value Funds?”, which provides a comprehensive analysis of portfolios of active mutual funds, ETFs and hedge funds through the lens of risk (anomaly) factors such as size, value and momentum. Among the questions they try to answer are: To what extent do active fund managers exploit these factor premia? If there are limits to arbitrage, do active funds contribute to the existence of these anomalies, or do they overweight underpriced stocks?

Among their important findings was that neither mutual funds nor ETFs systematically tilt their portfolios toward profitable factors, such as high book-to-market (BtM) ratios, high momentum, small size, high profitability and low investment growth. In fact, for some factors, mutual funds target the low-return leg of long/short factor portfolios rather than the high-return leg. This bias is especially strong for BtM ratios. In fact, they found that there are virtually no high-BtM funds in the sample, while there are many low-BtM “growth” funds. For example, only seven out of 2,657 funds in their sample have a BtM score in the fourth quintile or above.

Supporting evidence comes from David Blitz, who demonstrated in his February 2017 paper “Are Exchange-Traded Funds Harvesting Factor Premiums?” that while some ETFs are specifically designed for harvesting factor premiums, other ETFs implicitly go against these factors. Specifically, Blitz found the following:

From a factor-investing perspective, smart-beta ETFs tend to provide the right factor exposures, while conventional ETFs tend to be on the other side of the trade with the wrong factor exposures. In other words, these two groups of investors are essentially betting against each other.

As further evidence, in 1994, right after the publication of the famous Fama-French research on the value premium, the P/B of U.S. large growth stocks was 2.1 times that of large value stocks, and their price-to-earnings (P/E) spread was 1.5. (Data is from Dimensional.) Using Vanguard Russell 1000 Growth ETF (VONG) and Vanguard Russell 1000 Value ETF (VONV), we find that as of January 31, 2019, the P/B spread had actually widened to 3.2, and the P/E spread was basically unchanged at 1.4. At least here, we see no evidence that cash flows have caused the value premium to narrow. The bottom line is, it appears that despite what many investors believe, a massive net inflow into value stocks relative to growth stocks has not occurred.

We now turn to the concern that trading costs are underestimated.

Unrealistic Trading Costs

The role of liquidity is an important one when considering investment because while there may be anomalies that result in mispricings, in order to profit from those anomalies, investors must be able to exploit them after accounting for all the expenses of the effort. Andrea Frazzini, Ronen Israel and Tobias Moskowitz address the issue of implementation costs in their April 2018 study “Trading Costs.”

In his review of the paper, Alpha Architect’s Wes Gray called it “The Best Research Paper Ever Written on Trading Costs.” The study’s database consisted of $1.7 trillion of live-executed equity trades from a large money manager, AQR Capital Management. It covered the period August 1998 to June 2016 as well as 21 developed equity markets and almost 10,000 stocks.

Frazzini, Israel and Moskowitz measured the real-world trading costs and price impact function incurred by AQR, which trades portfolios based on many of the anomalies discovered in the academic literature, providing a unique look into how trading costs vary globally across trade type, size and exchange.

The authors identified the real-time price impact of a trade at various trade sizes. It’s important to note AQR’s trades were all made in a manner seeking to lower execution costs using a proprietary trading algorithm that, importantly, does not make any buy or sell decisions. The algorithm decides how patiently to trade (minutes versus days), but not what to trade (or not to trade). The following is a summary of their findings:

- Trading costs (bid-offer spreads and commissions), including market impact costs, have exhibited a steady decline over time across markets, though they did jump during the financial crisis (2007-2009) before resuming their decline. Some of the decline is driven by technological events, such as moving to decimalization in traded prices.

- The average bid-ask spread at the time of order arrival is 21.33 basis points (bps). However, it was rare for AQR’s trades to incur the full spread, or even half the spread, because of the passive limit orders. The main cost the firm’s trades faced was market (price) impact.

- The estimate of market impact is just under 9 bps, on average, for all trades completed within a day. The median cost is a bit lower at just more than 6 bps, suggesting that trading costs are positively skewed by more expensive trades.

- When weighting trades by their dollar value, the value-weighted mean is higher, at just more than 15 bps, for market impact. The largest trades are the most expensive trades.

- Costs are larger for smaller stocks and stocks with greater idiosyncratic risk, consistent with theories of market-maker inventory risk raising price impact. Without controlling for trade size, the average large-cap stock trade generates almost 9 bps of market impact costs compared to almost 19 bps for small-cap stocks.

- Buying to go long generates about 12.5 bps of price impact, while buying to cover has 15.5 bps of price impact. Short-selling is slightly more expensive, by 0.6 bps, on average, than selling long, but the difference is not statistically significant. There is no marked difference in trading costs between selling a long position versus selling short. If short-selling is indeed costlier, it is likely to be a function of opportunity cost (i.e., not being able to short) or of lending fees for stocks on special.

- The average trade experiences an additional 4 bps of market impact on the stocks traded relative to stocks of similar characteristics (BtM ratio, market cap and momentum) not traded by the algorithm that day. This likely is due to immediacy of demand and, thus, a temporary outcome that will be reversed.

- The patterns and estimates were similar across the 21 different equity markets studied.

Based on their findings, Frazzini, Israel and Moskowitz built a market impact cost model to estimate the cost of trading live funds based on passive indexes. Examining Vanguard 500 Index Fund and iShares Russell 2000 ETF, the model predicts their costs accurately, suggesting their cost estimates are in line with other large traders.

The authors also collected trading cost data from three different brokers (ITG, Deutsche Bank and J.P. Morgan) and a consulting firm (Ancerno, formerly a unit of Abel-Noser) that collectively cover trades from more than 2,000 institutions across 2,000 brokers globally. They found that their estimates match average costs across trade size, time and country from these other sources.

The authors then compared their estimates of trading costs with various other models in the literature and found that the estimates of costs produced by their model “are much closer to real-world trading costs facing a large trader and match those from other sources.”

Not only were they much closer, they were much lower than the cost estimates from other models. For example, Frazzini, Israel and Moskowitz found their estimate of annual costs on the S&P 500 is 4.81 bps, almost exactly what they obtained by looking at the returns of Vanguard 500 Index Fund. For the Russell 2000 Index, they estimated 12.36 bps, which also matches the costs of the iShares ETF.

It is important to note that the authors’ cost estimates represent those of the average sophisticated institutional trader, who serves as an arbitrageur in markets, and therefore more closely resemble the costs of the marginal investor. They do not represent the costs of retail investors or even the average investor.

The preceding findings have important implications for investors. First, they showed that trading costs for strategies based on a host of anomalies are substantially lower than the costs suggested in the literature, at least for patient institutional traders.

Second, because trading costs are much lower than previously thought, while factor-based strategies have capacity limits due to transaction costs, their capacity on these strategies might be much higher than academics have previously considered. Wes Gray also wrote an article here on how several factors perform even after considering trading costs. (In the interest of full disclosure, my firm, Buckingham Strategic Wealth, recommends AQR funds in constructing client portfolios.)

We now turn to the issue of investors underestimating the downside risks of factor investments.

Investors Underestimate Downside Risks

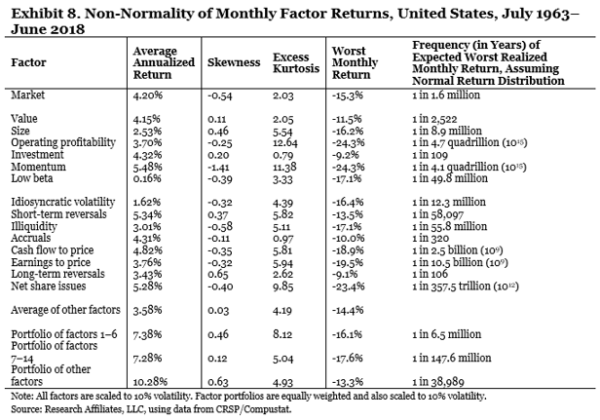

In their article, Arnott, Harvey, Kalesnik and Linnainmaa note that most factor returns stray far from a normal distribution, being prone to large drawdowns. Because factors have excess kurtosis (fat tails), it is a mistake to use simple risk management tools that ignore the tail behavior. Too many investors believe that creating a portfolio of factors will eliminate the extreme tail behavior. This is a dangerous misperception. They examined 15 major factors (market beta, size, value, momentum, operating profitability, low beta, idiosyncratic volatility, short-term reversals, long-term reversals, illiquidity, accruals, cash flow to price, earnings to price, long-term reversals and net share issuance). The table below shows the theoretical frequency with which the maximum drawdowns (MDDs) would occur if the return distributions were normally distributed. As you can see, the largest monthly drawdowns that actually occurred varied from once in 106 years (for long-term reversals) to once in 4.7 quadrillion (1015) years (in the case of operating profitability). Yet, they each occurred in the space of just 45 years.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Clearly, it’s important for investors to understand the nature of the risks they accept. And investors need to understand that each factor carries with it the risk of large drawdowns. In other words, if you cannot stand the heat, stay out of the kitchen. Importantly, this warning applies to the market beta factor, which had an MDD of 15.3 percent—if returns were normally distributed, this would be expected to occur just once in 1.6 million years! Investors who assumed returns were normally distributed would never anticipate such a loss.

There are a few other important points to note. First, investors dislike risks that exhibit both excess kurtosis and negative skewness—which is the case in 10 of the 15 factors (the five factors with positive skew were size, value, investment, and short- and long-term reversals). Thus, they require large premiums to accept such risks, providing reasons to believe the factors with negative skew and excess kurtosis should persist.

Second, it’s important to not consider investments in isolation. Instead, one should consider how their addition impacts the risk of the portfolio. The authors found that diversified portfolios of factors, while exhibiting excess kurtosis, actually exhibited positive skewness—the low correlation of returns of the factors to each other reduced the risk of large drawdowns. They found that portfolios of factors had much lower MDDs than the MDD of some of the individual factors. For example, they found that when building a portfolio of the six factors used in the most popular academic multifactor models (value, size, operating profitability, investment, momentum and low beta), standardized to a 10 percent volatility, the MDD was 16.1 percent, well below the 24.3 percent MDD of the two factors of operating profitability and momentum.

The bottom line is that diversification across factors is an important part of a prudent strategy. However, investors must accept that even portfolios that diversify across factors can experience severe drawdowns during crises.

The last issue we need to address is the time-varying nature of factor correlations.

Correlations of Factors

Arnott, Harvey, Kalesnik and Linnainmaa again explain:

Investors should be careful not to be fooled by the long-term factor return averages, because the market betas of factors vary widely over time. The value factor, for example, typically correlates negatively with the market. During the global financial crisis, however, the value factor correlated positively and significantly with the market, performing poorly as the markets tumbled and soaring as the stock markets rebounded.

However, it’s important to understand that doesn’t mean that diversification across factors is not effective over the long term (the horizon that should matter for long-term investors).

Consider the findings of a 2011 study by Clifford S. Asness, Roni Israelov and John M. Liew, “International Diversification Works (Eventually).” The authors explain that those who focus on the fact that globally diversified portfolios don’t protect investors from short systematic crashes miss the greater point that investors whose planning horizon is long term (and it should be, or you shouldn’t be invested in stocks to begin with) should care more about long-drawn-out bear markets, which can be significantly more damaging to their wealth.

In their study, which covered the period 1950-2008 and 22 developed market countries, the authors examined the benefit of diversification over long-term holding periods. They found that over the long run, markets don’t exhibit the same tendency to suffer or crash together. Thus, investors shouldn’t allow short-term failures to blind them to long-term benefits. To demonstrate this point, they decomposed returns into two pieces: (1) a component due to multiple expansion (or contraction) and (2) a component due to economic performance. They found that while short-term stock returns tend to be dominated by (1), long-term stock returns tend to be dominated by (2). They explained that these results,

…are consistent with the idea that a sharp decrease in investors’ risk appetite (i.e., a panic) can explain markets crashing at the same time. However, these risk aversion shocks seem to be a short-lived phenomenon. Over the long run, economic performance drives returns.

They further showed that “Countries exhibit significant idiosyncratic variation in long-run economic performance. Thus, country specific (not global) long-run economic performance is the most important determinant of long-run returns.”

What is true of countries is also true of factors that meet the criteria we established—they both exhibit significant idiosyncratic variation in long-run economic performance. Thus, diversification across both countries and factors is the prudent strategy. And discipline, the ability to stick to a plan, absorbing the short-term pain, is the key to success in investing. If there’s no pain, there’s no premium.

The bottom line is that investors must accept the risks that factor premiums, especially those tied to economic cycle risks, can crash at the same time during crises. However, that doesn’t mean that one should not diversify across factors. Instead, it means that it’s important that investors include a sufficient amount of safe fixed income assets in the portfolio to dampen the risk of the overall portfolio to an acceptable level.

Summary

Arnott, Harvey, Kalesnik and Linnainmaa provide investors with important information about factor-based investing. They demonstrated five unique risks that investors need to be cognizant of when investing in factors and why they could underperform the factors if they choose to ignore them. That knowledge can help you avoid making mistakes. In addition, knowledge helps provide the discipline that is critical to successful investing.

As Warren Buffett proclaimed:

Investors who are informed about the risks of their portfolio are far more likely to stay the course during the inevitable periods when it will perform poorly.

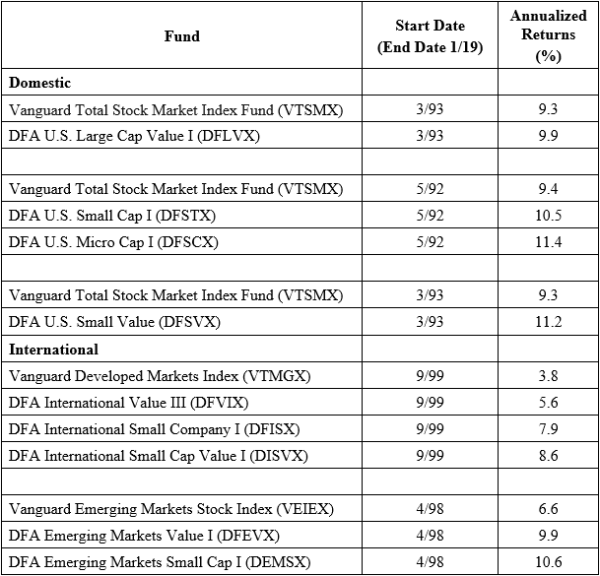

The bottom line is that factor investing, done well, can improve the odds of achieving your goals. As supporting evidence, consider the findings in the table below. It shows the live returns of the factor-based funds with the longest track record, those of Dimensional, and compares their returns with those of the market-like portfolios of the premier provider of index-based strategies, Vanguard. We’ll look at data for the longest period that both the factor-based fund of Dimensional and the total market fund of Vanguard have been available. Using live funds allows us to account for both fund expenses and trading costs. Data is from Portfolio Visualizer. (Full disclosure: My firm, Buckingham Strategic Wealth, recommends Dimensional funds in constructing client portfolios.)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

In each of the nine cases, the factor-based fund run by Dimensional outperformed the Vanguard total market fund, with the outperformance ranging from 0.6 percentage point to as much as 4.8 percentage points. Despite the higher fund expenses, both in terms of expense ratios and trading costs (due to higher turnover and trading in less liquid small stocks), the nine Dimensional funds produced an average outperformance of 2.6 percentage points. One other point to consider is that by increasing exposures to factors that have expected premiums, investors can lower their exposure to market beta because the equities they do hold have higher expected returns than the market. That allows them to hold more safe bonds. And by purchasing individual Treasuries directly or CDs, investors can eliminate the costs of a fund manager. The savings reduce the impact of the higher costs of factor-based funds. In other words, you have to consider the total portfolio’s implementation costs and not look at the expense ratios of the funds used in isolation.

As you have seen, well-designed factor-based strategies, which focus on the factors that have provided evidence of persistence, pervasiveness, robustness to various definitions and survive transactions costs while also having intuitive explanations for why their premiums should persist, have historically provided higher returns than market-based strategies.

For those interested, other articles I’ve written recently address the concerns raised here: “Time Varying Factor Premiums,” “3 Factor Investing Myths” and “The Failure of Factor Investing Was Predictable.”

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.