In “Your Complete Guide to Factor-Based Investing,” Andy Berkin and I presented the evidence demonstrating that momentum, both cross-sectional (or relative) momentum and time-series (or absolute, trend following) momentum, not only increases the explanatory power of asset pricing models while providing (historically) a premium, but that the premium has been persistent across time and economic regimes, has been pervasive around the globe and across asset classes, is robust to various formation and holding periods, has intuitive behavioral-based explanations for its existence (combined with limits to arbitrage, which prevent sophisticated investors from correcting anomalies), and is implementable (survives trading costs using patient trading strategies).

Research into momentum continues to demonstrate its persistence and pervasiveness, including across factors. Recent papers have focused on trying to identify ways to improve the performance of momentum strategies. For example, the study “Momentum Has Its Moments” found that momentum strategies can be improved on by scaling for volatility—targeting a specific level of volatility, reducing (increasing) exposure when volatility is high (low). And the study “Idiosyncratic Momentum: U.S. and International Evidence” found that results could be improved, reducing the risk of momentum strategies, by removing the return component due to market beta.(1)

Introducing Extreme Absolute Strength

Xuebing Yang and Huilan Zhang contribute to the literature on momentum with their study “Extreme Absolute Strength of Stocks and Performance of Momentum Strategies,” which appears in the June 2019 issue of the Journal of Financial Markets. Their study was stimulated by the findings from the 2013 study “Sources of Momentum Profits: Evidence on the Irrelevance of Characteristics,” which found that trading in stocks with more extreme past returns enhanced the performance of momentum strategies. The authors explored an alternative approach, asking the question: Does eliminating these extreme recent return stocks from the eligible universe improve returns? The strategy replaces the extreme stocks with T-bills, “consistent with the spirit that momentum strategies should avoid stocks with extreme recent returns.” Their database included all common stocks traded on the NYSE, AMEX and Nasdaq for the 1926-2015 period. They eliminated stocks with prices below $1.

The following is a summary of their findings:

- Stocks with extreme absolute strength (0-3rd percentile) feature very high volatility and are more likely to lose their momentum and experience reversals.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

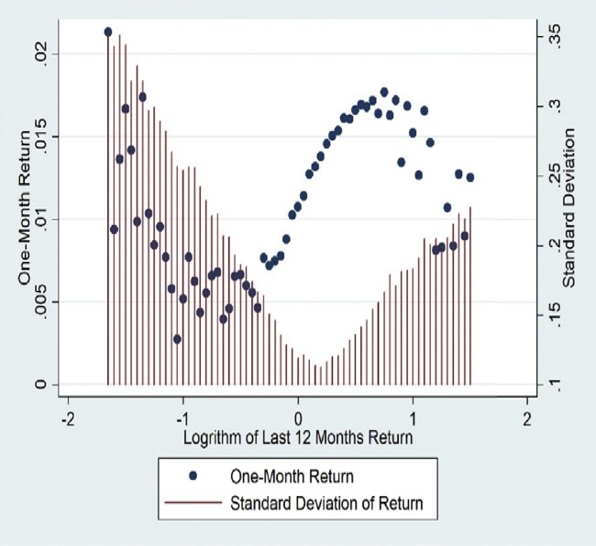

- As can be seen in the chart below, stocks with extreme absolute strength exhibit volatility that is disproportionally high relative to their potential contribution to the profitability of a momentum strategy.

- Removing these stocks from typical momentum portfolios significantly reduces the volatility of the portfolios while modestly increasing the average return in most cases, improving the risk-adjusted performance.

- The removal of stocks with extreme absolute strength can also effectively alleviate the problem of momentum crashes and renders momentum strategies profitable in the post-2000 era, a period during which momentum appeared to have vanished (due to momentum’s crash in April 2009).

- The strategy of removing extreme stocks works only when we identify the outliers using the absolute (versus relative) strength. On the other hand, stocks that have extreme relative strength exhibit weaker regularity in their future volatility and momentum. Removing these stocks from a momentum portfolio actually causes all the traditional performance indicators to deteriorate.

- The results held up in tests of robustness using various formation periods and holding periods, and minimum price per share.

As an example of the reduction in risk, Yang and Zhang found:

“In its most unfortunate month during 1965-2015, which is April 2009, a momentum strategy with a 12-month ranking period and 6-month holding period would experience a 39.23% loss per month. The average loss in the worst ten months of this strategy amounts to 21.77% per month. When stocks with absolute strength in the top or bottom three percentiles of historical distribution are removed from this portfolio, however, the loss in the worst month can be reduced to 17.08%, and the average loss in the worst ten months decreases to 11.01% per month. We find that avoiding momentum crashes is the main reason for the increase in the average returns of the strategy.

They also found that, while a momentum strategy with a 12-month ranking period and six-month holding period delivers a meager yearly return of about 0.72% (0.06% monthly) from 2000 to 2015, when stocks with extreme absolute strength are removed from the portfolio, the average yearly return could increase above 8.76% (0.73% monthly), and it is statistically significant.

They note:

The traditional momentum strategy is plagued with momentum crashes in 2000-2015. When our method helps it avoid most of the momentum crashes, the momentum strategy becomes profitable again in this period.

Summary

Yang and Zhang found that extreme absolute strength stocks are more likely to have momentum reversals, hurting the profitability of momentum strategies. Removing these stocks from typical momentum portfolios significantly reduces portfolio volatility, raising the portfolios’ Sharpe ratios and Sortino (a measure of downside risk-adjusted returns) ratios. They also found that removing extreme absolute strength stocks from momentum portfolios can effectively alleviate the problem of momentum crashes.

They concluded:

Our findings show that stocks with extreme absolute strength are a unique group of assets that should receive more attention in future research. These stocks exhibit some distinct features, such as disproportional volatility and a high likelihood of momentum reversal. Studies on them may help us better understand the behavior of portfolios, financial markets, and investors.

What’s the takeaway for investors? Momentum crashes are driven by highly negative betas of momentum portfolios during periods of market stress that are followed by market rallies. For example, when the stock market reversed in March 2009, momentum portfolios suffered. The approach suggested by Yang and Zhang effectively excludes the worst performing stocks in March 2009. It is highly likely that those are high-beta stocks. Since stocks with the highest betas are removed from the loser’s portfolio, the momentum strategy has less negative beta and therefore doesn’t suffer as much in the reversal in April 2009. Their paper suggests the improvement in performance is largely driven by reducing the pain of momentum crashes. It’s important to note that during good periods the strategy trims highest beta stocks from the portfolio of winners. That reduces beta of momentum during good periods. Thus, the momentum strategy that eliminates stocks with extreme returns has more stable beta across time and thus tends to perform much better than conventional momentum.

Yang and Zhang’s results seem to indicate that stocks with extreme absolute strength should be added to the list of stocks that are referred to as lottery stocks (such as IPOs, penny stocks, stocks in bankruptcy, and small growth stocks with low profitability and high investment). Investors seem to prefer them, even though historically stocks with these characteristics have generated very poor risk-adjusted returns (and thus should be avoided). Their insights provide value to all investors, not just those who employ momentum strategies, as long-only funds can add a screen to exclude them from their eligible universe of stocks—just as Dimensional Fund Advisors (and other firms that employ systematic approaches to portfolio construction) adds a screen to exclude stocks exhibiting negative momentum from their eligible universe of value and small stocks. (Full disclosure: My firm, Buckingham Strategic Wealth, recommends Dimensional funds in constructing client portfolios.)

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.