Over the past decade academics and practitioners alike have argued that multi-factor portfolios offer significant benefits to investors looking for enhanced and more diversified solutions. Among the papers making this argument is “The Death of Diversification is Greatly Exaggerated”, co-authored by my colleague Jared Kizer and Antti Ilmanen of AQR Capital. Their work was awarded the best article in the 14th annual Bernstein Fabozzi/Jacobs Levy Awards, having been chosen as the best paper published in the Journal of Portfolio Management over the prior 12 months.

The latest contribution to the literature

The latest contribution to the literature on multi-factor portfolio construction is from Benoit Bellone, Philippe Declerck, Mounir Nordine, and Thomas Vy, authors of the August 2019 study “Multi-Asset Style Factors have their Shining Moments.” They begin by noting that there are two types of multi-asset factors. The first are macro factors—fundamental sources of risk that are related to the global economic environment. They are perceived as “directional” and are often qualified as “Beta”, driving the absolute returns of asset classes. In terms of implementation, macro factors can be invested by taking long exposures to traditional asset classes.

The authors’ analysis focused on the second type, style factors. Unlike macro factors, they drive assets relative returns. Style factors should not account for the returns of equities for instance, but help explain for example why U.S. equities outperformed German equities. Most style factors (other than time-series momentum) are by construction, nondirectional and are implemented by taking long and short positions.

Their study focused on three cross-asset styles: “Carry, Value and Momentum, which have been argued ‘to be everywhere’ and supported by a growing body of cross-asset research.” Value can be defined as buying (selling) assets that are cheaper (more expensive) based on traditional metrics. Momentum can be defined as buying (selling) assets that have out (under) performed over given horizons. And carry can be defined as buying (selling) higher (lower)-yielding assets. They noted that they “believe that those three factors may be the most robust styles across asset classes and time.”

They based their choice on the following criteria: “We believe that any style factor should pass four filters to be selected:

- It should be justified and widely documented by academic research (which they cite examples of in each case). In particular, it should compensate for an intuitive and specific risk, which has its own cycle.

- It should be persistent across equity, bond and Fx markets over time based on very long data series.

- It also needs to be robust at multiple levels (security, sector and market levels);

- Finally, it needs to be weakly correlated to traditional asset classes and other styles; investable using only liquid instruments.”

They rejected other styles such as the “Defensive/Low-Beta” and “Size” that are highly related to directional market risks (Volatility, Credit risk) and/or cannot be investable using liquid instruments (Illiquidity factor).

Research Goals

The goal of their study was to try to answer the following questions:

- How to describe Multi-asset styles of performance across time and across different market regimes?

- How should Multi-asset styles be expected to behave during different phases of the Stock Market cycle?

- Are cross-asset styles sensitive to volatility conditions?

- Are there different responses to change in bond yields?

- Is there any style likely to be structurally more cyclical or defensive?

Eventually, we would like to contribute to the heated controversy opposing Style Rotation to Diversification. Is there a case for more time-varying and concentrated Multi-Asset style portfolio constructions?” In other words, should one build it and forget it, or try to time exposures based on the economic regime?

Their data sample uses daily data from December 27, 1999 to July 31, 2018, with data sourced from Bloomberg for Equity Index Futures (Emerging and Developed Market Country Indices, US and European Sectors), Government Bond Index Futures and Implied FX Forwards Rates and Spot currency prices, Factset Research for Equity Fundamentals and Thomson Reuters DataStream for interest rates and government bond-related fundamentals, or Macroeconomics time series.

The authors themselves noted the limitation of the relatively short time frame, covering just two economic regimes. For things like timing and regimes, having longer history is important. Their analysis begins by noting that since 1999, cross-asset style had followed their own cycles of expansion and contraction. The (1999-2007) and (2008-2018) periods had some structural differences, with most multi-asset styles experiencing a significant drop in their risk-adjusted performance since the 2008-2009 Great Financial Crisis. They then tried to understand what may have caused the structural weakening.

They note:

“First, both periods correspond to different monetary and business cycle environments. The first phase was being characterized by global housing and commodity booms accompanied by moderate but still positive real interest rates and non-perfectly synchronized monetary and fiscal policies. The second period was marked by extraordinary episodes of macro policy convergence (through quantitative easing, zero-bound policy rates, and synchronized fiscal stimuli). Lower global real interest rates, compressions in yield spreads and macro policy convergence may have explained some reduction in multi-asset risk premia, at least in the currency and fixed-income space.” Multi-Asset Style Factors Have Their Shining Moments Benoit Bellone, Philippe Declerck, Mounir Nordine, Thomas Vy

They cautioned against drawing too much from that analysis as “while such rough patches for alternative risk premia strategies may be frustrating, they already happened and are likely to happen again.” They quoted Cliff Asness “There is always a chance that the world has changed and that this time is truly different, and what was once true is no longer so… [but] ‘It’s different this time’ are the most dangerous words in investing”. In other words, the premiums may not have disappeared, it’s just that they may be regime dependent.

Next, they examined the question of predictability of factor premiums.

Predictability of Premiums

They began by noting that value styles are long cheap and short expensive assets. Cheap (value) assets have higher implied discount rates than expensive ones. Since the higher the discount rate of a given asset, the lower its duration, a long-short value strategy should be expected to exhibit a net short-duration exposure. For more color on the duration of equities take a read of my earlier post here and Wes wrote another here. In general, if interest rates are expected to rise (fall), value styles, because of their relatively high-risk premia, should outperform (underperform). Thus:

“…value strategies should outperform in rising yield environments, i.e., during the aftermaths of economic and financial crises when risk premia are already large. Value styles should also sparkle during periods of rising inflation expectations such as commodity booms or late-cycle phases of the business cycle when real interest rates are more likely to jump.” Multi-Asset Style Factors Have Their Shining Moments Benoit Bellone, Philippe Declerck, Mounir Nordine, Thomas Vy

They applied this same type analysis to the other styles such as Fx Carry and Value and Equity and Bond Carry. For example, they note:

“A relative high interest rate differential offers a compensation for currency depreciation, mainly due to higher expected inflation differential. As currency risk awareness rises at the end of a cycle, economic slowdowns are often the catalyst triggering capital outflows from the, riskier and less creditworthy, peripheral countries to the, riskless and creditworthy, core markets. Fx Carry should logically suffer during such periods of rising risk aversion and scarcer credit, often coinciding with economic slowdowns. At the apex of currency crises and bear markets, distressed currencies are likely to offer a higher interest rate spread, but also attractive valuations. Hence, Fx Carry and Value styles should both outperform during the early stage of a cyclical recovery, while both styles’ performance should be expected to diverge later. In the maturing part of the credit cycle, Fx Carry countries should exhibit growing imbalances (deteriorated competitiveness, external indebtedness, slowing credit demand, rising and diverging inflation rate differentials…) leading to poor valuations. In this topping period, Fx Carry should be more vulnerable, in absolute and relative terms compared to Fx Value. On the contrary, high duration styles, i.e., more sensitive to a change in the discount rate, such as for instance Equity and Bond carry should glow during periods of low and structurally falling inflation and interest rates, bear markets and economic slowdowns. In those times, assets with strong growth, high profitability but low risk premia (and low implied discount rates), are likely to be bid up, as strong nominal growth or high real returns look scarce and highly desirable.” Multi-Asset Style Factors Have Their Shining Moments Benoit Bellone, Philippe Declerck, Mounir Nordine, Thomas Vy

Considering cross-sectional momentum styles, they note that momentum is often negatively correlated to value styles. Thus, it should be expected to outperform when value tumbles, such as during bear markets and non-inflationary growth periods, characterized by steady or falling inflation expectations. And time-series momentum performs pretty well across clear trending economic phases, be it rampant asset class bear markets or low volatility bull markets.

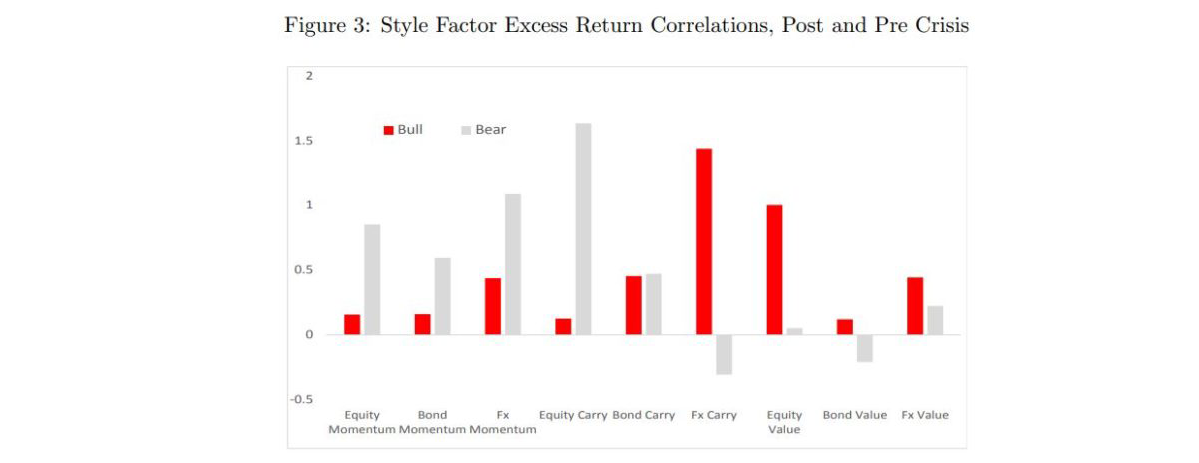

Looking specifically at equity styles they found that some styles have displayed a defensive bias (a tendency to outperform during bear markets and in high volatility regimes). This is particularly the case of Equity Carry, or Fx and Equity Momentum. On the other hand, some styles, such as Fx Carry or Bond and Equity Value, have exhibited a strong cyclical bias. They indeed tend to outperform during bull markets, low volatility regimes, and particularly in the aftermaths of market crises. And there were some styles, such as Bond Carry and Fx value, that showed little sensitivity to bear and bull markets. All momentum style factors tend to outperform in both phases of extreme risk aversion, which is in high and low volatility regimes. And as we already discussed, styles perform differently in rising and falling interest rate regimes. For example, Fx Carry, Equity Value, Bond Value tend to significantly outperform during rising rate, steepening yield curve regimes. On the other hand, Momentum styles, Equity Carry and Bond Carry have shined only during steady and falling yield episodes. The low correlation of the factors demonstrates their uniqueness as well as the benefits of diversifying across factors.

The authors concluded: “while Multi-Asset style factors are cash-neutral and close to market neutral across the cycle, we may find some financial and economic rationale for equity and interest rate regimes to impact their cyclical performance.

” The observation that factor returns are regime dependent leads to the temptation to time factors. In fact, the authors note that there are regimes where individual styles have delivered more than their historical average, and that they believe this stylized fact is due to the inner features of styles which have to be related to growth and interest rates regimes. With that in mind they examined whether an investor might be able to identify such market regimes on a real time basis. They found: “Across time and across regimes, a risk-balanced style portfolios has exhibited the highest performance (i.e. the lowest rank for a given percentile). It has also delivered the lowest rank dispersion across regimes. This suggests that, because of the benefits of diversification, beating a balanced portfolio, even conditionally to a given environment, looks very difficult.” Multi-Asset Style Factors Have Their Shining Moments Benoit Bellone, Philippe Declerck, Mounir Nordine, Thomas Vy

Conclusion

In their conclusion the authors noted:

“The Great Financial Crisis of 2008 has also marked a structural weakening in styles’ performance, likely due to major changes in macro conditions, of which unprecedented macro policy convergence, a compression in yield spreads and a fall in global real interest rates. Yet, this has not seemed to alter their inner characteristics.” Multi-Asset Style Factors Have Their Shining Moments Benoit Bellone, Philippe Declerck, Mounir Nordine, Thomas Vy

Their conclusion is basically the same as that reached by Cliff Asness in his 2016 paper “The Siren Song of Factor Timing.” Instead of trying to time factors, Asness recommended that investors should focus their attention on which factors they have the most confidence in, based on both evidence (particularly out-of-sample evidence including that in other asset classes) and economic theory. Having made that decision, investors should then diversify across these factors, staying the course through the inevitable crashes each factor will experience. He added that there is such great difficulty in timing factors that if you are going to “sin” by attempting to time them (which he didn’t rule out completely), he suggested that you only “sin a little.”

Asness’ recommendation is also consistent with that of the authors of the 2019 study “Optimal Timing and Tilting of Equity Factors”. While the authors, Hubert Dichtl, Wolfgang Drobetz, Harald Lohre, Carsten Rother, and Patrick Vosskamp, discovered that equity factors are predictably related to fundamental and technical time-series indicators and to such characteristics as factor momentum and crowding, they also found that such predictability is hard to benefit from after transaction costs.

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.