Trust and Financial Advice

- Burke and Hung

- Journal of Pension Economics and Finance, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Trust plays an essential role in financial decision-making. It’s so important that we have written on it prior posts here and here. In fact, trust is a predictor of stock ownership ( Guiso et al.,2008 ) and it also influences retirement savings behavior (Agnew et al., 2012). In this article, the authors ask the following research questions:

- Is trust in the financial sector an important predictor of financial advice-seeking behavior?

- Are individuals with a higher level of trust more likely to follow the advice they receive?

What are the Academic Insights?

The authors study survey data by analyzing the RAND American Life Panel, a nationally representative internet panel of over 5,000 respondents aged 18 and above). They use a measure of trust composed of five elements: trust in the stock market, banks, insurance companies, stockbrokers, and investment advisers. They also investigate a number of financial behaviors (DC plan participation, contribution behavior, withdrawal behavior, plan balances, and stock ownership) and measures of financial literacy and risk preferences. They also study data from a randomized controlled trial that exogenously varied access to (and provision of) financial advice.

The authors find the following:

1. YES- Across three different survey waves that span 2007 to 2011, the measure of financial trust is highly correlated with different types of financial advice-seeking: specifically related to retirement advice, DC plan advice, and advice in general. Additionally, the hypothetical choice experiment confirms that higher levels of trust do increase one’s propensity to seek advice. In fact, of the respondents whose trust scores were below the median, only 32% reported seeking retirement-related advice from planners or brokers, whereas 53% of respondents whose trust scores were above the median reported seeking retirement-related advice. There are some differences across demographic characteristics: individuals who are married, older than 45, college-educated, or have incomes above the national median are more likely to seek financial advice from a professional than their respective counterparts.

2. YES- By investigating how the recipient of advice, both solicited and unsolicited, affects performance on the hypothetical portfolio selection task, those who have higher trust in the financial system performed better on the portfolio allocation task (only for the solicited group). Additionally, the sizeable gap in behavior observed between those who choose to receive advice and those who choose against it is driven largely by self-selection, rather than the receipt of advice.

Why does it matter?

This paper’s results have several implications for (retirement) financial advice markets. First, low levels of trust may be significantly reducing the demand for financial advice. Second, there is no evidence that increasing the provision of advice by providing it to consumers without their request will improve financial decisions or outcomes.

Suggestions: 1) Increased understanding that investment advisors are bound to a fiduciary standard (legally required to act in their advisee’s best interest) may increase trust and by extension demand for these professionals’ services. 2) Instead of increasing advice distribution, it may be more effective to increase consumers’ understanding of, and trust that, high-quality sources of financial advice exist and let consumers self-select into advice.

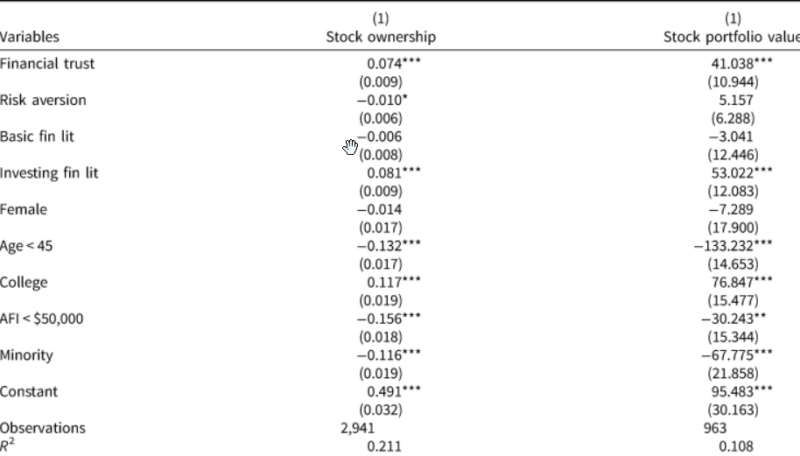

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We explore the relationships between financial trust and behaviors, attitudes, knowledge, and preferences related to utilizing professional financial advice. Using survey data from the RAND American Life Panel, we find that financial trust is correlated with advice usage and the likelihood of seeking advisory services. Leveraging an experiment that randomized provision of and access to advice, we find that trust is an important predictor of who chooses to receive advice, even after controlling for demographic characteristics and financial literacy. However, providing unsolicited advice has little impact on behavior, even for individuals with high levels of trust.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.