Sorry for the clickbait, but Hoover Institute fellow and “Grumpy Economist” John Cochrane’s answers to the seemingly benign question, “How should long-term investors form portfolios,” is too important to both advisors and academics to overlook.

His answer to the advisor community is not to remain passive with a simple 60/40 market portfolio and report alphas and betas, but rather to justify their fees by managing cash flows against liabilities such that the unique risks and tolerance levels of their individual clients are adequately smooth. This not only justifies their fees but also catches them up to advances in Modern Portfolio Theory.

His answer to the academic community bridges the intellectual gaps between the “Cambridge-school” and the “Chicago-school” by recognizing the practicalities and practices of investors. First, and apologies in advance for offending the “Chicago-school,” but investors aren’t hedging their wage income and calculating correlations with state variables when they are making investment decisions. It’s impossible. What investors care about are cash flows. And, sorry “Cambridge-school,” investors often act rationally in their pursuit of securing a steady stream of income while passing by the occasional $20 bill on the ground. Academics should justify their works by exploring the ramifications and opportunities given these differences in risk tolerance and needs among investors.

This summary of Cochrane’s keynote address, “New Developments in Long-Term Asset Management” given to the NBER Spring 2021 conference hopefully amplifies his message.

Cochrane’s Abstract:

How should long-term investors form portfolios in our time-varying, multifactor and friction-filled world? Two conceptual frameworks may help: looking directly at the stream of payments that a portfolio and payout policy can produce, and including a general equilibrium view of the markets’ economic purpose, and the nature of investors’ differences. These perspectives can rationalize some of investors’ behaviors, suggest substantial revisions to standard portfolio theory, and help us to apply portfolio theory in a way that is practically useful for investors.

Academics Have Made 55 years of Steady Progress in Understanding Markets; Investors and Advisors Need to Catch Up.

Modern Portfolio Theory has evolved over the last 55 years, but investors largely remain committed to only the first iteration of the theory. In the beginning, Bill Sharpe(1) and John Linter(2) touted simply owning the passive “Market” with varying degrees of leverage and cash to land on the “efficient frontier”. In this single period CAPM world, rational investors would seek returns as compensation for risk tied to their current portfolios. Actual investors have seemed to grasp the benefits of firing their expensive, tax-inefficient, and thus negative alpha-generating active managers in favor of passive funds. From 3% in 1995 and 14% in 2005, as of March 2020 passive funds have grown to 41% of combined U.S. MF and ETF assets under management(3). For domestic equity funds, the percentage managed passively is now over 50% and still growing(4).

Evidence began to quickly mount in academia as to the deficiencies of CAPM(5), and Modern Portfolio Theory accordingly evolved to better appreciate Robert Merton’s(6) multi-period world (i.e., Intertemporal CAPM or ICAPM) where investors hedge their current and future consumption against “state variables” with a variety of factors. Gene Fama and Ken French, for instance, first envisioned a 3-factor world model(7) and later a 5-factor model(8)

Actual investor behavior, in contrast, seems stuck in the first CAPM world. Instead of measuring correlations and volatility to help balance risk and return, most investors see their risk sorted into various asset buckets, regardless of whether those buckets (e.g., industry) represent priced risk. Although a smattering of these investors (and their advisors) invest in a zoo of factor funds, especially tied to value, those funds are almost never long-short, beta-neutral portfolios advocated by academics. Some ETF themes, like value’s typical counterpart “growth,” have no academic support at all. In fact, the newest fad — frontier funds – represents a step back towards active management.

Cochrane points out that even the practice of rebalancing lacks a theoretical foundation(9).

The use of asset groups like private equity and venture capital likewise has little support of enriching anyone except for the managers. And despite the growing realization that fluctuating discount rates allow for long-term investors to benefit from market panics when liquidity disappears, most endowments and plenty of investors ignore the opportunities and simply maintain a constant payout stream.

Why, Cochrane asks, have investor practices stayed largely stuck in old ways of thinking? Perhaps, he answers, investors are concerned more about cash flows — and academia should focus more on this topic. Perhaps, too, investors and their advisors should be asking not just questions to determine the appropriate balance between bonds and equities, but also questions related to a client’s ability to assume various risks.

He expands these thoughts in two related sections: “The Payoff Perspective” and “A General Equilibrium Approach”.

The Payoff Perspective

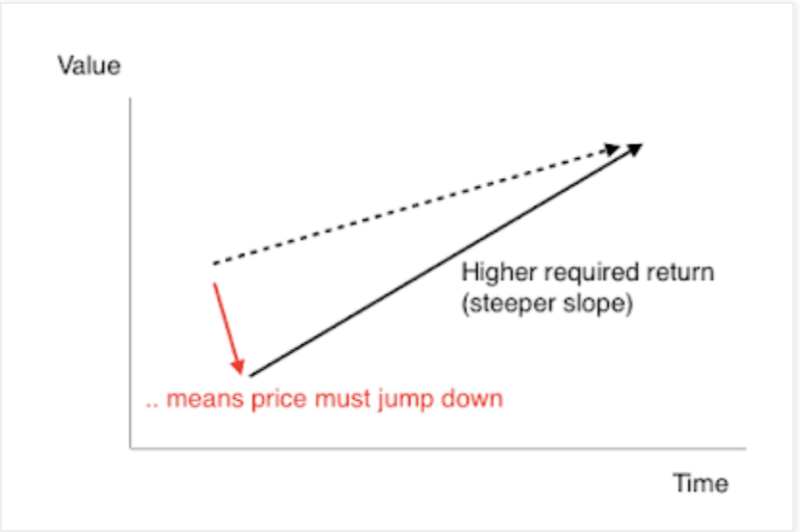

First, Cochrane asks us to reexamine what the “riskless” asset really is and builds from there. Cash is not riskless when matched to most liabilities. Cash rarely keeps pace with inflation — that college education bill or far-off needed retirement stream may grow much faster than the money sitting in a money fund. Instead, Cochrane argues for inflation-indexed annuities as the true riskless asset to build from. True, the value may fluctuate depending on the discount rate, but the real cash flows won’t — so don’t worry, be happy.

Cash flows that can meet your various needs, or as he points out — your spouse’s needs — are paramount. These cash flows, whether in the form of dividends or interest payments, vary much less than the volatility of the portfolio. Focusing on cash flows should allow for a greater willingness to accept volatility: lower prices just translate into higher expected returns for both bond and stock portfolios(10). Yes, dividends of the S&P 500 dipped slightly in both 2008 and 2020 but companies rightfully smooth these payments to reflect their estimates for long-term growth in cash flow.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Dividends don’t have to be the only means of payout. Buybacks and buyouts matter, too. Still, although theoretically equivalent, the desire for a steady dividend payment often trumps the tax efficiency of a share buyback(11) Investment advisors play a role in smoothing out portfolio payouts to allow for steady consumption, as well. He’s even willing to concede advisors should feel OK being paid for that!

Forming and managing the portfolio, calculating appropriate payouts, hedging state variables, and then cleanly characterizing the available payouts as a stream of “dividends” tailored to the individual might well belong under the hood of expert management, and worth a fee.

Focusing on smoothing consumption via consistent payouts also naturally invites in other assets into the overall portfolio, namely the investors’ own human capital to earn money. Additions to that enlarged portfolio should hopefully diversify career risk. A banker at Goldman Sachs, in other words, shouldn’t own Morgan Stanley. Not all investors are alike and become less so when taking their wage potential into account.

Individual investors and their advisors need to also understand how to manage the vacillating probability of permanent payout changes that threaten future consumption. Do the higher expected returns embedded in the value factor compensate for its greater payout volatility? For the investor working in a high technology start-up more associated with momentum portfolios, perhaps. For the investor working at a bank or energy company more associated with value portfolios, perhaps not.

As Cochrane states:

Currently, funds including “factor beta” funds such as value characterize their performance for investors by alpha and beta relative to a market index such as the S&P500…. That characterization is next to useless for long-term investors. Alpha and beta relative to the S&P 500 is only interesting if your portfolio, including your outside income and liability streams, consists only of the S&P500.

What, in other words, best protects my overall income stream, and how much variability to that stream can I handle? How much should I handle?

A General Equilibrium Approach

The answer to those concluding questions regarding how much risk I can, and should, assume requires us to also ask how much I am being compensated to assume that variability. Sadly, we don’t know. We can only extrapolate past returns to guestimate future expected returns. Even then, the world changes frequently enough so that true expected returns are likely constantly changing, too.

Luckily, the current market price represents an equilibrium of the average investor’s views concerning risk and rewards. As Cochrane says: “If you are not identifiably different than average, then you should hold the market portfolio.”

Sorry, being smarter than the market doesn’t count. Nor does finding someone smarter than the market given the propensity for charlatans within finance. Even if you discovered her, why wouldn’t you expect her to charge a fee in accordance with her skill leaving you with a market return? The right answer should often be “do nothing”, and Cochrane labels this reality the placebo test.

Portfolio Theory and Asset Pricing

Cochrane continues to probe why CAPM and ICAPM seem to leave investors with few choices other than “buy the market” despite their vastly different circumstances above and beyond simply tolerance for portfolio volatility. Most investors don’t even know their level of risk aversion tied to their portfolio variance until it smacks them aside the head, and they sell in a panic.

Related, who is taking the other side of your trade? If you want to own a portfolio skewed toward value or momentum stocks (and I admit I do), you should have a ready answer for why someone is willing to try and catch the falling knife or buy the “over” priced stock or bond (I’d like to think I do: see here, here and here, but plenty of smarter people than me could disagree). Are you really providing liquidity to some sap or are you failing to “look in the mirror,” and the sap is you? Be humble, in other words, then “look around the table” and tabulate the lions is his concluding test.

Too often this line of questioning leads us back to simply trying to figure out how risk-averse we are relative to the average investor and tilting our bond and equity exposure accordingly. Perhaps we supplement that recognition for differences in investment horizons leading us to the proliferation of target funds. But very few of us of are average. Is a low allocation to equities in retirement really correct for someone looking to bequeath assets? Does a high allocation to equities make sense to someone whose income fluctuates with the economy?

Outside Income Risk

Cochrane examines this last question regarding outside income risk at length. Given the inordinate size of our own human capital relative to our investment portfolios, shouldn’t we try and hedge wage income. If so, shouldn’t those with more stable incomes (or very small wage income) benefit from selling those hedges, in themselves basically wage insurance?

Sadly, Cochrane admits there is no good way of either buying or selling wage insurance. Sure, “running a long-run regression of [your] stream [of income] onto the set of asset payoffs” gives you a hedge portfolio to sell short but no one seems to do it, or even advises to do it. Why not? Doing so would go a long way in explaining not just time varying discount rates, equity premiums and excess returns of value portfolios.

Well, for starters, investors have little idea as to the variability of their income streams let alone how they correlate with various assets. Heck, we can’t even agree to the definition of value, let alone if it’s a proper “state variable” or after years of underperformance (well, until 2021) if its prospects for superior returns is greater or less than before(12). As an advisor myself, I can attest asking for income stream correlations from my clients would result in some blank stares.

Given impracticality of wage insurance, Cochrane instead advocates keeping it simple and intuitive. First, focus on what you can control, namely avoiding having to pay unnecessary fees and taxes. Second, understand the overall risks outside of the investable portfolio, especially in terms of income variability and real estate. If you work at JP Morgan, don’t own Wells Fargo, or at least construct a series of industry ETFs that avoid financials. And lastly, educate investors so they understand cashflows and discount rates.

Cashflow Betas, Factors, Preferences and Rare Disasters.

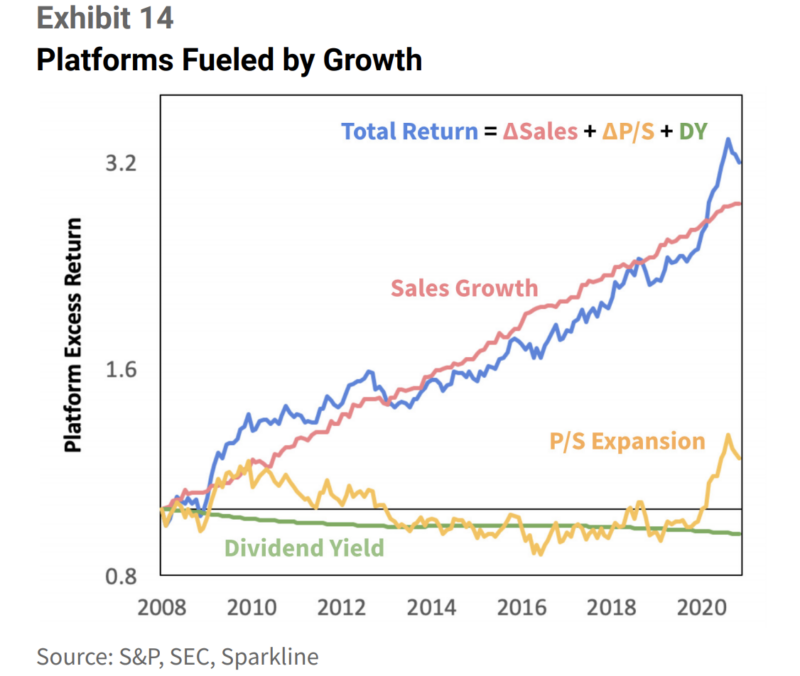

Cochrane expands on this latter point with a survey of some of the latest cashflow-centric research. Growth stock cashflows are delayed while value stock cashflows are immediate and often shrinking. Accordingly, in a rational world (well, at least in Sweden(13)), those with longer time horizons may favor growth stocks even if value stocks offer greater excess returns. Growth stocks will likely do better as the market discount rates for stocks drops, like it did in 2020. Woe to the young investor who didn’t open a Robinhood account and read Reddit and thus missed the boom in platform stocks but watch out to the Boomer reliant on portfolio payouts who jumps in now.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

He also ruminates on investors’ appetites to avoid risk, how they change depending on their liabilities and are related to their relative ability to survive disasters like 2008 and 2020. Many, including many universities and hedge funds, realized that this March they have more liabilities and income variability than they first perceived. Liquidity, as a result, froze.

Can these “rare disasters” and resulting spikes in risk aversion be avoided and perhaps taken advantage of? We are not all Warren Buffett. He once famously took the other side of disaster risk by selling deep out of the money puts prior to 2008(14). We need to make sure we survive whatever financial disaster hits us. Advanced planning for disasters like in 2020 allows some of us the wherewithal to “be greedy when others were fearful”. This difference in risk tolerance across time is what leads to changes in the discount rate across time.

Trading, Liquidity, and Institutional Frictions

Most startling to read from a University of Chicago Efficient Market accolade like Cochrane was his advocacy to play a more active role in portfolio management. Of course, although he is unwilling to engage in behavioral blaspheme (he is Fama’s son-in-law, for God’s sake), he does readily acknowledge that much of trading reflects less the changes in risk tolerance across individual lines and more on both perceived and real changes in relative information.

Should long-run investors adjust their portfolios based on new information? No, is the passive investor’s appropriate response. Even if your portfolio holds meme stocks like GameStop and AMC? OK, yes. Avoid the next dot.com “bubble”, OK, not his word, but holding anything with high trading volume and prices indicating an information premium is apt to perform relatively poorly. Related, liquidity affects expected return, so if you don’t need it, don’t pay for it. Do Treasuries Have a Place in Modern Portfolios? Not necessarily.

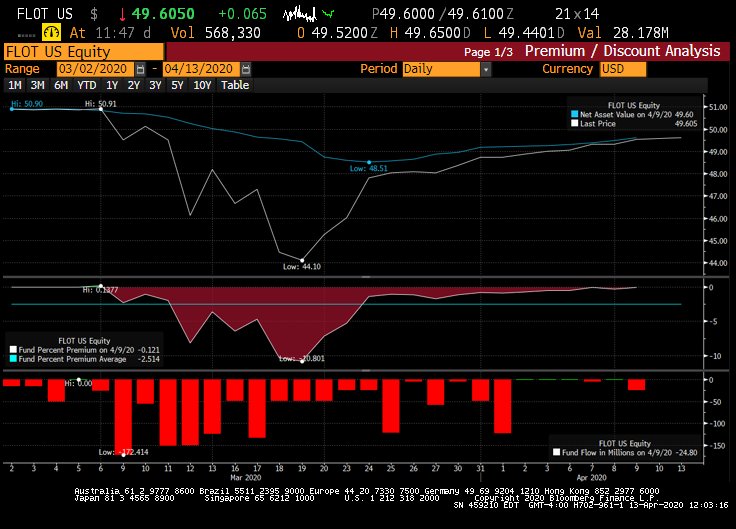

Institutional dynamics can also create opportunities to exploit, like the iron-clad idea of the $20 bill on the sidewalk (e.g., lasting deviations in interest rate parity). Rather than a story of investors being either too distracted or scared to pick up the money, he prefers, rightly in my opinion, a rational explanation around balance sheet and liquidity constraints. These constraints are more pronounced in moments of crisis like when ETF Authorized Participants (APs) let ETF prices like iShares Floating Rate Bond Fund ETF <FLOT> wander so far from their Net Asset Values (NAVs) during the Covid crisis.

To be fair, Cochrane, despite his reluctance to give behavioral finance its due, is unequivocal:

Perhaps, however, the alphas to be so gained are small but persistent, and subject to mark-to-market drawdowns. Then they are…looking at the issue as long-run payoffs [which] would allow long-run investors to see and fund the opportunity. Nonetheless, there is a deep and robust opportunity that someone should be taking – at a minimum family offices or wealthy individuals who do not have debt or other liability streams. Whether we call the phenomena time-varying risk aversion (habits), share demand due to trading frenzies, slow moving capital, institutional finance, or something else, there is a robust call for someone to take the other side.Deeply, the proposition in finance that demand curves are flat, so price equals present value of payoffs, does not stem from arbitrage. It stems from risk-bearing capacity, from the willingness of a pool of investors to take risks that others are temporarily unwilling to take.

Conclusion

Cochrane concludes not by capitulating the Chicago efficient market approach to portfolio management, but rather by building a needed bridge over to Cambridge’s more behavioral approach. Investors will always benefit from humbly asking what makes them so special to deviate from the average. If they look closely in the mirror, they should frequently conclude “not much” and default to focusing on keeping their taxes and fees low and maintaining the long-run income stream. Then stay the course. But not blindly.

If the investment advisory world can help you stay that course and better understand the risks to that income stream in relation to your other unique sources of income and future liabilities, they might even earn their fee. They may even help their clients find the occasional $20 bill on the ground while recognizing the approaching steam roller. Academics, in turn, can help build the tools to make all those tasks easier.(15)

References[+]

| ↑1 | Sharpe, William F. (1964). “Capital asset prices: A theory of market equilibrium under conditions of risk”. Journal of Finance. 19 (3): 425–442 |

|---|---|

| ↑2 | ] Lintner, John (1965). “The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets”. Review of Economics and Statistics. 47 (1): 13–37. |

| ↑3 | https://www.bostonfed.org/publications/risk-and-policy-analysis/2018/the-shift-from-active-to-passive-investing.aspx |

| ↑4 | https://www.institutionalinvestor.com/article/b1q8qzj06khp7c/Active-Managers-Kept-Losing-Out-to-Passive-Even-After-Markets-Crashed |

| ↑5 | Fama, Eugene F; French, Kenneth R (Summer 2004). “The Capital Asset Pricing Model: Theory and Evidence”. Journal of Economic Perspectives. 18 (3): 25–46. |

| ↑6 | Merton, R.C. (1973). “An Intertemporal Capital Asset Pricing Model”. Econometrica. 41 (5): 867–887 |

| ↑7 | Fama, Eugene F.; French, Kenneth R. (1993). “Common Risk Factors in the Returns on Stocks and Bonds.” Journal of Financial Economics.33 3-56 |

| ↑8 | Fama, E. F.; French, K. R. (2015). “A Five-Factor Asset Pricing Model”. Journal of Financial Economics. 116: 1–22. |

| ↑9 | See also my article on these pages Rebalancing…Not So Fast |

| ↑10 | I cover much of this reality in my article in these pages Market Volatility? Hang on and Enjoy the Ride. |

| ↑11 | See a prior post here: Buybacks: Why They Don’t Matter, Why They Do, and Why You Should Care but Still Relax. |

| ↑12 | See among many articles Cliff Asness of AQRs take on his “Gut Punch” |

| ↑13 | Betermier, Sebastien, Laurent E. Calvet, and Paolo Sodini. 2017. “Who Are the Value and Growth Investors?” The Journal of Finance 72 (1):5–46. URL https://onlinelibrary.wiley.com/doi/abs/10.1111/jofi.12473. |

| ↑14 | As I wrote about here. |

| ↑15 | See this piece on money doctors. |

About the Author: Jonathan Seed

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.