The rate of communication

- Huang, Hwang and Lou

- Journal of Financial Economics, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Previously, we have written about the Momentum of News, which highlights that lots of positive news can lead to future positive returns (without a look-ahead bias!). Today’s post builds on the concept that news (and sentiment?) are predictive for returns — which sounds intuitive. The writers of this paper apply the concept of disease transmission rates, and the average number of new infections generated by a single infected individual, to estimate the transmission of financial news.

The authors seek to answer the following questions:

- Can we estimate the “effective transmission rate” (aka the reproduction number) of financial news and opinions?

- Can we assess how much such rate varies with investor characteristics (age, income, gender, past, investment performances, and measures of lifestyle and state of residence)?

What are the Academic Insights?

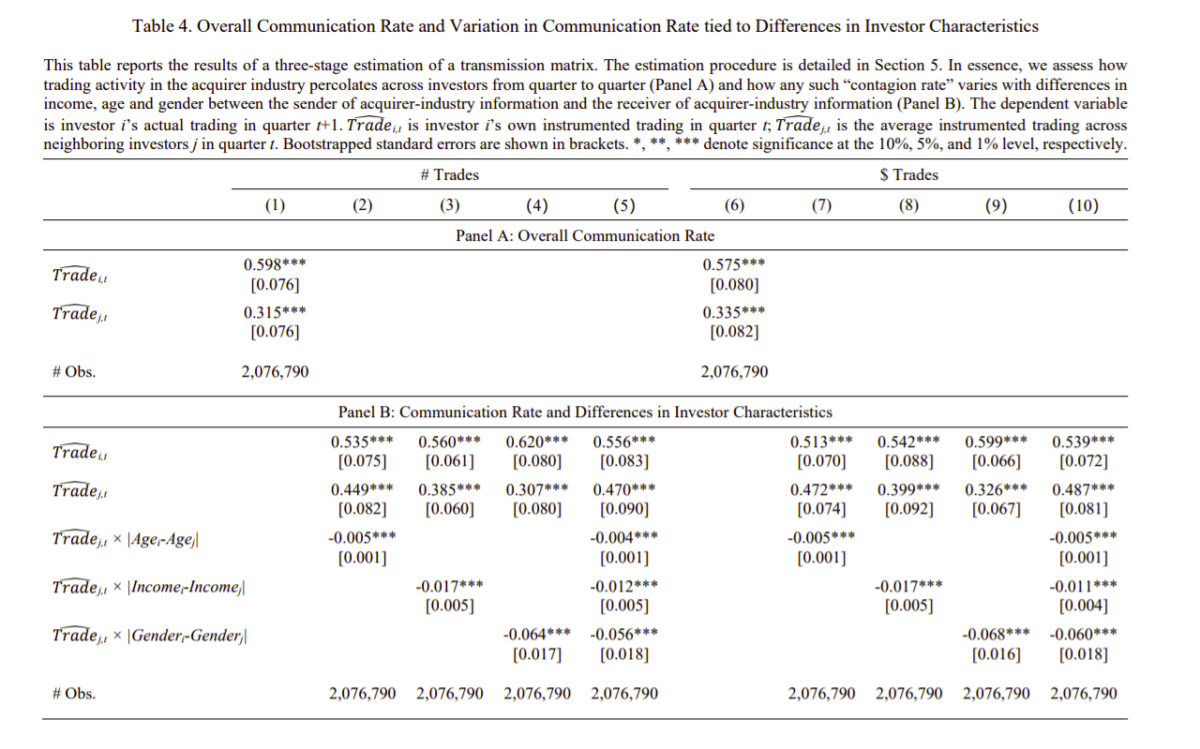

By studying a series of cross-industry stock-financed mergers and acquisitions (M&As) and detailed trading records of about 70,000 US households from a discount brokerage from 1991 through 1996, the authors find:

- The estimate of the overall communication rate is 0.32 with a 95% confidence interval of 0.17 to 0.46. In other words, one “infected” investor, on average, “infects” 0.32 of her neighbors. In epidemiology, an outbreak will fade if the reproduction number falls below one and will continue to spread if the number is above one. The finding of a communication rate of 0.32 for financial news suggests that while the transmission of financial information through social interactions is significant, it eventually dies out on its own without intervention, at least in this setting.

To put this into perspective, it was estimated (Cao et al., 2020) that the effective reproduction number of COVID-19 in China during the onset of its outbreak was 4.08 with a 95% confidence interval of 3.37 to 4.77. However, a key difference between the transmission of a pathogen and the transmission of an idea is that the latter occurs voluntarily. That is, for an idea to transmit, a mere interaction between two individuals is not sufficient. The sender of the information must be motivated to share the idea. The receiver must also be willing to listen and consider the idea interesting and credible enough to absorb and act on such an idea. This line of thinking forms the basis for this analysis of how much the communication rate varies with the characteristics of the underlying investor population.

- YES and here are the detailed findings:

- The transmission of an investment idea is strongest when there are few differences in age, income, or gender between the sender of financial information and her receiver. While the estimate of the overall communication rate is 0.32, the authors find that the communication rate between investors of the same age, the same income category, and the same gender rises to 0.47 with a 95% confidence interval of 0.29 to 0.65. (The homophily literature notes that people prefer to interact with people of similar backgrounds).

- The communication rate is the highest, 0.44, when both the sender’s and the receiver’s recent portfolio performances are above the sample median. If the sender’s recent portfolio performance is above the median, yet the receiver’s performance is below the median, the communication rate drops by 16% to 0.37. The communication rate is the lowest, 0.29, when both the sender’s and the receiver’s portfolio performances are below the sample median. (The psychology literature finds that people are more likely to share a story and others are more likely to listen if such a story helps receivers re-access positive emotional experiences).

- The communication rate is highest when the sender and the receiver lead a similar lifestyle as approximated through common ownership of unique vehicles (truck, recreational vehicle (RV), motorcycle). Moreover, the communication rate is highest in states for which survey evidence indicates that people spend more time visiting friends.

Why does it matter?

This paper is important because it contributes to the asset pricing literature by examining how information travels “privately” through social interactions, which are arguably getting more important with the advent of social technologies which may allow ideas to travel faster.

The Most Important Chart from the Paper:

Abstract

We study the transmission of financial news and opinions through social interactions. We identify a series of plausibly exogenous shocks, which cause “treated investors” to trade abnormally. We then trace the “contagion” of abnormal trading activity from the treated investors to their neighbors and their neighbors’ neighbors. Coupled with methodology drawn from epidemiology, our setting allows us to estimate the rate of communication and how much such rate varies with characteristics of the underlying investor population.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.