The Misguided Beliefs of Financial Advisors

- Juhani T. Linnainmaa, Brian T. Melezer, and Alessandro Previtero

- Journal of Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

The spotlight in this research(1) article is focused on the widespread criticism that the financial advice industry is rife with conflicts of interest that compromise the quality and cost of advisor recommendations. Despite regulations meant to eliminate conflicted advice, mandates that advisors act as fiduciaries, and banning commissions, these solutions have not completely addressed the problems associated with costly poor recommendations. The authors suggest the diagnosis and the solutions to these issues are mismatched. Setting conflicts of interest aside, perhaps advisors are simply overconfident of their investment skills. (see our piece on behavioral finance for more insight).

Do they really believe that passive products are not actually competitive alternatives for their clients and is there evidence that supports the fact that such a belief is misguided?

The authors use a unique data set provided by two large Canadian financial institutions that are directly suited to the research hypothesis:

Advisors within these firms provide advice on asset allocation and serve as mutual fund dealers (MFDs), recommending the purchase or sale of unaffiliated mutual funds. These advisors are not subject to fiduciary duty under Canadian law (Canadian Securities Administrators (2012)). The data include comprehensive trading and portfolio information on more than 4,000 advisors and almost 500,000 clients between 1999 and 2013. The data also includes the personal trading and account information of the vast majority of advisors themselves. This unique feature proves fruitful for the analysis—an advisor’s own trades reveal his beliefs and preferences, which allow us to test whether client trades that are criticized as self-serving may instead emanate from misguided beliefs.

- Are there similarities in the trading behavior of financial advisors and their clients?

- Are fees paid by advisors and clients similar too?

- Are advisers overconfident in their skill at identifying active managers and in their ability to outperform passive investments?

One caveat: The universe used to answer the research questions was limited to Canadian advisors and investors. Given that, the results may or may not be representative of other countries.

What are the Academic Insights?

- YES. Most Canadian advisors invest their personal assets in a manner similar to directions they provide to clients. The authors report correlations between the trading behavior of this universe of clients and advisors range from 0.12 to 0.31. Clients and advisors overwhelmingly buy funds that are actively managed, expensive and have exhibited high historical returns. The similarities extend to portfolio performance of portfolios and to asset purchases. The trades both make appear to be coordinated and systematic. There is little to no deviation in the types of trades made by clients and their advisors. However, there is little to no coordination between clients and other advisors. Surprisingly, when deviations do occur, they are characterized by a preference on the part of advisors for funds with even stronger historical returns, with even higher expense ratios, and with even more active and stock specific risk. As a result, clients and advisor share one last, sad similarity: an average net alpha of -3%, even after adjusting for rebates received by advisors. It does appear that there is some differentiation among advisors in that top decile advisors provide an advantage of some sort. Clients of bottom-decile advisors earn 170 bps less than top-decile advisors.

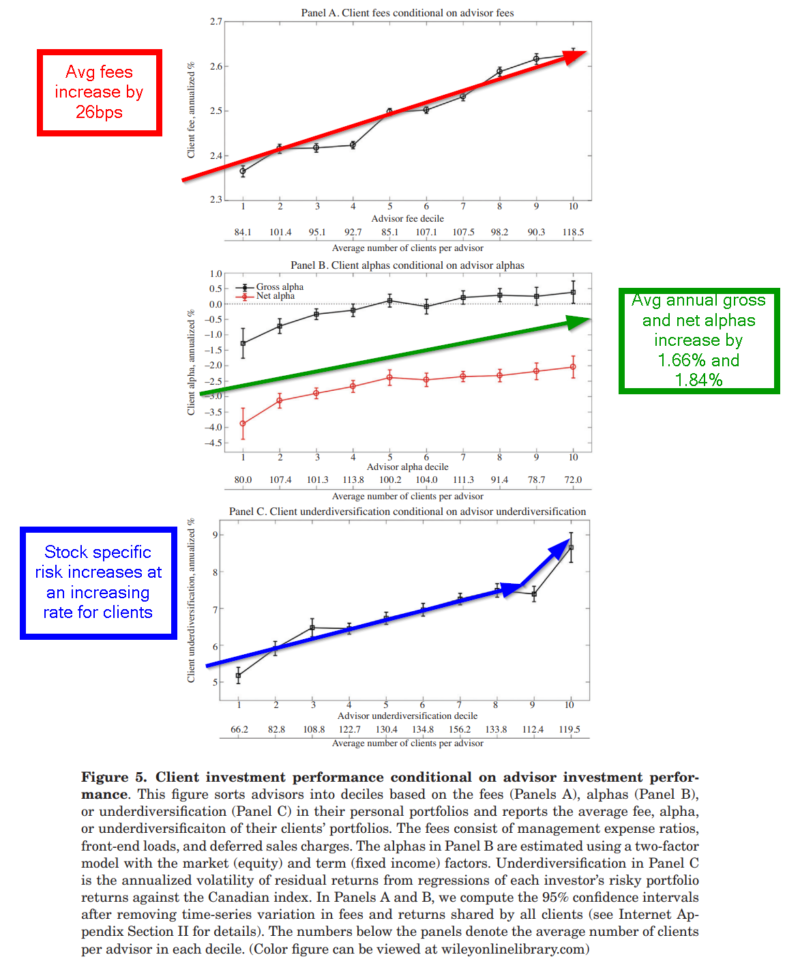

- YES. The average expense ratios are comparable with advisors at 2.44% and clients at 2.35%. One saving grace: at least advisors do not recommend funds that perform any worse than the funds they hold themselves. Advisors in the top decile based on fees recommend portfolios have expenses that are 26 bps higher than those in the bottom decile. See Panel A of Figure 5 below. Note the data in all 3 panels exhibit the performance of fees, alpha, and risk of clients conditional upon advisor performance.

- YES. The data reported in Panels B and C below suggest that advisors and clients invest in a manner that underperforms on a risk-adjusted basis (a two factor risk model is used to estimate alpha) and in fact hold underdiversified portfolios. Note the strong linear relationship exhibited by the characteristics of portfolios held by both advisors and clients. While the net alphas do increase across the board—that is, the poorest performing advisors recommend similarly performing investments for their clients. The highest decile advisors actually outperform slightly both in their own and client portfolios, although only on a gross basis. The bad news is that those portfolios also become increasingly riskier–stock specific risk increases in a linear fashion up to the top decile where it exhibits a very large relative increase.

Overall the results were very discouraging in terms of the quality of the advice given and followed by financial advisors. It boggles the mind, that even in the top-most deciles, advisors not only invest in but recommend funds to their clients that are more expensive, under-diversified, and still underperform on a net basis.

The authors conclude rather than self-serving behavior on the part of advisors:

“Their decisions imply that they have misguided beliefs: they are either overconfident in their ability to identify good investments or unaware that they could improve performance by investing passively.”

Why does it matter?

The focus of this research is to explain why financial advisors provide such low-quality advice at such costly rates and with such inferior performance. Rather than characterizing advisors as conflicted as to their fiduciary duties, the authors provide evidence that advisors are misguided in their beliefs about active management. The data clearly supports the idea that advisors recommend expensive, actively managed products because they believe that they as advisors have superior knowledge. Advisors willingly hold the investments that they recommend because they believe active management trumps passive, despite all evidence to the contrary. The policy implications of this outcome suggest that regulations limited to targeting the elimination of conflicts of interests for advisors may fall short of the mark.

The most important chart from the paper

Abstract

A common view of retail finance is that conflicts of interest contribute to the high cost of advice. Within a large sample of Canadian financial advisors and their clients, however, we show that advisors typically invest personally just as they advise their clients. Advisors trade frequently, chase returns, prefer expensive and actively managed funds, and underdiversify. Advisors’ net returns of −3% per year are similar to their clients’ net returns. Advisors do not strategically hold expensive portfolios only to convince clients to do the same; they continue to do so after they leave the industry.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.