The most basic tenet of financial theory is that risk and expected return are related. One widely used measure of risk is volatility. As far back as 1976, with the publication of Fischer Black’s “Studies of Stock Price Volatility Changes,” financial economists have known that volatility and returns are negatively correlated. This relationship results in the tendency to produce negative equity returns in times of high volatility—greater than expected volatility leads to negative stock returns as investors demand a higher risk premium to compensate them for the greater risk. The result is that the discount rate used to value future cash flows increases, lowering prices. Thus, there is a negative relationship between future returns (as the equity risk premium investors demand increases) and unexpected increases in volatility.

The knowledge of this relationship has led investors seeking for alternative ways to avoid big drawdowns during unexpected increases in volatility. To provide a hedging vehicle, the VIX index was created. The VIX is an index, like the S&P 500. However, it doesn’t measure price. Instead, it’s a weighted mix of the prices for a blend of S&P 500 index options from which implied volatility is derived. It was introduced in 1993 to provide an index upon which futures and options contracts on volatility could be written. The Chicago Board Options Exchange launched trading of VIX futures contracts in May 2004 and VIX options contracts in February 2006.

It’s important to understand that the VIX is a forward, not historical, measure of volatility. It represents investors’ expectations of future market volatility. If investors become fearful, their demand for portfolio insurance will increase, driving up the price of the VIX. As such, the media often refers to it as the “fear gauge.”

Jim Campasano contributes to the literature with his study, “Portfolio Strategies for Volatility Investing,” published in the Summer 2021 issue of The Journal of Alternative Investments, in which he examined a conditional strategy applied within a portfolio construct allocated equally to market and volatility risk. He began by noting that:

“investments in long volatility assets would have profited and hedged a broad-based portfolio during the financial crisis. Due to these hedging properties and the negative variance risk premium inherent in these assets, however, unconditional allocations to long volatility harm portfolio performance over time, given their negative returns.”

The negative outcomes from unconditional long exposure to the VIX led Campasano to examine the performance of an Enhanced Portfolio that dynamically invests in the S&P 500 Index and VIX futures:

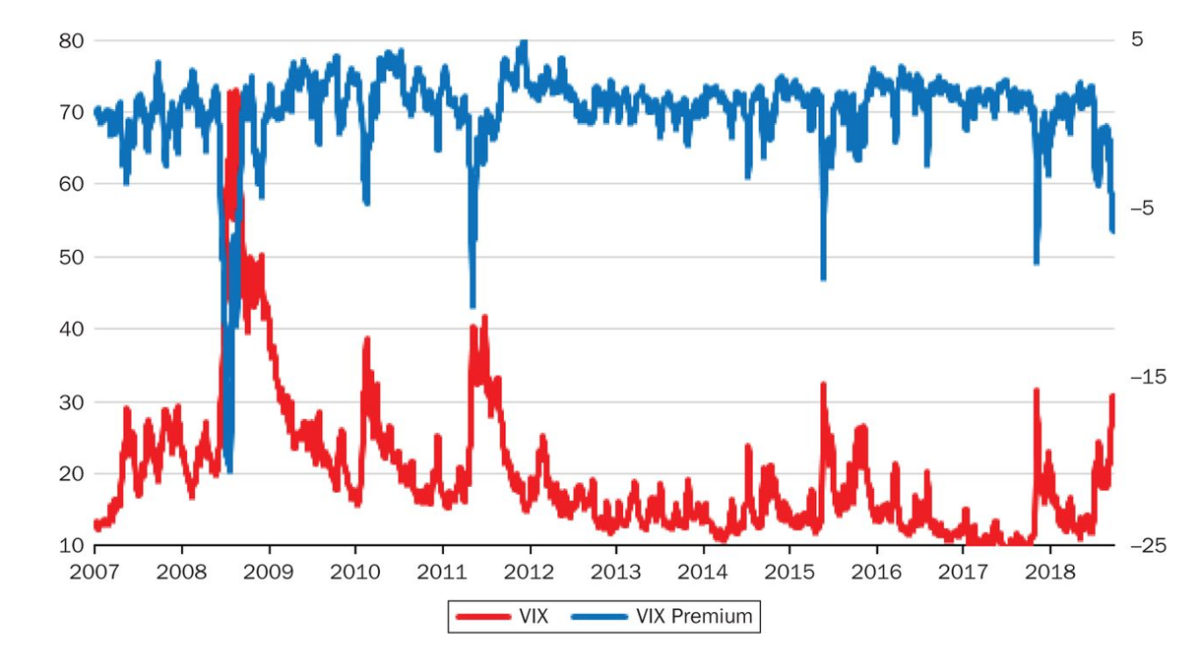

“The VIX futures investment is conditioned on the VIX premium, defined here as the difference between the 30-day constant maturity VIX future (VIX30) and VIX Index levels. When the VIX premium is positive and the VIX30 is higher than the VIX Index, the Enhanced Portfolio holds short VIX futures; when negative, it has long VIX futures positions.”

His data sample covered the period April 2007-2018. Following is a summary of his findings:

- The VIX premium, the difference between VIX30 and the current VIX Index levels, foretells investment risk and VIX futures returns.

- Although it was predominantly short volatility, the strategy was long volatility during much of the financial crisis.

- Both long and short volatility allocations were profitable over the sample period, and the strategy produced more consistent profits than the S&P 500 Index.

- From April 2007 through 2018, a portfolio that invested in the S&P 500 Index and the Enhanced Portfolio using VIX futures earned 1.79 percent on average each month, with a 1.02 Sharpe ratio, compared to a 0.68 percent return and a 0.50 Sharpe ratio for the S&P 500 Index. In addition, the Enhanced Portfolio’s downside volatility was similar to that of the S&P 500 Index, producing a Sortino ratio of 1.96 versus 0.71 for the S&P 500 Index.

- Unconditionally, the daily return of the VIX30 was -0.12 percent, consistent with a negative variance risk premium. Across quintiles, returns were decreasing. However, the VIX30 return was 0.27 percent when the premium was negative and -0.22 percent when it was positive.

- Conditioning a long or short VIX futures allocation on the VIX premium enables the portfolio to hold short VIX futures positions for most of the time and long VIX futures positions during turbulent periods.

- The Enhanced Portfolio was long volatility 19.1 percent of the time, short volatility 68.9 percent of the time, and flat volatility 12.0 percent of the time.

- In 2008 and 2018, the two years of the sample where the S&P 500 Index posted negative returns, the Enhanced Portfolio held long VIX futures positions 43.1 percent and 37.5 percent of the time, respectively, the two highest annual percentages. As a result of these long allocations, the Enhanced Portfolio outperformed each year, earning 39.9 percent and 2.0 percent, while the S&P lost 37.0 percent and 4.4 percent.

- While unconditionally holding a long VIX futures position lost money, both long and short VIX futures investments earned positive returns, and the portfolio outperformed related strategies over the entire period and each subsample.

- In 2012 and 2017, long VIX futures were held only 1.6 percent and 3.6 percent of the time, respectively, the lowest percentages of the sample. Due to the gains from short VIX futures positions, the Enhanced Portfolio outperformed by 17.8 percent and 4.4 percent.

- The Enhanced Portfolio outperformed in nine of the 12 years, with an average outperformance of 19.7 percent and underperformance of 6.2 percent.

- The Enhanced Portfolio outperformed the S&P 500 Index in each drawdown; during the longest and deepest drawdown from October 9, 2007 to March 9, 2009, the Enhanced Portfolio outperformed by approximately 72 percent.

- Over the entire sample period, the Enhanced Portfolio outperformed the S&P 500 Index and all related volatility strategies (such as put and covered call writing strategies) on both an absolute and a risk-adjusted basis, posting higher Sharpe and Sortino ratios. In addition, a Monte Carlo analysis, which randomly generated 10,000 subsamples from the sample period, showed that the outperformance was not an artifact of the sample period.

NOTES: This exhibit plots the VIX Index and the VIX premium, the difference between the VIX30, the 30-day constant maturity VIX future, and the VIX Index from April 2007 through 2018. The left vertical axis refers to the VIX Index, and the right vertical axis refers to the VIX premium.

Campasano also examined the performance of three variants of the Enhanced strategy.

“The EnhancedLong holds only long VIX futures positions; when the VIX premium is positive, it allocates entirely to the S&P 500 Index. In this regard, the EnhancedLong allocates only to volatility as a hedge. EnhancedShort is designed similarly, allocating only to short volatility when the VIX premium deems it advantageous(1). The third variant, the Enhanced90, adjusts the allocations so that the S&P 500 Index receives 90% of the risk allocation to reduce tracking error to the market and produce a portfolio with return volatility closer to the S&P 500 Index.”

In terms of construction rules, the author noted:

“While the VIX premium sign determines the VIX futures directional exposure, the relative weightings of the S&P 500 Index and VIX futures are determined under a risk parity approach: Portfolio weights are set such that expected return volatility is equal. In general, the VIX futures allocation is lower when market volatility is lower, which is favorable given volatility’s mean-reverting tendency. As long volatility allocations typically occur when volatility is elevated, the average short VIX futures allocation is approximately 20%, while the average long allocation is higher at 24%. When the VIX Index is in its lowest decile historically, the Enhanced Portfolio will not hold a short volatility position given its mean-reverting tendencies.”

Compasano found that all three performed favorably compared to the S&P 500 Index over the entire period and in two subsamples.

His findings led Compasano to conclude:

“Conditioning an allocation to volatility on the VIX premium enables investors to benefit from a long VIX futures position during heightened market risk and to profit from a short volatility holding during benign conditions. Over the period examined, the Enhanced Portfolio generates consistently positive returns relative to other portfolios, posting higher absolute and risk-adjusted returns.”

Investor Takeaway

In our book, “Your Complete Guide to Factor-Based Investing,” Andrew Berkin and I found that out of the hundreds of factors identified in the literature, only seven met each of the six criteria we recommended investors require a factor to have demonstrated before considering an allocation to that strategy. The carry trade is one of the seven factors we recommended, as it meets the criteria of having demonstrated a premium that is persistent across economic regimes, pervasive around the globe and across asset classes (stocks, bonds, commodities, and currencies), is investable (survives transactions costs) and has intuitive explanations for why the premium should be expected to persist. As the Enhanced strategies studied by Campasano are related to the carry trade, his findings provide further evidence of the pervasiveness of that factor, providing increased confidence that the premium related to it will persist.

Important Disclosures

The information presented here is for educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based upon third party data which may become outdated or otherwise superseded without notice. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. By clicking on any of the links above, you acknowledge that they are solely for your convenience, and do not necessarily imply any affiliations, sponsorships, endorsements or representations whatsoever by us regarding third-party websites. We are not responsible for the content, availability or privacy policies of these sites, and shall not be responsible or liable for any information, opinions, advice, products or services available on or through them. The opinions expressed by featured author are their own and may not accurately reflect those of Buckingham Strategic Wealth® or Buckingham Strategic Partners®, collectively Buckingham Wealth Partners. LSR-21-129

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.