Market timing is akin to chasing the Investing Unicorn: Give me “High returns with limited risk.” Now, we certainly love high returns with low risk. Of course, we also love losing a ton of body weight without having to exercise or go on a diet! In this article, we talk about avoiding the big drawdown with trend-following investment strategies.

Unfortunately, there is a problem with the market timing investing unicorn:

Problem #1: Unicorns don’t exist, and neither do high returns with low risk.

Sadly, high return assets with low-risk profiles don’t exist. Assets that earn high returns, such as equities (e.g., an S&P 500 index fund), come with a lot of risks (i.e., you can lose over half your wealth). The only way to earn high returns, but limit the risk, is to develop a timing methodology that identifies how to sell the high-returning asset before it decides to jump off a fiscal cliff.

This brings me to another problem in the search for high reward and low risk:

Problem #2: Market-timing is extremely difficult.

Let’s start this conversation with a concise summary of a 55-page academic analysis of a variety of systems that claim to have perfect market-timing ability:

Trying to perfectly time the market is a waste of time.

There you go. You no longer need to read this classic academic paper in which Ivo Welch and Amit Goyal assess a variety of market timing variables.

Our own research over several years confirms this sad reality. We’ve reviewed hundreds of different concepts and the results are not promising. Most signals never “survive” intense empirical scrutiny and we are generally skeptical of ANY system that purports to work all the time.

Simply stated: nothing works ALL the time.

Trend-following systems, which represent a form of market timing, are no different. They don’t — and can’t — work all the time.

A PDF version of this is available here.

Unicorns Don’t Exist. Got it. What’s This Trend-Following Stuff All About?

There is a glimmer of light at the end of this investing tunnel. Specifically, academic research indicates that investors who can stomach short-term volatility, avoid benchmark comparison, and follow a model, can systematically outperform over long periods of time. We find the same conclusion with what is often referred to as “tail-risk” investment strategies, better known as trend-following strategies.

Historically, two elements provide tail-risk protection:

- Focus on Strong Absolute Performance

- Focus on Strong Trending Performance

Of course, past performance is certainly no guarantee of future performance; nonetheless, historically, these methodologies have avoided large drawdowns. They haven’t eliminated short-term volatility and one can be sure they will underperform a buy & hold index at some point; however, they have protected portfolios from the most extreme loss situations.

Let’s explore a simple trend-following tool and what the evidence to date can show us.

Rule 1: If weak absolute performance appears, go to cash.

In the illustration below, the white line represents an asset class with poor absolute performance. In general, avoid assets with poor absolute performance.

Rule 2: If weak trending performance appears, go to cash.

In the illustration below, the purple line represents a long-term trend line (e.g., a moving average) and the white series represents real-time prices. The red circle highlights a point where the real-time price falls below the long-term average. In general, avoid assets with poor trending performance.

Do these simple tools work? Let’s look at the data.

Moskowitz, Ooi, and Pedersen, in a formal academic paper, highlight that technical rules don’t work all the time, but they have been effective at providing downside protection, historically:

“We document significant ‘‘time series momentum’’ in equity index, currency, commodity, and bond futures for each of the 58 liquid instruments we consider……A diversified portfolio of time series momentum strategies across all asset classes delivers substantial abnormal returns with little exposure to standard asset pricing factors and performs best during extreme markets.”

While market timing systems that work 100% of the time are impossible, we see that some systems, if followed over long periods, can work over time. It all gets back to discipline and being patient. In other words, can you stick with a process over a long period of time? Most people can’t.

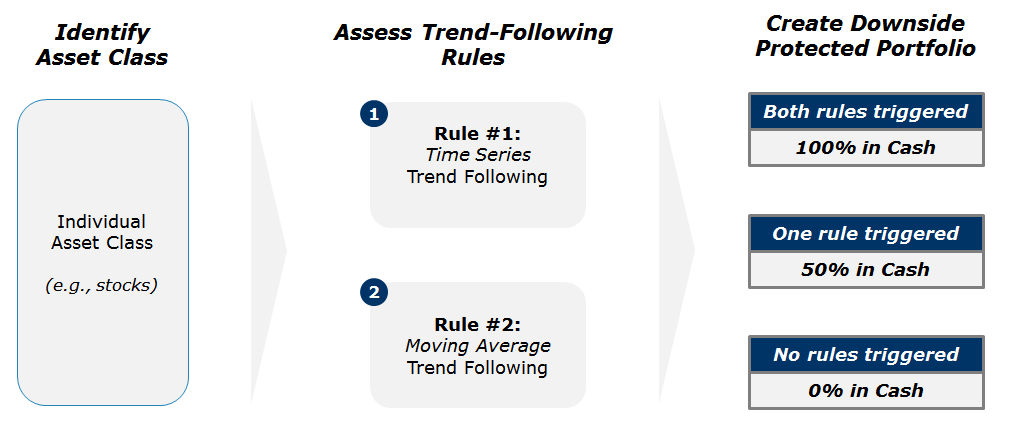

Let’s simplify the analysis presented in formal academic research and focus on analyzing 2 simple rules. Let’s call our trend-following rules, the “Downside Protection Model:”

The Downside Protection Model (DPM) follows two simple rules:

- Time Series Momentum Rules (TMOM)

- Simple Moving Average Rules (MA)

Let’s review the details of our simple rules:

- Absolute Performance Rule: Time Series Momentum Rule (TMOM)

- Excess return = total return over the past 12 months less return of T-Bills

- If Excess return >0, go long risky assets. Otherwise, go long alternative assets (T-Bills)

- Trending Performance Rule: Simple Moving Average Rule (MA)

- Moving Average (12) = average 12-month prices

- If Current Price – Moving Average (12) > 0, go long risky assets. Otherwise, go long alternative assets (T-Bills).

We assess these rules monthly and it is assumed we transact at the close of the month (in reality we would execute at a different time). These two rules are similar in nature and actually mathematically related.(1)

How can we combine these two principles in a simple way?

We find that complexity does not add value and simple models often beat experts. We extend this belief to our trend-following system by keeping it simple: 50 percent Absolute Performance (TMOM) and 50 percent Trending Performance (MA).

An Overview of the Downside Protection Model: 50% TMOM, 50% MA

Below is a figure that illustrates the basic trading rules we apply to provide downside protection on portfolios:

The system is simple: trigger one rule, go to 50% cash. Trigger both rules, and go to 100% cash. No rules triggered implies 100% long risk.

How Has the Trend-Following System Performed?

We provide a series of empirical tests on the system and apply the methodology to generic market indices. The goal is to identify if the system can achieve our goal of minimizing the chance of large drawdowns.(2)

Our core samples include 5 asset classes, assessed over the 1976-2014 time period:

- SPX = S&P 500 Total Return Index

- EAFE= MSCI EAFE Total Return Index

- LTR = The Merrill Lynch 10-year U.S. Treasury Futures Total Return Index

- REIT = FTSE NAREIT All Equity REITS Total Return Index

- GSCI = S&P GSCI Total Return Index

Results are gross, no fees are included. All returns are total returns and include the reinvestment of distributions (e.g., dividends). Data sources include Bloomberg. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

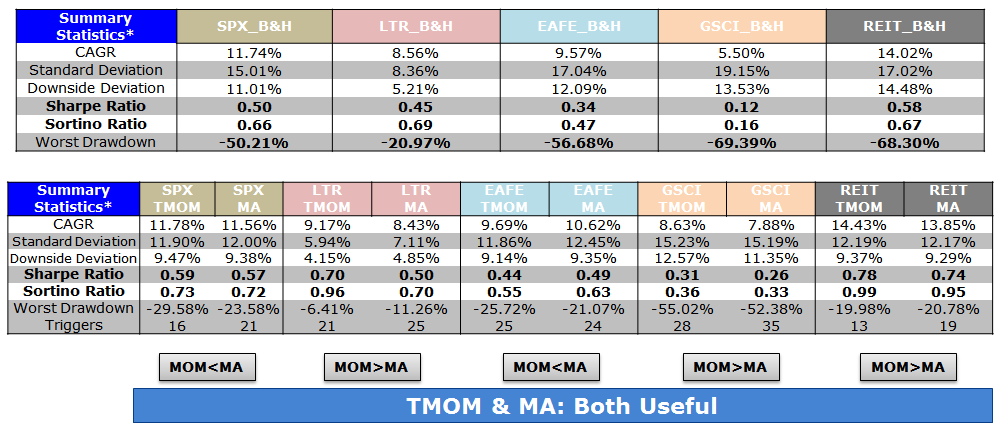

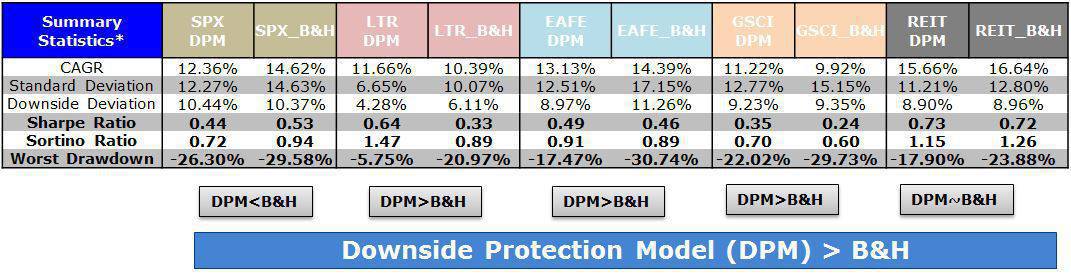

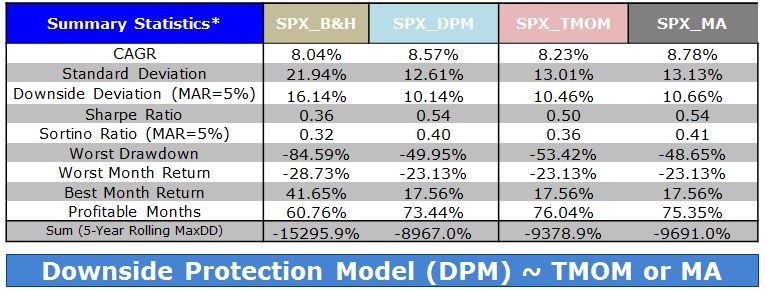

Comparison #1: Looking at these basic rules individually: Absolute Performance (TMOM) vs. Trending Performance (MA)

Before we compare the system as a whole, let’s compare each rule against the other to see if one is particularly more effective. From January 1, 1976 through December 31st, 2014, here is what we find:

- TMOM wins 60% of the time, MA wins 40% of the time (win = better Sharpe & Sortino; Loss = Sharpe & Sortino worse; Tie = combination of some sort)

- TMOM triggers around 20% less than MA does (number of triggers refers to the number of times the rule breaks out of the asset class and goes to T-Bills).

Bottom line: Both rules have been effective at providing downside protection.

Below are the stats:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

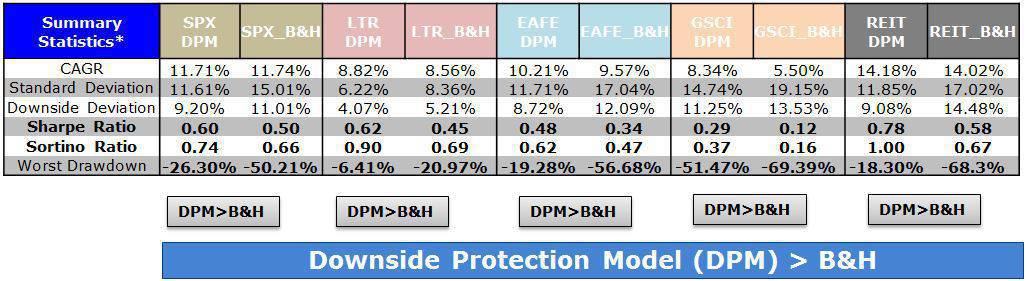

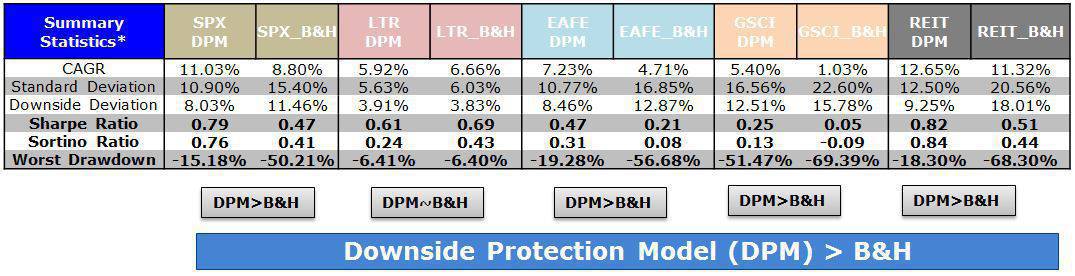

Comparison #2: Assess the Integrated Trend-Following Model: Absolute Performance (TMOM) plus Trending Performance (MA)

Now let’s combine the rules into our simple Downside Protection Model (DPM) and see if any incremental improvement occurs. Here is what we find:

- Downside Protection Model (DPM) wins overall (win = better Sharpe & Sortino; Loss = Sharpe & Sortino worse; Tie = combination of some sort).

Bottom line: Combining the rules into a single Downside Protection Model (DPM) appears to work.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Note: We have a post on the “World’s longest trend-following backtest,” and there are additional robustness tests are available in the appendix. We test every data set we can find!(4)

Are Trend-Following Models Sustainable?

The basic results above highlight that our simple trend-following system can potentially reduce the realized maximum drawdown for a portfolio.(5)

But perhaps the entire exercise above is an example of data mining and over-optimization. Nobody can ever prove, beyond any doubt, that a market timing model works. There is always a chance that any historical finding is driven by randomness, and thus, past performance will not reflect future performance. In the appendix, we stress test this system across numerous time periods and different markets, all of which present similar conclusions. This helps alleviate fears of data mining, but can never eliminate this potential.

However, we believe there is a behavioral story underlying the success of trend-following systems. Consider the concept of dynamic risk aversion, which is the idea that human beings don’t stick to a set risk/reward behavior—their appetite for risk can change depending on their recent experience.

For example, imagine we are making a decision to build a new house in California along the San Andreas Fault. If we just lived through an earthquake, taking on the risk of building a new house on the San Andreas Fault is probably scarier, even though the probability of another earthquake may not have changed. In contrast, when there hasn’t been an earthquake in fifty years, building a new house along a fault is not a big deal. As this example shows, our perception of risk is not constant and can change based on recent experience (if you doubt this example, kindly look at a picture of San Francisco’s skyline). In terms of market crashes, we will likely overreact to extreme times and underreact to peaceful times despite the statistical probability to the contrary.

Another assumption economists sometimes make is that risk, often measured in terms of standard deviation, or “volatility,” is relatively constant. These assumptions are challenged when extreme stock market drawdowns occur. Let’s look at another example: a 50% market correction when fundamentals imply a 20% correction is sufficient.

As market prices drop below the twenty percent threshold, an economist assumes that the new price is a bargain. Expected returns have gone up after prices have moved down, while volatility and risk aversion are assumed to be relatively constant. Implicitly, investors should swoop in to buy these cheap shares and bring the market to equilibrium (which in our example is their so-called fundamental value).

But this doesn’t happen.(6)

Stocks can—and have—gone down over 50 percent, and these movements are much more volatile than the underlying dividends and cash flows of the stocks they represent! Remember 2008/2009? How many investors swooped in to buy stocks at that point? If you’re like most humans, you threw the baby out with the bathwater and kept selling!

One approach to understanding this puzzle is by challenging the assumption that investors maintain a constant aversion to risk. Consider the possibility that investors change their view on risk after a steep drawdown (i.e., they just lived through an earthquake). In other words, fear rules the day, not rationality. Even though expected returns go up dramatically, risk aversion shoots up dramatically as well. This change means prices have to go down a lot further to justify an investment in these “cheap” stocks. This heightened aversion to risk, following a steep price drop, leads to more selling, and more selling leads to even more hate for risk, which leads to more selling, and so forth. What you end up with is a stampede for the exit and an intense sell-off in the marketplace—below fundamental value and well beyond what a traditional economist would consider “rational.” (One can review how market volatility affects our brains in more detail.)

Trend following and big drawdowns

The discussion above is a simplified story of investor psychology in the context of a stock market drawdown. For exposition purposes, we are leaving out many potentially important details. However, if one believes that investors rethink their tolerance for risk during a market debacle, and tend to sell shares at any price, this might help explain why long-term trend-following rules, systematically get an investor out of a cliff-diving bear market before everyone has jumped ship, have worked over time.

Of course, trend-following rules will only work if the massive bear market doesn’t happen in a short time period before the long-term trend rules can signal an exit. Technical rules will not save an investor from a 1987 type “flash” crash, but they can save an investor from a 1929 or a 2008 type crash, which can take a few months to develop. In the end, if one believes in a price dynamic that involves steep and relatively sharp declines, followed by slow grinding uphill climbs, simple technical rules will, by design, improve risk-adjusted-performance.

Oh, we almost forgot the most important point, we should mention that following a trend system is incredibly challenging from a discipline standpoint. One can expect to underperform during bull markets, and the only recourse is that you have a shot at avoiding a large drawdown during a bear market. Many investors theoretically like that concept (give up some upside to avoid huge losses), but in practice, it is extremely tough to lag on the buy and hold equivalent strategy for years on end. Many investors give up on the trend model, typically at the worst time. Human nature is tough to override.

Conclusion on avoiding big drawdowns

Simple trend-following rules focused on absolute and trending asset class performance, seem to be useful in a tail-risk management context. Our analysis of the downside protection model (DPM), applied on various market indices, indicates there is a possibility of lowering maximum drawdown risk, while also offering a chance to participate in a majority of the upside associated with a given asset class. Important to note, applying the trend system to a portfolio will not eliminate volatility and the portfolio will deviate (perhaps wildly) from standard benchmarks. For many investors, these are risky propositions and should be considered when using a trend-following construct.

Note: We implement our trend-following system via our Robust Asset Allocation system, as well as in our Value Momentum Trend Index.

References[+]

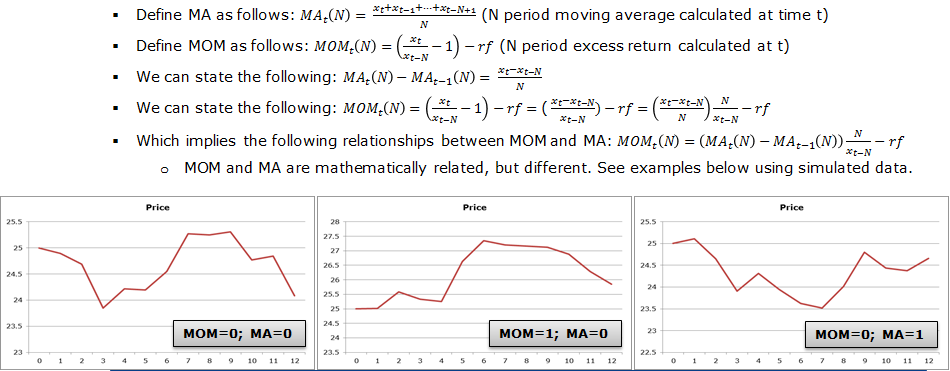

| ↑1 |

Mathematical Relationship Between TMOM and MA The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. |

|---|---|

| ↑2 | Note, that the goal is not to maximize return or minimize volatility but to minimize the chance of a large drawdown. |

| ↑3 |

Statistics Definitions

|

| ↑4 |

Robustness test of the integrated trend-following model across time periods and marketsSubperiod: 01/01/1976-12/31/1995

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Subperiod: 01/01/1996-12/31/2014

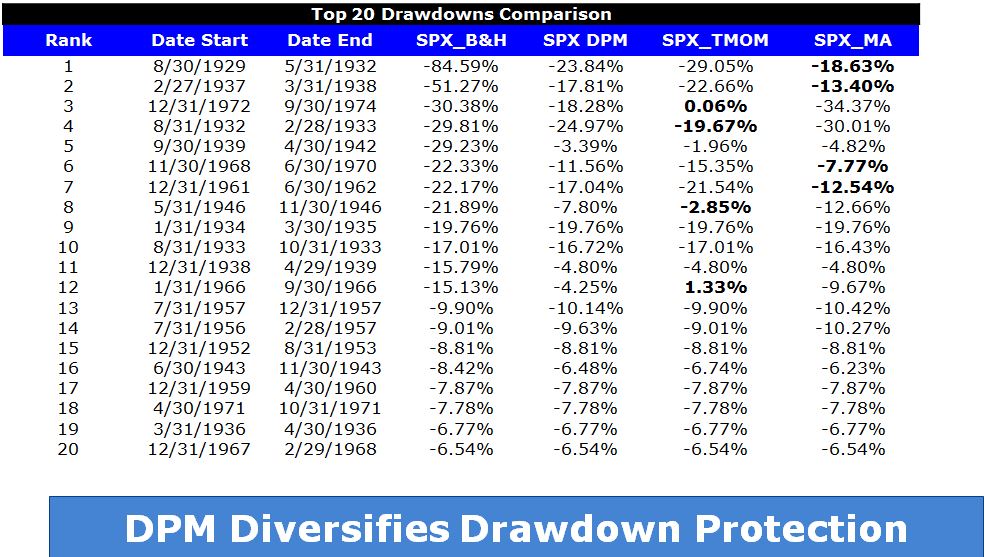

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request. Out of Sample Test #1–> U.S. Market (01/01/1928-12/31/1975)Our core sample includes 1 asset class, assessed over the 1928 to 1975 time period:

Results are gross, no fees are included. All returns are total returns and include the reinvestment of distributions (e.g., dividends). Data sources include Bloomberg. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Drawdown Comparison

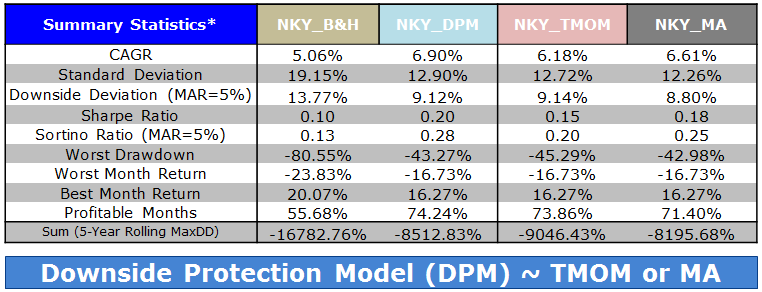

Out of Sample Test #2 –> Japanese and German Stock MarketsOur robustness samples include 2 global markets (Japan and Germany):

Results are gross, no fees are included. All returns are price returns and DO NOT include the reinvestment of distributions (e.g., dividends). Data sources include Bloomberg. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. We use zero as the alternative asset return when a trading rule is triggered. Nikkei Summary Results (1971-2014):

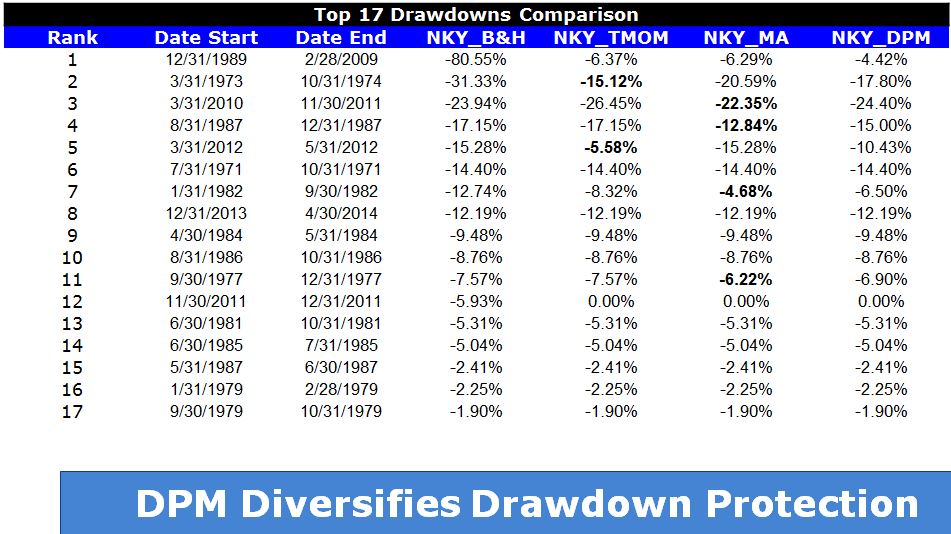

Drawdown Comparison (Nikkei)

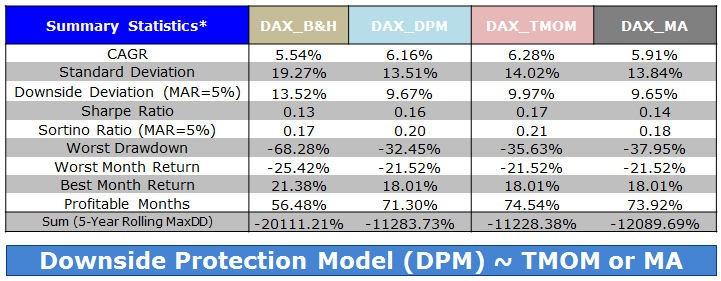

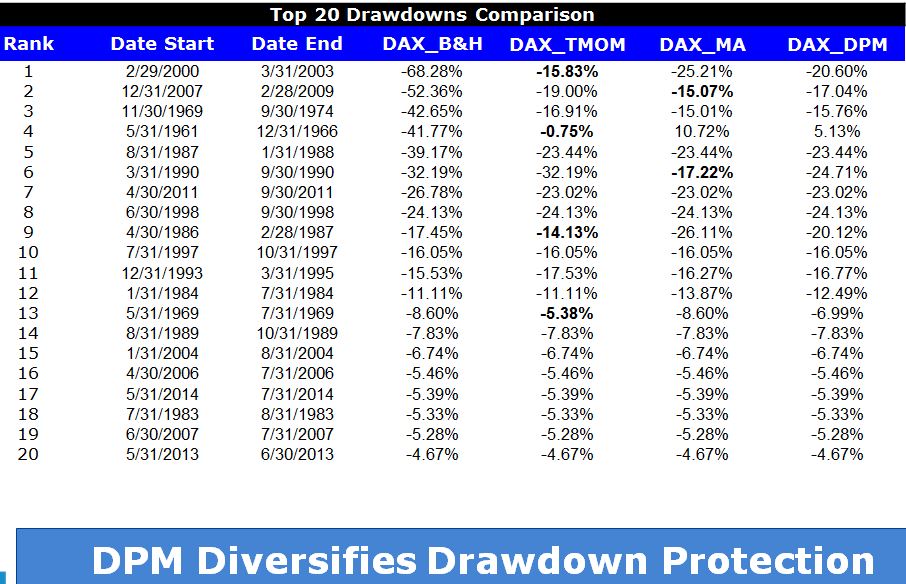

DAX Summary Results (1961-2014)

Drawdown Comparison (DAX)

|

| ↑5 | We aren’t the only ones to show that simple long-term trend rules work almost everywhere. |

| ↑6 | see Bob Shiller’s lecture and papers on this topic. http://oyc.yale.edu/economics/econ-252-08/lecture-6 |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.