What Drives Momentum and Reversal? Evidence from Day and Night Signals

- Yashar H. Barardehi, Vincent Bogousslavsky and Dmitriy Muravyev

- SSRN Working Paper

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category.

What are the research questions?

Theories abound in the financial literature explaining the drivers of momentum and reversal in one way or another. Not surprisingly, most portray the role of public and private information as key to the underlying relationships and weigh the type of information differently. For example, if the driver of momentum is a fundamental underreaction to public information, then “news” might signal a profitable momentum strategy. On the other hand, if the driver is an underreaction to private information, then a measure of “investor trading” might be the desired signal.

Using a sample of US equities listed on the NYSE, AMEX, and NASDAQ, covering the years between 1926 and 2019, the authors use past day and night returns to differentiate the impact of “news” events and “trading” events on momentum. Past cumulative overnight returns are used as a proxy for “news” and past intraday returns are proxied for “trading” events. Signals are calculated over various horizons and future returns are determined. Here is what they found.

What are the Academic Insights?

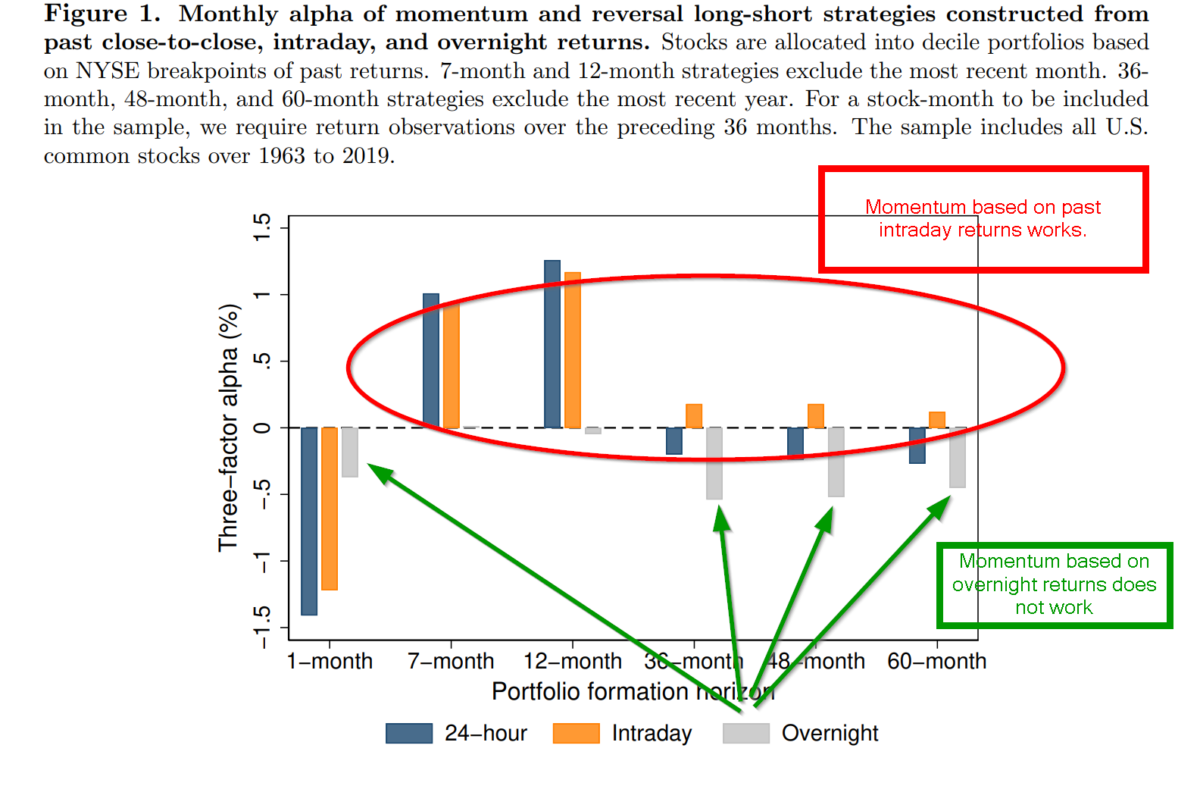

- The author’s reason that intraday returns are the result of continuous trading on the part of investors. If so, they are more likely driven by price pressure than overnight returns. If the portfolio was formed on past intraday returns, then short-term reversals occurred along with momentum. There was no long-term reversal.

- If the portfolio was formed on past overnight returns, only long-term reversal was observed. The authors propose that these results support the notion that investors’ trading produces intraday price pressure, which subsequently reverses.

- The results for momentum are consistent with investor underreaction. More specifically, they favor underreaction to the information contained in “trading” by other investors as opposed to a “news” event. The momentum signal is more effective and stronger if it is conditioned on low-volume days. The empirics of this particular result are surprising in that they are inconsistent with the high volume usually associated with investor overconfidence.

Why does it matter?

The results of this study add further weight to the theory of momentum as an underreaction by investors and provide insight into the formation of momentum-based strategies. The authors construct a new and original approach to separating the effects of information conveyed by “news” and the information described by the “trading” behavior of other investors. Certainly, there are other strategies that would benefit from the ability to understand how to capitalize on information contained in the trading behavior of other investors in addition to understanding announcement effects.

The most important chart from the paper

Abstract

How information affects asset prices is of fundamental importance. Public information flows through news, while private information flows through trading. We study how stock prices respond to these two information flows in the context of two major asset pricing anomalies— short-term reversal and momentum. Firms release news primarily during non-trading hours, which is reflected in overnight returns. While investors trade primarily intraday, which is reflected in intraday returns. Using a novel dataset that spans almost a century, we find that portfolios formed on past intraday returns display strong reversal and momentum. In contrast, portfolios formed on past overnight returns display no reversal or momentum. These results are consistent with underreaction theories of momentum, where investors underreact to the information conveyed by the trades of other investors.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.